Antifreeze Proteins Market Size, Share, Trends, & Industry Analysis Report

By Form (Solid and Liquid), By Source, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM1978

- Base Year: 2024

- Historical Data: 2020-2023

Overview

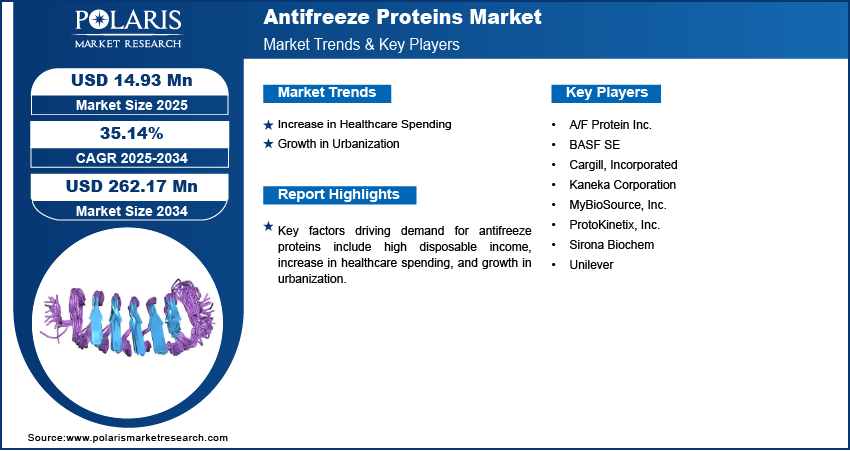

The global antifreeze proteins market size was valued at USD 11.14 million in 2024, growing at a CAGR of 35.14% from 2025 to 2034. Key factors driving demand for antifreeze proteins include high disposable income, increase in healthcare spending, and growth in urbanization.

Key Insights

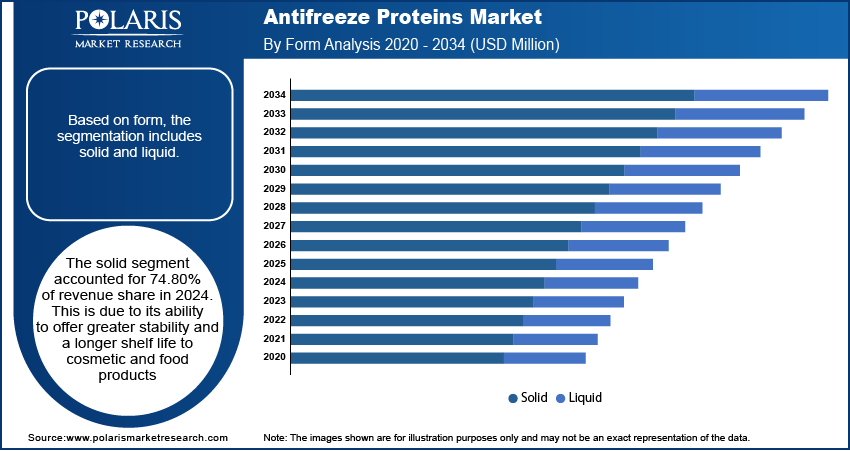

- The solid segment accounted for 74.80% of revenue share in 2024 due to its ability to offer a longer shelf life to cosmetic and food products.

- The fish segment held 57.44% of the revenue share in 2024, owing to its effectiveness in improving freeze tolerance.

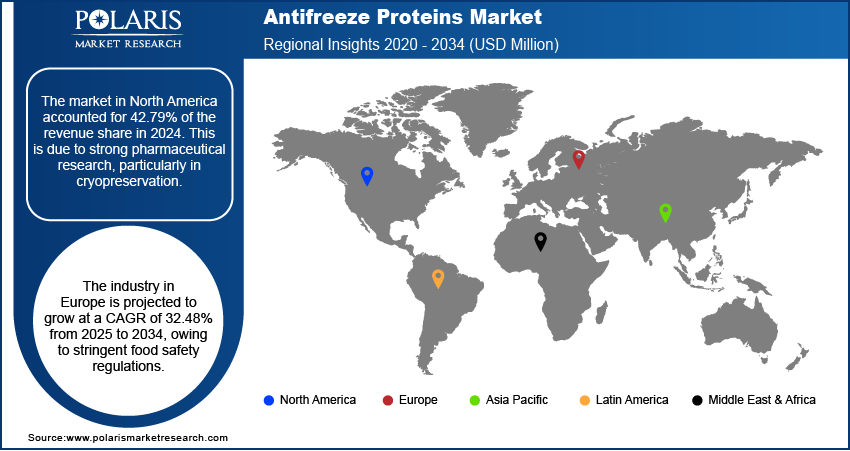

- The market in North America accounted for 42.79% of the revenue share in 2024, due to strong pharmaceutical research.

- U.S. held 90.53% of the revenue share in the North America antifreeze proteins landscape in 2024, due to the presence of the biopharmaceutical industry.

- The industry in Europe is projected to grow at a CAGR of 32.48% from 2025 to 2034, owing to stringent food safety regulations.

Industry Dynamics

- Increase in healthcare spending is propelling the demand for antifreeze proteins by increasing the development of innovative treatments.

- Growth in urbanization is increasing the adoption of frozen foods and ready-to-eat products. This is leading to high demand for antifreeze proteins.

- Advancements in biotechnology are creating a lucrative market opportunity.

- The high cost of production of antifreeze protein is projected to hamper the market growth.

Market Statistics

- 2024 Market Size: USD 11.14 Million

- 2034 Projected Market Size: USD 262.17 Million

- CAGR (2025-2034): 35.14%

- North America: Largest Market Share

AI Impact on Antifreeze Proteins Market

- AI helps in streamlining the research and commercialization of antifreeze proteins.

- AI helps in large-scale screening, which reduces time and costs in R&D.

- AI ensures better integration of antifreeze proteins into frozen products.

- AI also helps in consumer preferences and potential applications.

Special proteins found in cold-adapted organisms, such as insects, certain fish, and plants, are known as antifreeze proteins (AFPs). These proteins are a specific class of polypeptides and are also known as ice structuring proteins. The sources of antifreeze proteins reveal different α-helices and β-sheets structures. AFPs have various industrial functions and are used widely in different aspects of application. They are used in cell biology, food industry, and biotechnology.

Food sector widely uses antifreeze proteins to prevent ice crystal damage in frozen foods such as baked goods, dairy products, and meats. These proteins are also used in the biomedical field to improve organ cryopreservation, cells, and tissue. The horticultural sector depends on AFPs to enhance plant frost tolerance. The cryoprotective properties of antifreeze proteins further help in the preservation of organs for transplantation. Ice cream manufacturers use AFPs heavily for the enhancement of ice cream’s texture.

The high disposable income in various parts of the world is increasing consumer spending on premium products. These products include gourmet ice creams, frozen foods, and skincare formulations. All of these products need antifreeze proteins for quality and performance, leading to market growth. Bureau of Economic Analysis stated that the disposable personal income in the US increased +0.6% in April 2025 from March 2025. The adoption of luxury cosmetics is also growing due to high disposable income, which is increasing the use of antifreeze proteins for product differentiation.

Drivers & Opportunities/Trends

Increase in Healthcare Spending: Growing aging population and rising incidence of chronic diseases across the globe are encouraging people and governments to increase their healthcare spending. American Medical Association stated that health spending in the U.S. increased by 7.5% in 2023. This increase in healthcare spending propelled the development of innovative treatments. These treatments include cryopreservation techniques and organ transplantation methods. Antifreeze proteins are used in these technique and method to preserve biological materials. Increase in healthcare spending is leading to clinical trials for cell preservation and regenerative medicine, which need for antifreeze protein.

Growth in Urbanization: Better Jobs, higher education, and healthcare are encouraging people to move to cities. This is increasing the adoption of frozen foods and ready-to-eat products. These products require advanced preservation to maintain texture and nutritional value. This need for advanced preservation is propelling the demand for antifreeze proteins. Moreover, growth in urbanization is leading to the adoption of personal care products such as lotions and creams. Manufacturers of these products use antifreeze proteins to enhance the quality and performance. Therefore, the growth in urbanization is increasing the need for antifreeze proteins. United Nations stated that the global urban population is projected to increase to around two-thirds of the total population in 2050.

Segmental Insights

Form Analysis

Based on form, the segmentation includes solid and liquid. The solid segment accounted for 74.80% of revenue share in 2024. This is due to its ability to offer greater stability and a longer shelf life to cosmetic and food products. Manufacturers of frozen food and skin care products used solid antifreeze protein for its ease of storage, transportation, and integration. Solid AFPs also helped pharmaceutical companies in consistent dosing and minimizing drug degradation risks. Moreover, the need for advanced biopreservation in medicine propelled the dominance of the segment.

Source Analysis

In terms of source, the segmentation includes plants, fish, insect, and others. The fish segment held 57.44% of the revenue share in 2024. This is owing to its ease of extraction and effectiveness in improving freeze tolerance. Frozen food manufacturers of ice cream, meat, and seafood adopted fish antifreeze protein to improve the texture and quality. Fish-based antifreeze protein has a thermal hysteresis activity. This propelled its usage in medical and biotechnological applications for improving cryopreservation techniques. Moreover, the high consumption of seafood products, especially in the Asia Pacific region, increased the availability and demand for fish-derived antifreeze proteins. Organization for Economic Co-operation and Development stated that Asia is projected to account for 73% of fish and other aquatic food products available for consumption by 2034.

End Use Analysis

The segmentation in terms of end use includes food & beverages, pharmaceutical & medical, cosmetics, and others. The pharmaceutical & medical segment accounted for 65.37% of the revenue share in 2024. This is due to antifreeze protein usage in cryopreservation of cells, tissues, and organs. Regenerative medicine, organ transplantation, and advanced biotechnological research depended on antifreeze protein to enhance the survival rate of biological samples during freezing. These proteins are further used by pharmaceutical companies to stabilize injectable drugs and develop innovative therapies. The progress in cell and gene therapies also led to high adoption of antifreeze protein in the pharmaceutical & medical sectors.

The food & beverages segment is expected to grow at a CAGR of 34.85% from 2025 to 2034. This is owing to the growing adoption of frozen desserts, seafood, and ready-to-eat meals. Producers of these products integrated antifreeze protein in their products to maintain texture, prevent ice crystal formation, and extend shelf life. The rising popularity of premium ice creams and growth in urbanization globally are further projected to propel the segment growth. The increase in disposable income in some parts of the world is also increasing the segment growth.

Regional Analysis

The market in North America accounted for 42.79% of the revenue share in 2024. This is due to strong pharmaceutical research, particularly in cryopreservation. The high consumption of frozen desserts and processed seafood in the region contributed to antifreeze protein adoption as it improve texture and shelf life. Consumer preference for natural ingredients and clean-label products in the region also led to market growth. Moreover, the region’s advanced biotechnology sector contributed to high antifreeze protein demand in 2024.

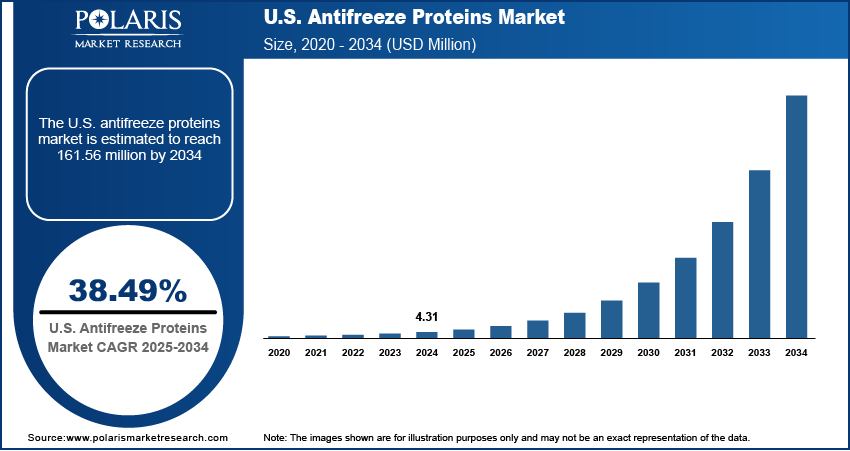

U.S. Antifreeze Proteins Market Insight

U.S. held 90.53% of the revenue share in the North America antifreeze proteins landscape in 2024. This is due to the presence of advanced academic research institutions and the biopharmaceutical industry. The high urbanization and disposable income also contributed to the demand for frozen food and cosmetics. This demand for cosmetics and frozen food increased the adoption of antifreeze proteins. Moreover, the market in the U.S. witnessed strong growth owing to the increasing use of antifreeze proteins in cryopreservation of cells, tissues, and organs.

Asia Pacific Antifreeze Proteins Market

The Asia Pacific market is projected to hold a significant revenue share in 2034, driven by growing food processing industries and rising healthcare expenditure. AFPs are being utilized in premium frozen foods and biomedical cryopreservation in countries such as Japan, South Korea, and Australia. The large population of the region is propelling the consumption of frozen foods. This is increasing the demand for antifreeze proteins as frozen food manufacturers use them to enhance shelf life. As of September 9, 2025, the population of Asia was 4,840,671,389. The growing agriculture sector in the region is also leading to market growth.

China Antifreeze Proteins Market Overview

The demand for antifreeze proteins in China is being driven by massive investments in biotechnology and the modernization of food sector. The high consumption of seafood and frozen food in China is propelling the demand for antifreeze proteins. China’s growing fashion industry is also increasing market revenue as these proteins are used in skin care products. Moreover, the growing organ transplant infrastructure and fertility clinics in China are increasing the adoption of antifreeze proteins for cryopreservation.

Europe Antifreeze Proteins Market

The industry in Europe is projected to grow at a CAGR of 32.48% from 2025 to 2034, owing to stringent food safety regulations. Advanced biomedical research and a high preference for natural and sustainable ingredients are increasing the adoption of antifreeze proteins in seafood and frozen food. Heavy investment in cryobiology by major countries such as Germany, the UK, and the Netherlands is also propelling the demand for antifreeze proteins. The high demand for personal care products such as skin care and lotions is further driving the market growth.

Key Players & Competitive Analysis Report

Food processing, pharmaceuticals, and biotechnology industries are increasing competition in the antifreeze proteins industry. Companies in the market are introducing products and advanced extraction methods to enhance protein stability and effectiveness. Research and development are expanding usage in cryopreservation, cold storage, and agriculture. Players are also investing in sustainable production techniques to meet environmental concerns. The competitive landscape is also shaped by strategic collaborations, licensing agreements, and technological advancements.

A/F Protein Inc.; BASF SE; Cargill, Incorporated; Kaneka Corporation; MyBioSource, Inc.; ProtoKinetix, Inc.; Sirona Biochem; and Unilever are some of the major companies operating in the antifreeze proteins industry.

Key Companies

- A/F Protein Inc.

- BASF SE

- Cargill, Incorporated

- Kaneka Corporation

- MyBioSource, Inc.

- ProtoKinetix, Inc.

- Sirona Biochem

- Unilever

Industry Developments

May 2021, ProtoKinetix, Incorporated, announced its collaboration with IQVIA to propel the development of AAGP.

Antifreeze Proteins Market Segmentation

By Form Outlook (Revenue, USD Million, 2020–2034)

- Solid

- Liquid

By Source Outlook (Revenue, USD Million, 2020–2034)

- Plants

- Fish

- Insect

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Food & Beverages

- Pharmaceutical & Medical

- Cosmetics

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Antifreeze Proteins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.14 Million |

|

Market Size in 2025 |

USD 14.93 Million |

|

Revenue Forecast by 2034 |

USD 262.17 Million |

|

CAGR |

35.14% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.14 million in 2024 and is projected to grow to USD 262.17 million by 2034.

The global market is projected to register a CAGR of 35.14% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are A/F Protein Inc.; BASF SE; Cargill, Incorporated; Kaneka Corporation; MyBioSource, Inc.; ProtoKinetix, Inc.; Sirona Biochem; and Unilever.

The solid segment dominated the market revenue share in 2024.

The food & beverages segment is projected to witness the fastest growth during the forecast period.