Aerospace Valves Market Size, Share, Trends, Industry Analysis Report

By Product Type, By Aircraft Type, By Material, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM2088

- Base Year: 2024

- Historical Data: 2020-2023

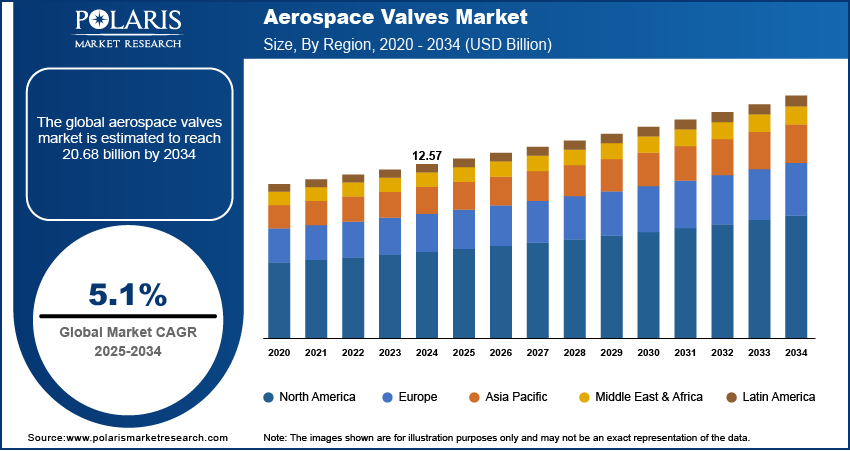

What is the market size for aerospace valves?

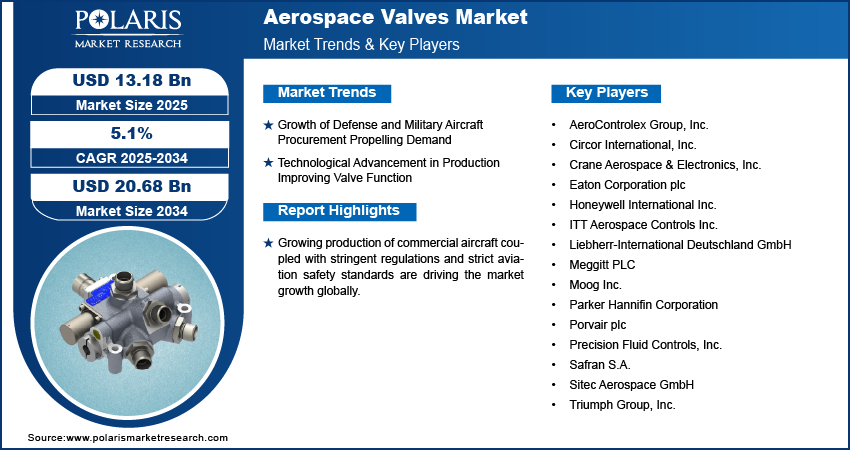

The global aerospace valves market size was valued at USD 12.57 billion in 2024, growing at a CAGR of 5.1% from 2025 to 2034. Growth of defense and military aircraft procurement coupled with technological advancement in valve production is propelling the market growth.

Key Insights

- Butterfly valves dominated in 2024, driven by their lightweight design, durability, and ability to efficiently regulate high-flow fluids.

- Titanium valves is projected to grow at a rapid pace during the forecast period, supported by high strength-to-weight ratio and contribution to fuel efficiency and overall aircraft performance.

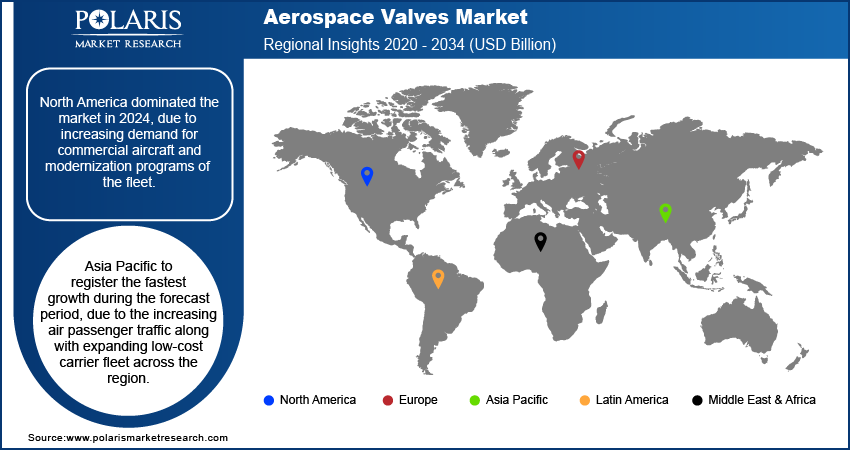

- North America held a significant share in 2024, fueled by rising demand for commercial aircraft and fleet modernization programs.

- The U.S. emerged as the primary hub in North America, supported by high defense spending and ongoing aircraft upgrade initiatives.

- Asia Pacific is expected to grow at a fastest pace during the forecast period, driven by rapid expansion of air passenger traffic and low-cost carrier operations.

- India witnessed strong momentum within Asia Pacific, owing to increasing aircraft production and assembly capacity.

Industry Dynamics

- Expansion of defense and military aircraft procurement due to rising geopolitical tensions and defense budget allocations worldwide driving the market.

- Technological advancements in manufacturing processes such as additive manufacturing (3D printing) enabling precision-engineered and lightweight valve components, further fueling the market growth.

- High manufacturing costs of precision-engineered valves are limiting the market growth.

- Incorporation of sensors and digital monitoring for real-time performance tracking, predictive maintenance, and improved system efficiency are creating growth opportunities.

Market Statistics

- 2024 Market Size: USD 12.57 Billion

- 2034 Projected Market Size: USD 20.68 Billion

- CAGR (2025–2034): 5.1%

- North America: Largest Market Share

The aerospace valves market consists of rugged parts for effective control of fluids and gases within airplane systems. Aerospace valves are widely used throughout fuel management, hydraulics, environmental control, and lubrication systems to achieve aircraft safety and performance. The use of more advanced materials and designs is enhancing efficiency, reliability, and cost efficiency, and thus aerospace valves are a vital component in defense and commercial aviation.

Growing production of commercial aircraft is fueling large-scale demand for aerospace valves worldwide. Growing air travel volumes, fleet renewal programs, and growth of single-aisle aircraft are forcing manufacturers to implement high-performance valves that provide secure and efficient fuel, hydraulic, and environmental control. The global support and services market is expected grow to USD 4.4 trillion in the next 20 years, as per Boeing, with advanced valve systems playing a crucial role in cutting-edge aircraft operations.

Stringent regulations and strict aviation safety standards are boosting the use of aerospace valves. Aircraft manufacturers are required to incorporate valves that provide consistent performance in harsh environments, such as high pressure, fluctuating temperatures, and corrosive conditions. The growing demand for operational safety and compliance are driving innovation and material development in aerospace valve industry.

Drivers & Opportunities

Growth of Defense and Military Aircraft Procurement Propelling Demand: Geopolitical tensions and rising defense spending budgets are increasing demand for aerospace valves in military aircraft. Valves play a vital role in fuel, hydraulic, and environmental control systems, providing operational efficiency and safety in harsh conditions. As per the Stockholm International Peace Research Institute (SIPRI), global world military expenditure stood at USD 2,443 billion during 2023, a 6.8% growth from 2022. This increase in defense expenditures is promoting the demand of high-performance, long-lasting, and light valve systems in fighter aircraft, transport planes, as well as unmanned aerial vehicles (UAVs).

Technological Advancement in Production Improving Valve Function: Advancement in additive manufacturing producing lightweight and precision-engineered aerospace valves are further accelerating the market. These technologies empower manufacturers to optimize valve design for fluid dynamics, weight reduction, and durability, which improves fuel efficiency and aircraft performance. A number of aerospace firms launched 3D-printed high-pressure hydraulic and fuel valves that cut up to 20% of component weight while maintaining the strength to withstand pressure.

Segmental Insights

By Product Type

Why butterfly valves dominated the market share in 2024?

Based on product type, the aerospace valves market is classified into butterfly valves, rotary valves, solenoid valves, flapper-nozzle valves, poppet valves, gate valves, ball valves, and others. Butterfly valves dominated the market share in 2024 with their light weight, long life, and capacity to control high-flow fluids with high efficiency. These valves are heavily utilized in fuel, hydraulic, and environmental control systems for commercial as well as military aircraft.

Ball valves are anticipated to register robust growth during the forecast period, driven by accurate control of fluid, ability to be automated, and compatibility for sophisticated aerospace applications.

By Aircraft Type

On the basis of aircraft type, the market is divided into narrow-body aircraft, wide-body aircraft, regional aircraft, general aviation, helicopters, military aircraft, spacecraft, and UAVs. Narrow-body aircraft accounted for dominance in the market during 2024 due to the growing commercial airline fleet and increased production rates of single-aisle aircraft.

Which aircraft segment is expected to expand at highest growth over the forecast period?

Military aircraft are expected to expand at a high rate over the forecast period, with growing defense expenditure and the development of aerial platforms owing to the rising demand for lightweight, high-performance, and robust valve systems.

By Material

What are the factors that dominated stainless steel valves segment in the aerospace valves market?

Based on material, the market is classified into stainless steel, titanium, aluminum, and other special alloys. Stainless steel valves dominated the market in 2024, supported by durability, corrosion resistance, and reliability within critical aerospace systems.

Titanium valves are expected to expand rapidly owing to its light weight and elevated strength-to-weight ratio, favorable to fuel efficiency and aircraft performance overall.

By Application

Which segment held the largest market share in 2024?

By application, the market is divided into fuel systems, hydraulic systems, environmental control systems, pneumatic systems, lubrication systems, and water & wastewater systems. The fuel systems held the largest market share in 2024 was held by fuel systems due to the immense requirement of accurate and consistent flow control for aircraft fuel management.

Hydraulic systems expected to record robust growth in the forecast period, as newer airplanes increasingly depend on sophisticated, automated fluid control technology to enhance efficiency and safety.

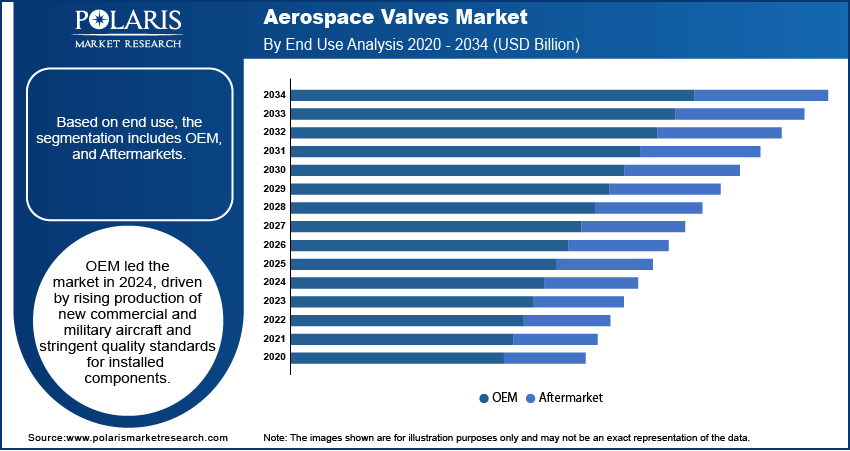

By End Use

Which is the end use segment dominated the market in 2024?

Based on end use, the aerospace valves market is categorized into OEM and aftermarket. The OEM segment dominated the market in 2024 due to increased manufacturing of new commercial and military aircraft and quality standards for the components installed.

The aftermarket business is expected to see significant growth in the forecast period, led by modernization programs for fleets, replacement of older aircraft, and maintenance, repair, and overhaul (MRO) operations that require high-performance replacement valves.

Regional Analysis

North America held a significant proportion of the global aerospace valves market in 2024 due to increasing demand for commercial aircraft and modernization programs of the fleet. Ongoing growth in domestic and foreign air travel are pushing carriers to increase their fleets, driving the installation and replacement of valves in multiple aircraft systems. The region also houses key aerospace OEMs and MRO facilities, which boosts a stable aftermarket demand for high-reliability and advanced valve components.

U.S. Aerospace Valves Market Overview

The U.S. continues to dominate the North American market, driven by high defense spending and aircraft upgrade programs. The Stockholm International Peace Research Institute (SPIRI) indicates that defense spending in the U.S. rose by 2.3% to USD 916 billion in 2023, highlighting manufacturing of future fighter jets, spy planes, and transport aircraft. Ongoing innovation in aerospace production and continued emphasis on defense preparedness are driving robust demand for hydraulic, pneumatic, and fuel system valves across platforms.

Asia Pacific Aerospace Valves Market Insights

Asia Pacific is expected to grow at a rapid pace over the forecast period. Increasing air passenger traffic coupled with low-cost carrier expansion, is driving commercial plane demand in the region. Growing defense expenditures and military fleet modernization in India, China, and Japan further increasing market growth. Regional governments are aggressively investing in developing local aerospace manufacturing capability, enabling increasing integration of locally assembled valve systems into aircraft platforms.

India Aerospace Valves Market Analysis

India is emerging as a key growth hub for aerospace valve makers owing to increasing aircraft production and assembly capacity. According to the International Air Transport Association (IATA), India is forecast to overtake China and the U.S. to rank as the world's third-largest air passenger market by 2030. Growing domestic production in line with the 'Make in India' program, as well as growth in commercial air travel, is increasing the demand for valve suppliers in fuel, hydraulic, and pneumatic systems for civil and defense aircraft.

Europe Aerospace Valves Market Assessment

The European aerospace valves market is expected to show robust growth in the next few years, led by rigorous aviation safety standards and sustainability-driven initiatives. Regional manufacturers are placing greater focus on advanced materials and high-efficiency valve technology that enables lightweight, fuel-efficient aircraft design. The region's carbon emission reduction drive and support for sustainable aviation fuels is also driving valve innovation. High demand from leading aircraft producers in France, Germany, and the UK continues to contribute to market expansion in Europe.

Key Players & Competitive Analysis

The global aerospace valves industry is intensely competitive and fueled by innovation and technological progress. Top players are working to enhance valve efficiency, minimize weight, and increase durability to keep pace with contemporary aircraft performance requirements. Growth in new production centers, collaboration with OEMs, and working on advanced valve systems for electric and hybrid airplanes are major strategic objectives.

How are the major key players in aerospace valves market?

Key players in the global aerospace valves market are AeroControlex Group, Inc., Circor International, Inc., Crane Aerospace & Electronics, Inc., Eaton Corporation plc, Honeywell International Inc., ITT Aerospace Controls Inc., Liebherr-International Deutschland GmbH, Meggitt PLC, Moog Inc., Parker Hannifin Corporation, Porvair plc, Precision Fluid Controls, Inc., Safran S.A., Sitec Aerospace GmbH, and Triumph Group, Inc.

Key Players

- AeroControlex Group, Inc.

- Circor International, Inc.

- Crane Aerospace & Electronics, Inc.

- Eaton Corporation plc

- Honeywell International Inc.

- ITT Aerospace Controls Inc.

- Liebherr-International Deutschland GmbH

- Meggitt PLC

- Moog Inc.

- Parker Hannifin Corporation

- Porvair plc

- Precision Fluid Controls, Inc.

- Safran S.A.

- Sitec Aerospace GmbH

- Triumph Group, Inc.

Aerospace Valves Industry Developments

In October 2022: Triumph Group acquired a contract from Lockheed Martin to produce brake valve assemblies for the F-16 Fighting Falcon aircraft. Triump Group provides production hardware and operational support for the F-16 program under this contract.

In August 2022: Marsh Brothers Aviation signed a four-year deal with Aviation Fabricators (AvFab) to provide aircraft seat actuator valves. The alliance came after Marsh Brothers helped fix AvFab's supply chain issues, and the company is expected to provide customized actuator valves for the MRO of private and commercial aircraft seats.

In February 2022: ITT Inc. subsidiary ITT Aerospace Controls added five new valves and actuators to its portfolio of aircraft components. The revamped line of products strengthens the company's presence in fluid handling applications within fuel, hydraulic, water, and environmental control systems utilized in aerospace and defense applications.

Aerospace Valves Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Butterfly Valves

- Rotary Valves

- Solenoid Valves

- Flapper-nozzle Valves

- Poppet Valves

- Gate Valves

- Ball Valves

- Others

By Aircraft Type Outlook (Revenue, USD Billion, 2020–2034)

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- General Aviation

- Helicopter

- Military Aircraft

- Spacecraft

- UAVs

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Stainless Steel

- Titanium

- Aluminum

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Fuel System

- Hydraulic System

- Environmental Control System

- Pneumatic System

- Lubrication System

- Water & Wastewater System

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- OEM

- Aftermarket

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerospace Valves Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 12.57 Billion |

|

Market Size in 2025 |

USD 13.18 Billion |

|

Revenue Forecast by 2034 |

USD 20.68 Billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 12.57 billion in 2024 and is projected to grow to USD 20.68 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are AeroControlex Group, Inc., Circor International, Inc., Crane Aerospace & Electronics, Inc., Eaton Corporation plc, Honeywell International Inc., ITT Aerospace Controls Inc., Liebherr-International Deutschland GmbH, Meggitt PLC, Moog Inc., Parker Hannifin Corporation, Porvair plc, Precision Fluid Controls, Inc., Safran S.A., Sitec Aerospace GmbH, and Triumph Group, Inc.

The butterfly valves segment dominated the market revenue share in 2024.

The hydraulic systems segment is projected to witness the fastest growth during the forecast period.