Agricultural Films And Bonding Market Share, Size, Trends, Industry Analysis Report

By Type (Agricultural Films, Twine, Netting, and Others); By Raw Material; By End-Use Industry; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 111

- Format: PDF

- Report ID: PM1186

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

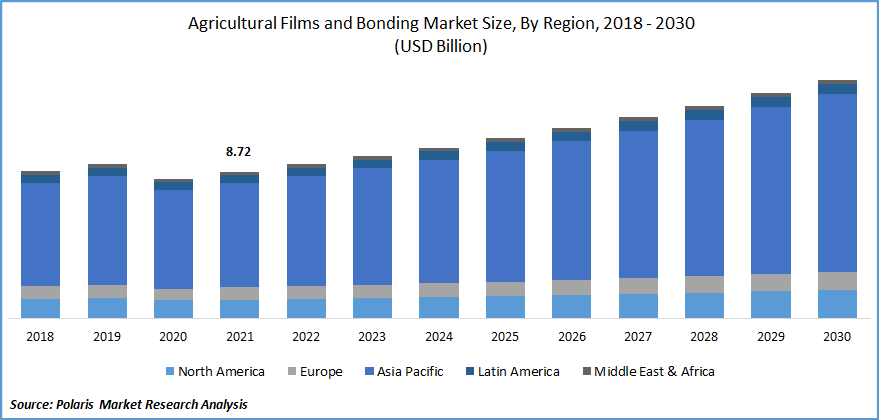

The global agricultural films and bonding market was valued at USD 8.72 billion in 2021 and is expected to grow at a CAGR of 5.6% during the forecast period. Market expansion is anticipated to be fueled by increasing food market demand and rising expectations for perfect agriculture productivity. The production of high crops and the shrinking amount of arable land are anticipated to have a favorable effect on the growth.

Know more about this report: Request for sample pages

The agricultural film has several benefits over traditional polymer film, including external nutrient provision, seed germination support, decreased soil compaction and erosion, increased soil warmth, weed suppression, and UV protection. Materials used for farming include agricultural film and bonding.

Using agricultural film and bonding to protect plants from rotting is a novel strategy that is far superior to traditional approaches. These coatings are more beneficial for agriculture because of their strength, transparency, anti-fog, diffusion, temperature effects, and degrading features.

The agricultural films and bonding market is expected to increase as a result of numerous market breakthroughs, such as fluorescent, Ultraviolet protection, and ultra-thermic screens. Because they maintain moisture and make handling and shipping easier, silage screens are mostly used on pasture fields to store animal feed.

The supply chain was disrupted as a result of the strong market demand for chemicals and supplies necessary to combat the COVID-19 pandemic, despite their high prices. The COVID-19 outbreak had an impact on the market for agricultural film and bonding. Governments all over the world have imposed a state of lockdown to stop the virus's spread as a result of the pandemic.

Many nations had a lack of raw resources as a result of the lockdown, which involved various limitations on international trade. Additionally, because agriculture-based activity was slowing down, there was a fall in market demand for agricultural film and bonding, which led to negative growth for agricultural film and bonding during the period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The key factor, such as the rising market demand for biodegradable products in the agricultural segment, is boosting the agricultural films and bonding market growth during the forecast period. To address the polyethylene contamination in the agroecosystem, biodegradable plastic mulches (BDM) are utilized as an alternative to traditional plastic mulches.

For use in farming and gardening, biodegradable mulch film has been developed. It is a biopolymer film with outstanding performance, biobased content, and compostability certification. The benefit of biodegradable film in the agro-industry is that the farmer can simply plow it in after harvesting instead of doing additional work to gather the mulch film.

The usage of plastics is regulated by numerous laws. Plastic use in agricultural films and bondings is in danger due to growing environmental concerns. Therefore, it is anticipated that these areas will see an increase in the supply of biodegradable films and bondings. In the market, recyclable or biodegradable plastics are chosen.

As these films and bondings lower the cost of removal, the agricultural films and bonding market is anticipated to expand during the time of forecasting. The biodegradable film reduces pollution and saves resources. Biodegradable film usage in agriculture also encourages sustainability and lessens soil contamination.

Report Segmentation

The market is primarily segmented based on raw material, end product, application, industry verticals, and region.

|

By Type |

By End-Use Industries |

By Raw Material |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Agricultural Films is expected to witness the fastest growth

Due to the increasing market demand for high-quality crops, this segment is predicted to increase at the quickest rate throughout the projection period. The benefits are provided by many agricultural films and bonding, which are mostly employed for producing food and vegetable crops across large areas including higher crop quality, retention of water, minimizing the spread of weeds, regulation of soil temperature, and cleaning the soil before planting, among others.

In 2021, the market share for twine was the highest. Baling twines are employed for product stacking and joining. They can also be used to stuff transportable containers for fruits and vegetables.

Polypropylene (PP) accounted for the highest market share in 2021

Numerous uses for polypropylene (PP) are found in farming and agriculture. They produce the netting and twines used in packing and damage prevention for the products. Corrugated PP is employed for irrigational applications, while PP twines are used for binding.

China, in particular, is predicted to have a large market demand for low-density polyethylene (LDPE). Due to their low manufacturing costs and superior product performance, LLDPE films are replacing the traditional LDPE in numerous applications. In the packaging sector, these films are used in a variety of ways.

As a result, LLDPE films are replacing HDPE since the latter is more appropriate and HDPE films are stiffer. Due to their superior qualities, including high tensile strength and puncture resistance, as well as their inexpensive cost in comparison to other varieties, LLDPE is in high market demand, which has led to their domination.

Greenhouse application is expected to hold the significant revenue share

Depending on the technology employed, the greenhouse may be a structure that is closed momentarily, semi-permanently, or even permanently. Greenhouses that have completely automated ventilation are taxed and closed in North America. These may also be mobile, temporary structures that are rolled into the outback. Hoop houses, often known as greenhouses, are exempt from taxes.

Agriculture films are up to 20 meters wide and range in thickness from 80 to 220 millimeters. Depending on the photo stabilizer employed, the shelf life of greenhouses ranges from 6 to 45 months. Traditional greenhouse movies are pricey because they're mechanized. These greenhouses have curving structures that are coated in glass or PE film. It has automatically controlled temperature sensors. Agriculture production can meet all requirements for exports due to its special structure and controlled environment.

Due to their extensive arable land and intense agriculture-based activity, China and the rest of Asia are where mulching films are most commonly used. To offset the negative impacts of the severe climate and to meet the rising demand for the goods from such projects, greenhouse covers are frequently utilized in horticulture and floriculture projects in Europe and the Middle East.

The demand in Asia Pacific is expected to witness significant growth

This increase can be ascribed to the region's expanding population as well as the desire for regulated agriculture, both of which are expected to fuel the agricultural film and bonding industries throughout the projection period. Stringent environmental restrictions regarding film disposal and production it is driving growth.

Population growth and growing food consumption per person put a strain on agro output. A decline in arable land prevents an increase in the area under cultivation. To meet the demands of the region's expanding population, managed agriculture must be practiced.

Additionally, due to the economic downturn and market saturation in Europe and North America, demand is migrating to the Asia-Pacific area. Manufacturers of agricultural film and bondings are focusing on this area because it has the strongest regional agricultural films and bonding market right now. In the area, China is both the top producer and consumer of agricultural films and bonding. As a result, there is a greater demand for agricultural films and bondings. The need for vegetables in Japan is met by crops grown in greenhouses.

Europe is predicted to have stagnating growth. However, shifting the market's attention to biodegradable materials is anticipated to accelerate regional expansion. Due to severe environmental rules brought on by the potentially hazardous content of some films, the Middle East and Latin America are predicted to have slow growth.

Competitive Insight

Some of the major players operating in the global agricultural films and bonding market include AB Rani Plast, Armando Alvarez Group, Berry Plastics Group, Inc., BP Industries (BPI), BASF SE, Barbier Group, British Polythene Plc., Britton Group, ExxonMobil Corporation, Kuraray Co. Limited., Plastika Kritis S.A., Dow Chemical Company, and The RKW Group.

Recent Developments

In April 2022, Coveris launched a product named Unterland R, a new stretch film for wrapping silage, which incorporates at least 30% recycled material from gathered agricultural films and bonding.

In January 2021, The Rani Group introduced RaniWrap Ecol, an agriculture bale wrap using 30% recycled raw materials. The fact that the recycled content comes from a closed system process that only uses recycled bale wrap polyurethane coating supports Rani Plast's environmental philosophy and is a crucial component of the new product.

In February 2021, Dow Company and Lucro Plastecycle recently signed a memorandum of understanding (MoU) to introduce polyethylene (PE) film products using post-consumer recycled (PCR) plastics. With this partnership, Dow expands its plastics circularity offering in the Asia Pacific area and offers close-the-loop customized solutions to assist India to achieve a circular economy.

Agricultural Films And Bonding Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 8.72 billion |

|

Revenue forecast in 2030 |

USD 14.22 billion |

|

CAGR |

5.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Raw Material, By End-Use Industries, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AB Rani Plast OY, Armando Alvarez Group, Berry Plastics Group, Inc., BP Industries (BPI), BASF SE, Barbier Group, British Polythene Plc., Britton Group, ExxonMobil Corporation, Kuraray Co. Ltd., Plastika Kritis S.A., The Dow Chemical Company, and The RKW Group. |