Aerospace Plastics Market Size, Share, Trends, Industry Analysis Report

: By Process, Product, End-Use (General Aviation, Rotary Aircraft, Commercial & Freighter Aircraft, and Military Aircraft), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 114

- Format: PDF

- Report ID: PM1182

- Base Year: 2024

- Historical Data: 2020-2023

Aerospace Plastics Market Overview

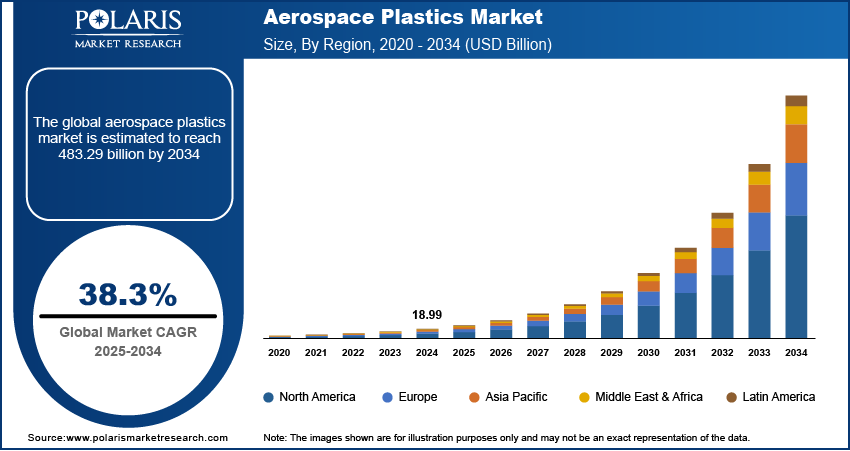

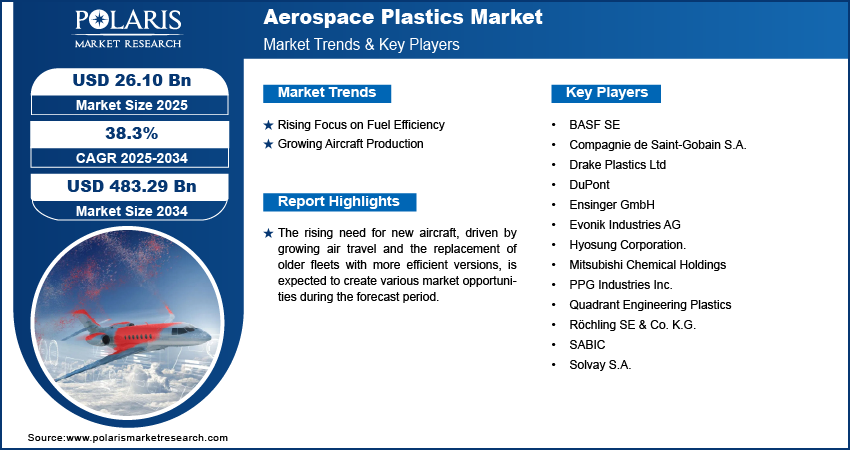

The global aerospace plastics market size was valued at USD 18.99 billion in 2024. The market is projected to grow from USD 26.10 billion in 2025 to USD 483.29 billion by 2034, at a CAGR of 38.3% from 2025 to 2034.

Aerospace plastics are used in the manufacturing of aircraft and other aviation equipment, such as wiring conduits, bushings, bearings, overhead bins, tray tables, and seating components. These plastics are designed to meet stringent safety and operational requirements. Polyphenylsulfone (PPSU) and acrylonitrile butadiene styrene (ABS) are two commonly used plastics in the aerospace industry.

The use of plastics in aerospace components has grown over time due to their design flexibility, reduced manufacturing and installation costs, higher specific strength, and minimal outgassing in a vacuum. The growing global aviation industry, increasing air travel, and rising emphasis on upgrading older aircraft are influencing the aerospace plastics market growth. The rising use of airplanes in complex operational conditions and military scenarios is also contributing to the market expansion. Furthermore, Technological advancements in the aerospace industry, such as 3D printing, are expected to boost the market.

To Understand More About this Research: Request a Free Sample Report

Continuous research and development initiatives by leading players to create advanced plastics are expected to support the aerospace plastics market development in the coming years. Additionally, the rise of low-cost airlines in emerging economies has increased demand for narrow-body aircraft, which require cabin interiors. Growing investments in air travel by emerging economies like India, China, and Brazil are expected to increase demand for aircraft, thereby increasing the aerospace plastic market demand.

Aerospace Plastics Market Dynamics

Rising Focus on Fuel Efficiency

Airlines globally are facing increasing pressure to improve fuel efficiency in order to reduce operating costs and comply with stringent environmental requirements. Fuel efficiency has become a critical factor for both commercial and military aircraft, prompting aerospace manufacturers to rely on advanced, high-performance thermoplastics. These plastics help reduce weight without compromising strength, ultimately achieving lower fuel consumption and reduced operating costs. Additionally, the performance and efficiency of an aircraft are directly impacted by its total weight. As a result, the growing emphasis on reducing aircraft weight and improving fuel efficiency is driving the aerospace plastics market revenue.

Growing Aircraft Production

The aerospace plastic market is influenced by the global aviation industry's expansion, increased air travel, and the modernization of older aircraft. Aerospace plastics are being used more often for a variety of purposes, including airframe structures, interiors, and parts. 3D printing and other additive manufacturing methods are gaining traction for producing complex plastic parts with high precision. The demand for aerospace composite materials, which are used to construct the fuselage or core of special mission aircraft, is expected to rise the demand for aerospace plastics market.

Aerospace Plastics Market Segment Insights

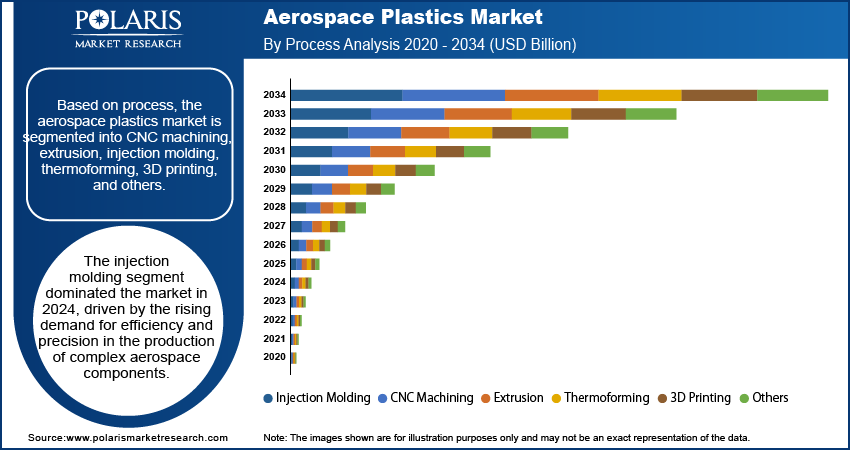

Aerospace Plastics Market Evaluation by Process Insights

Based on process, the aerospace plastics market is segmented into CNC machining, extrusion, injection molding, thermoforming, 3D printing, and others. The injection molding segment led the market with a 64.1% revenue share in 2024, driven by increased demand for efficiency and precision in the production of complex aeronautical components. Compared to conventional manufacturing techniques, injection molding enables the mass production of lightweight yet robust parts, such as interior panels, brackets, and housings, at a lower cost and with faster turnaround times.

The CNC machining segment is anticipated to experience significant growth during the forecast period. In aerospace applications, where even the slightest deviation can affect performance or safety, CNC machining offers unmatched precision and consistency. This method is particularly useful for producing parts made of high-performance polymers such as PEEK, PPS, and Ultem, which are utilized in critical applications such as structural elements, electrical systems, and engine parts.

Aerospace Plastics Market Assessment by End-Use Insights

The aerospace plastic market, based on end-use, is segmented into general aviation, rotary aircraft, commercial & freighter aircraft, and military aircraft. The commercial & freighter aircraft segment led the market and accounted for 74.5% of the revenue share in 2024. As airlines and cargo operators strive to maximize performance and reduce fuel consumption, traditional metals in the aerospace industry are increasingly being replaced by lightweight materials, such as specialized plastics. The excellent strength-to-weight ratios, resilience to corrosion, and longevity of these plastics play a key role in significantly reducing the weight of various aircraft parts, including panels, cargo doors, and interiors. Lighter planes consume less fuel, which lowers overall operating costs and reduces emissions, helping to meet stringent environmental regulations.

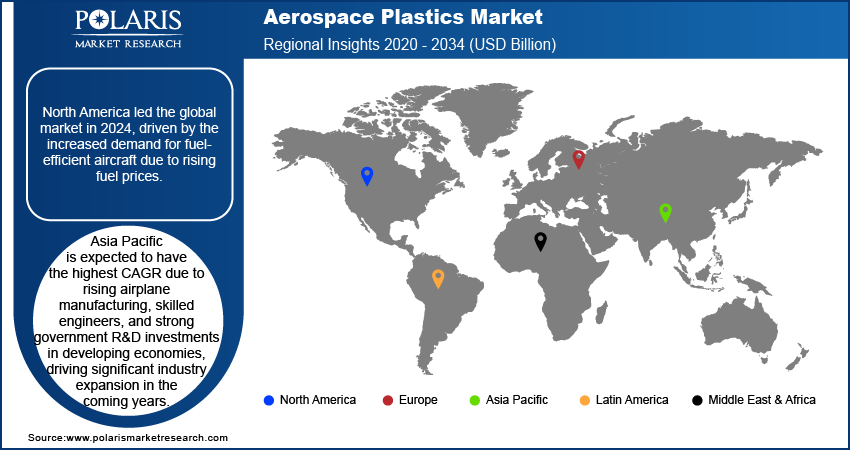

Aerospace Plastics Market Regional Analysis

By region, the report provides the aerospace plastics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America led the global market with a 58.8% market share in 2024. The region is witnessing an increased demand for fuel-efficient aircraft due to rising fuel prices. The shift towards upgrading or replacing inefficient aircraft with more fuel-efficient models is driving the demand for lightweight materials like aerospace plastics, contributing to regional market dominance.

In the upcoming years, Asia Pacific is expected to register the highest CAGR. This growth can be attributed to the availability of highly qualified engineers and the plenty of funds allocated to the research and development department by regional governments. The growing airplane manufacturing industry in the region’s emerging economies, such as China, India, and Japan, is significantly driving the aerospace plastic market dynamics. The growing middle class and heightened economic activity in the Asia-Pacific region are driving significant growth in the area’s aviation industry.

Aerospace Plastics Market – Key Players and Competitive Insights

The market for aerospace plastics is fragmented and highly competitive due to the presence of several multinational companies in both developed economies and emerging countries. Major market participants are implementing various methods, including agreements, collaborations, and mergers and acquisitions, to meet the rising demand for aerospace plastics and boost their market presence. The companies are also introducing innovative products to cater to the diverse market needs.

Manufacturing locally is one of the key business strategies used by manufacturers to benefit clients and increase the market sector. The aerospace plastics market report offers a market assessment of all the leading players, including SABIC; BASF SE; Evonik Industries AG; Solvay S.A.; Victrex plc; Quadrant Engineering Plastics; Drake Plastics Ltd; PPG Industries, Inc.; Compagnie de Saint-Gobain S.A.; DuPont; Röchling SE & Co. K.G.; Mitsubishi Chemical Holdings; Ensinger GmbH; Hexcel Corporation; and Hyosung Corporation.

List of Key Players in Aerospace Plastics Market

- BASF SE

- Compagnie de Saint-Gobain S.A.

- Drake Plastics Ltd

- DuPont

- Ensinger GmbH

- Evonik Industries AG

- Hyosung Corporation

- Mitsubishi Chemical Holdings

- PPG Industries Inc.

- Quadrant Engineering Plastics

- Röchling SE & Co. K.G.

- SABIC

- Solvay S.A.

Aerospace Plastics Industry Developments

In August 2024, Pexco announced the acquisition of Precise Aerospace Manufacturing. According to Pexco, the acquisition will enable it to use Precise Aerospace Manufacturing's resources and expertise to improve customer service and broaden its aerospace product portfolio.

In August 2024, Trelleborg Group acquired Magee Plastics, a US-based company specializing in composite materials and high-performance thermoplastic for the aerospace sector. The company states that the acquisition will improve its business unit of Sealing Solutions and strengthen its position in the aerospace industry.

Aerospace Plastics Market Segmentation

By Process Outlook

- CNC Machining

- Extrusion

- Injection Molding

- Thermoforming

- 3D Printing

- Others

By Product Outlook

- Polyphenylsulfone (PPSU)

- Polyetheretherketone (PEEK)

- Polyetherimide (PEI)

- Polycarbonate (PC)

- Polyamide (PA)

- Polymethyl Methacrylate (PMMA)

- Polyamide-Imide (PAI)

- PolyPhenyleneSulfide (PPS)

- Polyurethane (PU)

- Polyphenylene Ether (PPE)

- Others

By End-Use Outlook

- General Aviation

- Rotary Aircraft

- Commercial & Freighter Aircraft

- Military Aircraft

By Application Outlook

- Structural Components

- Window & Windshields, Doors, and Canopies

- Cabin Interiors

- Electrical, Electronics, and Control Panel

- Flooring & Wall Panels

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerospace Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.99 billion |

|

Market Size Value in 2025 |

USD 26.10 billion |

|

Revenue Forecast by 2034 |

USD 483.29 billion |

|

CAGR |

38.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The aerospace plastics market size was valued at USD 18.99 billion in 2024 and is projected to grow to USD 483.29 billion in 2034.

• The market is projected to register a CAGR of 38.3% from 2025 to 2034.

• North America held the largest share of the global market revenue in 2024.

• SABIC; BASF SE; Evonik Industries AG; Solvay S.A.; Victrex plc; Quadrant Engineering Plastics; Drake Plastics Ltd; PPG Industries, Inc.; Compagnie de Saint-Gobain S.A.; DuPont; Röchling SE & Co. K.G.; Mitsubishi Chemical Holdings; Ensinger GmbH; Hexcel Corporation; and Hyosung Corporation are a few of the key players in the market.

• The injection molding segment held the largest market share in 2024.

• The commercial & freighter aircraft segment held the largest market share in 2024.