Aluminium Bags and Pouches Market Share, Size, Trends, Industry Analysis Report

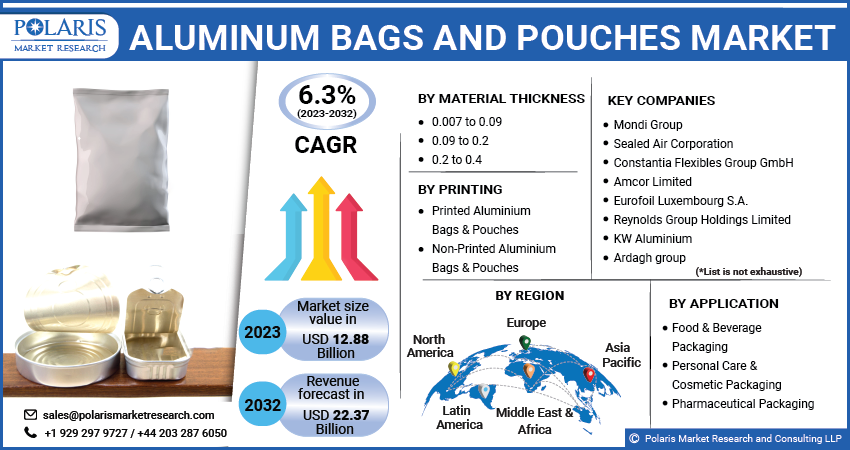

By Printing (Printed Aluminium Bags & Pouches and Non-Printed Aluminium Bags & Pouches); By Material Thickness; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 115

- Format: PDF

- Report ID: PM3647

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

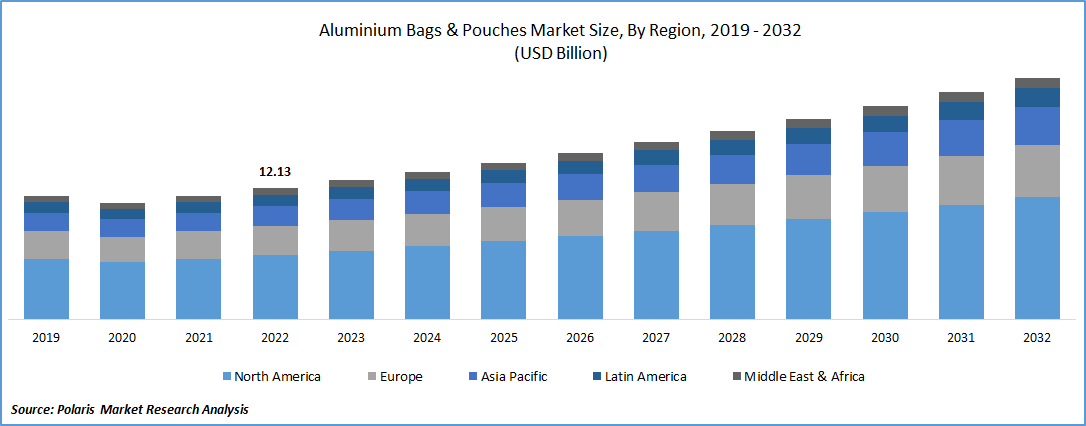

The global aluminium bags and pouches market was valued at USD 12.13 billion in 2022 and is expected to grow at a CAGR of 6.3% during the forecast period.

The growing popularity and adoption of these bags & pouches worldwide due to their several beneficial characteristics, including longer shelf life and superior barrier properties, coupled with the increasing focus among companies towards making the product more sustainable to be adopted as an alternative to conventional plastic packaging are among the key factors fueling the market growth. In addition, companies operating in the market are constantly developing and innovating bags & pouches with improved capabilities like higher convenience and functionality and are also investing heavily in market expansion, which is likely to create growth potential for the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in April 2022, Novelis announced that they are investing over USD 30 Mn to establish a new annealing line at their Germany facility. The new additional line will help the company double its current aluminum plant capacity to meet the constantly rising demand for sustainable packaging solutions.

Furthermore, with the increasing number of consumers shifting towards online shopping and several e-commerce platforms, there is a need for packaging solutions that provide product protection, convenience, and brand visibility. Developing packaging specifically tailored for e-commerce, including tamper-evident features and efficient shipping designs, are opening new revenue opportunities for the players over the years.

The outbreak of the COVID-19 pandemic has impacted the growth of the aluminum bags and pouches market in both ways. There was a surge in demand for packaged food products and essential items as people were stocking these supplies, leading to increased demand for such packaging solutions during the pandemic. On the other hand, the pandemic led to disruptions in global supply chains, including raw materials, manufacturing, and logistics, that impacted the production and availability of aluminum bags and pouches globally.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Consumers across the globe are seeking packaging solutions that offer convenience and ease of use; thereby, aluminum bags and pouches, which are lightweight, easy to carry, and often come with resealable closures, have gained significant popularity and led to higher adoption among these consumers. Moreover, the demand for on-the-go snacks, single-serve products, and portable food items has further driven the need for convenient packaging options at a rapid rate worldwide.

Furthermore, significant advances in manufacturing technologies like enhanced machinery, better printing techniques, and automation have led to increased production efficiency and reduced costs and have also allowed manufacturers to produce high-quality aluminum packaging at a faster pace, meeting the growing demand from various industries is also likely to contribute positively towards the aluminium bags and pouches market growth.

Report Segmentation

The market is primarily segmented based on printing, material thickness, application, and region.

|

By Printing |

By Material Thickness |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Non-printed aluminium bags & pouches segment accounted for the largest share in 2022

The non-printed aluminum bags & pouches segment accounted for the largest market share in 2022 due to its widespread use for packaging products from different industries, including food, pharmaceutical, and cosmetics. These bags & pouches are generally made of high-quality aluminum foil, which offers a barrier against the external elements and keeps the product fresh and completely free from contamination, which has fueled its popularity and prevalence among numerous end-users.

The printed segment is anticipated to grow substantially over the coming years due to the continuous expansion of various sectors, including food & beverage, pharmaceutical, and personal & care, boosting the demand for attractive and functional packaging solutions globally. It also offers excellent opportunities for branding and marketing purposes as companies can customize these packaging solutions with their brand logos, product information, and appealing designs to gain wider customer reach, thereby propelling the segment market.

0.09 to 0.2 segment held the significant market share in 2022

The 0.09 to 0.2 segment held the maximum market share in revenue in 2022, mainly driven by its numerous beneficial characteristics, including lightweight and flexible packaging, recycling & sustainability, and excellent barrier properties. Additionally, these materials allow for high-quality printing and customization, enabling companies to showcase their branding and product information in an effective way coupled with the visually appealing nature of aluminum packaging that can enhance product visibility and appeal to consumers, which in turn, escalating the product demand at a rapid pace across the globe.

Food & beverage packaging segment dominated the global market in 2022

The food & beverage packaging segment dominated the global market with considerable revenue share in 2022 and is projected to maintain its dominance throughout the anticipated period. The growth of the segment market can be highly attributable to several factors, including enhanced food safety, aroma protection, wide availability, lightweight, and comparatively low cost compared to many other packaging solutions, along with the change in consumer living styles leading to increased consumption of packaged food products across both developed and developing economies.

The personal care & cosmetic packaging segment is likely to grow at the fastest growth rate over the study period, mainly due to the increasing need and demand for packaging materials having robust barrier properties to keep the cosmetic formulations safe, as they are made of active ingredients that are highly vulnerable to contamination.

North America region is expected to witness highest growth during the forecast period

The North American region is projected to grow at a significant rate during the estimated period, which is highly accelerated by a drastic surge in demand for packaged food products due to the growing prevalence of hectic life schedules and increased consumer spending on personal care products, particularly in developed countries like the US and Canada. In addition, the regional governments have imposed several regulations to ensure the quality and safety of pharmaceutical and food products, resulting in huge demand for these bags & pouches as they meet the standards set by government authorities.

The Asia Pacific region led the industry market with substantial revenue share in 2022, owing to constant growth in the food & beverage industry due to surging population, changing lifestyles, rapid rate of urbanization, and increasing consumer disposable income of the middle-class population in the region. Consumers seek convenient and safe packaging options with the rising consumer emphasis on health and wellness. Along with this, manufacturers continuously explore the use of biodegradable and recycled plastics, influencing market growth.

Competitive Insight

Some of the major players operating in the global market include Mondi Group, Sealed Air Corporation, Constantia Flexibles Group GmbH, Amcor Limited, Eurofoil Luxembourg S.A., Reynolds Group Holdings Limited, KW Aluminium, Ardagh group, Express Flexi Pack, Raviraj Foils Limited, Novelis Aluminium, Aleris Corporation, Aluminium Foil Converters, ERAMCO, Symetal, Cosmoplast, and UNIPACK.

Recent Developments

- In September 2022, UFlex Ltd. new products of flexible packaging & chemical business. The new range of products includes a Nutri Series for aseptic packaging, which is suitable for processing in various types of Flexo labels and can be applied to a range of plastic materials and lacquered aluminum.

- In October 2022, Constantia Flexibles, a global manufacturer of flexible packaging, announced that the company is investing more than 80 million euros at its Constantia Teich facility in Austria. The main purpose of the investment is to incorporate a new rolling mill and additional lacquering line that will help the company to expand its potential market and create new growth opportunities in the aluminum market.

Aluminium Bags and Pouches Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 12.88 billion |

|

Revenue forecast in 2032 |

USD 22.37 billion |

|

CAGR |

6.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Printing, By Material Thickness, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Mondi Group, Sealed Air Corporation, Constantia Flexibles Group GmbH, Amcor Limited, Eurofoil Luxembourg S.A., Reynolds Group Holdings Limited, KW Aluminium, Ardagh group, Express Flexi Pack, Raviraj Foils Limited, Novelis Aluminium, Aleris Corporation, Aluminium Foil Converters, ERAMCO, Symetal, Cosmoplast, and UNIPACK. |

FAQ's

key companies in aluminium bags and pouches market are Mondi Group, Sealed Air Corporation, Constantia Flexibles Group GmbH, Amcor Limited, Eurofoil Luxembourg S.A.

The global aluminium bags and pouches market is expected to grow at a CAGR of 6.3% during the forecast period.

The aluminium bags and pouches market report covering key segments are printing, material thickness, application, and region.

key driving factors in aluminium bags and pouches market are Increasing popularity of aluminum bags and pouches.

The global aluminium bags & pouches market size is expected to reach USD 22.37 billion by 2032.