Ammonia Market Share, Size, Trends, & Industry Analysis Report

By Form (Liquid, Gas, Powder); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM1259

- Base Year: 2024

- Historical Data: 2020-2023

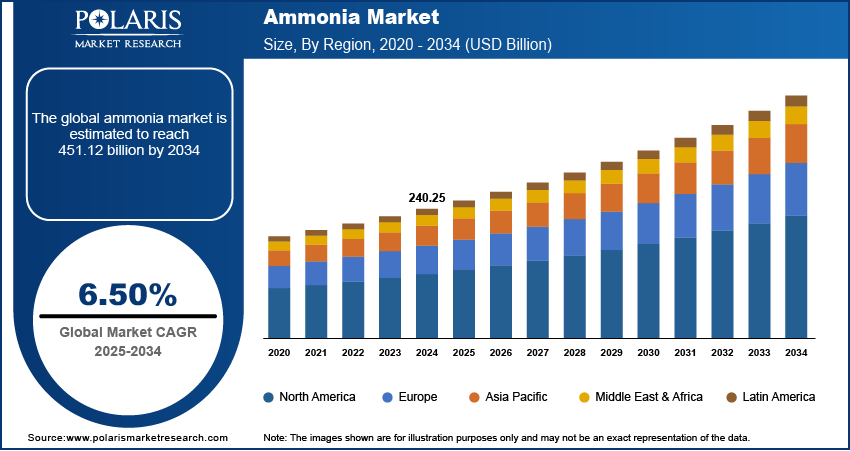

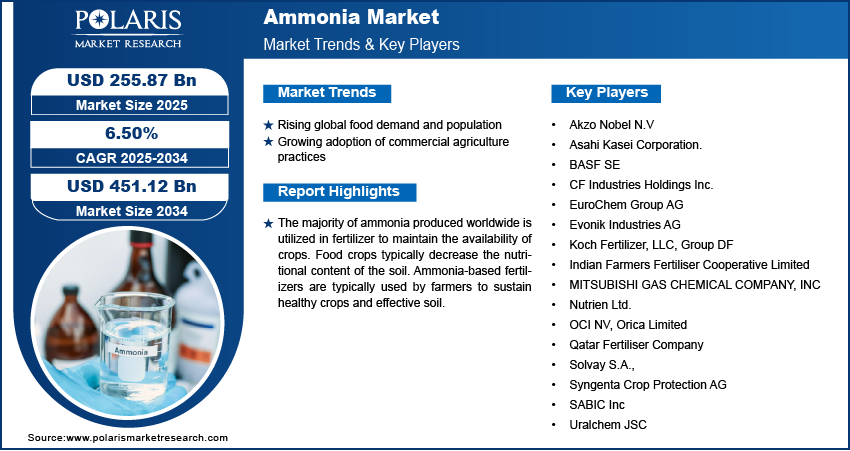

The global ammonia market size was valued at USD 240.25 billion in 2024, exhibiting a CAGR of 6.50% during 2025–2034. The market is driven by the rising demand for ammonia-based fertilizers in agriculture, increasing industrial applications, and growing investments in green ammonia production. The majority of ammonia produced worldwide is utilized in fertilizer to maintain the availability of crops. Food crops typically decrease the nutritional content of the soil. Ammonia-based fertilizers are typically used by farmers to sustain healthy crops and effective soil.

Key Insights

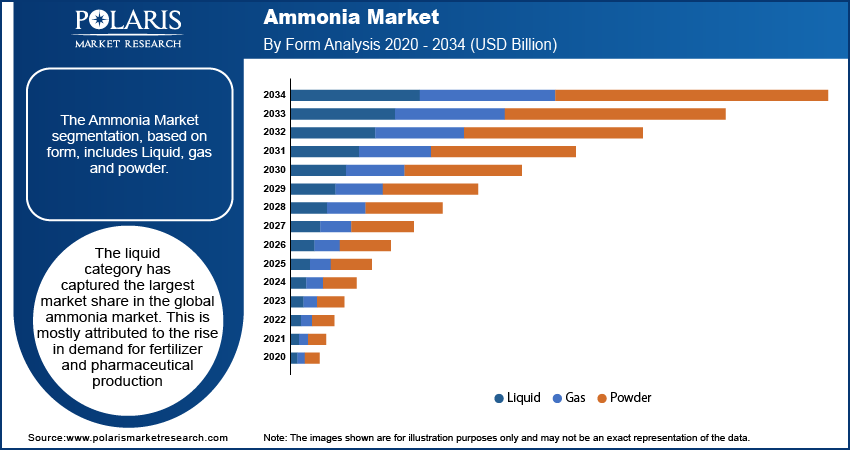

- The liquid ammonia segment leads the global market due to its widespread use in fertilizers and pharmaceuticals, whereas ammonia gas is used in limited niche applications.

- The fertilizer industry dominated the ammonia market in 2024, driven by rising global food demand and agricultural expansion.

- The pharmaceutical industry is projected to hold a significant revenue share due to ammonia's role in the synthesis of drugs and chemical manufacturing.

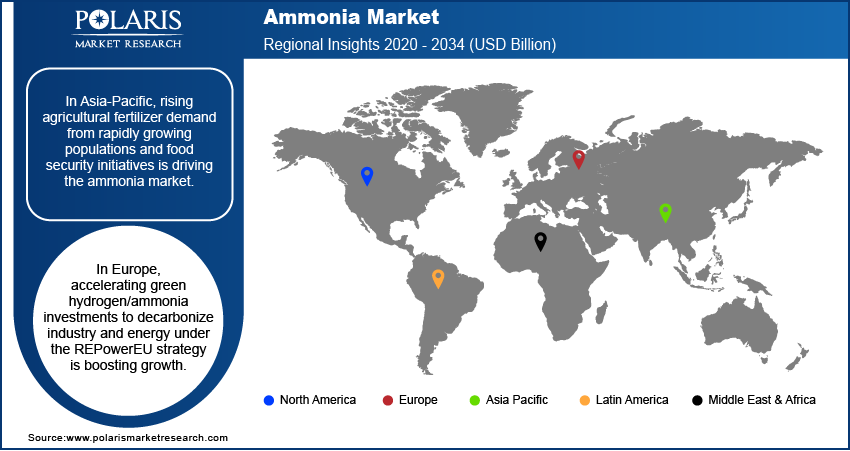

- The Asia-Pacific region holds the largest market share, supported by a vast agricultural base, industrial growth, and high fertilizer demand.

- China dominates the regional market, boasting the world’s largest ammonia production capacity and consumption, which serves both domestic and international needs.

- The Middle East & Africa (MEA) is emerging as a key ammonia hub, leveraging abundant natural gas resources, low energy costs, and growing investments in green and blue ammonia technologies.

Industry Dynamics

- The rising demand for nitrogen-based fertilizers, driven by the increasing global population and concerns over food security, is significantly boosting ammonia consumption.

- Ammonia's emerging role as a hydrogen carrier in clean energy applications is creating new growth avenues in the energy sector.

- Strict environmental regulations and safety risks associated with ammonia handling limit widespread adoption.

- Innovations in green ammonia production present a promising pathway for sustainable industry transformation and carbon neutrality.

Market Statistics

- 2024 Market Size: USD 240.25 billion

- 2034 Projected Market Size: USD 451.12 billion

- CAGR (2025-2034): 6.50%

- Asia Pacific: Largest market in 2024

Know more about this report: Request for sample pages

Ammonia is a colorless gas with a distinct odor that is used as a fundamental chemical in the production of many items that people use daily. It is naturally present in the environment in the air, soil, and water, as well as in plants, animals, and people. Additionally, ammonia is a major component of ammonium nitrate fertilizer, which extracts nitrogen, an essential ingredient for growing plants, especially lawns and crops.

For instance, the Indian government is carefully watching the production and distribution of fertilizers to make sure that farmers can easily access soil nutrients during the coronavirus pandemic. In the first three months of 2020, the production was suddenly cut by 80% to 90%. Additionally, a lot of nations have prioritized challenges related to food security and have taken steps to enhance grain output.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Fertilizer sales are projected to increase as a result of the expanding world population and rising food consumption. In terms of crop yield and agricultural productivity, the fertilizer sector is crucial. The essential nutrients that plants require to thrive, such as nitrogen, phosphorus, and potassium (NPK), are provided by fertilizers. Nitrogenous fertilizers are projected to become more widely used due to the increasing global popularity of commercial agriculture. The ammonia market for these fertilizers is reliant on the demand for grains and groundnut crops, which fuels fertilizer production as a whole.

The agriculture sector uses the majority of the ammonia produced as a supply of nitrogen, which is essential for plant growth. The substance is extensively used in the fertilizer sector to create solid products like urea, ammonium nitrate, and sulfate. Fast-releasing fertilizer ammonium phosphate is also useful for overseeding, establishing new grass, as well as other lawn-related duties.

Report Segmentation

The market is primarily segmented based on form, application, and region.

|

By Form |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

The liquid form is expected to witness the fastest growth in the global market

The liquid category dominated the worldwide ammonia market. This is mostly attributable to the rise in demand for fertilizer and pharmaceutical production. Ammonia gas is used in a small number of applications.

During the predicted period, it is likely that the gas category will grow steadily. Since the liquid is used in many applications, including those in the textile, pulp & paper, and mining industries, it is expected to develop significantly throughout the projected period in the global market.

Fertilizers industry accounted for the highest market share in 2024

Ammonium nitrate fertilizers, which produce nitrogen, an essential nutrient utilized for plant growth, including that of lawns and crops, are made of NH3, which is one of its building blocks. Farmers mostly depend on fertilizer to make their soil productive to promote healthy crops.

Fertilizers aid in raising the concentrations of vital nutrients in food crops, such as selenium and zinc. The market demand for fertilizers will rise as a result of the expanding population and rising food prices. The main drivers of ammonia market expansion in the global market are the advancement of modern farming methods and the growing use of bio-fertilizers.

Numerous household cleaning and disinfection products contain the active component ammonium hydroxide, sometimes referred to as household ammonia. It is used to clean a variety of surfaces, including tiles, sinks, tubs, and countertops, toilets, among other things. When 5% to 10% NH3 and water are combined, these cleaning solutions are suitable for use in homes.

Further, due to its great thermodynamic characteristics and low price, ammonia is a reliable and widely used refrigerant gas. Because NH3 has a lower density in the liquid phase than CFCs and HFCs, NH3-based refrigeration systems are 10 to 20% cheaper than those using those substances. Additionally, any leakage odor may be easily noticed, meaning that any refrigerant loss is also reduced.

Pharmaceutical Industry is expected to hold the significant revenue share

The worldwide market for ammonia is anticipated to be driven by the rising demand for ammonia in the production of medicines and vaccines, as well as its widespread use in fertilizers and other end-use products.

The market demand has a big impact on how ammonia is used in many end-use industries, including mining, agriculture, pulp & paper, and pharmaceuticals. The usage of fertilizers to boost productivity per available area of agriculture has increased noticeably as a result of an increase in the world's appetite for food.

The market for ammonia is growing as a result of the rising demand for fertilizer in developing nations. Ammonium carbonate, phenol, urea, amino acids, hydrogen cyanide, nitriles, hydrazine, hydroxylamine, and other substances are all prepared using ammonia in substantial amounts.

Regional Analysis

The Asia-Pacific ammonia market holds the maximum market share, driven by its vast agricultural sector, growing industrial base, and increasing demand for fertilizers. Ammonia is a key raw material for producing urea and other nitrogen-based fertilizers, which are crucial for sustaining high crop yields across densely populated countries in asia such as India, china, Indonesia. The region benefits from abundant coal and natural gas reserves, serving as feedstocks for ammonia synthesis. Moreover, initiatives toward green ammonia, especially in countries like Australia and Japan, are accelerating due to decarbonization efforts.

China ammonia market, holds a dominant position in the Asian region due to its largest ammonia production and consumers across the globe. China, plays a pivotal role in shaping the market dynamics in the region. With approximately 25%+ of the world’s ammonia output, China uses ammonia extensively in agriculture to feed its massive population. The country also uses ammonia in various industrial applications, including refrigeration, textiles, and chemical manufacturing. While traditionally reliant on coal gasification for ammonia production, China is now pivoting towards cleaner alternatives, including electrolysis using renewable energy, in response to tightening environmental regulations. Strategic investments are being directed toward green hydrogen and green ammonia projects in Inner Mongolia and Xinjiang. Moreover, the Chinese government supports carbon neutrality by 2060, indirectly promoting green ammonia adoption. The demand remains robust, especially during planting seasons, and prices often reflect seasonal fluctuations and input cost volatility. Overall, China’s evolving energy policies, technological upgrades in fertilizer manufacturing, and increasing emphasis on sustainable agriculture are expected to keep the country at the forefront of ammonia market growth in Asia-Pacific.

The Middle East & Africa (MEA) ammonia market is emerging as a strategic hub, supported by its rich natural gas reserves, favorable energy economics, and growing investments in low-carbon technologies. Ammonia is primarily produced in the region as a part of large-scale petrochemical operations, often integrated with urea and methanol plants. The region has a dual advantage - low-cost production and proximity to key import markets in Asia and Europe. MEA is also investing in blue and green ammonia projects to capitalize on global energy transition trends.

Saudi Arabia ammonia market is at the forefront of this transformation. Traditionally known for its natural gas-based ammonia production, the Kingdom is now positioning itself as a global leader in green ammonia. The country’s Vision 2030 and its commitment to sustainability are driving investments in hydrogen and ammonia megaprojects. NEOM’s Helios Green Fuels Project, for example, is a USD 5 billion initiative aimed at producing green hydrogen and ammonia using solar and wind power. Saudi Arabia’s established infrastructure, strategic Red Sea ports, and energy export orientation make it well-placed to serve global ammonia markets, especially as ammonia emerges as a viable hydrogen carrier for international transport. In addition, domestic fertilizer consumption is growing, driven by efforts to expand agricultural self-sufficiency. The government’s push for economic diversification through industrialization and clean energy will further bolster ammonia production capacity. Consequently, Saudi Arabia is not only securing its role in the traditional ammonia market but also setting the stage for dominance in the green ammonia supply chain.

Competitive Insight

Leading companies in the market include Clariant, Dow, and Solvay, all of which play a significant role in shaping the industry landscape.

Yara International ASA, originally part of Norsk Hydro before its spin-off in 2004, is a major global player in crop nutrition and environmental solutions. Listed on the Oslo Stock Exchange, Yara offers a wide range of products and services, such as fertilizers, animal nutrition, analytical services, and industrial chemicals. The company also provides solutions for emission control, mining, and other industrial applications. Yara runs manufacturing plants in 16 countries and maintains a strong commercial presence, with sales offices in over 60 countries and product distribution in more than 160 countries worldwide.

Qatar Fertilizer Company (QAFCO) is a prominent producer of ammonia and urea. Formed as a joint venture between the Qatari government and international partners, it functions under the umbrella of Industries Qatar Q.S.C. QAFCO’s product line includes ammonia, urea, melamine, aqueous ammonia, and urea-formaldehyde condensate. The company continues to invest in research and development, focusing on creating advanced and efficient ammonia-based solutions.

Recent Developments

- November 2023: Uralchem announced its plans to invest USD 51.15 million (RUB 50 billion) in construction of ammonia port in Taman. According to Uralchem, the port will be designed for the transportation and handling of ammonia.

- March 2024: Yara entered into a partnership with GHC SAOC, a subsidiary of Acme Cleantech. Under this agreement, Acme will provide Yara with low-emission ammonia produced using cleaner methods. The deal includes an annual supply of 100,000 tons of renewable ammonia, supporting Yara's efforts to reduce its carbon footprint.

- April 2024: JERA and CF Industries began exploring a potential joint venture to build a low-carbon ammonia facility with a projected annual capacity of 1.4 million metric tons. As part of the plan, JERA is looking to secure a 48% stake in the project and intends to source more than 500,000 metric tons of low-carbon ammonia each year to help meet Japan’s growing need for cleaner energy alternatives.

Ammonia Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 255.87 billion |

|

Revenue forecast in 2034 |

USD 451.12 billion |

|

CAGR |

6.50% from 2025 - 2034 |

|

Base year |

2023 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Form, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Akzo Nobel N.V, Asahi Kasei Corporation., BASF SE, CF Industries Holdings Inc., EuroChem Group AG, Evonik Industries AG, Koch Fertilizer, LLC., Group DF, Indian Farmers Fertiliser Cooperative Limited, MITSUBISHI GAS CHEMICAL COMPANY, INC, Nutrien Ltd., OCI NV, Orica Limited, Qatar Fertiliser Company, Solvay S.A., Syngenta Crop Protection AG, SABIC Inc., Uralchem JSC |

FAQ's

The global market size was valued at USD 240.25 billion in 2024 and is projected to grow to USD 451.12 billion by 2034.

The global market is projected to register a CAGR of 6.50% during the forecast period.

The Asia-Pacific region holds the largest market share, supported by a vast agricultural base, industrial growth, and high fertilizer demand.

A few of the key players in the market are Akzo Nobel N.V, Asahi Kasei Corporation., BASF SE, CF Industries Holdings Inc., EuroChem Group AG, Evonik Industries AG, Koch Fertilizer, LLC., Group DF, Indian Farmers Fertiliser Cooperative Limited, MITSUBISHI GAS CHEMICAL COMPANY, INC, Nutrien Ltd., OCI NV, Orica Limited, Qatar Fertiliser Company, Solvay S.A., Syngenta Crop Protection AG, SABIC Inc., Uralchem JSC.

The liquid ammonia segment leads the global market due to its widespread use in fertilizers and pharmaceuticals, whereas ammonia gas is used in limited niche applications.

The fertilizer industry dominated the ammonia market in 2024, driven by rising global food demand and agricultural expansion.