Aircraft Actuator Market Share, Size, Trends, Industry Analysis Report

By Installation Type (OEM and Retrofit); By Technology, By Wing Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3210

- Base Year: 2023

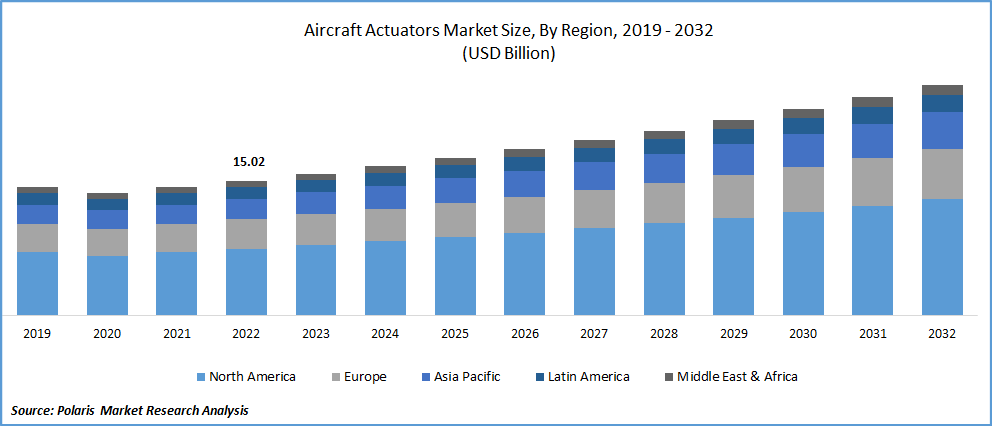

- Historical Data: 2019-2022

Report Outlook

The global aircraft actuator market was valued at USD 15.8 billion in 2023 and is expected to grow at a CAGR of 5.6% during the forecast period. The global aircrafts actuator demand is likely to witness the rapid growth over the anticipated period, as aircrafts actuators controls the movement of a system by conversion of signals to mechanical motion which is used in different systems of an aircraft such as fuel management systems, power generation and transmission of power system, flight control system and a core function of flow and motion control of all systems in an aircraft.

Know more about this report: Request for sample pages

Due to rise in air passenger traffic from big economies like India and China resulting a rapid rise in demand of aircrafts deliveries and manufactures are switching from old conventional hydraulic actuators to new and advanced electric actuators which also offers considerable superior benefits like increased efficiency, low wight and no leaking problems, this will subsidize the growth of actuators market over the forecasted period.

For instance, Moog Inc. was signed a contract with Lockheed Martin for the production of electro-hydrostatic actuators for the wing fold actuation system & leading-edge flap drive system on F-35 for next three years which will significantly lead to growth of market, because of the low procurement cost of F-35 the awarded contract will be successful and will boost the aircraft actuator market.

The outbreak of the COVID-19 pandemic has resulted a net worthy drop in demand of actuators over the world including regions Asia-Pacific, United States, and Europe. Due to the limited availability of components and equipment, limited staff at manufacturing facilities due to government rules and regulations, manufacturing shutting down and late delivery have become a diminishing factor of consistent decrease in revenues of several aircraft actuators suppliers, service providers and manufacturing units, But as the disturbance receded the supply chain of aircrafts deliveries gently recovered for the rising demand of aircraft actuators during pre-pandemic levels.

Industry Dynamics

Growth Drivers

The continuously growing adoption of advanced technologies and rising awareness of development of more electrical aircrafts (MEA) has resulted an encouragement among original equipment manufacturers (OEMs). They collaborate with suppliers to unlock the ability of designing and development of new electric aircraft architecture within the miniature time period.

In the aviation industries the MEA acts as a reproving facilitator and offers various net worthy potentials for aircraft such as fuel-efficient engines, weight reduction, reduction in functioning cost by reducing the maintenance costs, increase in the reliability of aircraft etc. as MEA system provides an incentive change with using electric power in non-propulsive systems which currently driving by traditional power sources like pneumatic, hydraulic and mechanical power resources.

Furthermore, the market of new advanced electric aircrafts actuators is rising due to various factors including the recognizable problems associated with the use of conventional traditional actuators power by pneumatic, mechanical, and hydraulic technologies. These actuators eliminate the problems faced while using the traditional actuators and offers 80% more efficiency than hydraulic counterparts as it uses more advanced and efficient motor with ability to face more heat which protects the actuator from component damage, therefore the demand of electric aircrafts actuators is accounted to grow at a rapid pace over forecasted period.

Report Segmentation

The market is primarily segmented based on installation type, Wing type, technology and region.

|

By Installation Type |

By Wing type |

By Technology |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Fixed wing aircrafts held high demand for aircrafts actuators during the anticipated period

In the commercial and aviation sectors the demand for fixed wing aircrafts is increasing at rapid pace, due to speedy urbanization and the rising nucleus of aircrafts OEMs with the aim of manufacturing high-performing advanced aircrafts with lowest weight profile, the rapid growth in passenger traffic is also a driving factor that can not be ignored with all the main propelling factors of market has account for significant growth during the predicted period.

Hydraulic actuators account to witness higher demand over the forecast period

Hydraulic segment garnered the largest revenue share. Hydraulic actuators provide deep rooted and essential benefits for high performance applications increases the demand for hydraulic actuators and due to high and advanced efficiency and high level of control and the electric actuators are anticipated to replace the hydraulic and pneumatic which will increase the demand for aircrafts actuators over the globe. However, Rotary actuators and linear actuators are further classification of aircrafts actuators based on type segment, which primarily used in automation applications such as valves and gates of aircrafts.

North America is anticipated to witness high growth in industry over the forecasted period

Industrial large manufacturers are becoming a major factor of driving market in the region of North America and for the development of aircrafts actuators the leading competitors are rapidly being aware of investing and R&D of actuators which will make actuators more efficient and reliable to capture the market from their rivals. In lieu of using conventional technology in aircrafts, the suitability development of aircrafts actuators for state-of-the-art technologies, such as more electric aircraft systems. Thus, the market of aircrafts actuators has accounted to witness the growth at a rapid pace.

Competitive Insight

Some of the major competitors operating in the global aircraft actuator market include Raytheon Technologies, Curtiss-Wright Corporation, Safran, Liebherr lnternational, Moog Inc., Maxon Motor, Sitec Aerospace, Progressive Automation, Tamagawa Seiki, PARKER HANNIFIN, Aero Space Controls, Beaver Aerospace & Defense, Eaton Corporation, Rockwell Collins, & Price Wheeler Corp.

Recent Developments

- In May 2022, Safran developed a new line of electro-hydrostatic actuators (EHA), different types of aircrafts having narrow-body & widebody commercial jets, with a nexus and bulky network of pipes, the aircraft’s hydraulic system electrifying the nose wheel steering.

- In January 2020, Honeywell International, regarding development of its new and advanced electromechanical actuators which is specifically designed for the urban air mobility (UAM). In contrast to the hydraulics, cables, and pushrods found on most conventional aircraft, this advance actuator will use electricity singularly for the smooth movement for primary flight control surface.

- In August 2022, Hanwha Aerospace signed a contract with the Vertical Aerospace which is a United Kingdom based manufacturer with characteristics of zero-emission, electric vertical take off and landing electrically powered aircrafts for designing, testing and supply of electromechanical actuators for aircrafts such as Vertical’s VX4 electric aircraft.

Aircraft Actuator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 16.64 billion |

|

Revenue forecast in 2032 |

USD 25.65 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Installation Type, By Wing type, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Raytheon Technologies Corporation, Curtiss-Wright Corporation, Curtiss-Wright Corporation, Safran SA, Liebherr-international Deutschland GmbH, Moog Inc., and Eaton Corporation plc, Moog Inc., maxon motor ag, Sitec Aerospace GmbH, Progressive Automation Inc„ Tamagawa Seiki Co. Ltd., PARKER HANNIFIN CORP, Aero Space Controls Corporation, Beaver Aerospace & Defense, Inc„ Eaton Corporation PLC, Rockwell Collins, Price Wheeler Corp., etc. |

FAQ's

The global aircrafts actuators market size is expected to reach USD 25.65 billion by 2032

Key players in the aircraft actuator market Raytheon Technologies, Curtiss-Wright Corporation, Safran, Liebherr lnternational, Moog Inc., Maxon Motor, Sitec Aerospace, Progressive Automation.

North America contribute notably towards the global aircraft actuator market.

The global aircraft actuator market expected to grow at a CAGR of 5.5% during the forecast period.

The aircraft actuator market report covering key segments are installation type, wing type, technology and region.