Air Quality Control System Market Size, Share & Trends Analysis Report

by Product Type (Indoor, Outdoor), By Pollutant (Physical, Chemical), By Component, By End Use (Industrial, Commercial), By Region, And Segment Forecasts, 2023 – 2032

- Published Date:May-2023

- Pages: 119

- Format: PDF

- Report ID: PM3246

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

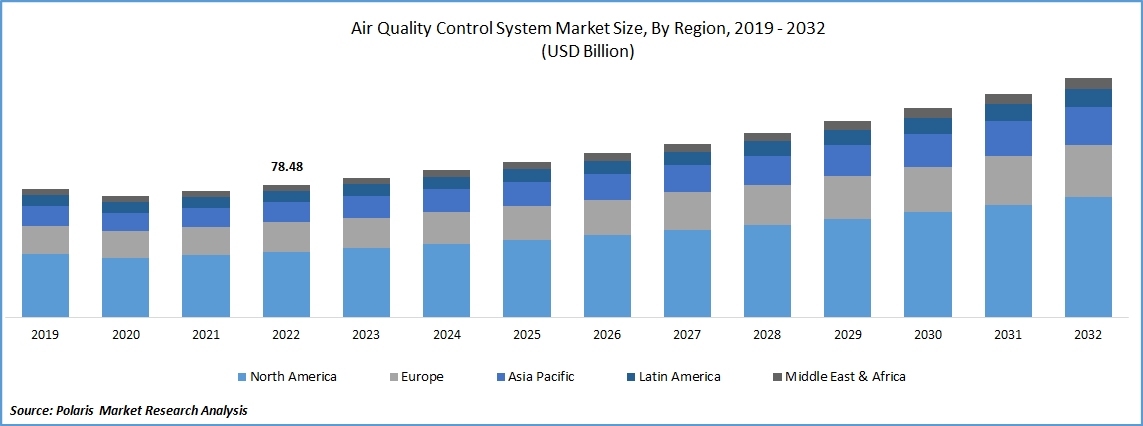

The air quality control systems market was estimated to be worth USD 78.48 billion in 2022 and is anticipated to grow at a CAGR of 6.2% from 2023 to 2032. Product demand is likely to be influenced by rising atmospheric pollution levels as well as strict government standards and rules for pollution control. Moreover, the number of fatalities caused by respiratory illnesses brought on by air pollution has significantly increased in recent years. In turn, this will increase product desire.

Know more about this report: Request for sample pages

A danger to the stability of the environment is air pollution. It significantly affects the environment, causing things like acid rain, an increase in toxicity, and global warming, among other things. Air quality Control systems are becoming more widely used in sectors like manufacturing, automotive, and oil and gas due to increasing demands for workplace safety. Accidents like the Aliso Canyon disaster and the Bhopal gas leak catastrophe have caused an increase in public awareness about the need to monitor the existence of pollutants in the atmosphere. In addition, rising government environmental conservation initiatives, such as funding for the implementation of air quality Control systems and smart city initiatives, are anticipated to spur market expansion over the course of the forecast period.

There have been many collaborations between public and commercial organizations in recent years. In order to safeguard the environment, major corporations like Honeywell International Inc. and Intel Corporation work with governments all over the world. The development of sensor networks and intelligent systems for observing the condition of air and water is the goal of these collaborations. The Clean Air Partners were established under the Clean Air Act by the Metropolitan Washington Council of Governments, in collaboration with the Maryland Department of Transportation, the Baltimore Metropolitan Council, and WGL Holdings, Inc. Clean Air Partners has installed Control equipment throughout the Baltimore-Washington region and offers statistics on the current and upcoming quality of the air there.

The global closure of numerous industries and power plants as a result of the COVID-19 pandemic has had a negative effect on the market for industrial air quality control systems. The market is primarily being driven by three main factors: rising consumer awareness, strict air quality control regulations, and rising public understanding of health risks. The development of renewable and alternative energy sources with no emissions, however, and the high cost of installing an air quality management system are anticipated to restrain the market's expansion.

The market is observing trends like an increase in the accessibility of inexpensive sensor networks, advancements in wireless communication, crowdsourcing, and rising public consciousness of environmental preservation. For instance, PurpleAir and The Weather Company worked together to collect real-time data from its sensor devices and make it available to Weather Underground, demonstrating the accessibility of low-cost sensor networks. (a subsidized unit of Weather Company).

Industry Dynamics

Growth Drivers

Power facilities are the main producers of SO2, mercury, and acid gas emissions in the energy sector. Around 98% of SO2, 94% of mercury, 86% of NOx, and 83% of fine particulate emissions in the power industry are caused by coal. In 2022, coal was used to produce about 42% of the world's electricity. Air quality control systems (AQCS), such as electrostatic precipitators, scrubbers, flue gas desulfurizers, and mercury control systems, can reduce the generation of the aforementioned harmful gases.

The air quality control systems market is being driven by the government's efforts to reduce environmental pollution and the increasing public concerns about it. The installation of systems that monitor emissions and reduce them to a safe level is mandated by strict international and national regulations, including the Clean Air Act (CAA) and the Mercury and Air Toxics standard, in power generation businesses that use fossil fuels.

Report Segmentation

The market is primarily segmented based on component, product type, end-use, and region.

|

By Pollutant |

By Product |

By End-use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The outdoor segment is expected to dominate the market during forecast period

The market has been divided into indoor and outdoor Control systems based on the sort of product. Due to greater integration efforts of these systems with other smart city infrastructure, such as smart poles, traffic systems, and streetlight options, the outdoor segment dominated the market in 2022. Another factor promoting the segment's expansion is government requirements for the use of air quality Control equipment in sectors like oil and gas and pharmaceuticals. The outdoor market is split into permanent and portable segments.

The chemical segment will account for a higher share of the market during forthcoming years

The industry has been divided into chemical and physical segments based on pollutants. Due to rising vehicle emissions, which include dangerous pollutants like carbon monoxide, the chemical sector dominated the market in 2022. The industry has been divided into segments for nitrogen oxides (NOX), sulphur oxides (SOX), carbon oxides (COX), volatile organic compounds (VOCs), and others based on chemical pollutants. Due to an increase in the number of factories and vehicles, two main sources of COx emissions, the carbon oxides segment held the biggest share. Additionally, capnography is frequently performed using carbon dioxide Control devices in intensive care and anaesthesia.

Industrial sector is expected to hold the significant revenue share in projected timeframe

The industry has been divided into residential, commercial, and industrial segments based on end use. In 2022 the industrial sector had the biggest share, and over the following six years it is anticipated to grow at the highest CAGR. Due to strict government regulations, a growing number of industries are adopting air quality Control devices, which is responsible for the industrial segment's expansion. Oil and gas, manufacturing, food and beverage, pharmaceutical, healthcare, and other sectors make up the industrial segment. In 2022, the industrial end-use category was dominated by the oil and gas sector. Oil and gas conduit infrastructure has been rapidly expanding as a result of rising demand for natural gas and petroleum.

The demand in North America is expected to witness significant growth during forecast period

North America continues to retain a dominant position in the market. This can be ascribed to the region's increasing acid rain levels, which have made 90% of North American lakes acidic. Governments have responded by requiring stringent oversight of air quality, which will spur market expansion. Additionally, the existence of well-established distribution platforms used by top manufacturers is encouraging for market expansion. Due to the rising incidence of respiratory and cardiovascular diseases brought on by the region's air pollution in many of its cities, Asia Pacific is anticipated to experience the greatest CAGR over the course of the forecast period.

Competitive Insight

Mergers and mergers are taking place among some of the major air quality control systems market players, including 3M, Emerson Electric Co., General Electric Company, HORIBA, Ltd., Merck, Siemens AG, Teledyne Technologies Incorporated, and Thermo Fisher Scientific, Inc.

Recent Developments

- In July 2022, Through its subsidiary, JERA Power Taketoyo G.K., JERA Co., Inc. began commercial operation of Unit 5 of the Taketoyo Thermal Power Station located at 1-1 Ryugu, Taketoyo-Cho, Chita County, Aichi Prefecture, Japan. The company has been replacing aging equipment for the past couple of years. This high-efficiency coal-fired power plant is equipped with Ultra-Supercritical (USC) power generation technology.

- As of 2022, the Quang Trach 1 Coal-fired Power Plant is under construction in Vietnam with a capacity of 1.2 gigawatts, and the estimated plant investment is USD 1.27 billion. The project is expected to be commissioned by 2025 and generate up to 8.4 billion kilowatt-hours of electricity annually.

Air Quality Control Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 82.50 billion |

|

Revenue forecast in 2032 |

USD 141.36 billion |

|

CAGR |

6.2% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Pollutant, By Product Type, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

3M, Emerson Electric Co., General Electric Company, HORIBA, Ltd., Merck, Siemens AG, Teledyne Technologies Incorporated, and Thermo Fisher Scientific, Inc.

|

Navigate through the intricacies of the 2023 Air Quality Control Systems Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

key companies in air quality control systems market are 3M, Emerson Electric Co., General Electric Company, HORIBA, Ltd., Merck, Siemens AG, Teledyne Technologies Incorporated, and Thermo Fisher Scientific, Inc.

The air quality control systems market anticipated to grow at a CAGR of 6.2% from 2023 to 2032.

The air quality control systems market report covering key segments are component, product type, end-use, and region.

Key driving factors in air quality control systems market are increase in demand for air filters in medical and pharma industries.

The global air quality control system market size is expected to reach USD 141.36 billion by 2032.