Aircraft Engine Test Cells Market Share, Size, Trends, Industry Analysis Report

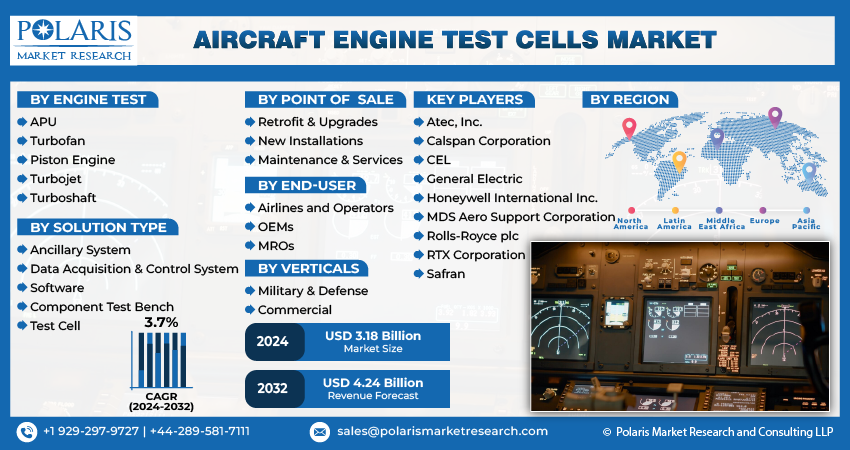

By Engine Test (APU, Turbofan, Piston Engine, Turbojet and Turboshaft); By Solution Type; By Point of Sale; By End-User; By Verticals; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4763

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

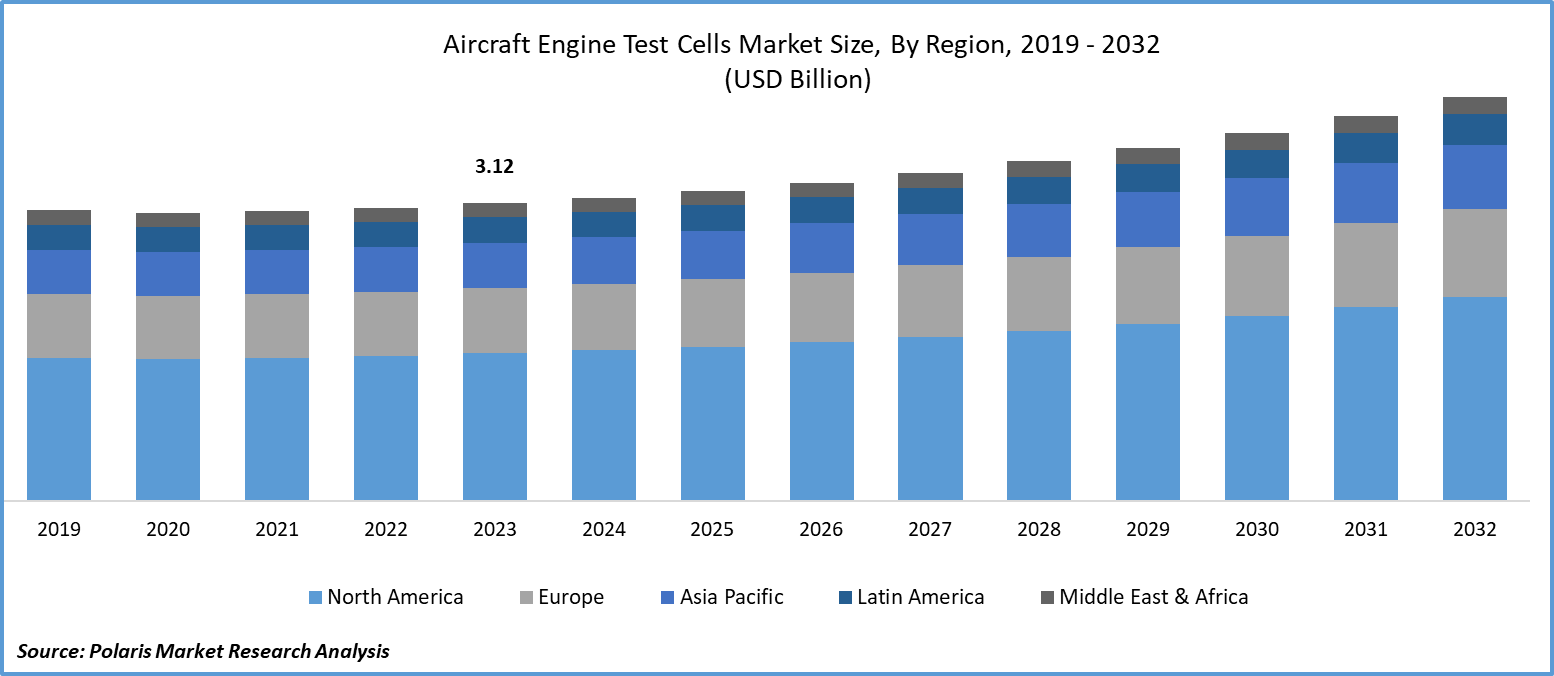

Global aircraft engine test cells market size was valued at USD 3.12 billion in 2023. The market is anticipated to grow from USD 3.18 billion in 2024 to USD 4.24 billion by 2032, exhibiting the CAGR of 3.7% during the forecast period

Aircraft Engine Test Cells Market Overview

The increasing demand for commercial aircraft and related maintenance, repair, and overhaul (MRO) services is a key driver for the aircraft engine test cells market growth. As airlines expand their fleets to meet growing passenger demand, there is a corresponding need for more frequent testing and maintenance of aircraft engines. This includes the testing of newly manufactured engines as well as the maintenance and upgrading of existing engines. Additionally, the growing complexity of modern jet engines requires more sophisticated testing equipment and facilities, further driving the demand for advanced engine test cells.

- For instance, in January 2024, Safran Aircraft Engines and France's ONERA, the national aerospace research agency, initiated the first wind tunnel tests using the ECOENGInE, a 1:5 scale prototype of the upcoming Open Fan. These tests are being conducted at ONERA's wind tunnel facility in Modane, France.

To Understand More About this Research: Request a Free Sample Report

An aircraft engine test cell is a specialized facility created for the safe testing and assessment of aircraft engines under controlled circumstances. Before engines are installed in aircraft, engineers can use them to evaluate engine performance characteristics, simulate different flying scenarios, and ensure the engines meet safety, reliability, and efficiency standards. These test cells, which are outfitted with cutting-edge equipment, gather information on engine performance, including thrust, fuel consumption, temperature, vibration, and other vital indicators.

The COVID-19 pandemic has significantly impacted the global aircraft engine test cell market expansion. The aviation sector, facing travel restrictions, lockdown measures, and a substantial decrease in passenger demand, has experienced severe challenges. As a result, the demand for aircraft engine testing services and the overall market for engine test cells have been significantly affected by these circumstances.

Aircraft Engine Test Cells Market Dynamics

Market Drivers

Increasing spending to build new testing facilities for aviation engines to encourage market expansion

Rapid growth in global air traffic is driving demand for more fuel-efficient commercial aircraft, including wide-body and narrow-body types. Factors such as economic globalization fuel this trend, expanded air routes, and a growing middle class spending capability. Airlines are modernizing their fleets with advanced models such as the Airbus A350 and Boeing 787 Dreamliner, known for fuel-efficient engines such as the Rolls-Royce Trent XWB and the General Electric GEnx. This fleet modernization requires thorough testing of aircraft engines, leading to increased demand for Aircraft Engine Test Cell Solutions in the commercial aviation sector.

Market Restraints

Heavy investment of funds is likely to impede the market growth.

Significant financial investments profoundly impact the aircraft engine test cell market development, exemplified by the substantial commitments and resources allocated by major industry players like GE Aerospace and Rolls-Royce in the United States. For instance, GE Aerospace's initiative to establish one of the largest engine test cells globally in Brazil underscores the extensive financial backing and resources necessary to develop and operate state-of-the-art testing facilities. This project, which involved over 150 suppliers and 700 workers in the construction of the 62-acre site, required a total expenditure of USD 50.0 million. It highlights not only the substantial financial investment but also the extensive involvement of the supply chain and workforce needed to bring such a facility to fruition.

Report Segmentation

The market is primarily segmented based on engine test, solution type, point of sale, end-user, verticals, and region.

|

By Engine Test |

By Solution Type |

By Point of Sale |

By End-User |

By Verticals |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Aircraft Engine Test Cells Market Segmental Analysis

By Engine Test Analysis

- The turbofan segment led the aircraft engine test cells market opportunity with substantial revenue share in 2023. Owing to their superior altitude capability compared to other engine types. This capability makes them ideal for a wide range of applications in both military and commercial aviation. One of the key advantages of turbofans is their ability to operate efficiently at high altitudes, which is crucial for long-haul flights and military missions. Additionally, turbofans are known for their relatively quiet operation compared to other engine types, making them a preferred choice for both passengers and residents near airports. This combination of altitude performance and low noise makes turbofans highly desirable for various aircraft types, driving the demand for engine test cells tailored to their specific requirements.

By Solution Type Analysis

- The test cells segment accounted for the largest market share in 2023 and is likely to retain its position throughout the aircraft test cells market forecast period. These test cells play a crucial role in enhancing various aspects of aircraft engines and advancing aviation technology. Researchers are actively developing new test cells to address evolving industry needs and to meet the demands of increasingly complex engine designs. These advanced test cells are designed to provide more accurate and comprehensive testing, leading to improved engine performance, efficiency, and reliability. As a result, the demand for these innovative test cells is expected to drive growth in the market as airlines and manufacturers seek to enhance their engine testing capabilities.

By Point of Sale Analysis

- Based on the point of sale analysis, the market has been segmented on the basis of retrofits & upgrades, new installations, and maintenance & services. The retrofit & upgrades segment is expected to grow at the fastest CAGR during the aircraft engine test cells market forecast period. These projects offer a practical and cost-effective approach to extending the lifespan and enhancing the functionality of existing test cells. By implementing upgrades and modernization efforts, operators can maximize the efficiency and effectiveness of their test facilities without the need for complete overhauls or expensive replacements. These improvements can include the integration of advanced technologies, such as data analytics and automation, to streamline testing processes and improve overall performance. Additionally, upgrades can be tailored to address specific needs and challenges faced by test cell operators, ensuring that the enhancements are both practical and impactful.

By End-User Analysis

- The OEMs segment holds the largest market revenue share in 2023 owing to the significant investments in the modernization of engine test facilities are driving an increased demand for advanced testing equipment, fostering technological advancements, and expanding the global footprint of industry players.

By Verticals Analysis

- The commercial segment is anticipated to hold a significant market revenue share during the aircraft engine test cells market expansion period. The surge in global air traffic is fueled by economic growth, increasing disposable incomes, and a growing wanderlust among people worldwide. This escalating demand for air travel, for both leisure and business purposes, is especially noticeable in emerging markets, where a burgeoning middle class is propelling the need for flights.

In response, airlines are enlarging their fleets and ordering new aircraft equipped with sophisticated engines that require meticulous testing to meet safety, performance, and regulatory criteria. Engine testing is integral to the aircraft manufacturing process, ensuring optimal engine performance under diverse conditions and pressures. Consequently, the demand for engine testing services is intricately tied to the expansion of airline fleets and the growth in air traffic. Aircraft engine test cells are essential in this regard, providing the necessary facilities for testing engines before their installation on aircraft.

Aircraft Engine Test Cells Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The region is known for its technological advancements and heavy investments in aerospace and aviation. This includes innovations in engine design and testing methodologies, leading to a high demand for advanced engine test cells. For instance, in March 2022, Rolls-Royce North America injected $400 million into a significant modernization of engine test facilities in Indiana, marking a total company investment in the United States of nearly $1.5 billion over the past ten years. With numerous colleges, research centers, and government organizations actively working to advance aerospace technologies, North America is a center for aerospace research and development. This raises the need for sophisticated testing facilities.

The Asia Pacific region is expected to be the fastest growing region, with a healthy CAGR during the projected period. The dynamic and rapidly expanding sector for aircraft engine test cell market growth in the Asia-Pacific region is being propelled by the burgeoning aviation industry. Several factors, including the escalating volume of air travel, the emergence of low-cost carriers, and substantial government investments in aviation infrastructure throughout the region, fuel this growth. The objective of achieving self-reliance in aircraft engine production has led to substantial investments in testing and research and development facilities for aviation engines.

Competitive Landscape

The aircraft engine test cells market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Atec, Inc.

- Calspan Corporation

- CEL

- General Electric

- Honeywell International Inc.

- MDS Aero Support Corporation

- Rolls-Royce plc

- RTX Corporation

- Safran

Recent Developments

- In February 2024, Safran and its collaborator Turbotech announced advancements in their project to create hydrogen-fueled turboprop engines for the general aviation sector.

- In November 2023, Hindustan Aeronautics Limited (HAL) revealed the establishment of a Joint Venture (JV) with Safran from France, operating under the name "Safran Helicopter Engines Pvt Ltd." The company's announcement indicates that this JV will handle the design, development, certification, production, sales, and support of helicopter engines.

- In October 2023, Hindustan Aeronautics Limited (HAL) and Safran have inked a Memorandum of Understanding (MoU) to enhance industrial cooperation in the manufacturing of ring forgings for commercial engines. As per the agreement, HAL will manufacture LEAP (Leading Edge Aviation Propulsion) engines, which power the Airbus A320 Neo family and Boeing 737 Max, at its foundry and forge facility in Bengaluru.

Report Coverage

The aircraft engine test cells market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, engine test, solution type, point of sale, end-user, verticals, and their futuristic growth opportunities.

Aircraft Engine Test Cells Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.18 billion |

|

Revenue forecast in 2032 |

USD 4.24 billion |

|

CAGR |

3.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Engine Test, By Solution Type, By Point of Sale, By End-User, By Verticals, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Aircraft Engine Test Cells Market report covering key segments are engine test, solution type, point of sale, end-user, verticals, and region.

Aircraft Engine Test Cells Market Size Worth $4.24 Billion By 2032

Aircraft Engine Test Cells Market exhibiting the CAGR of 3.7% during the forecast period

North America is leading the global market

key driving factors in Aircraft Engine Test Cells Market are Increasing spending to build new testing facilities for aviation engines