Transthyretin Amyloidosis Treatment Market Share, Size, Trends, Industry Analysis Report

By Type (ATTR-PN, ATTR-CM); By Therapy; By Disease Type; By Region; By Distribution Channel; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2778

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

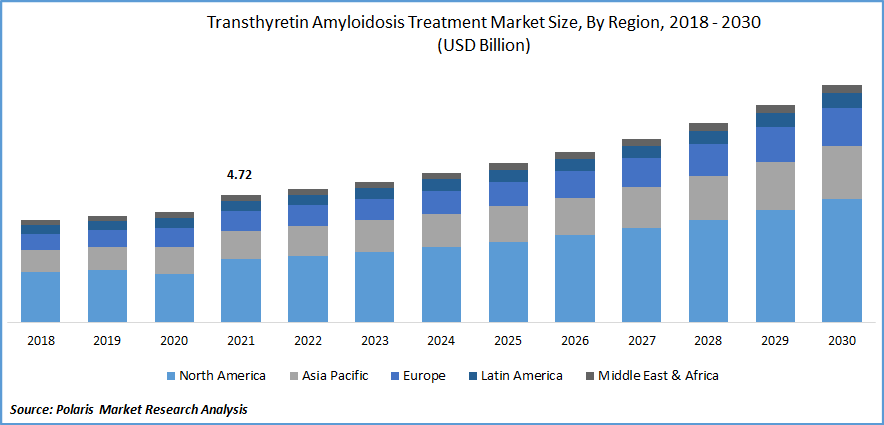

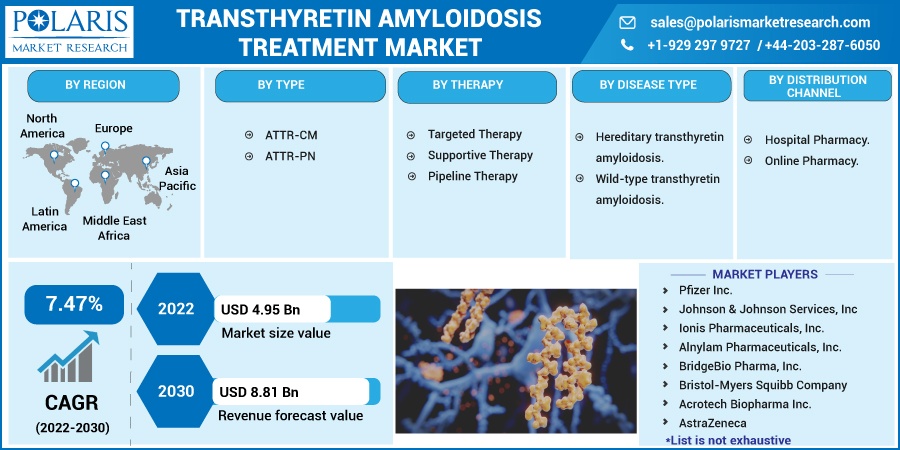

The global transthyretin amyloidosis treatment market was valued at USD 4.72 billion in 2021 and is expected to grow at a CAGR of 7.47% during the forecast period.

The increasing prevalence of transthyretin amyloidosis among geriatric patients and rising demographic of aging population are anticipated to drive the patient population of transthyretin amyloidosis therapy. For instance, a study published by European Journal of Heart Failure in 2022, reported transthyretin amyloidosis (ATTR) to be found in patients at and above the age of 70. Moreover, geriatrics suffering from cardiomyopathy from transthyretin amyloidosis were found to predominantly have the heredity type of TTR gene.

Know more about this report: Request for sample pages

The increasing age of patient population, alongside the increasing cardiomyopathy patients being diagnosed with transthyretin amyloidosis is expected to support the growth of market. Transthyretin amyloidosis is a rare genetic disease that occurs due to the buildup of an abnormal Transthyretin (TTR) protein. The disease predominantly produces two conditions, namely cardiomyopathy (CM) and polyneuropathy (PN). Furthermore, increasing awareness of transthyretin amyloidosis therapy by social and government initiatives is anticipated to foster market growth.

The impact of the COVID-19 pandemic created an upsurge in the transthyretin amyloidosis treatment market due to patients undergoing diagnosis and treatment of co-morbid conditions including cardiac, neurological and other conditions. Moreover, the sanctions in emergency healthcare protocols, accelerated approvals for key drugs and government regulations for essential healthcare services have supported the growth of market.

For instance, an article published by the Orphanet Journal of Rare Diseases in May 2021, stated that transthyretin amyloidosis patients to be provided with specialized management in the event of contracting the coronavirus. Moreover, minimal treatment interruptions were advised in these patients keeping in mind the complexity of managing the therapy. This, coupled with the increasing availability of novel drugs by key players, is responsible for bolstering the growth of transthyretin amyloidosis market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The underdiagnosed state of transthyretin amyloidosis among patient population suffering from chronic diseases, coupled with rise in a number of diagnostic tests to detect rare diseases, is anticipated to support the patient population undergoing treatment of transthyretin amyloidosis. This, combined with an increasing number of clinical trials to develop pipeline drugs for treating transthyretin amyloidosis and associated medical conditions, is one of the major factors augmenting the growth of the market.

Furthermore, key initiatives undertaken by major governments across the world to increase awareness of transthyretin amyloidosis and its treatment, supported by reimbursements for patients, are anticipated to increase therapy adoption, thereby fostering the growth of the market.

Report Segmentation

The market is primarily segmented based on type, therapy, disease type, distribution channel, and region.

|

By Type |

By Therapy |

By Disease Type |

By Distribution Channel |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

ATTR-PN segment is expected to witness fastest growth

The ATTR-PN segment is expected to grow at a higher pace through the forecast period. The increasing occurrence of neuropathic disorders alongside a rise in diagnosis of neuropathic disorders associated with transthyretin amyloidosis is projected to drive the growth of the ATTR-PN segment. For instance, a study published by the NCBI, in October 2022, demonstrated a positivity rate of 1.1% through genetic testing among transthyretin amyloidosis polyneuropathy patients to be hereditary in nature. The increasing number of patients undergoing specialty diagnosis to detect rare diseases is expected to increase the patient pool of transthyretin amyloidosis and thereby support the growth of the market.

Moreover, the ATTR-CM segment is expected to hold a majority share through the forecast period. The segment is expected to grow due to a larger patient pool suffering from cardiomyopathy and increasing availability of key drugs gaining swift approvals for treating ATTR-CM segment. Moreover, a sedentary lifestyle, increasing intake of carcinogens such as usage of tobacco along with unhealthy eating habits are associated to the aggravation of conditions such as transthyretin amyloidosis. This further increases the patient pool for treatment, thereby supporting the growth of the segment.

Targeted therapy accounted for the largest market share in 2021

The targeted therapy segment is expected to grow through the study period owing to the increasing adoption of novel therapies in treating transthyretin amyloidosis such as transthyretin gene silencers and gene editing. Moreover, the higher demand for alternate target therapies owing to the complex nature of the disease is also promoting key companies to develop novel target therapies. This, coupled with a higher prevalence of the disease, is anticipated to support the growth of the segment. Furthermore, increasing regulatory approvals for targeted therapies by major health organizations such as the USFDA and EMA with a view to promoting treatment of rare diseases such as transthyretin amyloidosis is projected to augment the growth of the segment.

Supportive and pipeline therapies are expected to grow through the forecast period owing to the advent of genome sequencing and artificial intelligence accelerating the screening of potential drug candidates. For instance, in July 2022, Alnylam Pharmaceuticals, Inc. announced received FDA approval of the AMVUTTRA for the treatment hATTR in adults associated with polyneuropathy. Additionally, European Medicines Agency (EMA) has also recommended approval for the treatment of hATTR amyloidosis in patients with stage 1 or 2 polyneuropathy.

Hereditary transthyretin amyloidosis sector is expected to hold the significant revenue share

The hereditary transthyretin amyloidosis segment is anticipated to grow through the forecast period owing to higher fatalities among patients with co-morbidities, thereby growing the patient population for the treatment of hereditary transthyretin amyloidosis. This, coupled with increasing awareness by experts for patients to undergo diagnosis for rare diseases such as the aforementioned condition, is further expected to enlarge the patient pool, thereby boosting the segment growth.

Moreover, the further classification and advanced staging systems developed for further understanding of familial-based transthyretin amyloidosis such as Portuguese classification system and Coutinho’s staging system, are expected to promote further research and subsequent clinical trials for key drugs. Furthermore, the development of innovative techniques for the therapy management of chronic diseases associated transthyretin amyloidosis is anticipated to support the growth of hereditary transthyretin amyloidosis segment.

The demand in North America is expected to witness significant growth

The rise in prevalence of transthyretin amyloidosis, along with the predominant nature of the disease among North American population as compared to the global incidence of the disease is responsible for the increasing patient population suffering from transthyretin amyloidosis-oriented chronic conditions in the region.

Moreover, key health chains, along with the US FDA supporting these health services to support patient care, are major factors affecting the growth of the North American transthyretin amyloidosis treatment market. For instance, in August 2022, UC San Diego Health announced to the provision of a new injectable, which reduced the patient doses from once in three weeks to once in three months. This massively improves patient compliance, improves their quality of life, and is anticipated to drive therapy adoption.

The increased adoption of novel therapies for transthyretin amyloidosis combined with major market players gaining market authorization, such as orphan drug designation granted for Eplontersen to treat transthyretin amyloidosis in the U.S., is anticipated to bolster the growth of market in North America.

Europe is anticipated to grow through the forecast period owing to the launch of key drugs by companies and support from government regulations such as swift approvals for standardizing the treatment of transthyretin amyloidosis. For instance, in July 2022, the European Medical Agency (EMA) published a marketing authorization of Amvuttra for the treatment of hereditary mediated hATTR- type amyloidosis.

Additionally, the key companies investing in the development of key drugs for treating multiple conditions associated with transthyretin amyloidoses such as polyneuropathy and cardiomyopathy, are anticipated to support the growth of the market further.

Competitive Insight

Some of the major players operating in the global market include Pfizer, Johnson & Johnson Services, Ionis Pharmaceuticals, Alnylam Pharmaceuticals, BridgeBio Pharma., Bristol-Myers, Acrotech Biopharma., AstraZeneca, Astellas Pharma, Prothena, and SOM Biotech.

Recent Developments

In October 2022, Regeneron collaborated with Intellia, and announced successful clinical trials of their CRISPR Cas9-based gene editing treatment, NTLA-2001. The treatment has demonstrated a drastic reduction in serum transthyretin responsible for ATTR amyloidosis. The Phase 1 trial provides promising results for further trials, thereby catering to the rising demand for novel therapy in transthyretin amyloidosis treatment.

Moreover, in October 2022, Alnylam Pharmaceuticals Inc. announced successful Phase 3 trials of Patisiran for cardiomyopathy associated with transthyretin-mediated amyloidosis. The clinical trial now ensures subsequent approval and commercialization of the same in the U.S.

Transthyretin Amyloidosis Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.95 billion |

|

Revenue forecast in 2030 |

USD 8.81 billion |

|

CAGR |

7.47% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Therapy, By Disease, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Pfizer Inc., Johnson & Johnson Services, Inc, Ionis Pharmaceuticals, Inc., Alnylam Pharmaceuticals, Inc., BridgeBio Pharma, Inc., Bristol-Myers Squibb Company, Acrotech Biopharma Inc., AstraZeneca, Astellas Pharma Inc., Prothena, SOM Biotech S.A. |