Alpha Olefin Market Share, Size, Trends, Industry Analysis Report

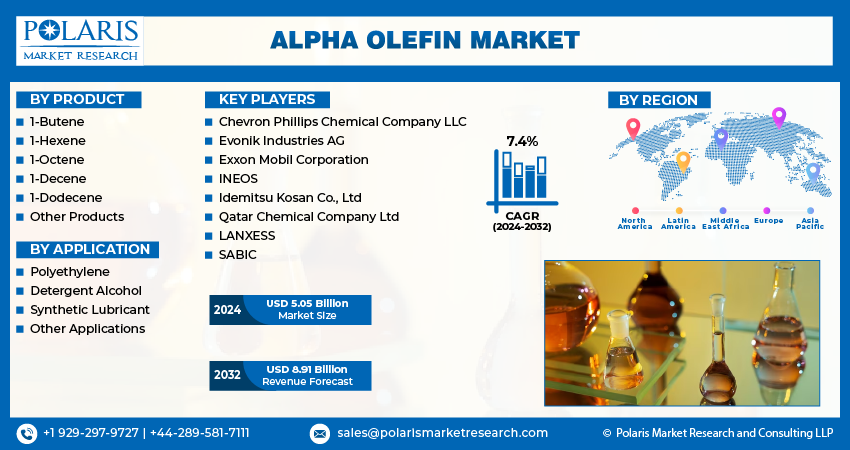

By Product (1-Butene, 1-Hexene, 1-Octene, 1-Decene, 1-Dodecene, and Other Products); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM1194

- Base Year: 2023

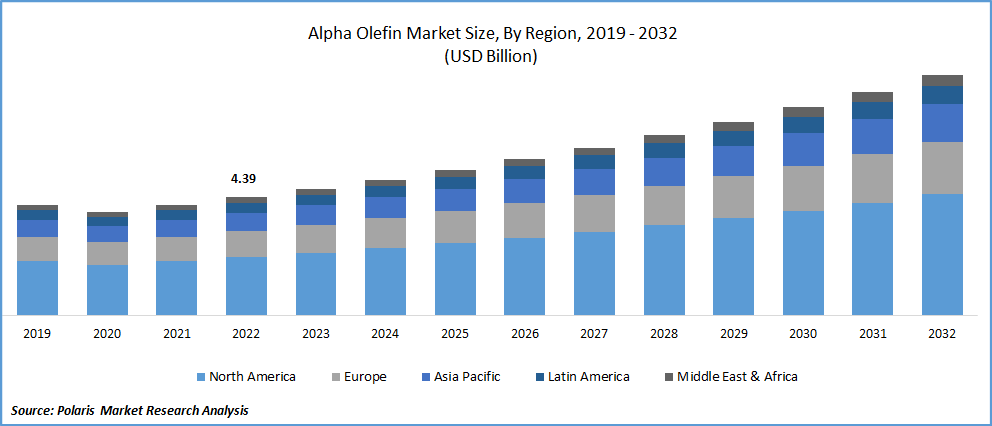

- Historical Data: 2019-2022

Report Outlook

The global alpha olefin market was valued at USD 4.71 billion in 2023 and is expected to grow at a CAGR of 7.4% during the forecast period. Rising demand for polyethylene which is used in a variety of application like manufacturing, packaging, consumer goods, and others, have anticipated the growth of the alpha-olefin market. The most widely utilized procedure, ethylene oligomerization, creates alpha which is organic molecules. Products from the oligomerization process typically have even-numbered carbon chains between C4 to C30+.

Know more about this report: Request for sample pages

The prior market restraint is considered the manufacturing method for alpha olefin. Olefins are manufactured under conditions of high pressure and temperature. It's possible for incorrect pressure and temperature fluctuations to cause a product flaw that renders it useless and causes the manufacturing firm to suffer a substantial loss. The expansion of the alpha olefin market is anticipated to be hampered by these factors.

The growing demand from the paper industries is a significant market driver that is anticipated to expand the alpha olefins market size. The alpha olefins market will grow throughout the anticipated period due to the persistent increase in demand for various plastics, including polypropylene, polyethylene, and synthetic lubricants. Alpha Olefins are in high order because of the constant rise in automobiles worldwide. Using synthetic greases in automobiles, such as alpha olefins, will become a significant market driver for rising alpha olefins market revenue.

The COVID-19 pandemic has caused many concerns that have resulted in significant economic losses as many enterprises worldwide have come to a stop. The COVID-19 epidemic had a negative impact on the market because of the state-wide lockdown, social isolation policies, and international travel bans that impacted the oil and gas and automotive industries. Supply chain disruptions, the closing of manufacturing facilities, and a global economic recession this has eventually reduced the demand for alpha olefins.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One of the critical reasons propelling the expansion of the alpha-olefin market is the rising demand for synthetic lubricants based on polyalphaolefin (PAO). The increase in demand for polyethylene brought on by its use in various products and processes, including consumer goods, packaging, industrial processes, and others, as well as the expansion of the polyethylene applications sector, accelerated the market's growth. However, increased demand for polyalphaolefin (PAO) in synthetic lubricants and its use as an artificial basis to make up for strict environmental regulations have negatively impacted the industry.

Additionally, the market for alpha olefins benefits from increased industrialization, oil refining operations, research and development activities, and rising demand from the paper and pulp sectors.

Alpha olefins are used to make alkenyl succinic anhydride (ASA). Alkenyl succinic anhydride is a standard paper sizing agent used in the paper industry to increase paper softness and water resistance. The use of alkenyl succinic anhydride has grown due to rising environmental concerns and paper used in the packaging sector, which has boosted the expansion of the alpha-olefin market. The Environmental Paper Network (EPN) reports that annual increases in paper use may be seen. As a result, growth in the demand for paper is fueling the alpha olefin market's expansion.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

The 1-hexene segment accounted for the fastest-growing product segment

The production of Linear Low-Density Polyethylene (LLDPE) and High-Density Polyethylene (HDPE) polymers using 1-hexene as a standard monomer is predicted to increase the usage of this segment. The 1-hexene market is anticipated to rise further due to increasing demand for polyethylene by expanding automotive and consumer products industries in emerging nations like China, India, and Brazil.

Additionally, it is a synthetic lubricant ingredient, which is anticipated to accelerate market growth further. The synthesis of detergent alcohols using 1-dodecane will increase demand for the substance from commercial and domestic cleaners and its growing use in the personal care sector. However, it is projected that 1-dodecane will be replaced by the ever-increasing usage of alkyl aromatics and bio-based detergent alcohols.

The polyethylene segment held a significant market revenue share.

Polyethylene is the most prominent application segment in terms of market share. The primary market for polyethylene compounds is construction. Along with being utilized for prototype development on CNC machines and 3D printers, polyethylene is also used in the packaging industry. High-density polyethylene is inexpensive to manufacture, provides a high moisture barrier, and may be used to create opaque packaging.

Depending on the application, low-density polyethylene is frequently favored because of its low production costs, heat sealability, excellent clarity, elongation, and softness. The installation of strict laws for pollution control is anticipated to fuel demand for synthetic lubricants. The market for synthetic greases is projected to be significantly influenced by rising R&D spending. The market is also expected to grow due to the broad range of applications for these lubricants.

North America dominated the global market in 2022

North America dominated the worldwide market and is anticipated to expand at the highest rate over the forecasting period. Due to its broad and varied industrial base, the area has considerable market potential for alpha olefins. The presence of several manufacturing businesses, together with an increase in petrochemical and infrastructural expansions for gas and oil, are expected to fuel regional market growth. Due to its extensive natural resource reserves, North America is viewed as a potential investment center for producing alpha-olefins by domestic and foreign businesses.

Competitive Insight

Some major global players in the worldwide market include Chevron Phillips Chemical Company LLC, Evonik Industries AG, Exxon Mobil Corporation, INEOS, Idemitsu Kosan Co., Ltd, Qatar Chemical Company Ltd, LANXESS, and SABIC.

Recent Developments

June 2022: INEOS Oligomers has started up its new 120,000 tonnes per annum Low Viscosity Polyalphaolefin (LV PAO) unit at Chocolate Bayou.

Alpha Olefin Market Report Scope

|

Report Attributes |

Details |

|

The market size value in 2024 |

USD 5.05 billion |

|

Revenue forecast in 2032 |

USD 8.91 billion |

|

CAGR |

7.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Chevron Phillips Chemical Company LLC, Evonik Industries AG, Exxon Mobil Corporation, INEOS, Idemitsu Kosan Co., Ltd, Qatar Chemical Company Ltd, LANXESS, and SABIC |

FAQ's

key segments are product, application, and region.

Alpha Olefin Market Size Worth $8.91 Billion By 2032.

The global alpha olefin market expected to grow at a CAGR of 7.3% during the forecast period.

North America is leading the global market.

key driving factors are Increase in usage of polyethylene in the plastic industry.