Aluminum Bottles Market Share, Size, Trends, Industry Analysis Report

By Capacity (Below 250 ml, 250 to 500 ml, 500 ml to 1 Liter, Above 1 Liter); By Printing Type; By Distribution Channel; By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3839

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

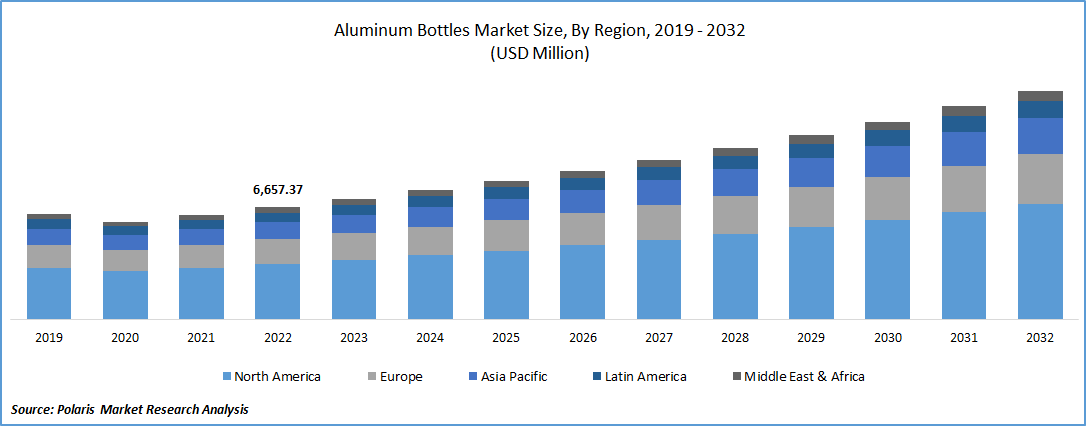

The global aluminum bottles market was valued at USD 6,657.37 million in 2022 and is expected to grow at a CAGR of 7.4% during the forecast period.

The growing application of aluminum bottles in various setups is driving the demand for these containers. For instance, CCL Container introduced a new pure aluminum-made wine bottle designed to resemble a classic burgundy bottle. This innovative container addresses the increasing demand for sustainability and freshness in the wine industry while maintaining the traditional shape of a conventional glass bottle.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the use of aluminum bottles in the wine industry contributes to sustainability efforts. Aluminum is highly recyclable, and the introduction of these bottles reduces reliance on single-use glass containers, which can be resource-intensive and pose recycling challenges. The aluminum wine bottles provide an eco-friendly alternative, aligning with the growing demand for sustainable packaging solutions.

Industry Dynamics

Growth Drivers

Government regulations and standards

Government regulations and standards play a crucial role in driving the demand for aluminum bottles. For instance, the recent notification by the Department for Promotion of Industry and Internal Trade (DPIIT) in India of the Quality Control Orders (QCOs) for the 'Potable Water Bottles' highlights the government's commitment to strengthening the quality ecosystem and ensuring consumer safety. The QCO for the 'Potable Water Bottles' requires defined certification as per the Indian Standard (IS) for the production import of potable bottles made of copper or aluminum. This certification requirement ensures that only high-quality and safe water bottles are produced and sold in the market. It creates a benchmark for manufacturers, encouraging them to meet the specified standards and produce reliable and compliant aluminum bottles. This creates consumer trust and confidence in the quality and safety of aluminum bottles.

Report Segmentation

The market is primarily segmented based on capacity, printing type, distribution channel, end use and region.

|

By Capacity |

By Printing Type |

By Distribution Channel |

By End Use |

By Region |

|

|

|

|

|

For Specific Research Requirements: Request for Customized Report

By Capacity

Below 250 ml segment is expected to witness fastest growth during forecast period

The below 250 ml segment is expected to have faster growth for the market. The demand for smaller-sized packaging stems from the need for convenience and portability. Consumers prefer products that are easy to carry and consume on the go. Aluminum bottles below 250 ml offer a compact and lightweight solution, making them highly suitable for individual or single-use servings. The convenience factor has driven the demand for this segment in industries such as beverages, personal care, cosmetics, pharmaceuticals, and healthcare.

By Printing Type

Printed segment accounted for the largest market share in 2022

Printed segment holds the largest market share for the market in the study period. Printed aluminum bottles provide a highly effective platform for branding and visual communication. By leveraging customized printing options, brands can showcase their logos, graphics, product information, and promotional messages directly on the packaging. This helps create strong brand recognition, enhance shelf presence, and attract consumers' attention. The ability to visually communicate with customers through printed designs on aluminum bottles is a significant driver for brands seeking to differentiate themselves in the market and establish a memorable brand image.

By Distribution Channel

Online segment is expected to hold the larger revenue share during forecast period

The online segment is projected to witness a larger revenue share in the coming years. They provide a platform for businesses to showcase their aluminum bottle offerings effectively. Through high-quality product images, detailed descriptions, and customer reviews, online platforms offer enhanced visibility and information about the products. Customers can gather comprehensive details about the features, specifications, and benefits of aluminum bottles, enabling them to make informed purchasing decisions. This transparency and accessibility contribute to the growth of the online segment.

By End-Use

Beverage’s segment projected to register higher growth during forecast period

The beverages segment is expected to have higher growth for the market. The beverages industry, including non-alcoholic and alcoholic beverages, is a significant driver of the aluminum bottles market. Aluminum bottles are preferred for packaging beverages due to their durability, weight, and ability to preserve the freshness and quality of the contents. The demand for energy drinks, ready-to-drink beverages, juices, and other packaged beverages has been rising, and aluminum bottles provide a convenient and sustainable packaging solution for these products. The increasing consumer preference for on-the-go consumption and the need for portability has further fueled the demand for aluminum bottles in the beverages sector.

By Regional Analysis

Europe registered with the highest growth rate in 2022

Europe is projected to witness a higher growth rate for the market. The rising concern for environmental sustainability among companies is creating new opportunities for the region. For instance, Waitrose, a leading UK supermarket chain, has replaced glass bottles with aluminum cans for its small-format wine ranges. Reportedly, nearly three million small bottles of still and sparkling wine were purchased from Waitrose by consumers in 2022. The complete shift to aluminum cans, effective from 15th January, is expected to save over 300 tonnes of glass packaging. This initiative not only reduces the environmental impact associated with glass production but also showcases the potential for aluminum as a more sustainable alternative. It demonstrates how companies are actively seeking greener solutions, thus driving the demand for aluminum in Europe's market.

The Circular Economy Action of the European Green Deal is playing a pivotal role in driving the growth of the aluminum bottles market in Europe. As part of this ambitious plan, measures such as the ban on miniature shampoo bottles, body lotions, and shower gels in EU hotels have been implemented to promote sustainability and combat waste in 2022. These regulations have prompted a significant shift in the packaging preferences of hotels, favoring more environmentally friendly alternatives like aluminum bottles. With their recyclability, lightweight design, and ability to ensure product protection, aluminum bottles have emerged as a preferred choice for hotels seeking compliance with the Circular Economy Action. Consequently, this transition has created a strong market demand for aluminum bottles in Europe, fueling the growth of the industry and reinforcing the region's commitment to a more sustainable future.

North America is poised to experience a substantial increase in revenue share. According to the Aluminum Association based in Arlington, Virginia, there has been a significant rise in demand for aluminum in the packaging industry. Preliminary estimates indicate a growth of 6.6 percent for the aluminum industry in the United States and Canada during the first half of 2022. This follows a year-over-year growth of nearly 8 percent in 2021, with growing demand levels estimated in the first quarter. This increasing demand for aluminum is indicative of its growing usage in various packaging applications. With the packaging industry seeking more sustainable options, the demand for aluminum bottles is expected to grow steadily in North America, aligning with the overall rising demand for aluminum in the region.

Competitive Insight

The Aluminum Bottles market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Ball

- CCL Container

- Crown Holdings & Aluminum Closures

- Exal

- Montebello Packaging

- Nampak

Recent Developments

- In April 2023, California Olive Ranch, introduced eco-friendly aluminum bottles, showcasing its dedication to sustainability and responsible packaging practices.

- In September 2022, Ball Corporation & Boomerang Water joined forces to offer consumers with a sustainable solution for maintaining hydration with their large portfolio of aluminum bottles.

Aluminum Bottles Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 7,136.04 million |

|

Revenue forecast in 2032 |

USD 13,555.95 million |

|

CAGR |

7.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Capacity, By Printing Type, By Distribution Channel, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The aluminum bottles market report covering key segments are capacity, printing type, distribution channel, end use, and region.

Aluminum Bottles Market Size Worth $13,555.95 Million By 2032.

The global aluminum bottles market is expected to grow at a CAGR of 7.4% during the forecast period.

Europe is leading the global market.

key driving factors in the aluminum bottles market are government regulations and standards.