Aesthetic Medicine Market Share, Size, Trends, Industry Analysis Report

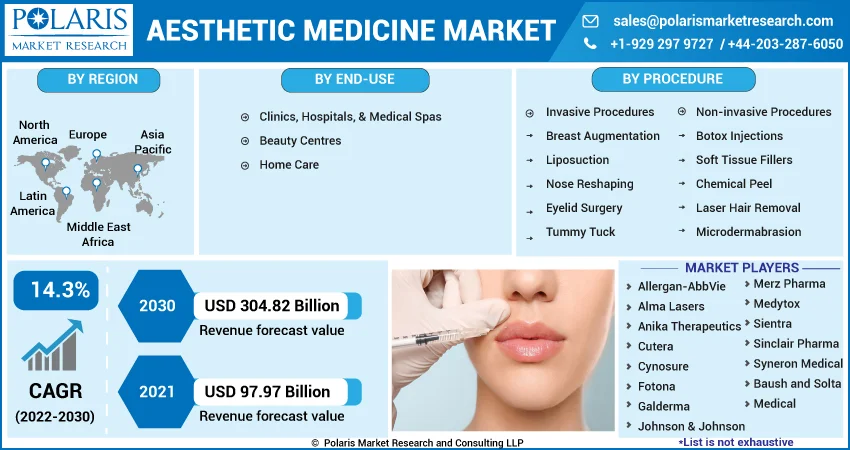

By Procedure (Invasive, Non-Invasive); By End-Use (Clinics, Hospitals, & Medical Spas, Beauty Centres, Home Care); Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 118

- Format: PDF

- Report ID: PM1244

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

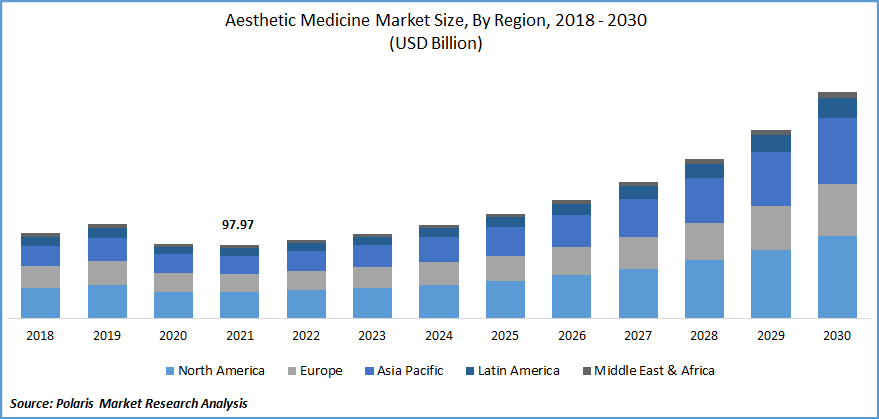

The global aesthetic medicine market was valued at USD 97.97 billion in 2021 and is expected to grow at a CAGR of 14.3% during the forecast period. The demand for aesthetic procedures has increased due to the manufacturers' creation of unique aesthetic medicines & devices in recent years. In the coming years, technologically advanced products like non-invasive body sculpting tools that use fat-freezing technology, for instance, are likely to produce lucrative potential. The global market for aesthetic medicine is anticipated to grow due to these advances in the beauty industry.

Know more about this report: Request for sample pages

Due to Allergan's Cool Sculpting gadget, the most well-known current technology for body contouring and fat reduction is probably cryolipolysis. Cryolipolysis is a non-surgical and non-invasive process that freezes subcutaneous fat cells with the administration of slow, intense, regulated chilling; following this, the cells go through apoptosis and are eliminated from the body. As reported by the Aesthetic Society (U.S.), non-invasive body fat reduction was one of the top five non-invasive procedures in the U.S. in 2020, with 140,314.

The increased concerns about their physical appearance among middle- and upper-class Americans are anticipated to increase demand for aesthetic medicine in the U.S. In North America, botox injection is the most popular and widely used technique. Cosmetic procedures are also gaining popularity with patients due to how quickly they can recover.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market for aesthetic medicine is expected to expand as a result of rising awareness of and demand for preventative procedures that give injectable drugs with anti-aging benefits early in life. Additionally, it is anticipated that market participants' emphasis on R&D expenditures will result in advances in aesthetic medications, hence increasing demand for them.

However, it is anticipated that throughout the projection period, unfavorable reimbursement regulations and the high cost of cosmetic operations will restrain the market. The demand for cosmetic operations is rising globally. It is predicted to significantly boost the aesthetic medicine market. Rising interest in skin texture, there is a growth in demand for different non-invasive or minimally invasive therapies like re-surfacing, injectables, and other services.

Report Segmentation

The market is primarily segmented based on procedure, end-use, and region.

|

By Procedure |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Non-invasive segment is expected to grow at a highest CAGR over the projected period

In 2021, the non-invasive procedures market segment held a significant market share. Over the projection period, the segment is also anticipated to grow at the fastest CAGR. The desire for non-invasive procedures has increased globally due to fewer pain, quick outcomes, and low costs. Botox injections, soft tissue fillers, and chemical peels are popular non-invasive procedures. US FDA approved JUVEDERM VOLUMATM for chin augmentation in adults aged 21 or above in June 2020. Allergan Aesthetics is a division of AbbVie Inc.

Invasive cosmetic operations like liposuction, breast augmentation, and nose contouring will be among the most common in 2021. According to the Aesthetic Society, the popularity of abdominoplasty, buttock augmentation, breast operations, and liposuction has increased by 63% since 2020. Specialized facial operations, such as brow and face lifts, increased by 54% in 2017.

Beauty sector is expected to hold a significant revenue share in 2021

A large portion of the global medical aesthetics market is anticipated to be accounted for by beauty centers due to the expansion of these facilities and growing consumer awareness of skin conditions. The medical spas, hospitals, and clinics held the most significant market share in the global medical aesthetics market in 2018. They will continue to be the leading revenue-generating sector over the forecast period.

The better availability of financial and infrastructural resources with clinics and hospitals, including qualified surgeons and others, can be attributable to several things, including this share. Over the past few decades, homecare facilities have become increasingly popular in the healthcare sector due to several factors, such as the increased use of technological devices in these settings and their integration with information technology.

Asia Pacific is expected to witness highest growth over the forecast period

Asia Pacific is anticipated to experience a quicker revenue growth rate throughout the forecast period. High demand from nations like South Korea, China, and India boosts market income. The rise of medical tourism, particularly in Asian countries, is anticipated to fuel market revenue growth. The first fully injectable liquid polycaprolactone in the world, GOURI, was created by DEXLEVO, an Asian aesthetic and medical device company, and was selected as the best injectable at the 20th Aesthetic & Anti-aging Medicine World Congress (AMWC), which will take place between March 31 and April 2, 2022.

North America accounted for the largest revenue share in 2021. The market for aesthetic medicine is anticipated to grow as people become more aware of and want preventative therapies that, early in life, offer the anti-aging benefits of injectable drugs. The American Society of Plastic Surgeons (ASPS) analyzed the growth in cosmetic surgery procedure rates between 2000 and 2018. Botox injection use surged by 845%, compared to a 48% increase in breast augmentation procedures.

Competitive Insight

Some of the major players operating in the global market include Allergan-AbbVie, Alma Lasers, Anika Therapeutics, Cutera, Cynosure, Fotona, Galderma, Johnson & Johnson, Merz Pharma, Medytox, Sientra, Sinclair Pharma, Syneron Medical, Baush and Solta Medical. There are many both domestic and international businesses competing in the highly fragmented aesthetic medicine market.

A stringent regulatory approval procedure, however, makes it difficult for new products to enter the market. Rapid technological advancement and acceptance of new gadgets for better treatment are the main factors influencing the competitiveness. Leading companies have made mergers and acquisitions a major component of their market share retention strategies.

Recent Developments

Allergan Aesthetic merged with Cypris Medical, a Chicago-based private medical device company, in January 2021. The clinical trial has already started, and it aids in assessing and verifying Xact's safety when used to treat the skin on the face and deepen the nasolabial sulcus.

Allergen Aesthetics, and unit of AbbVie, recently purchased Soliton, Inc., a medical technology company, in December 2021. The company's non-invasive body contouring therapy portfolio will grow as a result of this acquisition.

Sisram Medical Ltd (Alma Lasers) developed ClearSkin PRO in February 2020, a revolutionary applicator with twice the strength of earlier solutions, resulting in dramatically younger-looking skin.

Galderma made a large investment in its aesthetic portfolio in December 2020, including the expansion of its US salesforce and additions to the digital capabilities of ASPIRE Galderma Rewards. Initiatives have strengthened the company's position in the medical aesthetics sector.

Initium, a hyaluronic acid filler, was introduced to the South Korean market by JW Pharmaceutical, in March 2020.

Aesthetic Medicine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 97.97 billion |

|

Revenue forecast in 2030 |

USD 304.82 billion |

|

CAGR |

14.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Procedure, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Allergan-AbbVie, Alma Lasers, Anika Therapeutics, Cutera, Cynosure, Fotona, Galderma, Johnson & Johnson, Merz Pharma, Medytox, Sientra, Sinclair Pharma, Syneron Medical, Baush and Solta Medical |