Electric Aircraft Market Share, Size, Trends, Industry Analysis Report

By Type (Rotary Wing, Fixed Wing, Hybrid Wing); By Component; By Technology; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 116

- Format: pdf

- Report ID: PM4380

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

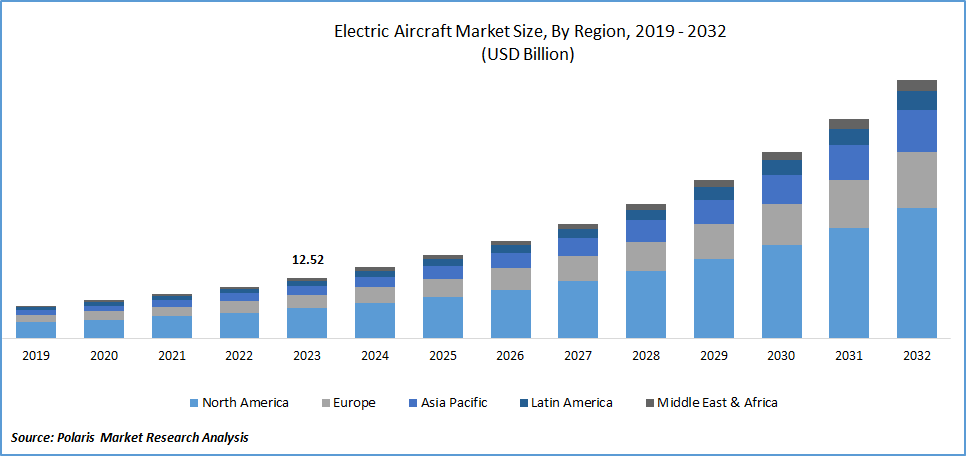

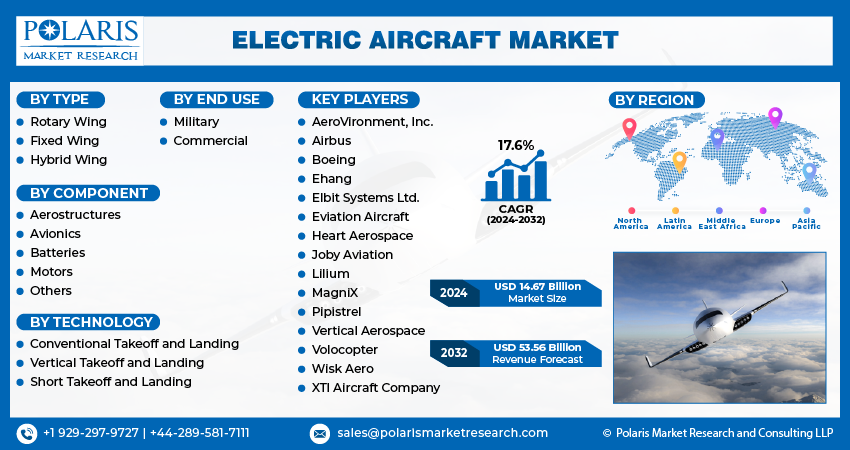

The global electric aircraft market was valued at USD 12.52 billion in 2023 and is expected to grow at a CAGR of 17.6% during the forecast period.

Electric aircraft rely on electric propulsion systems, unlike traditional aircraft propelled by internal combustion engines, electric aircraft harness electric motors for thrust and lift. These aircraft draw their power from advanced batteries, fuel cells, or a hybrid combination, signifying a departure from fossil fuel dependency in aviation.

The increase in the development of electric aircraft lies in their utilization of electric motors, marking a departure from traditional combustion engines. These aircraft rely on electricity stored in cutting-edge batteries or generated by fuel cells, reducing carbon emissions and fostering sustainability. The environmentally conscious design of electric aircraft results in significantly lower or zero carbon emissions during operation, aligning with global efforts to address climate change. Electric propulsion systems contribute to quieter aircraft operation, mitigating noise pollution and making them well-suited for urban air mobility applications. Electric aircraft often feature innovative design elements, including distributed propulsion systems, optimizing overall efficiency and performance.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the market are adopting acquisition as a strategy to strengthen market presence.

For instance, in April 2022, Textron Inc. completed the acquisition of Pipistrel. Pipistrel will integrate into Textron's latest business segment, Textron eAviation. This strategic move aligns with Textron's goal of providing a range of sustainable aircraft solutions tailored for urban air mobility, general aviation, cargo transport, and specialized mission applications.

Electric aircraft find versatile applications across aviation sectors. They serve as air taxis, providing efficient and rapid transport in congested urban areas. Short-haul transportation benefits from their point-to-point connectivity, reducing travel time and environmental impact. Electric aircraft play a crucial role in training and recreational aviation, capitalizing on lower operational costs. In surveillance and reconnaissance, small unmanned electric vehicles offer silent and low-profile solutions. Research and development benefit from electric aircraft platforms for testing new technologies. Cargo transport explores electric aircraft efficiency for short-haul routes. Specialized missions, including medical evacuation and environmental monitoring, leverage their unique capabilities.

Industry Dynamics

Growth Drivers

Environmental Concerns and Rise in Urban Air Mobility Concepts

Growing environmental concerns propel the demand for electric aircraft as the aviation industry seeks sustainable alternatives. Electric aircraft, emitting fewer or zero carbon emissions, address the urgent need to combat climate change. Their quieter operation mitigates noise pollution, particularly in urban areas. Tightening global regulations, coupled with incentives and supportive policies, drive the aviation sector towards cleaner technologies. Public preferences for eco-friendly travel contribute to the increasing adoption of electric aircraft, aligning with corporate sustainability goals.

The surging demand for urban air mobility (UAM) is a pivotal driver in the electric aircraft market's expansion. Electric aircraft, specifically tailored for short-distance travel within urban landscapes, address congestion challenges and provide sustainable alternatives. The environmental benefits of reduced emissions align with modern preferences for eco-friendly transportation. Ongoing technological advancements, coupled with regulatory support and intense market competition, contribute to the growing acceptance of electric aircraft in the evolving landscape of UAM.

Report Segmentation

The market is primarily segmented based on type, component, technology, end use, and region.

|

By Type |

By Component |

By Technology |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Rotary Wing Segment Accounted for a Significant Market Share in 2023

The rotary wing segment accounted for a significant revenue share of the market in 2023. Rotary wing electric aircraft utilize electric motors powered by batteries to generate lift and thrust. Their notable characteristic is the capability for vertical takeoff and landing (VTOL), rendering them well-suited for Urban Air Mobility scenarios, functioning as air taxis for brief urban journeys. Extending beyond urban environments, they serve various purposes, including emergency response, search and rescue missions, surveillance activities, and military operations. The electric propulsion not only diminishes environmental impact by reducing emissions but also contributes to a quieter operational profile, alleviating concerns related to noise pollution. Continual advancements in technology, especially in battery efficiency, augment the operational capabilities and versatility of rotary wing electric aircraft.

By Component Analysis

The Batteries Segment Accounted for a Significant Market Share in 2023

The batteries segment accounted for a significant market share. Batteries for electric aircraft are pivotal, with advancements crucial for performance. Higher energy density, ensuring more energy in a compact space, directly impacts range and endurance. Achieving a high power-to-weight ratio is essential for efficiency, emphasizing the need for lightweight yet powerful batteries. Fast charging capabilities minimize downtime, enhancing operational efficiency. Long cycle life contributes to durability, while effective thermal management ensures safety. Seamless integration with aircraft systems, coupled with regulatory compliance, is vital for certification and airworthiness.

By Technology Analysis

The Vertical Takeoff and Landing Segment Accounted for the Largest Market Share in 2023

The vertical takeoff and landing segment accounted for the largest market share. Electric Vertical Takeoff and Landing (eVTOL) aircraft showcase diverse applications owing to their distinctive capabilities. Urban Air Mobility (UAM) stands out as a prominent application where eVTOLs function as on-demand air taxis, offering efficient and flexible short-distance commuting options. Additionally, these aircraft hold potential in medical evacuation, swiftly transporting critical patients in challenging terrains. Cargo transport can be revolutionized by eVTOLs, ensuring rapid and efficient delivery in congested urban settings. For military purposes, eVTOLs serve in reconnaissance, surveillance, and personnel/equipment transportation to otherwise inaccessible locations. They also find utility in tourism, environmental monitoring, infrastructure inspection, and disaster response and could potentially offer individualized personal transportation.

By End Use Analysis

The Commercial Segment Accounted for the Largest Market Share in 2023

The commercial segment accounted for the largest market share in 2023. The growing trend in the development of electric aircraft for commercial applications is gaining momentum. This shift signifies a notable transformation in the aviation industry, driven by a combination of environmental considerations and advancements in technology. Emphasizing sustainability, these electric aircraft contribute to a significant reduction in carbon emissions, lowered operational costs, and decreased levels of noise pollution.

Particularly integral to the concept of urban air mobility, electric vertical takeoff and landing aircraft are enabling efficient travel in densely populated areas. Factors such as government incentives, intense market competition, and corporate responsibility are further propelling the integration of electric aircraft into commercial fleets.

Regional Analysis

North America Accounted for the Largest Revenue Share in 2023

North America accounted for the largest revenue share. A greater focus on sustainable aviation and urban air mobility drives the North American electric aircraft industry. Notable players like Joby Aviation and Archer Aviation are advancing electric vertical takeoff and landing (eVTOL) solutions for urban transportation. Robust investments from venture capital, governmental support, and collaborations between startups and industry giants drive innovation. Ongoing research enhances electric aircraft efficiency, range, and safety, while regulatory developments by the Federal Aviation Administration (FAA) ensure industry reliability. Partnerships, educational contributions, and a dynamic landscape of technological advancements in battery technology and electric propulsion systems further propel the sector's growth.

The upsurge in the demand for electric aircraft in Asia-Pacific is driven by heightened environmental awareness, leading to a keen interest in more sustainable transportation options. Governments across the region are proactively endorsing the integration of electric vehicles, aircraft included, utilizing regulatory frameworks and incentives to align with a broader commitment to environmentally responsible transportation practices. Advancements in battery technology & electric propulsion systems and enhanced feasibility and overall performance of electric aircraft further support market growth. Electric aviation plays a crucial role in enhancing regional connectivity by facilitating economical and environmentally friendly short-haul routes, effectively meeting the demand for efficient transportation within the closely interconnected nations of Asia. Ongoing demonstration projects and pilot initiatives are actively underway, effectively showcasing the capabilities of electric aircraft and instilling confidence among various stakeholders, including passengers, regulatory bodies, and investors.

Key Market Players & Competitive Insight

The market faces fierce rivalry, with companies leveraging cutting-edge technology, top-notch product offerings, and a robust brand reputation to propel revenue expansion. Key players employ diverse tactics, including dedicated research and development, strategic mergers and acquisitions, and continuous technological advancements. These strategic maneuvers are aimed at broadening their product ranges and sustaining a competitive advantage. The market dynamic is shaped by constant innovation and a commitment to delivering high-quality solutions, underscoring the importance of strategic initiatives in ensuring sustained competitiveness.

Some of the major players operating in the global market include

- AeroVironment, Inc.

- Airbus

- Boeing

- Ehang

- Elbit Systems Ltd.

- Eviation Aircraft

- Heart Aerospace

- Joby Aviation

- Lilium

- MagniX

- Pipistrel

- Vertical Aerospace

- Volocopter

- Wisk Aero

- XTI Aircraft Company

Recent Developments

- In January 2023, Stellantis and Archer formed a collaborative partnership for the manufacturing of Archer's Midnight electric vertical takeoff and landing (eVTOL) aircraft. Leveraging Stellantis' advanced manufacturing technology, expertise, and financial support, the collaboration aims to facilitate the efficient manufacturing of Archer's eVTOL aircraft.

- In October 2022, Pipistrel announced the initial delivery of its Velis Electro, an all-electric, two-seater aircraft, to Canada. The Waterloo Institute for Sustainable Aeronautics and Waterloo Wellington Flight Centre is set to leverage the Velis Electro for expanded research and collaborative initiatives, specifically focusing on assessing battery-powered electric flight in the Canadian market.

Electric Aircraft Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.67 billion |

|

Revenue forecast in 2032 |

USD 53.56 billion |

|

CAGR |

17.6% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Component, By Technology, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Electric Aircraft Market Size Worth $ 53.56 Billion By 2032

The top market players in Electric Aircraft Market are global presence, including AeroVironment, Inc., Airbus, Boeing

North America is region contribute notably towards the Electric Aircraft Market.

The global electric aircraft market is expected to grow at a CAGR of 17.6% during the forecast period.

The key segments in the Electric Aircraft Market Market are type, component, technology, end use, and region.