Anti-money Laundering Market Share, Size, Trends, Industry Analysis Report

By Component (Software, Services); By Service; By End-use; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 115

- Format: PDF

- Report ID: PM2823

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

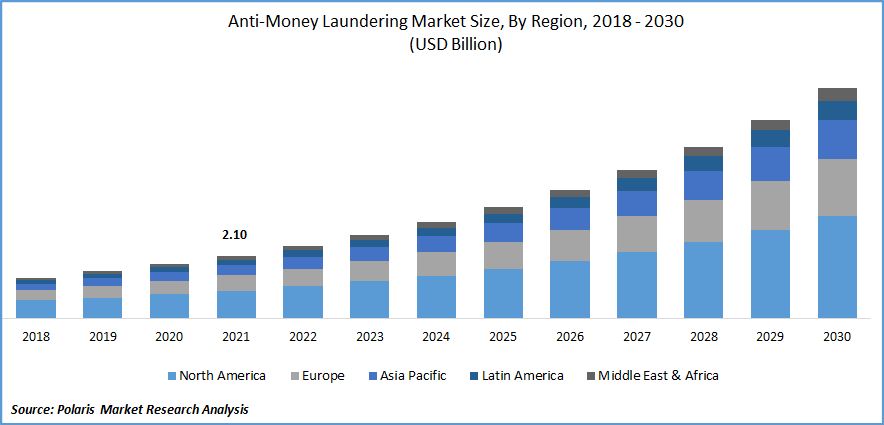

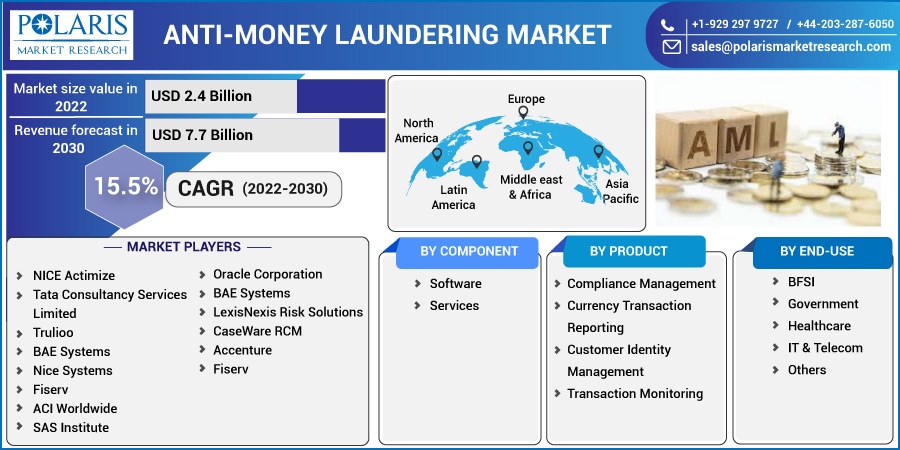

The global anti-money laundering market was valued at USD 2.10 billion in 2021 and is expected to grow at a CAGR of 15.5% during the forecast period.

The market's promising growth potential is attributed to the rise in instances of money laundering around the world. Businesses utilize anti-money laundering software to spot dubious customer data and transactions. Compliance specialists also use the tool to adhere to corporate policies and laws, such as the US Bank Secrecy Act, which was developed to stop crimes related to money laundering.

Know more about this report: Request for sample pages

Anti-money laundering software gathers information from financial transaction and management tools, including accounting software and ERP systems, intending to reduce money laundering operations.

When it comes to identifying, analyzing, and resolving instances of money laundering, anti-money laundering solutions provide clients with greater performance. These instances can be handled more effectively and quickly thanks to anti-money laundering system’s robust data analysis, higher risk protection, and speedier processing times.

In addition, several governing organizations have put laws and rules into place to fight cases of money laundering and the funding of counterterrorism. The Financial Action Task Force is an intergovernmental organization that assists nations with updating and drafting anti-money laundering legislation.

For instance, the Presidential Advisory Committee against Corruption stated that newly passed anti-money laundering and anti-terrorist laws would considerably boost Nigeria's battle against terrorism and corruption. President Muhammadu Buhari recently signed the Terrorism Bill and the Money Laundering Bill into law. New rules replaced the Money Laundering Prohibition Act and the 2011 Terrorism Prevention Amendment Act.

Because anti-money laundering regulations vary from country to country, financial institutions must make sure that their operations comply with the rules unique to the jurisdiction in which they are doing business. Financial institutions can create a set of regulations that must be adhered to stop unauthorized funds from entering their economic systems by using these rules.

Digital technology has advanced with COVID-19. Political restrictions worldwide have caused everyone to rely on digital platforms to meet their everyday needs. Online payments are the primary use. Electronic wallets, often known as eWallets, are becoming popular. The likelihood of unlawful financial activity has grown as a result of this development.

The FATF has issued a warning to banks concerning unlawful financial activities. Because of this, there is a growing need for AML solutions, which has a significant effect on market growth. As more people use digital platforms, the amount of data on networks is increasing, placing a strain on the infrastructure security of banks and other financial organizations.

Despite several measures, banks nevertheless experience considerable losses as a result of hacking attacks. As a result, there is an increasing need for better AML solutions, which has an impact on market growth. Cybercrime is on the rise as networks collect more data. Banks and other financial organizations are using data analytics technologies more regularly to improve their security processes. This is projected to have a significant impact on market expansion.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Transaction monitoring is a critical stage and significant control in the AML and countering the financing of terrorism policies and procedures used by financial institutions. When comparing transactions to specific customer profiles, financial institutions can use transaction monitoring tools to determine whether any transactions raise any red flags.

Financial regulators have increased their focus on monitoring AML risk activities throughout time, including pressuring financial institutions to implement a suitable transaction monitoring process. Authorities also expect businesses to demonstrate the potency and effectiveness of their systems.

Financial institutions can use transaction monitoring software platforms to create a range of monitoring scenarios. These platforms also allow for effective data analysis and distinguishing between genuine suspicious behavior and other false positives. On account of such factors, the demand for AML systems equipped with sophisticated transaction monitoring technologies is rising.

Report Segmentation

The market is primarily segmented based on component, product type, end-use, and region.

|

By Component |

By Product |

By End-use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

In 2021, the Software Segment Dominated the Market, Accounting for the Largest Market Share

Organizations can ensure that governmental entity's legal standards are met with anti-money laundering software. Money launderers create new strategies to get around the systems as technology advances. As they encounter more resistance, money launderers will keep developing their methods. In addition, institutions with a potential ML/TF risk, such as banks and finch, must abide by these restrictions. Who must comply with these regulations may vary depending on the country.

Companies that violate regulations risk financial fines and potentially even more severe penalties due to audits. Businesses utilizing AML software solutions in this situation can quickly safeguard themselves from legal consequences and smoothly pass audits. On account of such factors the software segment is further projected to gain prominence in the extended run.

The Transaction Monitoring Segment will Account for a Higher Share of the Market

The transaction category dominated the market in 2021. Financial firms & organizations can carry out customer transactions in real-time, fraud transaction monitoring software & services.

For instance, according to FISCO, about 370 billion financial transactions are made annually in the world. The monitoring of AML transactions is based on best practices, typologies, and an in-depth understanding of financial crime because of the highly regulated nature and required audit criteria. Modern AML transaction monitoring tools improve this strategy.

To identify new forms of criminal conduct more quickly and comprehend customer behavior and relationships, machine learning and AI, particularly network analytics, improve human-based expert knowledge. This should be supported by an efficient and automated alert and case management solution that prioritizes cases to best use the reporting officers' resources and provide them with the tools they need to access all pertinent information and advance cases effectively.

BFSI is Expected to Hold the Significant Revenue Share

The BFSI segment dominated the market in 2021. The BFSI segment's other subsectors include wealth management organizations, retail banking, commercial banking, and digital banking. Banks constantly deal with an elevated risk of fraud and financial crimes due to the digitalization and automation of financial systems and a significant increase in online transactions.

Because anti-money laundering regulations outline the safeguards that banks must take to avoid and identify financial crimes, the BFSI sector needs anti-money laundering solutions. For instance, IDBI Intech Ltd, which provides specialized solutions in banking, financial services, and insurance (BFSI), successfully integrated its anti-money laundering solution at India's largest insurance company Life Insurance Corporation of India, on August 2021.

The Demand in North America is Expected to Witness Significant Growth

North America emerged as the largest regional market in 2021. The presence of sizeable players in the region contributed to the region's expansion. Because there are so many institutions in the area, it is anticipated that anti-money laundering solutions will be adopted quickly in the near future.

Additionally, it is projected that the development of inorganic strategies to incorporate artificial intelligence among anti-money laundering providers will fuel market growth. The US Congress approved the Anti-money Laundering Act of 2020, which imposes specific anti-money laundering standards on financial institutions and promotes the adoption of anti-money laundering solutions throughout the nation.

Competitive Insight

Some of the major players operating in the global market include NICE Actimize, Tata Consultancy Services Limited, Trulioo, BAE Systems, Nice Systems, Fiserv, Cognizant Technology Solutions Corporation, ACI Worldwide, SAS Institute, Oracle Corporation, LexisNexis Risk Solutions, CaseWare RCM and Accenture.

Recent Developments

- April 2024: An AI-powered cloud service called Financial Services Compliance Agent was unveiled by Oracle to assist banks in reducing their exposure to anti-money laundering (AML) threats. Oracle stated that banks can use the agent to carry out economic scenario testing to improve compliance, identify suspicious transactions, and modify controls.

- September 2023: IBM revealed that its payment-as-a-service solution, the Payments Center, became a member of the Swift Partner Program. According to IBM, the collaboration will open up new channels of cooperation with more than 11,000 Swift members worldwide.

- The cloud-based platform the “Arachnys” will be made available by Oracle, in January 2022, in order to strengthen and integrate it with “Oracle's Financial Services Financial Crime and Compliance Management” solution suite.

Anti-money Laundering Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.4 billion |

|

Revenue forecast in 2030 |

USD 7.7 billion |

|

CAGR |

15.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Product Type, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

NICE Actimize, Tata Consultancy Services Limited, Trulioo, BAE Systems, Nice Systems, Fiserv, Cognizant Technology Solutions Corporation, ACI Worldwide, SAS Institute, Fiserv, Oracle Corporation, BAE Systems, LexisNexis Risk Solutions, CaseWare RCM and Accenture |