Arbovirus Testing Market Share, Size, Industry Analysis Report

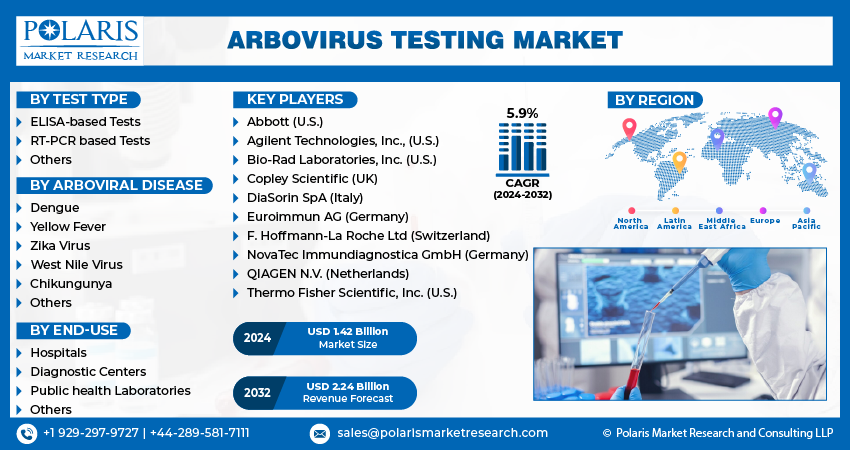

By Test Type (ELISA-based Tests, RT-PCR based Tests, and Others); By Arboviral Disease; By End-use; By Region; Segment Forecast, 2025- 2034

- Published Date:Jun-2025

- Pages: 115

- Format: PDF

- Report ID: PM4566

- Base Year: 2024

- Historical Data: 2020-2023

The Arbovirus Testing Market reached 1.25 billion in 2024, growing at a CAGR of 4.7% during 2025–2034. Climate change and globalization are increasing vector-borne disease risks, fueling demand for arbovirus diagnostics.

Market Overview

Key factors responsible for the market growth include rise in arthropod-borne viral diseases, coupled with awareness among individuals regarding regular check-up. Moreover, climate change, urbanization, and increased movement of people and goods also responsible for the spread of arboviral diseases. Furthermore, the recent advancements in the field of clinical diagnostics coupled with the increasing number of government initiatives with the objective of managing the burden of arboviral diseases are expected to propel the market growth during the forecast timeframe.

- For instance, in March 2022, the World Health Organization announced the launch of the Global Arbovirus Initiative. This initiative is intended to tackle emerging arboviruses with epidemic & pandemic potential.

To Understand More About this Research: Request a Free Sample Report

An increase in the investments towards research & development of new diagnostic products and growing awareness programs by various organizations will significantly propel the demand for arbovirus testing. Benefits of early testing of the patients suffering from various arboviral diseases coupled with increasing incidences of dengue, yellow fever, and chikungunya are anticipated to contribute to the arbovirus testing market expansion.

The development of newer molecular methods to perform various assays at a constant temperature by negating the need of expensive thermal cycling equipment is expected to prove beneficial for the market growth. For instance, in most cases, the time required for isothermal amplification has now reduced to 5 to 20 minutes.

Growth Factors

Increasing occurrence and resurgence of arthropod-borne viral infections will boost the arbovirus testing market growth

Arboviruses, also known as arthropod-borne viruses, are spread to humans and other vertebrates primarily through the species such as flies, mosquitoes, and ticks. The people living in the tropical and subtropical areas of the world are at a greater risk of developing arboviral diseases owing to the warm temperatures and humidity. Factors such as increasing incidence of arthropod-borne infections coupled with the high mortality associated these diseases will significantly contribute to the market growth.

- For instance, according to the statistics published by the European Centre for Disease Prevention and Control, in 2023, around 6 million dengue cases were reported in 92 countries/territories across the world.

Government initiatives for awareness and fundings for research of arboviral testing drives the market growth

The potential of arboviral infections to cause outbreaks, severe illness, and public health emergencies has led many governments to consider them as critical health concerns. As a result, the governments are prioritizing these medical conditions and focusing on providing funds, allocating resources, and establishing programs that concentrate on control and prevention.

- For instance, till 2023, 805 Sentinel Surveillance Hospitals with laboratory support have been built by the Government of India to improve dengue diagnostic capabilities in endemic states.

Moreover, governments across many countries are focused towards the partnerships with academic institutions and public health organizations to finance research and development activities for arbovirus infection. Such initiatives aimed at enhancing the current treatment options and diagnostic capabilities will prove beneficial for the growth of arbovirus testing market.

Restraining Factors

Restricted access to diagnostic testing methods and lack of awareness will hamper the overall arbovirus testing market

A large group of people in the developing countries are not aware about the availability of facilities required for the testing of arthropod-borne viruses. Moreover, restricted access to the advanced diagnostic techniques will result in the lower demand for arbovirus tests. Furthermore, the inadequate healthcare infrastructure in several under-developed countries is expected to limit the market growth in the coming years.

Report Segmentation

The market is primarily segmented based on test type, arboviral disease, end-use, and region.

|

By Test Type |

By Arboviral Disease |

By End-use |

By Region |

|

|

|

|

By Test Type Insights

The ELISA-based tests segment generated the largest revenue in 2024

Based on test type, the ELISA-based tests held the largest share of arbovirus testing market. Technological advancements in ELISA testing for detection of arbovirus disorders and an increased focus on research and development of new ELISA tests are the factors responsible for such high share. Moreover, the ability to assess the efficacy of vector control measures and identification of high-risk areas are some of the factors that will boost the segment’s growth.

By Arboviral Disease Insights

The dengue segment accounted for the significant share of the market

The dengue segment held the considerable market share in 2023. Presence of large patient pool suffering from dengue worldwide and growing mortalities with dengue are the primary factors favoring growth. In response to the growing burden of this disease, the companies are concentrating on the development and launch of testing products, which eventually fuels segmental expansion.

- For instance, according to the statistics published by the European Centre for Disease Prevention and Control, in 2023, around 6,000 dengue related deaths were reported in 92 countries/territories across the world.

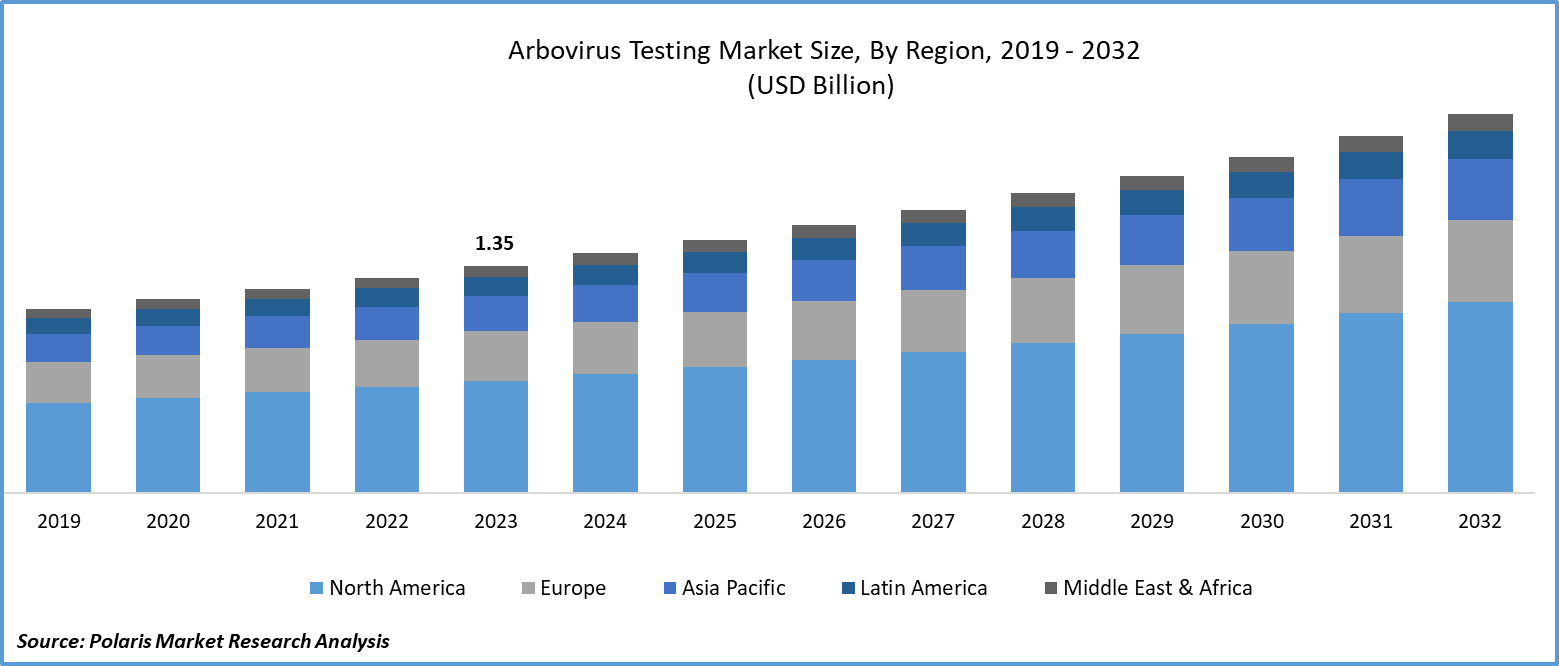

Regional Insights

North America region generated the largest revenue share in 2024

North America arbovirus testing market was the largest in 2023. Factors such as rising burden of Neglected Tropical Diseases (NTDs) and growing incidence of West Nile Virus & other forms of arboviral diseases contribute to the region’s share. Moreover, factors such as the changing distribution of the vectors mainly Aedes aegypti & Aedes albopictus coupled with the climate change leading to high temperature and humidity will fuel the market growth in the upcoming years.

- For instance, according to the statistics published by the Centers for Disease Control & Prevention (CDC), in 2023, the number of cases of West Nile virus disease in the U.S. was 2,406.

Asia Pacific is anticipated to register the highest CAGR during the projected period. The growing patient population pool suffering from various arboviral diseases such as dengue, yellow fever, and chikungunya will contribute to the region’s growth. Moreover, rising focus of government initiatives to promote benefits of early detection coupled with the increased focus of companies to focus on untapped markets in this region will fuel the arbovirus testing market growth.

- For instance, according to the data by the National Center for Vector Borne Diseases Control, in 2023, the number of suspected chikungunya cases in India was 93,455.

Key Market Players & Competitive Insights

Development of new tests by the companies is expected to strengthen their market position

The arbovirus testing market is moderately competitive. The other small and medium-sized companies are expected to improve their market shares owing to the increasing investments in research & developments for rapid tests, high efficacy with fewer side effects, and new product launches. For instance, in November 2021, Achiko AG announced the initiation of development of a DNA aptamer-based dengue fever diagnostic test.

Some of the major players operating in the global market include:

- Abbott (U.S.)

- Agilent Technologies, Inc., (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Copley Scientific (UK)

- DiaSorin SpA (Italy)

- Euroimmun AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- NovaTec Immundiagnostica GmbH (Germany)

- QIAGEN N.V. (Netherlands)

- Thermo Fisher Scientific, Inc. (U.S.)

Recent Developments in the Industry

- In April 2024, Grifols announced received the CE mark for its new Procleix ArboPlex Assay under the In Vitro Diagnostic Regulation (IVDR). This assay is an automated nucleic acid test (NAT) for the detection of arboviruses such as dengue, chikungunya, Zika viruses, and West Nile

- In May 2022, Anitoa Systems announced the introduction of a portable RT-PCR molecular test. This test is used to detect infections caused by dengue virus.

Report Coverage

The arbovirus testing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, test type, arboviral disease, end-use, and their futuristic growth opportunities.

Arbovirus Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1.31 billion |

|

Revenue forecast in 2034 |

USD 1.98 billion |

|

CAGR |

4.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Arbovirus Testing Market report covering key segments are test type, arboviral disease, end-use, and region.

Arbovirus Testing Market Size Worth $1.98 Billion By 2034

Arbovirus testing market exhibiting the CAGR of 4.70% during the forecast period.

North America is leading the global market

key driving factors in Arbovirus Testing Market are Increasing occurrence and resurgence of arthropod-borne viral infections