South Korea Sterilization Monitoring Market Size, Share, Trends, Industry Analysis Report

By Technology (Biological Indicators, Chemical Indicators), By Product, By Method, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6247

- Base Year: 2024

- Historical Data: 2020-2023

Overview

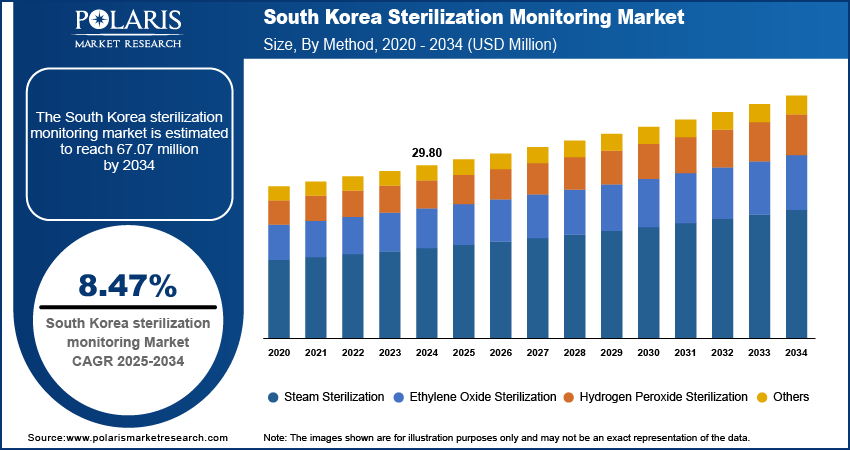

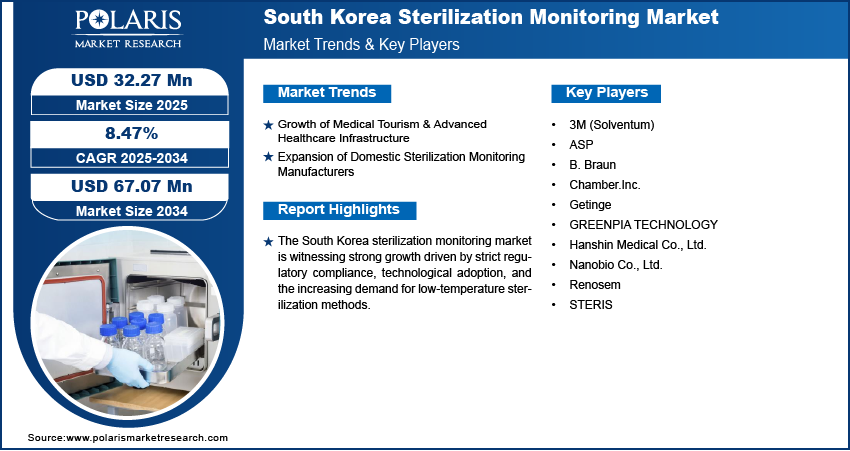

The South Korea sterilization monitoring market size was valued at USD 29.80 million in 2024, growing at a CAGR of 8.47% from 2025 to 2034. Key factors driving demand for sterilization monitoring across South Korea include the country’s strict regulatory environment, expansion of domestic sterilization monitoring manufacturers, growth of medical tourism, and the presence of advanced healthcare infrastructure.

Key Insights

- The sterilization strips segment led revenue share in 2024, due to their universal compatibility and high adoption in hospitals, labs, and pharma facilities.

- The hydrogen peroxide sterilization segment is projected as the fastest-growing segment during the forecast period, fueled by the rising demand for low-temperature sterilization of delicate medical devices.

Industry Dynamics

- South Korea's advanced healthcare system and booming medical tourism drive demand for international-grade sterilization standards.

- Local players innovate cost-effective monitoring solutions, reducing import reliance while meeting strict MFDS compliance needs.

- High compliance costs for advanced monitoring systems strain budgets of small clinics, limiting adoption despite stricter MFDS regulations.

- Medical tourism growth drives demand for internationally certified sterilization solutions, benefiting local innovators.

Market Statistics

- 2024 Market Size: USD 29.80 million

- 2034 Projected Market Size: USD 67.07 million

- CAGR (2025–2034): 8.47%

AI Impact on South Korea Sterilization Monitoring Market

- AI-integrated sterilizers monitoring systems monitor temperature, pressure, exposure time, and other parameters in real time.

- AI technology is used to analyze usage patterns and sensor data to predict equipment failures, which can minimize downtime and enable continuous operation in high-demand hospital settings.

- AI platforms help generate sterilization logs and compliance reports aligned with the Korean Ministry of Health standards.

- AI algorithms improve throughput and reduce cycle times, mostly in surgical and dental environments.

Sterilization monitoring refers to the process of validating and verifying the effectiveness of sterilization procedures to ensure medical and laboratory equipment is free from viable microorganisms. The South Korea sterilization monitoring market is strongly driven by the country’s strict regulatory environment, particularly the strict guidelines enforced by the Ministry of Food and Drug Safety (MFDS). These regulations mandate wide sterilization validation protocols across healthcare, pharmaceutical, and biotechnology sectors, thereby necessitating consistent monitoring solutions to meet compliance standards. This regulatory pressure has created an environment where healthcare providers and manufacturers must adopt reliable biological and chemical indicators to demonstrate sterilization efficacy.

The rising focus on patient safety and infection control has accelerated the adoption of robust sterilization monitoring practices. The demand for automated sterilization monitoring systems and advanced data logging solutions is also increasing as South Korea continues to strengthen its healthcare infrastructure. Strict MFDS management combined with technological advancements is creating a regulated, innovation-driven market. These advancements encourage suppliers to tailor offerings for compliance and operational efficiency in critical care environments.

Drivers & Opportunities

Growth of Medical Tourism & Advanced Healthcare Infrastructure: Healthcare providers are under increasing pressure to maintain globally accepted sterilization standards, with the country emerging as a preferred destination for international patients seeking high-quality medical procedures. For instance, in April 2025, the Ministry of Health revealed that foreign medical tourists reached 1.17 million in 2024, marking a nearly 93.2% increase from 610,000 in 2023, highlighting Korea's rising global importance for medical and aesthetic excellence. Advanced hospital facilities and specialty clinics rely heavily on precise sterilization monitoring solutions to ensure infection-free environments and uphold patient safety. This trend supports the adoption of technologically refined sterilization indicators and integrated monitoring systems to maintain compliance with both domestic and international healthcare protocols. Hence, the growth of medical tourism and the presence of advanced healthcare infrastructure in South Korea are driving the expansion opportunities.

Expansion of Domestic Sterilization Monitoring Manufacturers: The expansion of domestic sterilization monitoring manufacturers has created a more competitive and responsive supply ecosystem within South Korea. Local manufacturers are increasingly investing in product innovation and regulatory compliance to serve rising demand from hospitals, laboratories, and the pharmaceutical sector. In April 2024, the Korean bio-plasma firm secured a contract with Osstem Implant to supply MFDS-approved STERLINK sterilizers for dental applications. This follows prior USD 1.8 million U.S./Japan distributor agreements. Their proximity and understanding of regional compliance requirements allow them to offer cost-effective and customized solutions. This local production capacity reduces dependence on imports and accelerates the availability of advanced sterilization services and monitoring technologies across the country.

Segmental Insights

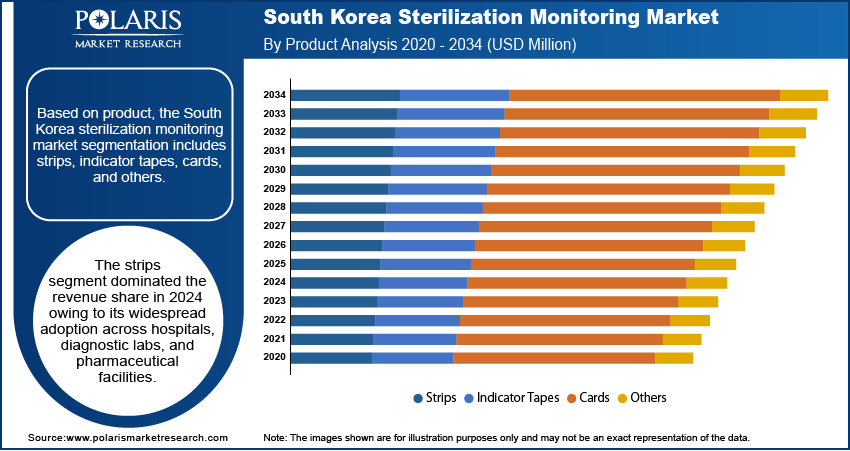

Product Analysis

In terms of product, the segmentation includes strips, indicator tapes, cards, and others. The strips segment dominated the revenue share in 2024 owing to its widespread adoption across hospitals, diagnostic labs, and pharmaceutical facilities. These strips are cost-effective, easy to use, and provide quick visual confirmation of sterilization cycle completion, making them a preferred choice in high-throughput healthcare environments. Their compatibility with various sterilization methods, especially steam and hydrogen peroxide, further enhances their utility. The consistent regulatory preference for physical monitoring indicators and the focus on routine validation procedures contribute to the segment’s strong market presence.

Method Analysis

The segmentation, based on method, includes steam sterilization, ethylene oxide sterilization, hydrogen peroxide sterilization, and others. The hydrogen peroxide sterilization segment is expected to witness the fastest growth during the forecast period, driven by its increasing application in low-temperature sterilization of heat-sensitive instruments. South Korea’s technologically advanced healthcare sector is progressively adopting hydrogen peroxide-based sterilization due to its efficacy, shorter cycle time, and reduced environmental impact. This method is especially valuable in high-end medical and surgical facilities where delicate devices require effective yet non-damaging sterilization. The rise in demand for low-temperature sterilization options, alongside a growing awareness of equipment longevity and patient safety, supports the accelerated adoption of this method.

Key Players & Competitive Analysis

The South Korea sterilization monitoring market is shaped by technological advancements and stringent MFDS regulations, creating revenue opportunities for both large players and small and medium-sized businesses. Domestic firms such as ASP and Greenpia Technology leverage sustainable value chains to offer cost-effective biological/chemical indicators, while multinationals such as 3M and STERIS dominate with advanced automated systems. Industry trends reveal rising demand for low-temperature sterilization validation, driven by latent demand from hospitals and dental clinics. Competitive intelligence highlights strategic investments in radio-frequency identification(RFID)-enabled tracking and rapid-read indicators to address supply chain disruptions.

A few major companies operating in the South Korea sterilization monitoring market include 3M (Solventum); ASP; B. Braun; Chamber.Inc.; Getinge; GREENPIA TECHNOLOGY; Hanshin Medical Co., Ltd.; Nanobio Co., Ltd.; Plasmapp Co., Ltd.; Renosem; and STERIS.

Key Players

- 3M (Solventum)

- ASP

- B. Braun

- Chamber.Inc.

- Getinge

- GREENPIA TECHNOLOGY

- Hanshin Medical Co., Ltd.

- Nanobio Co., Ltd.

- Plasmapp Co., Ltd.

- Renosem

- STERIS

South Korea Sterilization Monitoring Industry Developments

- June 2025: Solventum launched the Attest Super Rapid VH₂O₂ Clear Challenge Pack, combining FDA-cleared biological and chemical indicators in a single-use transparent pack. The product supports sterilization monitoring, aligning with guidelines to reduce hospital-acquired infections through validated load-by-load verification.

- October 2023: ASP expanded its sterilization monitoring portfolio with new steam-focused products, including BIOTRACE readers/indicators, VERISURE chemical indicators, and SEALSURE tape. The solutions aim to enhance workflow efficiency and sterility assurance in healthcare sterile processing departments.

South Korea Sterilization Monitoring Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Biological Indicators

- Chemical Indicators

By Product Outlook (Revenue, USD Million, 2020–2034)

- Strips

- Indicator Tapes

- Cards

- Others

By Method Outlook (Revenue, USD Million, 2020–2034)

- Steam Sterilization

- Ethylene Oxide Sterilization

- Hydrogen Peroxide Sterilization

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Clinics

- Biopharma/Biotech Companies

- Ambulatory Surgery Centers

- Research and Academic Institutes

- Other End Use

South Korea Sterilization Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 29.80 Million |

|

Market Size in 2025 |

USD 32.27 Million |

|

Revenue Forecast by 2034 |

USD 67.07 Million |

|

CAGR |

8.47% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 29.80 million in 2024 and is projected to grow to USD 67.07 million by 2034.

The market is projected to register a CAGR of 8.47% during the forecast period.

A few of the key players in the market are 3M (Solventum); ASP; B. Braun; Chamber.Inc.; Getinge; GREENPIA TECHNOLOGY; Hanshin Medical Co., Ltd.; Nanobio Co., Ltd.; Plasmapp Co., Ltd.; Renosem; and STERIS.

The strips segment dominated the revenue share in 2024.

The hydrogen peroxide sterilization segment is expected to witness the fastest growth during the forecast period.