API Management Market Share, Size, Trends, Industry Analysis Report

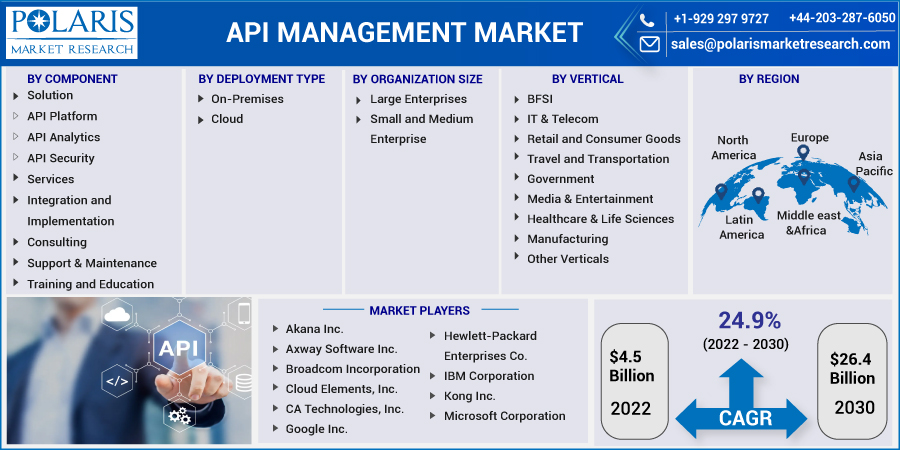

By Component (Solution and Services); By Deployment Type; By Organization Size; By Vertical; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM2849

- Base Year: 2021

- Historical Data: 2018-2020

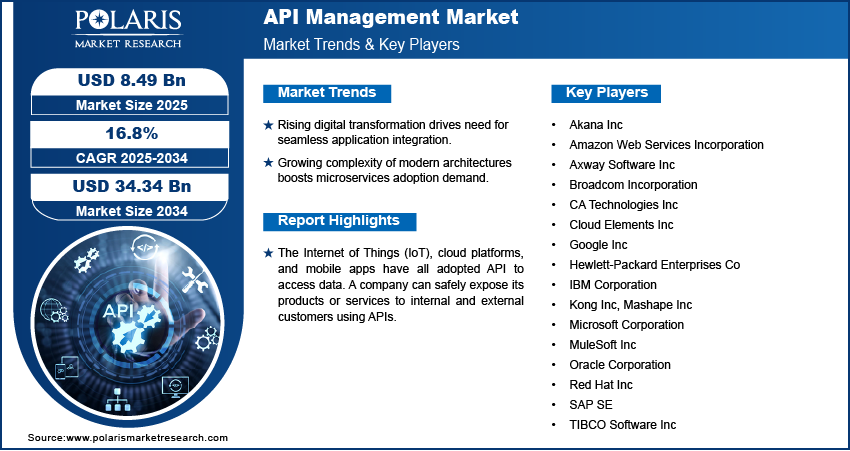

The global API management market was valued at USD 7.29 billion in 2024 and is expected to grow at a CAGR of 16.8% during the forecast period. APIs management market growth is anticipated to be significantly accelerated by factors like the rising demand for the latest APIs, which are necessary to connect crucial data with devices and apps, and the rising adoption of sophisticated analytics to continue exploring more knowledge.

Key Insights

- By component, the solution subsegment held the largest share in 2024 and is driven by the increasing need for comprehensive software platforms that offer full API lifecycle management.

- By deployment type, the cloud subsegment held the largest share in 2024 due to increasing demand for improving data security and shit towards the use of cloud storage.

- By organization size, the large enterprises subsegment held the largest share in 2024 due to the substantial IT budgets and complex digital transformation initiatives undertaken by large organizations.

- By vertical, the IT & Telecom subsegment held the largest share in 2024 due to the rapid pace of digitalization and innovation within the IT and telecommunications sector.

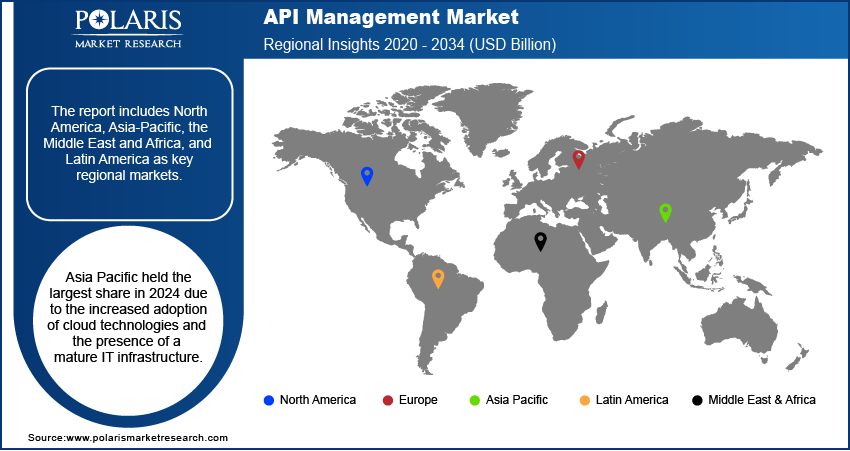

- By region, Asia Pacific held the largest share in 2024 due to the increased adoption of cloud technologies and the presence of a mature IT infrastructure.

Industry Dynamics

- The increasing demand for digital transformation across various industries is a main driver, requiring seamless integration and connectivity between diverse applications.

- The increasing complexity of modern application architecture, especially the adoption of the microservices approach, significantly boosts demand.

- Growing security and compliance concerns are a major growth factor, as these interfaces are crucial entry points to business data.

Market Statistics

- 2024 Market Size: USD 7.29 billion

- 2034 Projected Market Size: USD 34.34 billion

- CAGR (2025-2034): 16.8%

- North America: Largest market in 2024

AI Impact on Market

- AI greatly improves the security of products and services by enabling advanced threat detection. It does this by analyzing traffic and usage patterns in real-time to find unusual activity that might show a security risk.

- AI uses predictive analytics to look at historical data and anticipate future product usage and traffic spikes.

- AI analyzes large amounts of product data to provide deeper insights into how products are being used, how they are performing, and where there might be hidden inefficiencies.

To Understand More About this Research: Request a Free Sample Report

In addition, the application programming interfaces (APIs) management industry will continue to expand due to the rising need for API-led connectivity and the requirement for both public and private APIs to speed up digitalization. However, the market's capacity to grow is constrained by difficulties with cybersecurity related to APIs and server accessibility limitations.

The Internet of Things (IoT), cloud platforms, and mobile apps have all adopted API to access data. A company can safely expose its products or services to internal and external customers using APIs. The process of creating, disseminating, publishing, controlling, and analyzing APIs is called API management solutions.

An API management package typically includes a programmer portal, an API gateway, API management solutions, and analytics. For internal and external engineers, API management facilitates the creation, acquisition, supervision, scaling, and division of APIs. API management includes several cycles that enable organizations to maintain transparency and control over the APIs crucial for integrating data and applications throughout projects and the cloud.

The digital revolution and increased desire to understand customers fueled the industry’s growth. In a digital economy that is constantly changing, APIs are essential to enabling new offerings. Still, the demand for digital-first initiatives has elevated APIs to a higher priority than ever. Every corporation must quickly adapt to new business practices and adjust its operations.

Additionally, during the COVID-19 pandemic, customers are learning how to communicate with companies through a variety of applications on workstations, tablets, smartphones, and other devices. Since healthcare providers, medical research facilities, governmental organizations, businesses, and other organizations must exchange crucial coronavirus data with one another and convey vital messages to their staff, clients, and even the broader population, information sharing is more critical than ever.

The market for APl management has benefited from the pandemic. Organizations are aggressively implementing digital transformation due to the COVID-19 epidemic and revamping their corporate operations. API has been given major attention to the digital-first strategy to adapt to new business practices like remote content sharing and communication. Businesses were obliged to reassess the economy and supply lines in light of the COVID-19 outbreak.

To assist producers in overcoming supply chain disruptions, APIs may track and communicate data on units produced, faults, and all other pertinent information. As a result, API strategy can address current circumstances and meet future needs.

Industry Dynamics

Growth Drivers

Increasing demand for sustainable solutions based on the API connection and technological advancements is boosting the market growth over the forecast period. People are moving from rural to urban areas, creating demand for new buildings and, in turn, for new access solutions. The world is witnessing rapid urbanization, as the major cities are driving the economy’s growth.

According to Our World in Data (OWID), it is estimated that more than two-thirds of the world's population will live in urban areas by 2050. By 2050, the global population is estimated to increase to around 9.8 billion, and more than twice as many people in the world will be living in urban (6.7 billion) than in rural areas (3.4 billion).

Moreover, with the rising demand for new buildings, there also arises a demand for sustainable solutions, including energy efficiency and reducing greenhouse gas emissions from customers. As seen by API's increasing use in connecting with customers, employees, and partners, API-based connection services are rapidly growing as a methodology.

IoT, SaaS, big data, social media, portable devices, and APIs are just a few examples of more recent innovations that are expanding the market for new businesses, creating new opportunities for revenue streams, and requiring the development of effective and original client-understanding strategies.

Report Segmentation

The market is primarily segmented based on component, deployment type, organization size, vertical, and region.

|

By Component |

By Deployment Type |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

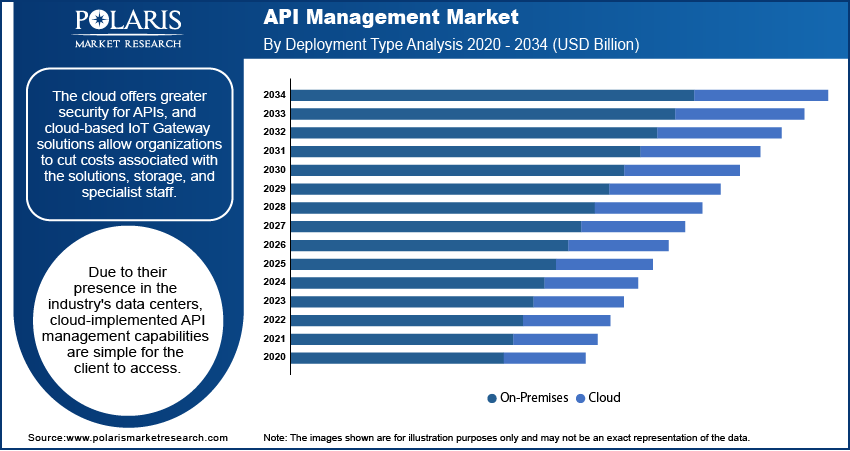

The cloud segment is expected to witness the fastest growth

The cloud offers greater security for APIs, and cloud-based IoT Gateway solutions allow organizations to cut costs associated with the solutions, storage, and specialist staff. Due to their presence in the industry's data centers, cloud-implemented API management capabilities are simple for the client to access. The market for the cloud segment is being affected by the development of necessary apps and services by cloud solution suppliers owing to the emergence of cloud technology.

Additionally, the demand for the on-premises deployment type is anticipated to be impacted by the rising costs associated with sustaining on-premises solutions, including the price of hardware, personal computers, and other necessary tools. This deployment option is preferred by organizations that deal with sensitive user data for operational purposes. Numerous merchants are switching from an On-Premises arrangements option to SaaS-based software as a result of these advantages.

Solution segment industry accounted for the highest market share in 2024

Over the forecast period, the solutions segment's market share is higher. Businesses must provide more data using APIs to enhance experiences for internal and external users as a result of the proliferation of apps and connected devices. The demand for API Management solutions is being driven by the necessity for enterprises to coordinate frameworks and components with apps and devices consistently. It is crucial to have a suitable framework in place so that APIS may be designed, controlled, and managed safely.

The BFSI segment is expected to hold the significant revenue share

The BFSI sector has begun standardizing open banking features and monetizing APIs. The industry is making this change to modernize business processes and improve the experiences of clients and bankers. The integration of many other businesses and user handling of financial information will change as a result of the continuous implementation of APl technology in banking. This will promote an economical banking method.

The API technology helps customers and outside businesses improve their capabilities and services to customers. Accepting and using APIs can expand and enhance the services and products offered. API's capabilities may significantly impact the future of the BFSI business.

The demand in North America is expected to witness significant growth

Due to current industry trends, North American regions are anticipated to hold the most significant market share. This is due to the region's abundance of platform service providers and recent technological advancements. Additionally, the industry is seeing an upsurge in innovations like big data analytics and the Internet of Things (IoT).

Furthermore, the Asia-Pacific region is growing with the fastest CAGR over the forecast period. The use of API management platforms is likely to be fueled by the rising uptake of digital initiatives like cloud, big data, and analytics throughout the forecast period. For instance, the most recent Intelligent Automation Network Report 2022 indicates that 42% of transformative digital leadership have participated in robotic process automation, compared to 30% who have engaged in intelligent automation solutions.

While 47% of the company increases its spending on such solutions, organizations in the area are engaging in iPaas solutions to provide innovation, and business continuity as more businesses use cloud technology. Additionally, with the rise of digital economies in the Asia Pacific, open banking operations are the next major upheaval. Nations like Singapore are aggressively adopting API technology to foster collaboration and expand the ecosystem.

Competitive Insight

Some of the major players operating in the global market include Akana Inc., Axway Software Inc., Amazon Web Services Incorporation, Broadcom Incorporation, Cloud Elements, Inc., CA Technologies, Inc., Google Inc., Hewlett-Packard Enterprises Co., IBM Corporation, Kong Inc., Microsoft Corporation, Mashape Inc., MuleSoft, Inc., Oracle Corporation, Red Hat Inc., SAP SE, and TIBCO Software Inc.

Recent Developments

In August 2024: EQT completed its acquisition of WSO2. EQT will guide WSO2 with the strategic direction needed for rapid growth and the development of new solutions

In March 2022: Google launched two new products to assist fleet operators in enhancing delivery efficiency and maximizing fleet effectiveness: the Last Mile Fleet Solutions from the Google Streetview Platform and the Cloud Fleet Navigation API through Google Cloud.

In July 2022: Microsoft introduced its API management service with Azure Private Link Support. With the addition of Private Link capability, users can now set up a private destination for their API management server so that clients in their local network can safely access the instance using Azure Private Link.

API Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.29 billion |

| Market size value in 2025 | USD 8.49 billion |

|

Revenue forecast in 2034 |

USD 34.34 billion |

|

CAGR |

16.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Component, By Deployment Type, By Vertical, By Organization Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Akana Inc., Axway Software Inc., Amazon Web Services Incorporation, Broadcom Incorporation, Cloud Elements, Inc., CA Technologies, Inc., Google Inc., Hewlett-Packard Enterprises Co., IBM Corporation, Kong Inc., Microsoft Corporation, Mashape Inc., MuleSoft, Inc., Oracle Corporation, Red Hat Inc., SAP SE, and TIBCO Software Inc. |

FAQ's

? The global market size was valued at USD 7.29 billion in 2024 and is projected to grow to USD 34.34 billion by 2034.

? The global market is projected to register a CAGR of 16.8% during the forecast period.

? North America dominated the market share in 2024.

? The solution segment accounted for the largest share of the market in 2024.