APAC Pipeline Pigging Market Analysis & Segment Forecast to 2032 Share, Size, Trends, Industry Analysis Report

By Services (Pigging, and Intelligent Pigging); By Application; By End-Use; By Country; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 117

- Format: PDF

- Report ID: PM4933

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

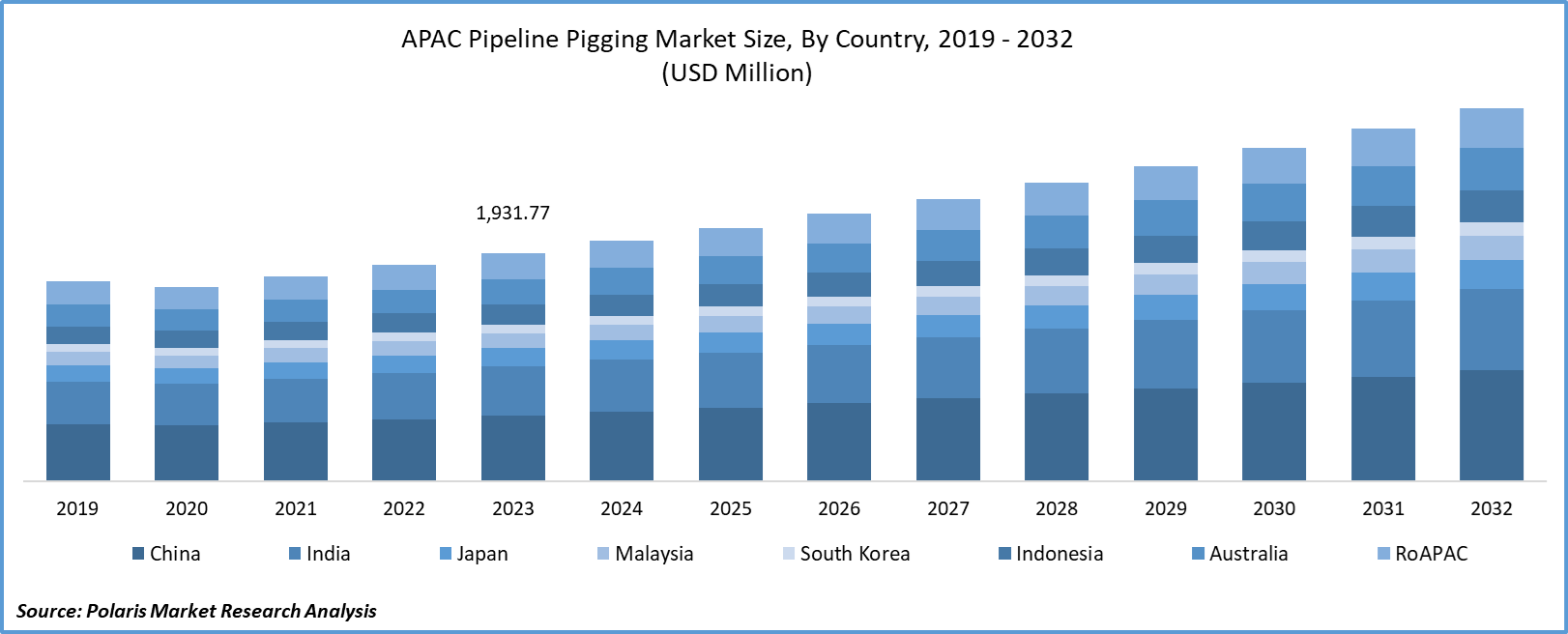

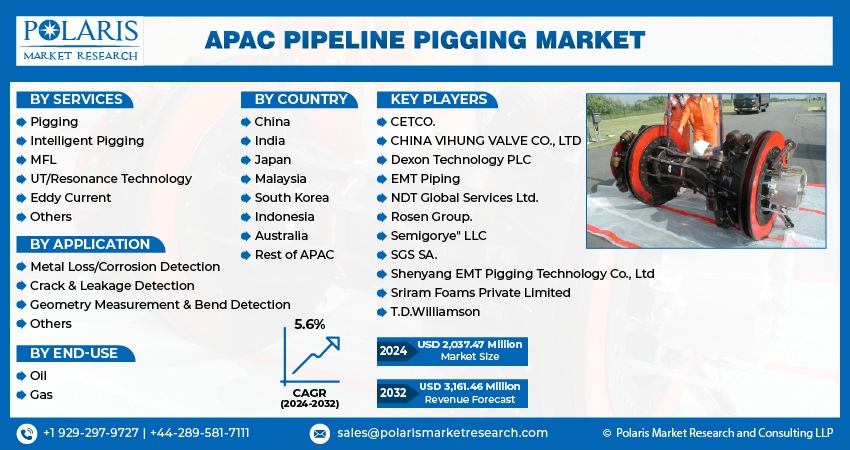

The APAC pipeline pigging market Analysis & Segment Forecast to 2032 size was valued at USD 1,931.77 million in 2023. The market is anticipated to grow from USD 2,037.47 million in 2024 to USD 3,161.46 million by 2032, exhibiting a CAGR of 5.6% during the forecast period.

Industry Trend

The pipeline-pigging services market in the Asia Pacific (APAC) region is currently undergoing rapid expansion, driven by several key factors, such as the escalating demand for pipeline maintenance and repair solutions across the region. This surge is propelled by the burgeoning number of oil and gas pipelines, necessitating efficient and cost-effective maintenance services. The adoption of pipeline-pigging services further fuels market growth. Pipeline pigging, renowned for its cost-effectiveness and efficiency, is increasingly favored in the region for its ability to clean and inspect pipelines thoroughly.

Furthermore, the agreement between countries for natural gas supply through extensive pipelines spanning numerous kilometers significantly contributes to the demand for asia pacific pipeline pigging services for maintenance, thus driving the market.

To Understand More About this Research: Request a Free Sample Report

The growth of the pipeline-pigging services market in Japan is attributed to the country's extensive network of gas pipelines. This expansion is primarily driven by the need for efficient maintenance and inspection of these pipelines to ensure optimal performance and safety standards. As companies recognize the importance of regular cleaning and inspection to prevent corrosion and improve operational efficiency, the demand for pipeline pigging services has surged. With Japan's significant investment in its gas infrastructure, companies specializing in pipeline-pigging services are experiencing heightened demand, thus contributing to the market's growth.

- For instance, in February 2020, Russia signed a pivotal 30-year agreement to supply natural gas to China, denominated in euros. As part of this agreement, Gazprom, the Russian energy giant, is obligated to furnish the China National Petroleum Corporation with an additional 10.0 billion cubic meters (bcm) of gas annually by 2026. Russia has committed to constructing a new 620-kilometer pipeline, augmenting onward supply by interlinking two existing Russian pipelines: The Power of Siberia, joining the Chayandinskoye gas field with northeast China, and another in the east linking two gas fields.

These projects underscore the critical role of pipeline maintenance, safety and the indispensable contribution of pipeline pigging services to drive market expansion in the APAC region.

Key Takeaway

- China dominated the largest market and contributed to more than 38% of the share in 2023.

- The India market is expected to be the fastest-growing CAGR during the forecast period.

- By services category, the pigging segment accounted for the largest market share in 2023.

- By application category, the metal loss/corrosion detection segment is projected to grow at a high CAGR during the projected period.

What are the market drivers driving the demand for the Asia Pacific pipeline-pigging market?

The growing energy demand in the Asia-Pacific region has been projected to spur market demand.

The Asia-Pacific region is home to a significant portion of the world's population, and it continues to experience population growth. As more people inhabit the region, there is a corresponding increase in energy demand for various purposes, such as residential, commercial, and industrial activities. This heightened demand for energy requires an expansion of energy infrastructure, including pipelines, to facilitate the transportation of oil, gas, and other resources from production sites to consumption centers. The Asia-Pacific region is home to a significant portion of the world's population, and it continues to experience population growth. As more people inhabit the region, there is a corresponding increase in energy demand for various purposes, such as residential, commercial, and industrial activities. This heightened demand for energy requires an expansion of energy infrastructure, including pipelines, to facilitate the transportation of oil, gas, and other resources from production sites to consumption centers.

Industrial activities consume large amounts of energy for powering machinery, heating, and chemical processes. Pipelines are indispensable for supplying the raw materials and fuels necessary for industrial operations. The expansion of industrial infrastructure drives the demand for energy resources, thereby necessitating the construction and maintenance of pipelines to ensure a reliable supply chain.

Which factor is restraining the demand for APAC pipeline pigging?

Initial investment costs are expected to hinder the growth of the market.

The adoption of pipeline pigging services is the initial investment required to implement pigging technologies and equipment. Setting up pigging infrastructure, including the purchase of pigging devices, sensors, and inspection tools, can involve significant upfront costs for pipeline operators. Additionally, specialized training for personnel and the integration of pigging systems into existing pipeline networks may require additional investments. For some operators, especially those with smaller or less developed pipelines, these upfront costs can be prohibitive, leading to hesitation or delay in adopting pigging solutions. Despite the long-term benefits of improved pipeline integrity and operational efficiency, the initial capital outlay can act as a deterrent to widespread adoption, thereby restraining the overall demand for pipeline-pigging services in the APAC region.

Report Segmentation

The market is primarily segmented based on services, applications, end-use, and country.

|

By Services |

By Application |

By End-Use |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Services Insights

Based on services analysis, the market is segmented into pigging and intelligent pigging. Pigging held the largest market in 2023. With aging pipeline infrastructures in Asia Pacific, there's a growing need for regular maintenance to ensure safe and efficient operations. Pigging is an effective method for cleaning pipelines, removing debris, and preventing corrosion, which extends the lifespan of the pipelines. Stringent regulations regarding pipeline safety and environmental protection have pushed companies to invest in technologies like pigging to meet compliance standards. Regular inspection and maintenance, facilitated by pigging, help companies adhere to these regulations.

Pigging can significantly improve the efficiency of pipeline operations. By removing build-up and optimizing flow, pigging reduces energy consumption and operational costs. Additionally, it helps prevent costly leaks and unplanned downtime by identifying potential issues before they escalate.

By Application Insights

Based on application analysis, the market has been segmented on the basis of metal loss/corrosion detection, crack & leakage detection, geometry measurement & bend detection, and others. The metal loss/corrosion detection segment is expected to be the fastest-growing CAGR during the forecast period. Pipeline operators in the Asia Pacific region are increasingly recognizing the importance of ensuring the integrity and safety of their pipelines. Corrosion is a pervasive threat to pipeline infrastructure, and its early detection is crucial for preventing leaks, ruptures, and environmental damage. As a result, there's a growing emphasis on adopting advanced pigging technologies specifically designed for accurate corrosion detection. Regulatory bodies across the Asia Pacific are imposing stringent standards and regulations regarding pipeline integrity and safety. Compliance with these standards necessitates regular inspection and maintenance of pipelines, including effective corrosion detection methods. Pipeline operators are compelled to invest in corrosion detection pigging solutions to meet these regulatory requirements and avoid penalties or shutdowns due to non-compliance.

Country Insights

China

China region accounted for the largest market share in 2023. China has been rapidly expanding its pipeline infrastructure, particularly in sectors such as oil and gas, petrochemicals, and water management. The construction of new pipelines and the maintenance of existing ones drive the need for pigging services to ensure operational efficiency, integrity, and safety. China's continuous industrial growth and urbanization necessitate efficient transportation of resources like oil, gas, and water. Pipelines play a crucial role in this transportation network, and regular maintenance through pigging services is essential to keep these pipelines functioning optimally.

China's extensive network of oil and gas pipelines is crucial for transporting energy resources across the country. These pipelines connect oil and gas fields to refineries, petrochemical plants, and distribution centers. Maintenance of these pipelines is essential to prevent leaks, ensure uninterrupted flow, and comply with safety regulations. Top of FormIndia

India

India is expected for the growth of fastest CAGR during the forecast period. India is witnessing substantial investments in infrastructure development, including the construction of pipelines for oil, gas, water, and other fluids. As the pipeline network expands, the demand for pigging services rises to ensure the integrity, safety, and efficiency of these pipelines. With a growing emphasis on operational efficiency and safety in industrial operations, companies in India are increasingly recognizing the importance of proactive pipeline maintenance. Pigging services enable companies to optimize pipeline performance, minimize downtime, and prevent costly accidents or leaks.

SGS India Private Limited offers smart pigging solutions designed to mitigate risks, lower costs, and uphold the long-term integrity of pipelines. These solutions address the limitations of traditional pipeline pigging methods by combining the functionalities of intelligent pigging with the simplicity of cleaning pigs. Equipped with electromagnetic, contactless sensors embedded within a flexible polyurethane or foam body, the smart pig efficiently scans pipelines for internal corrosion, cracks, and other defects.

Competitive Landscape

The APAC pipeline-pigging market is dominated by major players with extensive experience and expertise in pipeline-pigging technologies and services. These companies typically offer a comprehensive range of pigging solutions, including intelligent pigging, cleaning pigs, inspection services, and pigging accessories. They often have established partnerships with pipeline operators and engineering firms, enabling them to secure large-scale contracts for pipeline maintenance and integrity management projects in the APAC region.

Some of the major players operating in the APAC market include:

- CETCO.

- CHINA VIHUNG VALVE CO., LTD

- Dexon Technology PLC

- EMT Piping

- NDT Global Services Ltd.

- Rosen Group.

- Semigorye" LLC

- SGS SA.

- Shenyang EMT Pigging Technology Co., Ltd

- Sriram Foams Private Limited

- T.D.Williamson

Recent Developments

- For instance, in 2022, China and India took the forefront in a global gas pipeline construction initiative valued at $534 billion. China is currently constructing approximately 17,800 km of gas pipelines at an estimated cost of $21.9 billion, while India is undertaking the construction of 14,300 km of pipelines at a cost of $20.7 billion. These pipeline projects contribute to the growing demand for pipeline maintenance and services, including pigging, to ensure the integrity, safety, and efficiency of the infrastructure. Pigging services play a vital role in commissioning new pipelines, conducting pre-operation inspections, and optimizing operational performance.

Report Coverage

The APAC pipeline pigging market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, services, application, end-use, and their futuristic growth opportunities.

APAC Pipeline Pigging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,037.47 Million |

|

Revenue Forecast in 2032 |

USD 3,161.46 Million |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Services, By Application, By End-Use, and By Country |

|

Country scope |

China, India, Japan, Malaysia, South Korea, Indonesia, Australia, Rest of APAC |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

key companies in APAC Pipeline Pigging Market are CETCO., CHINA VIHUNG VALVE CO., LTD, Dexon Technology PLC, EMT Piping, NDT Global Services Ltd

The APAC pipeline pigging market exhibiting a CAGR of 5.6% during the forecast period.

The APAC Pipeline Pigging Market report covering key segments are services, applications, end-use, and country.

key driving factors in APAC Pipeline Pigging Market are Increased demand for energy, including oil and gas

The APAC pipeline pigging market size is expected to reach USD 3,161.46 Million by 2032