Japan Sterilization Monitoring Market Size, Share, Trends, Industry Analysis Report

By Technology (Biological Indicators, Chemical Indicators), By Product, By Method, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6248

- Base Year: 2024

- Historical Data: 2020-2023

Overview

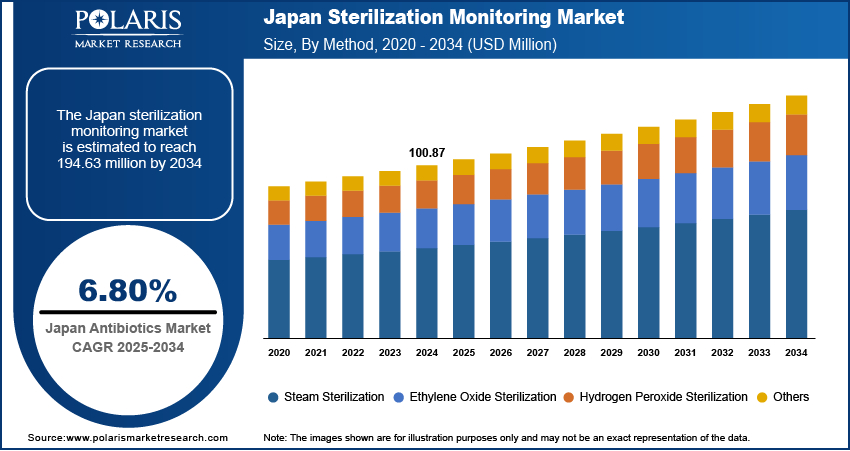

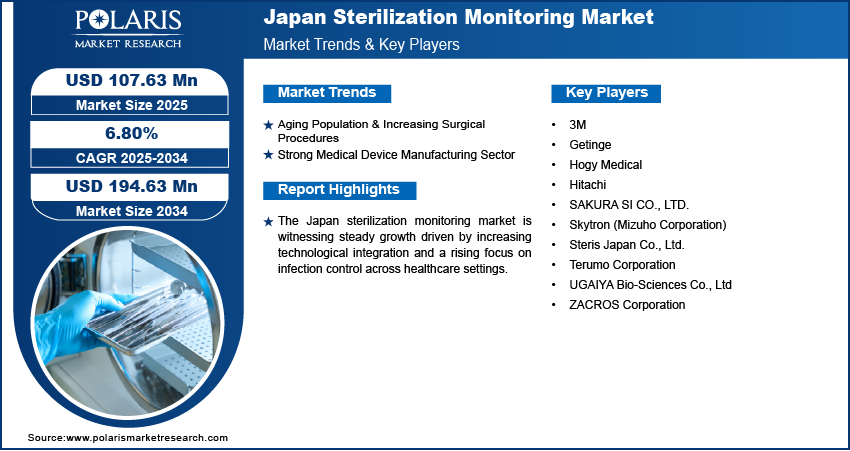

The Japan sterilization monitoring market size was valued at USD 100.87 million in 2024, growing at a CAGR of 6.80% from 2025 to 2034. Key factors driving demand for sterilization monitoring across Japan include the rising incidence of chronic diseases, the expanding aging population across the region, increasing government healthcare spending, and advancements in biosurgical products.

Key Insights

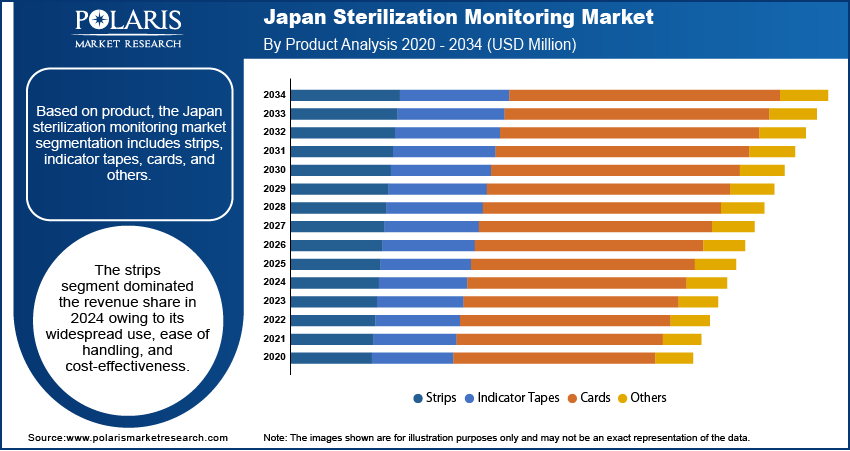

- In 2024, the strips segment led in revenue share due to their broad adoption, user-friendly design, and affordability.

- The chemical indicators segment is projected to grow notably during the forecast period, driven by fast results, simple readability, and compatibility with advanced sterilization systems.

Industry Dynamics

- Japan's aging population and increasing surgical volumes drive sterilizer demand. More elderly patients require surgeries for chronic conditions, increasing the need for rigorous hospital sterilization protocols.

- The country's advanced medical device industry fuels sterilization monitoring growth, with strict quality controls supporting advanced surgical and diagnostic equipment production.

- Japan's aging healthcare workforce struggles to keep up with rising sterilization demands, risking slower adoption of advanced monitoring technologies due to training gaps and resistance to change.

- Growing demand for automated, AI-driven sterilization solutions presents a major market opportunity, especially with Japan's tech-savvy hospitals aiming for efficient, error-proof systems to comply with strict safety standards.

Market Statistics

- 2024 Market Size: USD 100.87 million

- 2034 Projected Market Size: USD 194.63 million

- CAGR (2025–2034): 6.80%

AI Impact on Japan Sterilization Monitoring Market

- Smart hospital initiatives in Japan include AI-enabled sterilization systems that connect with centralized monitoring platforms. It enables automated reporting and remote diagnostics.

- ·AI tools help analyze equipment usage and sensor data to predict failures, which ensures uninterrupted sterilization in hospitals and clinics and reduces downtime.

- In Japan, complex approval processes for AI integration in the medical industry require robust validation, which can hinder the AI adoption in sterilization monitoring.

Sterilization monitoring refers to the process of evaluating and verifying the effectiveness of sterilization procedures used in healthcare settings to ensure the complete elimination of microbial life.

The Japan sterilization monitoring market is witnessing steady growth, largely driven by the rising adoption of technology across hospitals and healthcare institutions. The demand for accurate and real-time monitoring solutions has surged as hospitals increasingly integrate advanced sterilization equipment and automated tracking systems. This shift toward technologically advanced sterilization practices are aimed at improving patient safety, minimizing healthcare-associated infections, and maintaining compliance with strict regulatory standards. The integration of digital sterilization indicators, wireless data logging systems, and centralized monitoring platforms enhances operational efficiency and ensures consistent quality control. In August 2024, PENTAX Medical received FDA clearance for its DEC Duodenoscope (ED34-i10T2s), now compatible with ASP’s STERRAD 100NX Sterilizer. This enables hydrogen peroxide gas plasma sterilization, enhancing safety in duodenoscope reprocessing and reducing cross-contamination risks. Furthermore, the adoption of smart sterilization monitoring tools aligns with Japan’s broader healthcare modernization initiatives, reflecting a growing focus on precision, traceability, and accountability in infection control protocols within clinical environments.

Drivers & Opportunities

Aging Population & Increasing Surgical Procedures: The aging population in Japan, coupled with a steady rise in surgical procedures is boosting the demand for sterilizers. The prevalence of age-related chronic conditions requiring surgical interventions also increases as the elderly demographic expands, thereby elevating the need for strict sterilization protocols in hospitals and surgical centers. According to a September 2023 World Economic Forum report, over 10% of Japan's population is aged 80 and above, while nearly a third, 36.23 million, are over 65, highlighting the country's rapidly aging demographic. This boosts the demand for reliable monitoring systems to ensure infection-free environments, particularly in high-risk procedures involving immunocompromised patients. The increasing focus on patient safety and post-operative care further highlights the importance of accurate sterilization validation.

Strong Medical Device Manufacturing Sector: Japan's strong medical device manufacturing sector supports the growth of the sterilization monitoring market. A 2024 Ministry of Economy, Trade and Industry (METI) report projected Japan's medical device market to grow, reaching around USD 38 billion by 2027, driving the demand for reliable sterilization services across healthcare facilities. There is a parallel need for high-standard sterilization and quality control measures with a robust infrastructure for producing advanced surgical and diagnostic equipment. The presence of technologically advanced manufacturing facilities ensures a continuous demand for sterilization monitoring tools that align with industry requirements, contributing to hygiene and safety benchmarks.

Segmental Insights

Product Analysis

In terms of product, the segmentation includes strips, indicator tapes, cards, and others. The strips segment dominated the revenue share in 2024 owing to its widespread use, ease of handling, and cost-effectiveness. Strips are commonly utilized across various sterilization methods, offering quick and reliable results, making them ideal for routine monitoring in hospitals and clinical laboratories. Their compatibility with both steam and chemical sterilization processes improves their appeal in diverse healthcare environments. Additionally, the availability of a wide range of strip designs tailored to specific sterilization cycles strengthens their adoption in Japan’s highly regulated healthcare environment.

Technology Analysis

Based on technology, the segmentation includes biological indicators and chemical indicators. The chemical indicators segment is expected to witness significant growth during the forecast period due to their rapid response time, ease of interpretation, and integration with modern sterilization cycles. These indicators are particularly favored for providing immediate visual confirmation of exposure to sterilization parameters such as temperature and pressure. The demand for chemical indicators is rising across centralized sterilization departments and point-of-use applications as healthcare providers in Japan increasingly prioritize operational efficiency and real-time monitoring. Their versatility and low-cost implementation contribute to their growing preference among healthcare facilities aiming to maintain high sterilization standards.

Key Players & Competitive Analysis

The Japan sterilization monitoring market is highly competitive, with players such as 3M, Getinge, Steris Japan, and Terumo Corporation driving innovation through emerging technologies such as advanced biological indicators and real-time monitoring systems. Competitive intelligence reveals that small and medium-sized businesses are gaining traction by offering cost-effective solutions. Revenue growth is fueled by increasing demand in healthcare and pharmaceutical sectors, with strategic investments in automation and AI-based sterilization validation. Vendor strategies focus on expansion opportunities through partnerships and localized product offerings. Disruptions and trends, such as the shift toward eco-friendly sterilization methods, present future development strategies for companies. Growth projections indicate steady revenue opportunity, supported by emerging market segments in biotech and medical device manufacturing. Expert insights suggest that technological advancements and supply chain optimizations will shape the competitive positioning of industry leaders, ensuring sustainable value chains in the Japan sterilization monitoring market.

A few major companies operating in the Japan sterilization monitoring market include 3M; Getinge; Hogy Medical; Hitachi; SAKURA SI CO., LTD.; Skytron (Mizuho Corporation); Steris Japan Co., Ltd.; Terumo Corporation; UGAIYA Bio-Sciences Co., Ltd; and ZACROS Corporation.

Key Players

- 3M

- Getinge

- Hogy Medical

- Hitachi

- SAKURA SI CO., LTD.

- Skytron (Mizuho Corporation)

- Steris Japan Co., Ltd.

- Terumo Corporation

- UGAIYA Bio-Sciences Co., Ltd

- ZACROS Corporation

Japan Sterilization Monitoring Industry Developments

- July 2024: Medical Bear, a Japanese sterilization service provider, partnered with Getinge to digitize sterile supply flows. This collaboration sets a new standard for innovation in Japan's healthcare sector.

Japan Sterilization Monitoring Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Biological Indicators

- Chemical Indicators

By Product Outlook (Revenue, USD Million, 2020–2034)

- Strips

- Indicator Tapes

- Cards

- Others

By Method Outlook (Revenue, USD Million, 2020–2034)

- Steam Sterilization

- Ethylene Oxide Sterilization

- Hydrogen Peroxide Sterilization

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Clinics

- Biopharma/Biotech Companies

- Ambulatory Surgery Centers

- Research and Academic Institutes

- Other End Use

Japan Sterilization Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 100.87 Million |

|

Market Size in 2025 |

USD 107.63 Million |

|

Revenue Forecast by 2034 |

USD 194.63 Million |

|

CAGR |

6.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 100.87 million in 2024 and is projected to grow to USD 194.63 million by 2034.

The market is projected to register a CAGR of 6.80% during the forecast period.

A few of the key players in the market are 3M; Getinge; Hogy Medical; Hitachi; SAKURA SI CO., LTD.; Skytron (Mizuho Corporation); Steris Japan Co., Ltd.; Terumo Corporation; UGAIYA Bio-Sciences Co., Ltd; and ZACROS Corporation.

The strips segment dominated the revenue share in 2024.

The chemical indicators segment is expected to witness significant growth during the forecast period.