Aquafeed Additives Market Share, Size, Trends, Industry Analysis Report

By Product; By Application (Carp, Rainbow Trout, Salmon, Crustaceans, Tilapia, Catfish, Sea Bass, Groupers, Others); By Source; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 118

- Format: PDF

- Report ID: PM1323

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

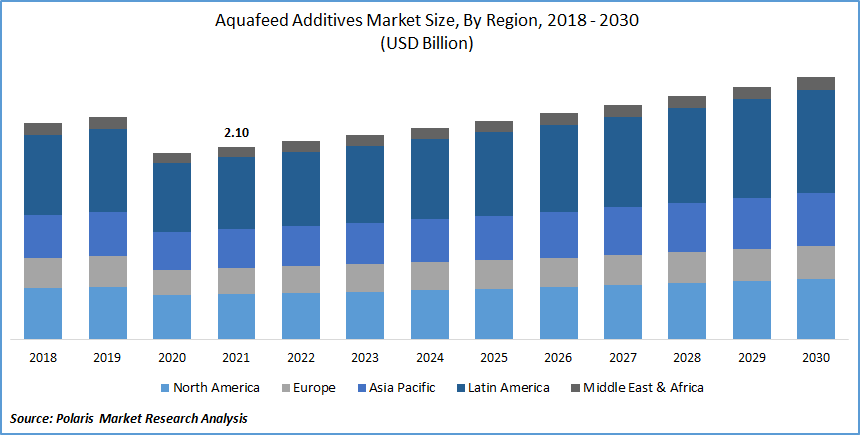

The global aquafeed additives market was valued at USD 2.10 billion in 2021 and is expected to grow at a CAGR of 3.5% during the forecast period. The major factors, such as benefits associated with the aquafeed additives due to their high demand in reducing the diseases in aquatic animals, are boosting the aquafeed additives market growth during the forecast period.

Know more about this report: request for sample pages

Aquafeed additives are nutritious or non-nutritive components added in minute amounts (alone or in combination) for a specific reason, such as enhancing the effectiveness of a fish as a finished product, preserving the physiochemical quality of the nutrition, and assisting fish growth with synthetic chemicals such as antibiotics and hormones. These are also used to improve feed absorption and promote consumer acceptability of products since they contain essential nutrients in refined form. These are utilized to prevent the diseases occurring in aquatic animals due to the growth in environmental degradation.

Increased consumption and demand for seafood are the primary driving factors for market expansion throughout the anticipated period. The U.S. market meets the majority of seafood demand. The National Marine Fisheries Service has adopted tight regulatory frameworks for fishing sector production, consumption, and marketing, resulting in a more structured and contemporary aquafeed market. The use of antibiotics as growth promoters in aquatic animal feed additives was recently prohibited in the U.S.

Industry Dynamics

Growth Drivers

The rapid expansion and introduction of aquaculture in the worldwide industry, combined with improved nutritional awareness among consumers, has boosted global sales of complex feed and feed supplements. Increased product consumption for carp, salmon, tilapia, and catfish is expected to support market growth due to the rising driven mainly by their high protein content.

Fish consumption in countries in Asia, especially in eastern and southeastern Asia, has already been influenced by a range of large, growing, and ramping up the urban population, and increased fish trade has expanded the global aquafeed additives market. For example, as per the Food and Agriculture Organization of the United Nations, Fish provided over 20% of per capita animal protein consumption for around 3.3 billion individuals. In 2017, fish contributed approximately 17% of total animal protein and 7% of all nutrients consumed globally.

Between 1961 and 2017, the average yearly growth rate of total food fish consumption was 3.1 percent, exceeding the annual population growth rate (1.6 percent). The rough estimate for per capita meat consumption in 2018 is 20.5 kg. In 2018, 67 million tonnes of fish were traded globally for total merchandise exports of USD164 billion, making fish and fish products among the most traded food commodities in the world. This translates to about 38% of all fish captured or farmed globally.

Further, in 2020, the outbreak of coronavirus illness (COVID-19) has already had a severe impact on commerce among important exporters and importers. Total fish output is predicted to rise from 179 million tonnes in 2018 to 204 million tonnes by 2030. Aquaculture production is expected to reach 109 million tonnes in 2030, a 32 percent (26 million tonnes) growth from 2018.

Asia will completely dominate the aquaculture sector, accounting for more than 89% of production by 2030. The industry is predicted to grow the highest in Africa, up 48 percent, owing to enhanced culturing equipment implemented in recent years. Thus, the rise in fish consumption has led to increased demand for aquafeed additives, which boosts the market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on products, application, source, and Geographic Region.

|

By Product |

By Application |

By Source |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by source

Based on the source segment, the plant-based additives segment is expected to be the most significant revenue contributor in the global market. Plant-based additives originating from corn, soybean, cottonseed, peas, sunflower seed, and other natural sources are highly sought after. These additives' alternative causes are substantial in protein and nutrient content, making them more in request in the aquafeed additives business. As a result, they are a progressively better alternative to animal-based supplements used in aquafeed manufacturing since they are easily digestible and contain more protein.

Geographic Overview

In terms of geography, Asia Pacific had the largest revenue share. The region's prominence is attributed to the region's development of production and consequently of salmon farming due to simple farming practices and the capacity to grow inside land-based farm systems, which is predicted to support the growth of the aquafeed additives market.

Furthermore, the Asia Pacific aquafeed additives industry is driven by abundant resources and low labor wages. India is one of the countries included in this range. On the other hand, people prefer fish and other seafood to meet their protein needs in the diet. This increased awareness has increased the demand for aquafeed products in India.

Moreover, North America is anticipated to witness a high CAGR in the global aquafeed additives market. The dominance is expected to rise significantly due to increased seafood consumption in nations like the U.S. and Canada. The rising demand for aquaculture-produced seafood can be related to a loss in wild fisheries productivity and increased daily intake of seafood throughout the region.

Competitive Insight

Some of the major players operating in the global aquafeed additives market include Nutriad Inc., Kemin Industries Inc., Dupont De Nemours Inc. ALLER AQUA A/S, Coppens International B.V., ALLTECH, INC., Biomin GmbH, Charoen Pokphand Foods Public Company Limited, Avanti Feeds Limited, Diana Group, Norel S.A., Olmix Group, Delacon Biotechnik Gmbh, Lallemand Inc., and Camlin Fine Sciences Inc, among others.

Aquafeed Additives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.10 billion |

|

Revenue forecast in 2030 |

USD 2.86 billion |

|

CAGR |

3.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Source, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Nutriad Inc., Kemin Industries Inc., Dupont De Nemours Inc. ALLER AQUA A/S, Coppens International B.V., ALLTECH, INC., Biomin GmbH, Charoen Pokphand Foods Public Company Limited, Avanti Feeds Limited, Diana Group, Norel S.A., Olmix Group, Delacon Biotechnik Gmbh, Lallemand Inc., and Camlin Fine Sciences Inc, among others. |