Aircraft Landing Gear Market Share, Size, Trends, Industry Analysis Report

By Type (Main Landing, Nose Landing Gear), By Sub-System (Actuation System, Steering System, Brake system, Others), By Aircraft Type; By End User (OEM, Aftermarket) By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 118

- Format: PDF

- Report ID: PM2414

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

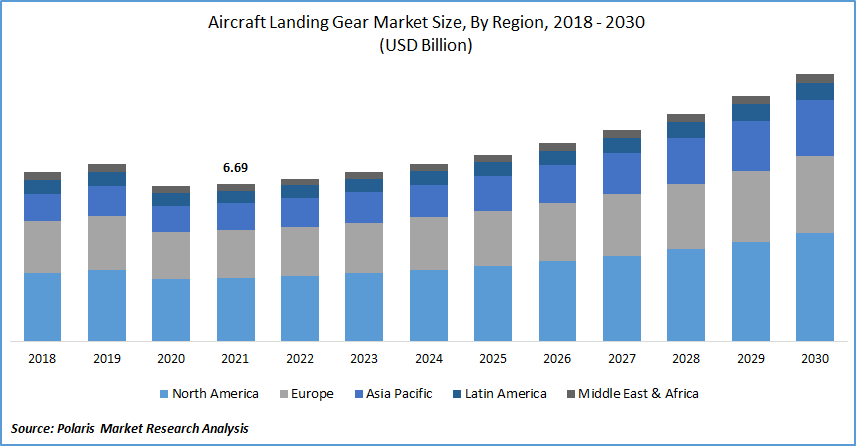

The global aircraft landing gear market was valued at USD 6.69 billion in 2021 and is expected to grow at a CAGR of 6.4% during the forecast period. The rising advancement and technological development of aircraft is the chief driving factor surging the market growth. The aircraft landing gear is a crucial component in the airplane, controlled by a pneumatic or hydraulic system, and has a specific service life. It provides suspension and movement during landing, take-off, and taxi.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Along with this, a rapid increase in the aviation and aerospace sector is anticipated to boost industry adoption. Additionally, the rising disposable public inclination towards aviation is stimulating industry expansion. Moreover, people worldwide prefer aviation for traveling over buses and trains, which enhances the industry demand. Furthermore, rising R&D activities, government expenditure, and expansion of industry players are other significant factors amplifying the aircraft landing gear market growth in foreseen years.

The outbreak of the COVID-19 has shown a significant impact on the various sector of the economy. The aircraft landing gear market was drastically affected during the pandemic due to the traveling ban across the borders. Further, strict lockdown and social distancing regulations hamper industry growth. The disruption in the supply chain, procrastination in trade, and restriction on transport all over the world impede the industry demand during the pandemic. However, the gradual opening of the lockdowns also presents various growth prospects for the aircraft landing gear market growth in the upcoming years.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing growth of the commercial aviation industry is the chief driving factor pushing the industry growth in the forecast period. The rising public inclination toward the aviation industry and growing government expenditure on airplane development are other major factors propelling the industry demand. Additionally, rising technological investment towards the infrastructure improvement of the aerospace sector is a significant factor bolstering the industry growth during the forecast period. Rising government activities, funds, and development activities are driving the aircraft landing gear market demand with a beneficial growth rate in the coming years.

According to Airport Business in 2020, the UK aviation minister announced £30 million (€35m) for the departure lounge construction at Birmingham Airport. It will serve more than one million passengers every month, so it is designed with state-of-the-art infrastructure and world-class facilities, including high-security alerts. In addition to this, according to the Australian government department of home affairs, in 2018, the government provided USD 50.1 million in funding to regional airports to assist with security upgrades. As a result, the rising government expenditure on the aviation industry pushes the aircraft landing gear market growth throughout the forecast period.

Report Segmentation

The market is primarily segmented on the basis of type, sub-system, aircraft, end-user, and region.

|

By Type |

By Sub-system |

By Aircraft Type |

By End User |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Type

The main landing gear segment is leading the segment in 2021 with the largest revenue generation, and it is anticipated to dominate the industry expansion in the projected period. The segment is rising due to the need for minimum volume, high-performance minimum weight, and improved life of gear systems. The threat of increasing accidents pushes the industry demand toward adopting airplane landing gear systems in the coming years.

For instance, according to the wire in 2020, the hazards caused by airplane accidents are huge and more dangerous. It is found that around 40 accidents were taken place related to airplanes. It includes ten commercials, fatal, and others. Therefore, the threat of airplane accidents is rising, enhancing airplane focus on developing improved aviation infrastructure, pushing the industry growth.

The nose gear segment is projected to exhibit a progressive growth rate in the forecast period. The segment demand is expected to rise due to factors such as the rising requirement for a supportive gear system due to heavy and loaded airplanes. The nose gear provides a suspension system during takeoff, landing, and taxi. It absorbs the kinetic energy of the landing impact and reduces the loads transmitted to the airframe. Additionally, stringent government regulations towards aviation safety enhance industry growth.

For instance, according to the Airport Authority of India, in 2021, The government of India implementing strict laws towards the security of airports (aviation) which includes technological and other improvements, mobile check-in counters, improvement in cargo terminals, reduction in bunching of flights, and contracting out of operating, the introduction of better systems of passenger transfer between terminals and maintenance facilities, and many other. Thereby, these factors are surging the segment demand in the projected period.

Geographic Overview

Geographically, North America accounted for the largest revenue share in the global industry. The increasing orders and aircraft sales across the region is the primary factor driving the industry growth. Moreover, various industry players across the region are the key factor driving the industry growth. It includes Collins Aerospace (US), Triumph Group (US), Crane Co. (US), Boeing, Bombardier Inc, and Parker Hannifin (US). These factors are propelling the demand for aircraft, which, in turn, augments the market growth across North America.

Moreover, the European market is anticipated to exhibit the highest CAGR over the years due to the increasing disposable income and rising public inclination towards aerospace. The expansion of companies across the region is bolstering the market growth across the region. It includes Airbus, Leonardo, Spa, and Safran SA. For instance, according to GOV. In the UK in 2017, new ways for detecting explosive devices concealed in electrical items were developed with a considerable investment of approximately £3 million. And this technological development enhances the surveillance and monitoring of explosive detection. Therefore, with the rising government spending, the market is expected to grow.

Competitive Insight

Some of the major players operating in the global market include AAR, Circor International, Eaton Corporation, GKN Aerospace, Hawker Pacific Aerospace, Heroux-Devtek, Inc., Honeywell International, Liebherr Group, Magellan Aerospace, Safran, SPP Canada Aircraft, Triumph Group, United Technologies, and UTC Aerospace Systems.

Aircraft Landing Gear Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 6.69 Billion |

|

Revenue forecast in 2030 |

USD 11.39 Billion |

|

CAGR |

6.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Sub-system, By Aircraft, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

AAR, Circor International, Eaton Corporation, GKN Aerospace, Hawker Pacific Aerospace, Heroux-Devtek, Inc., Honeywell International, Liebherr Group, Magellan Aerospace, Safran, SPP Canada Aircraft, Triumph Group, United Technologies, and UTC Aerospace Systems. |