Aluminum Composite Material Market Size, Share, & Industry Analysis Report

By Product Type (Fire-Resistant, Anti-Bacterial, Anti-Static), By Coating Type, By Application, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6219

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

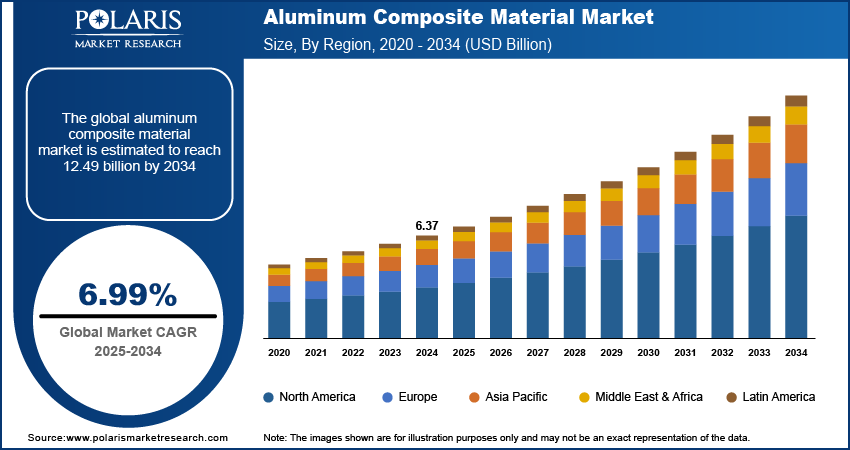

The global aluminum composite material market size was valued at USD 6.37 billion in 2024, growing at a CAGR of 6.99% from 2025–2034. Growth in commercial construction projects and adoption of green building standards are driving the demand for sustainable and energy-efficient aluminum composite materials.

Key Insights

- The polyvinylidene difluoride segment dominated the aluminum composite material market share in 2024.

- The transportation segment is projected to grow at the fastest CAGR, due to the rising focus on lightweight and fuel-efficient vehicles and increasing adoption of aluminum composite panels in railways, metros, and cargo trucks.

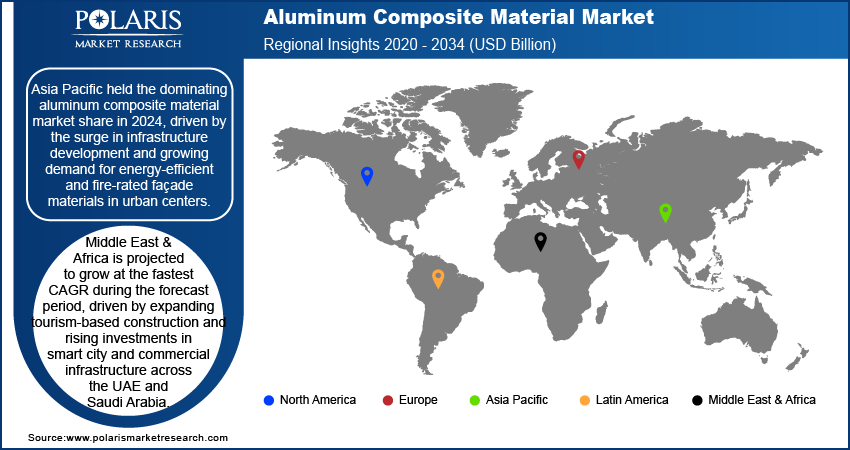

- The Asia Pacific aluminum composite material market dominated the global market share in 2024, fueled by rapid urbanization, robust growth in infrastructure projects, and large-scale manufacturing activities.

- The China aluminum composite material market held the largest regional share of the Asia Pacific market in 2024, driven by the presence of major ACM manufacturers and government-backed investments in commercial infrastructure and industrial modernization.

- The market in Middle East & Africa is projected to grow at the fastest CAGR during the forecast period, driven by increasing construction of commercial buildings and airports, along with rising adoption of energy-efficient façade materials.

- The UAE aluminum composite material market is expanding steadily, fueled by ambitious urban development initiatives, growing demand for sustainable architectural materials, and regulatory focus on fire-resistant and environmentally compliant construction solutions.

Industry Dynamics

- Rising commercial and residential construction across urban regions is driving the demand for aluminum composite materials due to their thermal insulation and lightweight properties.

- Adoption of green building standards is driving the use of recyclable and non-combustible cladding materials such as ACM in environmentally compliant projects.

- Expansion of smart city projects creates opportunity for ACM manufacturers to supply advanced cladding materials across government-based infrastructure developments in the coming years.

- Volatility in aluminum prices affects the overall cost structure of ACM panels and creates pricing uncertainty for manufacturers and buyers.

Market Statistics

- 2024 Market Size: USD 6.37 Billion

- 2034 Projected Market Size: USD 12.49 Billion

- CAGR (2025–2034): 6.99%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Aluminum composite materials (ACM) are engineered panels made by bonding two thin aluminum sheets to a non-aluminum core. These panels are widely used in exterior and interior cladding systems, signage and industrial applications due to their lightweight nature, structural rigidity and corrosion resistance. ACM panels offer a smooth surface finish and fabricated easily to meet modern architectural and design requirements.

These materials are primarily utilized in construction, automotive and transportation sectors where durability, aesthetic appeal, and weight reduction are essential. In building construction, ACM panels are applied to facades and curtain walls to improve thermal insulation and reduce structural load. In the automotive industry, they help reduce vehicle weight and enhance fuel efficiency. According to OICA, global vehicle production increased from 79.9 million units in 2021 to 84.8 million units in 2022, marking an 11% growth, and further rose to 93.4 million units in 2023, representing a 10% increase. Their resistance to weathering and pollutants further makes them suitable for high-performance environments.

The global aluminum composite material market is experiencing growth due to rapid infrastructure development across urban regions. Rising commercial and residential construction is creating demand for energy-efficient and cost-effective façade materials. ACM panels address these requirements by offering thermal insulation, extended service life and low maintenance. Growing investments in transportation infrastructure, such as airports and metro stations are further supporting ACM adoption for cladding and interior use due to their lightweight composition and fire-resistant properties. Additionally, stricter building codes related to fire safety and environmental standards are driving the use of recyclable and non-combustible materials, driving the use of ACM panels in projects aligned with global green construction standards.

Drivers & Opportunities

Rapidly Growing in Commercial Construction Projects Globally: The global aluminum composite material market is experiencing growth due to the rising number of commercial construction projects across urban regions. Office buildings, shopping centers, hospitals, and educational institutions are adopting advanced façade materials to enhance structural performance and aesthetics. According to Oxford Economics, the global construction market is projected to expand from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, driven by urbanization and the development of green infrastructure, with China, the US, and India leading the growth. ACM panels offer a lightweight structure, ease of installation, and long-term durability, making them suitable for high-rise and large-scale developments. Their ability to provide thermal insulation and weather resistance supports energy-efficient design goals in commercial properties. As real estate developers focus on cost-effective and low-maintenance materials, ACM panels are fueling demand across commercial infrastructure projects worldwide.

Increasing Adoption of Green Building Standards: The adoption of green building standards is influencing material selection in construction projects, driving the demand for aluminum composite materials. Regulatory bodies are mandating the use of recyclable, non-toxic, and energy-efficient materials that meet environmental compliance. For instance, the U.S. Environmental Protection Agency (EPA) supports green building through programs including ENERGY STAR and LEED, promoting sustainable practices such as energy efficiency, renewable energy use and improved indoor air quality. ACM panels meet with these criteria due to their recyclability, fire-resistant variants, and insulation properties. Developers are incorporating ACM panels into designs to reduce energy consumption and meet LEED or other green certification benchmarks. As sustainability becomes central to urban development and building policies, ACM panels are positioned as a viable solution that addresses regulatory requirements and performance expectations in green construction.

Segmental Insights

Product Type Analysis

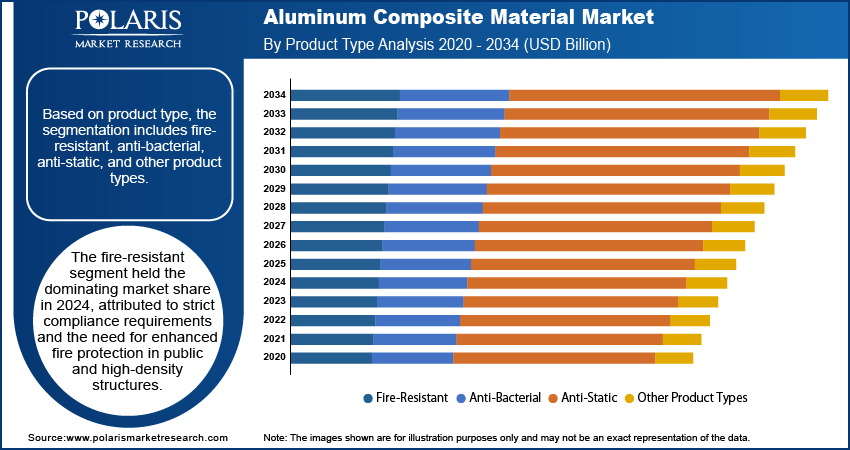

Based on product type, the segmentation includes fire-resistant, anti-bacterial, anti-static, and other product types. The fire-resistant segment dominated the market in 2024, driven by rising demand for non-combustible materials in high-rise buildings and public infrastructure projects. In March 2025, Alumaze launched Alumaze Elite, a high-premium ACP sheet range designed for luxury-grade architectural cladding with advanced fire-resistant properties. This combines cutting-edge technology, refined aesthetics and enhanced safety, the product sets a new benchmark in premium aluminum composite panels. Growing implementation of fire safety regulations in urban areas increasing the adoption of fire-rated ACM panels across residential and commercial applications. These panels are preferred due to their ability to limit flame spread and meet international fire code standards, making them suitable for airports, metro stations, and institutional buildings. Manufacturers are expanding fire-rated product lines to meet strict compliance requirements in countries with stringent construction codes.

The anti-bacterial segment is projected to grow at the fastest CAGR during the forecast period, due to increasing awareness of hygiene and infection control in public spaces and healthcare facilities. Demand for surface materials that reduce microbial growth is rising across hospitals, clinics, and educational buildings. Anti-bacterial ACM panels are used in areas with frequent human interaction to enhance safety and reduce contamination risks. Growth in healthcare infrastructure, along with rising concerns about surface-borne infections, is supporting the market expansion of anti-bacterial panels in developed and developing economies.

Coating Type Analysis

By coating type, the segment includes polyvinylidene difluoride, polyethylene, polyester, and other coating types. The polyvinylidene difluoride segment dominated the market in 2024, owing to its superior weather resistance and long-term durability. This coating type is widely used in building facades and exterior cladding applications where exposure to UV radiation, heat, and pollutants is high. PVDF-coated ACM panels maintain color integrity and surface finish over time, making them suitable for architectural and commercial buildings. Their high resistance to corrosion and moisture supports their preference in regions with harsh environmental conditions, which contributed to their significant market share in recent years.

The polyethylene segment is projected to grow at the fastest CAGR during the forecast period, due to its cost-effectiveness and wide availability. Polyethylene-coated panels are used across a variety of interior applications, including signage, displays, and interior partitions. Growth in retail outlets, advertising displays, and interior renovations in emerging economies is contributing to the increasing demand for PE-coated ACM panels. Although not preferred for fire-sensitive applications, their affordability and ease of fabrication support their adoption across short- to medium-term installations.

Application Analysis

Based on application, the segmentation includes building & construction, advertising boards, transportation, industrial, and other applications. The building & construction segment dominated the market in 2024, driven by rising investments in commercial and residential infrastructure. ACM panels are widely used for external cladding, curtain walls, roofing, and interior finishes due to their strength-to-weight ratio and design flexibility. Growing demand for modern building facades that offer energy efficiency, aesthetics, and low maintenance is contributing to their large-scale deployment. High-rise buildings, shopping malls, and airports are key end users in urban developments across Asia, Europe, and the Middle East.

The transportation segment is projected to grow at the fastest CAGR during the forecast period, owing to the rising focus on lightweight and durable materials in automotive and rail applications. ACM panels help reduce vehicle weight while maintaining structural rigidity and corrosion resistance. They are used in bus bodies, train interiors, and transport shelters to improve fuel efficiency and extend product life. Expansion of electric vehicle production and public transport infrastructure is supporting the growth of ACM panels in transportation.

Distribution Channel Analysis

By distribution channel, this segment includes direct sales, distributors, and online sales. The direct sales segment dominated the market in 2024, driven by bulk procurement from construction contractors, project developers, and government bodies. Large-scale infrastructure and commercial building projects prefer direct purchasing models to ensure consistent quality, timely delivery, and customized product specifications. Manufacturers are maintaining direct relationships with key clients to secure long-term contracts in the building and transportation sectors. This distribution approach supports better pricing, technical support, and logistical efficiency, contributing to its dominant share.

The online sales segment is projected to grow at the fastest CAGR during the forecast period, due to the increasing digitalization of procurement processes and rising preference for e-commerce platforms among small and medium buyers. Online portals offer access to a wide range of ACM products, including customized sizes, finishes, and core types. This channel is increasing popular among interior designers, small contractors, and retail signage companies seeking convenience and price comparison. Growth in digital infrastructure and online B2B platforms is expected to further support this trend.

Regional Analysis

Asia Pacific aluminum composite material market dominated the global market in 2024. This is driven by large-scale urbanization and government-led infrastructure development programs across China, India, and Southeast Asia. Expanding construction of high-rise buildings, commercial complexes, and metro rail systems is generating consistent demand for ACM panels due to their durability and ease of installation. Moreover, growing investments in transportation terminals, airports, and institutional buildings are increasing the use of fire-rated and energy-efficient façade materials across urban centers. In addition, government policies supporting smart cities and sustainable construction in India and China are boosting the adoption of recyclable and fire-resistant ACM panels in public infrastructure. As an example, under India’s Union Budget 2024-25, the Smart Cities Mission was allocated USD 19.67 billion. By March 2025, 7,502 projects, or 93% of the total 8,062, had been completed, while 560 projects, or 7%, were still underway.

The China Aluminum Composite Material Market Insight

The China held a dominating market share in the Asia Pacific aluminum composite material landscape in 2024, fueled by the rapid growth in real estate development and public infrastructure investments. Large-scale construction projects, including airports, exhibition centers, and urban transit systems are driving the use of ACM panels in interior and exterior applications. Moreover, the government’s focus on green building codes and sustainable urban planning is accelerating the demand for energy-efficient and environmentally compliant cladding solutions. In addition, domestic manufacturers are expanding their production capacity to meet local demand and reduce dependency on imports, further strengthening market presence.

Europe Aluminum Composite Material Market

The aluminum composite material landscape in Europe is projected to hold a substantial share in 2034. This is owing to the rising renovation activities across aging building infrastructure and strict environmental compliance requirements. Retrofitting of commercial buildings in Germany, France, and the UK is increasing demand for ACM panels due to their insulation benefits and lightweight properties. As per the European Trade Union Institute, achieving Europe’s 2020 energy targets is expected to drive around USD 43.08 billion in additional yearly investment from 2010 to 2030 through building retrofits and energy-efficient construction. Moreover, strong building codes regarding fire safety and energy efficiency are driving the use of non-combustible and certified ACM products. In addition, rising adoption of modern architectural designs in public and educational buildings is creating opportunities for advanced cladding materials with customizable surface finishes and durability features.

Middle East & Africa Aluminum Composite Material Market

The market in Middle East & Africa is projected to grow at the fastest CAGR during the forecast period. This growth is expanding due to rising investments in tourism-related infrastructure such as hotels, airports, and cultural centers. Countries such as the UAE and Saudi Arabia are focusing on luxury commercial construction where ACM panels are widely used for their aesthetic and performance characteristics. Moreover, government-backed projects under initiatives such as Saudi Vision 2030 are increasing the use of high-quality façade materials in public and private developments. In addition, the region’s harsh climate conditions are creating demand for weather-resistant ACM panels that endures high temperatures and sand exposure.

UAE Aluminum Composite Material Market Overview

The market in UAE is expanding driven by large-scale hospitality and mixed-use development projects in Dubai and Abu Dhabi. The construction of luxury hotels, shopping malls, and entertainment venues is fueling the need for high-performance and visually appealing cladding materials. For instance, the UAE’s Ministry of Energy and Infrastructure announced that it is carrying out 129 development projects worth about USD 3.21 billion under its five-year plan for 2018-2023. Moreover, strict fire safety standards are increasing the adoption of non-combustible and PVDF-coated ACM panels in high-rise buildings. In addition, the country’s focus on sustainable architecture and LEED-certified buildings is pushing developers to incorporate recyclable and energy-efficient materials into their projects.

Key Players & Competitive Analysis Report

The aluminum composite material market is moderately competitive, with key manufacturers focusing on developing fire-resistant, weatherproof and application-specific panel solutions. Leading companies are expanding their product lines through the use of non-combustible cores, advanced coating technologies and recyclable materials to meet evolving regulatory standards and architectural design requirements. In addition, increasing partnerships between panel producers, construction contractors and real estate developers are fueling product customization based on regional building codes and environmental performance criteria, while enhancing long-term competitiveness across infrastructure, commercial and industrial construction projects.

Major companies operating in the aluminum composite material industry include 3A Composites GmbH, Arconic Corporation, Mitsubishi Chemical Infratec Co., Ltd., Alubond U.S.A (Mulk Holdings), ALUCOMAT, Jiangsu Yaret Technology Industrial Park Co., Ltd, Guangzhou Goodsense Decorative Building Materials Co., Ltd., Alstrong Enterprises India Pvt. Ltd., Interplast Co. Ltd. (Harwal Group), Shanghai Huayuan New Composite Materials Co., Ltd., Euro Panel Products Limited (EUROBOND), and Hindalco Industries Limited.

Key Players

- Alstrong Enterprises India Pvt. Ltd.

- Alubond U.S.A (Mulk Holdings)

- ALUCOMAT

- Arconic Corporation

- Euro Panel Products Limited (EUROBOND)

- Guangzhou Goodsense Decorative Building Materials Co., Ltd.

- Hindalco Industries Limited

- Interplast Co. Ltd. (Harwal Group)

- Jiangsu Yaret Technology Industrial Park Co., Ltd.

- Mitsubishi Chemical Infratec Co., Ltd.

- Shanghai Huayuan New Composite Materials Co., Ltd.

- 3A Composites GmbH

Industry Developments

- May 2025: Viva announced to launch an in-house production facility for A2-grade fire retardant core used in aluminium composite panels. This aims to enhance product safety standards while reducing import dependency.

- July 2024: Aludecor introduced concrete finish aluminium composite panel, expanding design possibilities for modern architecture. This innovation combines aesthetic appeal with durability, offering a concrete-based texture in a lightweight, easy-to-install format.

Aluminum Composite Material Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Fire-Resistant

- Anti-Bacterial

- Anti-Static

- Other Product Types

By Coating Type Outlook (Revenue, USD Billion, 2020–2034)

- Polyvinylidene Difluoride

- Polyethylene

- Polyester

- Other Coating Types

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Building & Construction

- Exterior Cladding

- Interior Decoration

- Roofing & Canopies

- Advertising Boards

- Transportation

- Automotive

- Railways

- Marine

- Industrial

- Machinery Enclosures

- Cleanrooms

- Other Applications

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Direct Sales

- Distributors

- Online Sales

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aluminum Composite Material Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.37 Billion |

|

Market Size in 2025 |

USD 6.80 Billion |

|

Revenue Forecast by 2034 |

USD 12.49 Billion |

|

CAGR |

6.99% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Applicationat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.37 billion in 2024 and is projected to grow to USD 12.49 billion by 2034.

The global market is projected to register a CAGR of 6.99% during the forecast period.

Asia Pacific dominated the market in 2024, driven by rapid urbanization and large-scale commercial and residential construction projects.

A few of the key players in the market are 3A Composites GmbH, Arconic Corporation, Mitsubishi Chemical Infratec Co., Ltd., Alubond U.S.A (Mulk Holdings), ALUCOMAT, Jiangsu Yaret Technology Industrial Park Co., Ltd, Guangzhou Goodsense Decorative Building Materials Co., Ltd., Alstrong Enterprises India Pvt. Ltd., Interplast Co. Ltd. (Harwal Group), Shanghai Huayuan New Composite Materials Co., Ltd., Euro Panel Products Limited (EUROBOND), and Hindalco Industries Limited.

The fire-resistant segment dominated the market in 2024, driven by increasing implementation of fire safety regulations and rising adoption of non-combustible cladding materials in high-rise buildings and public infrastructure.

The transportation segment is projected to grow at the fastest CAGR, due to rising demand for lightweight and durable materials in electric vehicles, trains, and public transport infrastructure.