Aerospace Testing Market Size, Share, Trends, Industry Analysis Report

By Sourcing Type (In-house, Outsourced), By Testing, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: pdf

- Report ID: PM5832

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

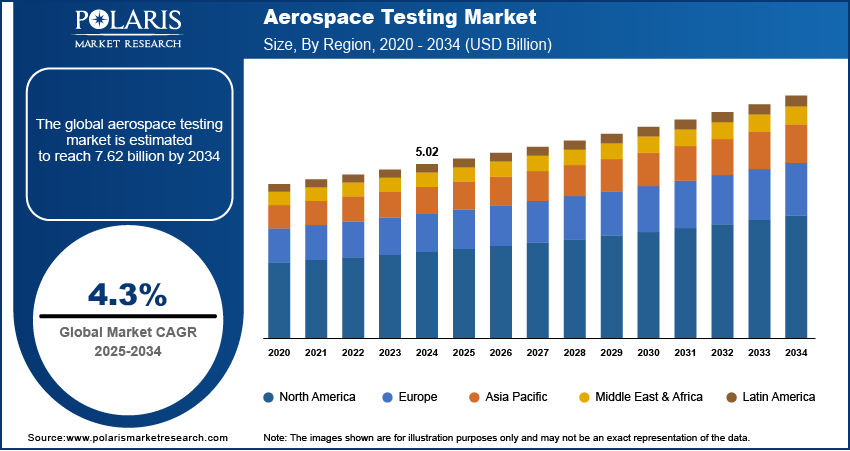

The global aerospace testing market size was valued at USD 5.02 billion in 2024, and is anticipated to register a CAGR of 4.3% from 2025 to 2034. The aerospace testing market is mainly driven by the increasing demand for new aircraft, especially commercial planes, due to rising air travel. Stricter aviation safety regulations around the world also play a big role, requiring thorough testing for all components.

The aerospace testing market involves examining aircraft, spacecraft, and aerospace parts to ensure they are safe, reliable, and perform as per the standard. This includes various checking processes such as structural testing, environmental testing, and material analysis, which are crucial throughout the design, manufacturing, and maintenance of aerospace products.

To Understand More About this Research: Request a Free Sample Report

One major driver is the increasing demand for new aircraft, especially commercial planes, which directly boosts the need for extensive testing services. Another significant factor is the strict and constantly evolving safety regulations imposed by aviation authorities worldwide. Furthermore, ongoing technological advancements in aerospace, such as new materials and complex electronic systems, create a continuous demand for advanced and specialized testing methods.

Each new aircraft, from its initial design to final assembly and delivery, must undergo thorough testing to meet international safety and performance standards. For example, according to the International Air Transport Association (IATA), global air passenger traffic has seen significant growth, driving the demand for more aircraft, which, in turn, increases the need for robust testing across the aerospace industry.

Industry Dynamics

Increasing Demand for Aircraft Production

The global market is seeing a significant rise in the demand for new aircraft, especially in the commercial aviation sector. This growth is driven by increasing air passenger traffic and the need for airlines to modernize their fleets with more fuel-efficient and environmentally friendly planes. As manufacturers ramp up production, there is a corresponding surge in the need for thorough testing at every stage, from raw materials and components to complete aircraft systems.

According to the press release by the International Air Transport Association (IATA) titled "Global Air Passenger Demand Reaches Record High in 2024" published in January 2025, global air passenger traffic in 2024 rose by 10.4% compared to 2023, surpassing pre-pandemic (2019) levels by 3.8%. This sustained growth in passenger demand means more orders for new aircraft. It leads to greater volume and complexity in the testing required for airworthiness certification and quality assurance. This trend strongly drives the demand for aerospace testing services.

Strict Aviation Safety Regulations

The aerospace industry operates under some of the most stringent safety regulations globally. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) continuously update and enforce these rules to ensure the highest levels of safety and reliability for aircraft and their components. This regulatory environment mandates extensive testing throughout the entire lifecycle of an aerospace product, from design and manufacturing to maintenance and repair.

The Federal Aviation Administration (FAA) outlines numerous regulations in Title 14 of the Code of Federal Regulations (14 CFR), such as Part 36 (Noise Standards) and Part 39 (Airworthiness Directives), which require detailed testing and compliance. These ongoing and evolving requirements mean that aerospace manufacturers and maintenance organizations must invest heavily in advanced testing equipment and services to meet certification standards and ensure operational safety. This constant need for regulatory compliance is a significant factor boosting the market growth.

Segmental Insights

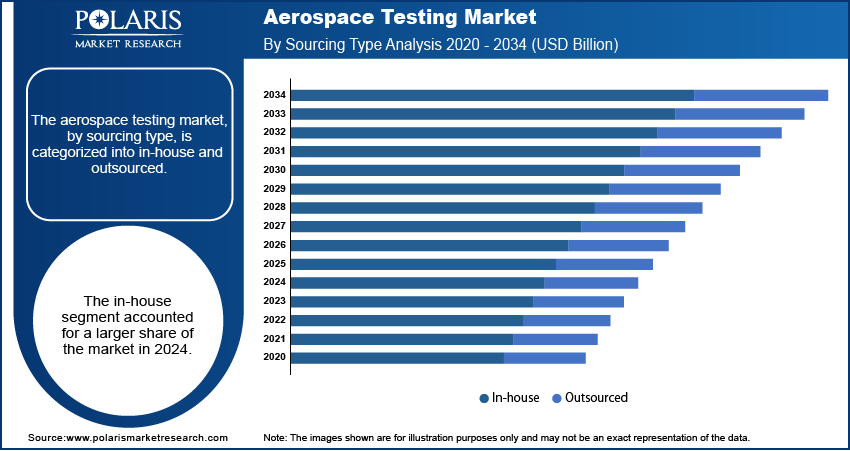

Sourcing Type Analysis

The in-house segment held a larger share in 2024, as major aerospace manufacturers prefer to maintain direct control over critical testing processes. Keeping testing in-house allows these companies to protect sensitive intellectual property, ensure high levels of data security, and maintain strict quality control standards throughout the development and production phases. For example, a prime manufacturer might conduct extensive structural integrity tests on a new wing design at its facility to closely monitor results and quickly implement design adjustments.

The outsourced segment is anticipated to register a higher growth during the forecast period. This surge is driven by the need for specialized expertise, cost optimization, and increased flexibility among aerospace companies. Outsourcing allows smaller firms or those with fluctuating testing needs to access state-of-the-art testing facilities and a broader range of technical skills without significant capital investment.

Testing Analysis

The structural/component testing segment held the largest share in 2024. This is because every part of an aircraft engine, from its smallest bolt to its largest wing, must be rigorously tested to ensure it can withstand the extreme forces and conditions of flight. This includes checks for fatigue, stress, vibration, and overall durability to guarantee the safety and longevity of the airframe and its many integrated systems. For example, the Federal Aviation Administration (FAA) mandates extensive structural testing to verify an aircraft's airworthiness before it can carry passengers or cargo, emphasizing the critical role this segment plays in the market.

The avionics/flight and electronics testing segment is anticipated to register the highest growth during the forecast period. This segment is driven by the rapid advancements in aircraft technology, including the increasing complexity of flight control systems, navigation, communication, and onboard electronics. With the rise of autonomous features, interconnected systems, and the push for more electric aircraft, the need for sophisticated testing of these integrated electronic components is accelerating. The development of new flight management systems requires advanced testing to ensure seamless integration and reliable performance in various flight scenarios, pushing this segment forward.

End User Analysis

The commercial segment held the largest share in 2024, due to the consistent and high volume of aircraft production and maintenance needed for global passenger and cargo travel. Every new commercial airplane, as well as those undergoing routine checks and repairs, requires extensive testing to ensure they meet strict safety and performance regulations set by aviation authorities. For instance, the International Air Transport Association (IATA) continually reports on the significant growth in air passenger traffic, directly correlating to the ongoing demand for commercial aircraft and, consequently, robust testing services across the area.

The space exploration segment is anticipated to experience the highest growth rate during the forecast period. This rapid expansion is fueled by increasing investments from both government space agencies and a growing number of private companies venturing into space. As these programs advance, there is a heightened need for specialized testing of rockets, satellites, and spacecraft components to ensure they can withstand the extreme conditions of launch and space environments. For example, the National Aeronautics and Space Administration (NASA) regularly conducts rigorous environmental and structural tests on components for missions to the Moon and Mars, highlighting the critical role of advanced testing in enabling successful space exploration endeavors.

Regional Overview

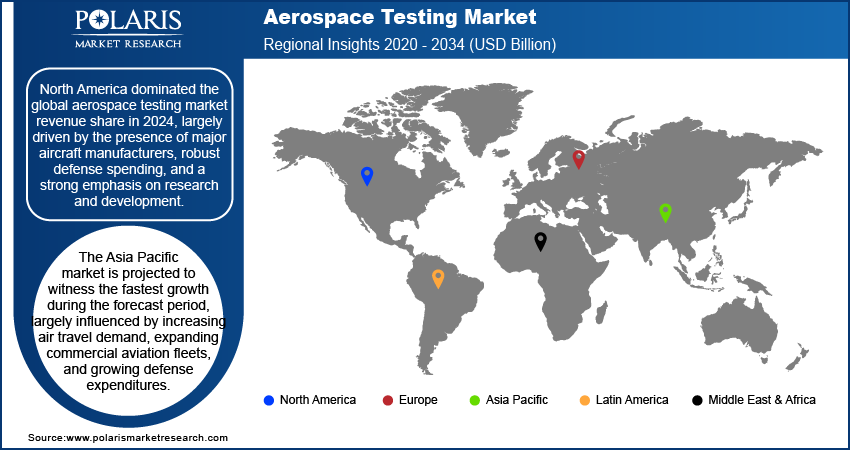

The North America aerospace testing market held the largest share in 2024, largely driven by the presence of major aircraft manufacturers, robust defense spending, and a strong emphasis on research and development. The region benefits from well-established aviation infrastructure and a highly regulated environment that necessitates continuous and advanced testing of aerospace components and systems. The ongoing modernization of commercial fleets and substantial investments in military aerospace programs contribute to a consistent demand for comprehensive testing services across the region.

U.S. Aerospace Testing Market Insight

In North America market, the U.S. is a leading contributor due to its dominant aerospace and defense industry, including a large number of original equipment manufacturers and a vast network of suppliers. Stringent regulations from bodies such as the FAA require extensive testing for both new aircraft development and the maintenance of existing fleets. Furthermore, significant government funding for defense and space exploration initiatives, such as those by NASA, continually fuels the demand for advanced testing technologies and services.

Europe Aerospace Testing Market Trends

Europe is a prominent region in the global market, supported by a strong presence of key aerospace players and a collaborative approach to aircraft development. The region's focus on sustainable aviation and the development of new, fuel-efficient aircraft models drives demand for advanced material and propulsion system testing. European regulatory bodies, such as EASA, enforce rigorous standards, ensuring all aerospace products undergo thorough testing for safety and environmental compliance. This consistent regulatory pressure and innovation in aircraft design maintain a steady need for testing services across the region. The Germany aerospace testing market contributes a significant share in Europe. The country's strong engineering base, coupled with its role in major international aerospace programs, means there is a constant demand for high-precision testing. German aerospace companies are often at the forefront of developing new materials and manufacturing processes, which, in turn, require specialized testing to validate their performance and safety. This focus on innovation and quality makes Germany a key player in the European aerospace testing landscape.

Asia Pacific Aerospace Testing Market Overview

The Asia Pacific market is rapidly growing, largely influenced by increasing air travel demand, expanding commercial aviation fleets, and growing defense expenditures. Countries in this region are investing heavily in upgrading their aerospace capabilities, leading to a rising need for both in-house and outsourced testing services. The establishment of new maintenance, repair, and overhaul (MRO) facilities also contributes to the heightened demand for testing. China is a key country driving the growth of the Asia Pacific market. With a rapidly expanding domestic aviation sector and ambitious goals in both commercial aircraft manufacturing and space exploration, the demand for aerospace testing services is surging. The country's increasing focus on developing its own aircraft and aerospace technologies means there is a significant push for building robust testing infrastructure and expertise to meet international standards and ensure product reliability.

Key Players and Competitive Insights

The competitive landscape of the aerospace testing market is dynamic, featuring a mix of large, diversified testing, inspection, and certification (TIC) companies alongside specialized, smaller firms. Competition often revolves around technological expertise, global reach, and the ability to offer comprehensive testing solutions that meet stringent regulations and evolving aircraft designs.

A few prominent companies in the industry include Element Materials Technology, SGS SA, Intertek Group plc, Applus+ (Applus Services, S.A.), TÜV SÜD, TÜV Rheinland, MISTRAS Group, Bureau Veritas, DEKRA, Eurofins Scientific, Laboratory Testing Inc. (LTI), and Collins Aerospace (Raytheon Technologies Corporation).

Key Players

- Applus+ (Applus Services, S.A.)

- Bureau Veritas

- Collins Aerospace (RTX Corporation)

- DEKRA

- Element Materials Technology

- Eurofins Scientific

- Intertek Group plc

- Laboratory Testing Inc.

- MISTRAS Group

- SGS SA

- TÜV Rheinland

- TÜV SÜD

Industry Developments

October 2024: Element announced a strategic acquisition of ISS Inspection Services. This acquisition expands Element's capabilities in non-destructive testing (NDT), inspection, and other special process services, particularly benefiting the aerospace, space, and defense sectors by enhancing their after-market (AM) and maintenance, repair, and overhaul (MRO) offerings.

September 2023: SGS completed the acquisition of the remaining 40% interest in Maine Pointe, LLC, a global supply chain and operations consulting firm.

Aerospace Testing Market Segmentation

By Sourcing Type Outlook (Revenue – USD Billion, 2020–2034)

- In-house

- Outsourced

By Testing Outlook (Revenue – USD Billion, 2020–2034)

- Material Testing

- Fuel Testing

- Environmental Testing

- Structural/Component Testing

- Avionics/Flight & Electronics Testing

- Propulsion System Testing

- Others

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Military & Defense

- Space Exploration

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Aerospace Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.02 billion |

|

Market Size in 2025 |

USD 5.22 billion |

|

Revenue Forecast by 2034 |

USD 7.62 billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.02 billion in 2024 and is projected to grow to USD 7.62 billion by 2034.

The global market is projected to register a CAGR of 4.3% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Element Materials Technology, SGS SA, Intertek Group plc, Applus+ (Applus Services, S.A.), TÜV SÜD, TÜV Rheinland, MISTRAS Group, Bureau Veritas, DEKRA, Eurofins Scientific, Laboratory Testing Inc. (LTI), and Collins Aerospace (Raytheon Technologies Corporation).

The in-house segment accounted for the largest share of the market in 2024.

The space exploration segment is expected to witness the fastest growth during the forecast period.