Amyloidosis Treatment Market Size, Share, Trends, Industry Analysis Report

: By Treatment (Chemotherapy, Immunosuppressive Drugs, Transplantation, Supportive Care, Surgery, and Others), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5132

- Base Year: 2023

- Historical Data: 2019-2022

Amyloidosis Treatment Market Overview

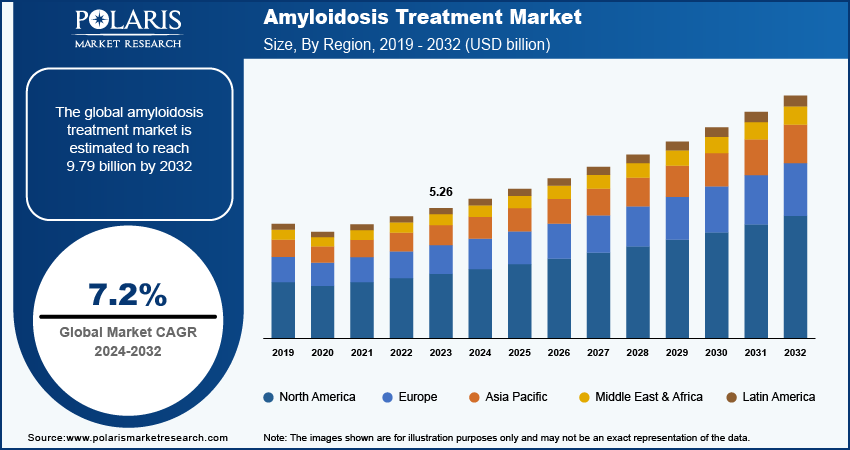

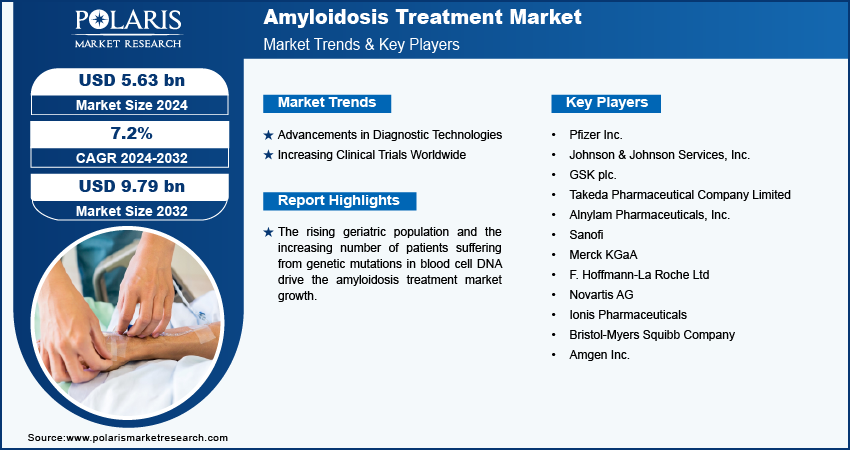

The amyloidosis treatment market size was valued at USD 5.26 billion in 2023. The market is projected to grow from USD 5.63 billion in 2024 to USD 9.79 billion by 2032, exhibiting a CAGR of 7.2 % during 2024–2032.

Amyloidosis is a rare but serious condition characterized by the abnormal accumulation of amyloid proteins in various organs leads to organ dysfunction. The treatment for amyloidosis has evolved significantly, with approaches tailored to the specific type of amyloidosis diagnosed. AL amyloidosis, AA amyloidosis, and transthyretin amyloidosis are a few types of amyloidosis, and each type requires different therapeutic methods.

The rising geriatric population is driving the amyloidosis treatment market. As per data published by the United Nations, the number of people aged 65 years and above worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion by 2050. Older adults often have multiple comorbidities, which complicate their health and increase the likelihood of conditions such as amyloidosis. This necessitates more comprehensive diagnosis and treatment options.

For Specific Research Requirements: Request a Free Sample Report

The amyloidosis treatment market is driven by the increasing number of patients having genetic mutations in blood cell DNA. Certain genetic mutations, including those associated with hereditary forms of amyloidosis such as ATTR amyloidosis, predispose individuals to develop the amyloidosis condition, leading to a higher incidence of diagnosed cases. This increases the demand for amyloidosis treatments.

Amyloidosis Treatment Market Driver Analysis

Advancements in Diagnostic Technologies

Improved diagnostic tools, such as advanced imaging techniques and enhanced biomarker tests, allow for earlier and more accurate identification of amyloidosis. This leads to timely treatment initiation, increasing the overall demand for amyloidosis therapies. Moreover, enhanced diagnostics enable the differentiation between various subtypes of amyloidosis, such as AL and ATTR, which guide effective treatment decisions and create a demand for tailored therapies. Therefore, advancements in diagnostic technologies drive the amyloidosis treatments market growth.

Increasing Clinical Trials Worldwide

The proliferation of clinical trials raises awareness about amyloidosis among healthcare professionals and the public. This increases interest in amyloidosis therapies as patients seek options that are potentially more effective. Additionally, a growing number of clinical trials led to the establishment of dedicated research centers and networks specializing in amyloidosis, which enhances the overall treatment environment and increases patient engagement. Therefore, the rising number of clinical trials worldwide fuels the growth of the global amyloidosis treatment market.

Amyloidosis Treatment Market Segment Insights

Amyloidosis Treatment Market Breakdown, By Treatment

Based on treatment, the global amyloidosis treatment market is segmented into chemotherapy, immunosuppressive drugs, transplantation, supportive care, surgery, and others. The chemotherapy segment dominated the market in 2023 due to its established efficacy in managing related conditions, particularly AL amyloidosis. Chemotherapy agents, such as bortezomib and cyclophosphamide, have shown significant success in reducing the production of amyloid light chains, which are responsible for the disease's progression. The ability of these drugs to achieve rapid hematologic responses has solidified their position as a first-line treatment, driving substantial market growth. Furthermore, the increasing prevalence of AL amyloidosis, coupled with advancements in combination therapies, has propelled the demand for chemotherapy as clinicians seek effective ways to enhance patient outcomes and prolong survival rates.

The transplantation segment is expected to grow at a robust pace in the coming years, owing to the rising recognition of hematopoietic stem cell transplantation as a curative option for patients suffering from AL amyloidosis. Healthcare providers are increasingly considering transplantation for patients affected by advanced disease as more clinical studies demonstrate the long-term benefits and improved survival rates associated with this approach. Additionally, the development of better pre-and post-transplant care protocols has improved patient outcomes and reduced complications, further encouraging the adoption of transplantation. The growing body of evidence supporting its effectiveness is likely to stimulate demand in the coming years, positioning transplantation as a pivotal treatment modality in the management of amyloidosis.

Amyloidosis Treatment Market Breakdown By End User

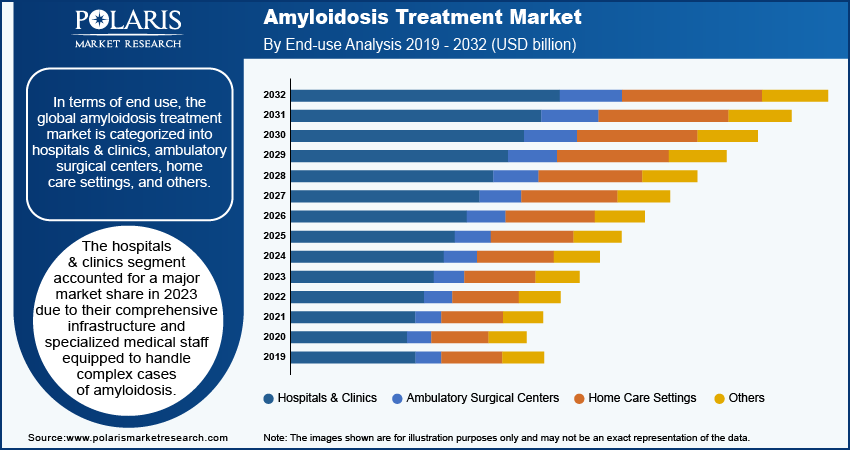

In terms of end user, the global amyloidosis treatment market is categorized into hospitals & clinics, ambulatory surgical centers, home care settings, and others. The hospitals & clinics segment accounted for a major market share in 2023 due to their comprehensive infrastructure and specialized medical staff equipped to handle complex cases of amyloidosis. These facilities provide a multidisciplinary approach, allowing for collaboration among oncologists, hematologists, and nephrologists to deliver optimal care. The availability of advanced diagnostic tools and treatment options in hospitals and clinics further enhances patient outcomes, attracting more individuals seeking timely and effective interventions. Additionally, the increasing complexity of treatment protocols and the need for close monitoring during chemotherapy and other therapies have set the role of these institutions as primary treatment centers.

The home care settings segment is projected to grow at a rapid pace during the forecast period owing to the rising preference for patient-centered care, where individuals receive treatment in the comfort of their own homes. Advances in telemedicine and home health monitoring technology enable healthcare providers to deliver quality care remotely, facilitating ongoing support and treatment adherence. Moreover, as more patients affected by amyloidosis achieve stability or remission, they often prefer less invasive and more convenient treatment options, further driving demand for home care solutions. The increasing focus on reducing hospital readmissions and healthcare costs also encourages the shift toward home care, making it a vital segment in the evolving landscape of care delivery for amyloidosis.

Amyloidosis Treatment Regional Insights

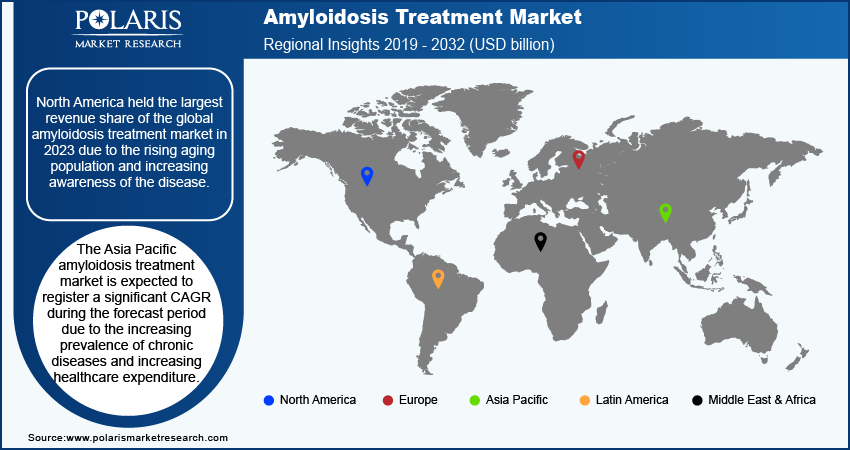

By region, the study provides the amyloidosis treatment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the highest revenue share of the global amyloidosis treatment market in 2023 due to the rising aging population, increasing awareness of the disease, and advancements in diagnostic technologies that facilitate earlier detection. Comprehensive healthcare infrastructure, along with access to specialized treatment centers, enhances the quality of care available to patients. Additionally, ongoing research and clinical trials conducted in the US significantly contribute to the development of innovative therapies for amyloidosis, further solidifying the country's leadership in the regional market.

The Asia Pacific amyloidosis treatment market is expected to register a significant CAGR during the forecast period due to the increasing prevalence of chronic diseases, rising healthcare expenditure, and improving healthcare infrastructure in countries such as China and India. Furthermore, advancements in healthcare technologies and an expanding focus on personalized medicine enhance treatment accessibility and efficacy, making Asia Pacific a key region in the future landscape. Further, a large patient population and significant investments in healthcare resources would fuel the market growth in the region in the coming years.

Amyloidosis Treatment Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development to expand their offerings, which will help the amyloidosis treatment market grow even more. Market participants are also undertaking a variety of strategic activities, including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations, to expand their global footprint. To expand and survive in a more competitive and rising market environment, the amyloidosis treatment market players must offer innovative solutions.

The amyloidosis treatment market is fragmented, with the presence of numerous global and regional market players. A few major players in the market include Pfizer Inc.; Johnson & Johnson Services, Inc.; GSK plc.; Takeda Pharmaceutical Company Limited; Alnylam Pharmaceuticals, Inc.; Sanofi; Merck KGaA; F. Hoffmann-La Roche Ltd; Novartis AG; Ionis Pharmaceuticals; Bristol-Myers Squibb Company; and Amgen Inc.

Pfizer Inc., founded in 1849 by Charles Pfizer and his cousin Charles Erhart in Brooklyn, New York, is a global player in biopharmaceuticals. The company has a rich history spanning over 170 years, marked by innovation and a commitment to improving health outcomes worldwide. Pfizer Inc. has emerged as a major player in the treatment of transthyretin amyloidosis (ATTR), particularly through its innovative therapies, VYNDAQEL (tafamidis) and VYNDAMAX. These medications specifically target transthyretin amyloid cardiomyopathy (ATTR-CM), a rare and progressive disease characterized by the accumulation of misfolded transthyretin proteins in the heart and other organs.

Takeda Pharmaceutical Company Limited, founded in 1781, is a prominent Japanese multinational pharmaceutical company headquartered in Tokyo, Japan. Takeda has made significant strides in this area with the development of therapies aimed at treating transthyretin amyloidosis (ATTR). Moreover, the company has been involved in several clinical trials aimed at evaluating the safety and efficacy of its amyloidosis treatments. In May 2024, Takeda Pharmaceutical signed an agreement to license AC Immune's ACI-24.060, an immunotherapy that targets amyloid beta, a protein that may be a root cause of amyloidosis.

Key Companies in Amyloidosis Treatment Market

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- GSK plc.

- Takeda Pharmaceutical Company Limited

- Alnylam Pharmaceuticals, Inc.

- Sanofi

- Merck KGaA

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Ionis Pharmaceuticals

- Bristol-Myers Squibb Company

- Amgen Inc.

Amyloidosis Treatment Industry Developments

June 2022: The US Food and Drug Administration approved Alnylam Pharmaceuticals AMVUTTRATM, a novel therapy for the treatment of hereditary transthyretin (hATTR) amyloidosis with polyneuropathy.

March 2023: Ionis Pharmaceuticals, a biotechnology company based in Carlsbad, California, announced that the US Food and Drug Administration (FDA) has accepted for review a New Drug Application (NDA) for eplontersen, an investigational antisense medicine for the treatment of people suffering from hereditary transthyretin-mediated amyloid polyneuropathy (ATTRv-PN).

Amyloidosis Treatment Market Segmentation

By Treatment Outlook (Revenue, USD Billion, 2024–2032)

-

Chemotherapy

- Immunosuppressive Drugs

- Transplantation

- Supportive Care

- Surgery

- Others

By End Use Outlook (Revenue, USD Billion, 2024–2032)

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Others

By Regional Outlook (Revenue, USD Billion, 2024–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Amyloidosis Treatment Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 5.26 billion |

|

Market Size Value in 2024 |

USD 5.63 billion |

|

Revenue Forecast by 2032 |

USD 9.79 billion |

|

CAGR |

7.2 % from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global amyloidosis treatment market size was valued at USD 5.26 billion in 2023 and is projected to grow to USD 9.79 billion by 2032.

The global market is projected to register a CAGR of 7.2 % during 2024–2032

North America held the largest share of the global market in 2023.

A few key players in the market are Pfizer Inc.; Johnson & Johnson Services, Inc.; GSK plc.; Takeda Pharmaceutical Company Limited; Alnylam Pharmaceuticals, Inc.; Sanofi; Merck KGaA; F. Hoffmann-La Roche Ltd; Novartis AG; Ionis Pharmaceuticals; Bristol-Myers Squibb Company; and Amgen Inc.

The transplantation segment is projected for significant growth in the global market during the forecast period.

The hospitals & clinics segment dominated the amyloidosis treatment market in 2023.