Agricultural Films Market Size, Share, Trends, Industry Analysis Report

: By Raw Material, Application (Green House, Mulching, Silage), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5643

- Base Year: 2024

- Historical Data: 2020-2023

Agricultural Films Market Overview

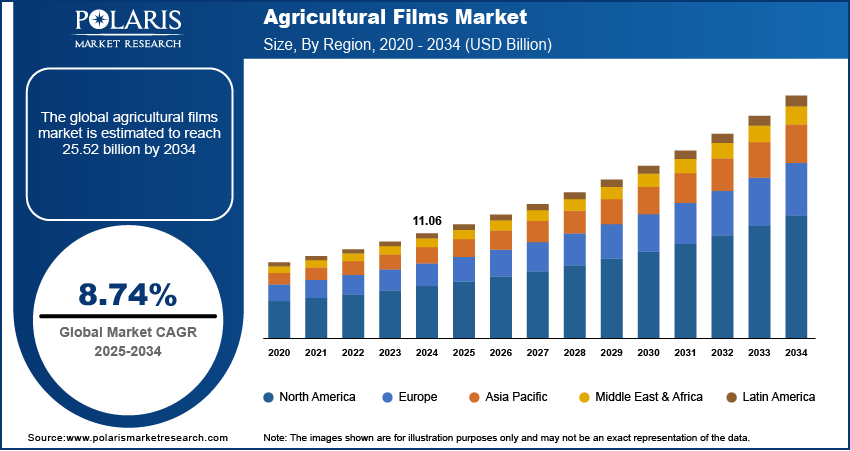

The global agricultural films market was valued at USD 11.06 billion in 2024. It is expected to grow from USD 12.00 billion in 2025 to USD 25.52 billion by 2034, at a CAGR of 8.74% during the forecast period.

Agricultural films are polymer-based materials used in farming applications to improve productivity, protect crops, and improve resource efficiency. Agricultural films have emerged as a critical component in modern farming practices as the global demand for food continues to rise. The growing need for high-yield farming is driving the agricultural film market demand. Farmers are adopting innovative techniques to maximize output per hectare with limited arable land and increasing population pressures. A January 2025 Royal Society report highlights a challenge in land sparing: while high-yield farming can boost production efficiency, it increases overall output by lowering prices, raising profits, or freeing resources, potentially offsetting conservation benefits. Agricultural films help in optimizing soil moisture, regulating temperature, and minimizing weed growth, all of which contribute to enhanced crop productivity. This growing emphasis on yield optimization, particularly in regions facing agricultural constraints, is fostering sustained demand for these materials.

To Understand More About this Research: Request a Free Sample Report

The expansion of the agricultural film market is the rising adoption of protected agriculture and greenhouse farming. These controlled environment systems are gaining popularity for their ability to extend growing seasons, improve crop quality, and reduce the impact of external climatic fluctuations. Agricultural films such as greenhouse covers, mulching films, and silage films play a vital role in maintaining the desired microclimate within these structures. The usage of specialized films is expected to grow in parallel as more farmer’s transition to greenhouse farming to meet market demands for consistent and high-quality produce. This alignment between technological adoption and the need for efficient farming practices continues to propel the market forward.

Agricultural Films Market Driver Dynamics

Increasing Demand for Sustainable Farming Practices

Modern agriculture is under pressure to reduce its ecological footprint while maintaining productivity, prompting the adoption of practices that minimize soil degradation, water wastage, and chemical usage as the industry shifts toward environmentally responsible solutions. This urgency is reflected in investment trends, for instance, a January 2025 Climate Policy Initiative report notes that annual financial flows to sustainable agriculture averaged USD 301 billion during FY 2020–2022. Agricultural films support these goals by enabling precise input management, enhancing soil health through mulching, and reducing the need for herbicides and irrigation. Biodegradable and recyclable film options further align with sustainability objectives, appealing to both regulatory bodies and environmentally conscious stakeholders. As a result, the push for greener farming methods is directly influencing the adoption of advanced agricultural films.

Technological Advancements in Film Manufacturing

Innovations in polymer science and manufacturing techniques have led to the development of films with enhanced UV resistance, tensile strength, and controlled permeability, making them more efficient and long-lasting in diverse agricultural conditions. Additionally, the integration of smart features, such as light-diffusing and thermally insulating properties, allows farmers to optimize growing conditions more effectively by improving film performance, durability, and environmental compatibility. Leading chemical companies are responding to these market demands with innovative solutions that address both performance and sustainability needs. For instance, in July 2024, BASF launched Tinuvin NOR 211 AR, a stabilizer for agricultural plastics, enhancing resistance to UV radiation, thermal stress, and inorganic chemicals. The innovation supports plasticulture trends such as down gauging and multilayer films, improving durability while reducing waste. These advancements boost crop yields and also reduce the frequency of film replacement, improving cost-efficiency and operational sustainability. Consequently, continuous innovation in film technology is playing a pivotal role in expanding the application scope and acceptance of agricultural films.

Agricultural Films Market Segment Assessment

Agricultural Films Market Assessment by Raw Material Outlook

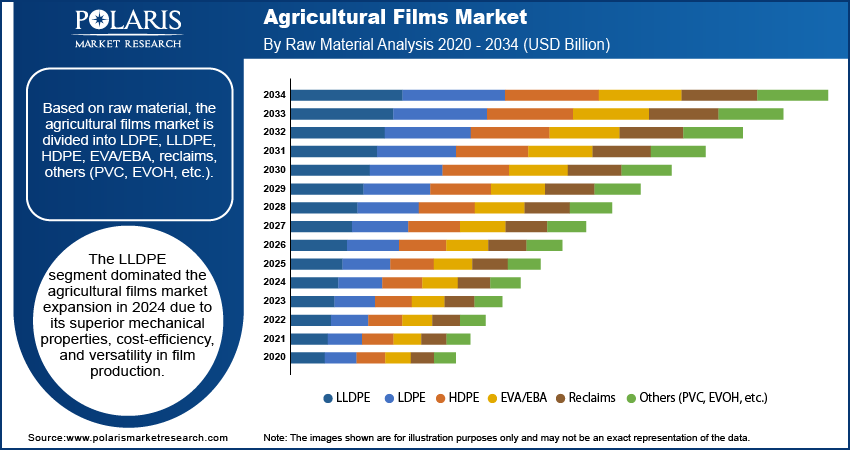

The global agricultural films market assessment, based on raw material, includes LDPE, LLDPE, HDPE, EVA/EBA, reclaims, others (PVC, EVOH, etc.). The LLDPE segment dominated the Agricultural Films market expansion in 2024 due to its superior mechanical properties, cost-efficiency, and versatility in film production. LLDPE offers enhanced flexibility, high tensile strength, and excellent puncture resistance, making it well-suited for various agricultural applications, such as greenhouse coverings, mulching, and silage films. Its compatibility with advanced film manufacturing technologies allows for the production of thinner yet durable films, reducing material usage while maintaining performance. Additionally, the recyclability of LLDPE supports growing sustainability initiatives in agriculture, further driving its preference among manufacturers and end-users.

Agricultural Films Market Evaluation by Application Outlook

The global agricultural films market evaluation, based on application, includes green house, mulching, silage. The green house segment is expected to witness the fastest Agricultural Films market growth during the forecast period primarily due to the increasing adoption of protected cultivation practices. Greenhouse farming is becoming a preferred solution for ensuring year-round crop production with improved yield and quality as climate variability and land constraints intensify. Agricultural films used in greenhouses help regulate temperature, control light transmission, and protect crops from adverse weather conditions, thereby enhancing productivity. The rising demand for high-value crops and the push toward modern, technology-integrated farming systems are accelerating the uptake of greenhouse films, particularly in emerging economies.

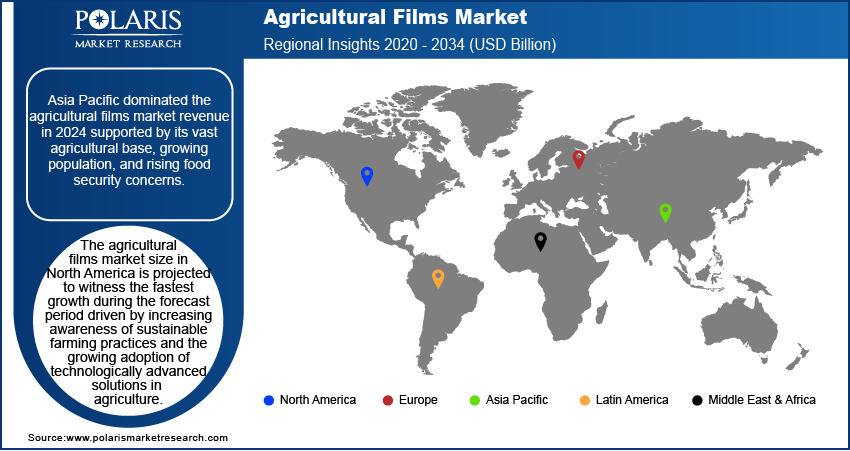

Agricultural Films Market Outlook by Region

By region, the report provides the Agricultural Films market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominated the Agricultural Films market revenue in 2024 supported by its vast agricultural base, growing population, and rising food security concerns. Government data from major agricultural producers in the region demonstrates the robust agriculture sector driving demand for protective film solutions. According to a November 2024 report by the IBEF India's foodgrain production reached 330.5 million MT in 2022-23 (IBEF, Nov 2024), reinforcing its position as the world’s 2nd largest producer of food grains, fruits, and vegetables. Rice procurement for KMS 2023-24 is projected at 521.27 LMT, up from 496 LMT in 2022-23. Countries across the region are increasingly adopting advanced agricultural practices to meet the surging demand for food and improve land productivity. Government initiatives promoting the use of plasticulture, along with investments in protected farming infrastructure, have further accelerated the use of agricultural films. Moreover, the presence of leading film manufacturers and the availability of cost-effective raw materials contribute to the region’s strong production capabilities and widespread adoption across both large-scale and smallholder farms.

The agricultural films market size in North America is projected to witness the fastest growth during the forecast period driven by increasing awareness of sustainable farming practices and the growing adoption of technologically advanced solutions in agriculture. The region's emphasis on precision farming and resource optimization has led to rising demand for films that enhance crop yield, conserve water, and reduce input costs. Additionally, research and innovation in biodegradable and high-performance films are gaining traction, aligning with environmental regulations and consumer preferences. The strong support for modern agricultural infrastructure and the presence of technologically advanced farming operations further position North America as a major growth market.

Agricultural Films Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for agricultural films market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Agricultural films market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with agricultural films market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. A few key major players are Agriplast Tech India Pvt. Ltd.; Armando Alvarez Group; BASF SE; Berry Global Group, Inc.; Coveris; Dow Inc.; ExxonMobil Corporation; Groupe Barbier; Kuraray Co., Ltd.; Novamont S.p.A.; Plastika Kritis S.A.; Polifilm; Rani Plast Oy; RKW Group; Trioplast Industrier AB.

Berry Global Group, Inc., headquartered in the United States, is a global manufacturer of innovative agricultural films and other engineered materials. Operating over 265 manufacturing facilities worldwide, Berry Global has a strong presence in Europe and North America. The company offers a comprehensive range of agricultural films, such as silage wraps, greenhouse films, mulching films, and crop packaging solutions. These products are designed using advanced technologies to enhance durability, functionality, and environmental sustainability. Berry Global is committed to reducing plastic waste by adopting a circular economy approach, focusing on recyclable and thinner film designs that minimize raw material usage without compromising performance. Notable innovations include ProTechnology, which reduces film weight by up to 25%, and Film&Film bale wrapping methods that optimize silage preservation. Additionally, Berry’s Silotite and Baletite brands have been recognized for their efficiency in reducing silage losses. Through its sustainable practices and cutting-edge solutions, Berry Global continues to lead the agricultural films market while addressing environmental concerns and supporting modern farming needs.

BASF SE, headquartered in Ludwigshafen, Germany, specializes in chemical innovations, such as solutions for sustainable agriculture. In the agricultural films segment, BASF focuses on enhancing crop yield and quality while promoting eco-friendly practices. A key product is its soil-biodegradable biopolymer ecovio M2351, specifically developed for mulch films. These films help increase yield, speed up harvesting, conserve water, and reduce herbicide use. Importantly, they are certified soil-biodegradable according to EN17033 standards, meaning they fully degrade into natural soil components through microorganisms like bacteria and fungi. Farmers can plow these films back into the soil after harvest, saving time and costs while preventing microplastic contamination, a common issue with conventional polyethylene (PE) mulch films. In addition to mulch films, BASF’s agricultural plastics portfolio includes greenhouse films, silage stretch films, drip irrigation pipes, and nonwovens. These products contribute to modern farming by improving moisture retention, regulating temperature, and protecting crops from pests and extreme weather conditions. BASF’s commitment to sustainability aligns with global efforts to reduce environmental impact in agriculture. BASF SE supports the transition to sustainable food production while addressing critical challenges like soil health and microplastic pollution by offering innovative and biodegradable solutions.

Key Companies in Agricultural Films Market

- Agriplast Tech India Pvt. Ltd.

- Armando Alvarez Group

- BASF SE

- Berry Global Group, Inc.

- Coveris

- Dow Inc.

- ExxonMobil Corporation

- Groupe Barbier

- Kuraray Co., Ltd.

- Novamont S.p.A.

- Plastika Kritis S.A.

- Polifilm

- Rani Plast Oy

- RKW Group

- Trioplast Industrier AB

Agricultural Films Market Development

January 2025: RKW Group announced its participation in Fruit Logistica (Berlin, Feb 5-7) to showcase agricultural films, nonwovens, and packaging solutions for plant cultivation, food packaging, and transport. The product range includes crop covers, greenhouse films, and secure transport materials.

October 2023: Grupo Armando Alvarez and RedSea partnered to produce intelligent greenhouse covers integrating Iyris technology. The 100% recyclable films regulate temperatures, reduce water/energy use, and enhance crop yields in hot climates through advanced light and heat management.

Agricultural Films Market Segmentation

By Raw Material Outlook (Revenue, USD Billion, 2020 - 2034)

- LDPE

- LLDPE

- HDPE

- EVA/EBA

- Reclaims

- Others (PVC, EVOH, etc.)

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Green house

- Mulching

- Silage

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Agricultural Films Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.06 billion |

|

Market Size Value in 2025 |

USD 12.00 billion |

|

Revenue Forecast in 2034 |

USD 25.52 billion |

|

CAGR |

8.74% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global agricultural films market size was valued at USD 11.06 billion in 2024 and is projected to grow to USD 25.52 billion by 2034.

The global market is projected to grow at a CAGR of 8.74% during the forecast period.

Asia Pacific dominated the agricultural films market in 2024.

Some of the key players in the market are Agriplast Tech India Pvt. Ltd.; Armando Alvarez Group; BASF SE; Berry Global Group, Inc.; Coveris; Dow Inc.; ExxonMobil Corporation; Groupe Barbier; Kuraray Co., Ltd.; Novamont S.p.A.; Plastika Kritis S.A.; Polifilm; Rani Plast Oy; RKW Group; Trioplast Industrier AB.

The LLDPE segment dominated the agricultural films market expansion in 2024.

The green house segment is expected to witness the fastest agricultural films market growth during the forecast period.