Architectural Metal Coatings Market Share, Size, Trends, Industry Analysis Report

By Type (Polyurethane, Polyester, Fluoropolymer, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 116

- Format: PDF

- Report ID: PM2660

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

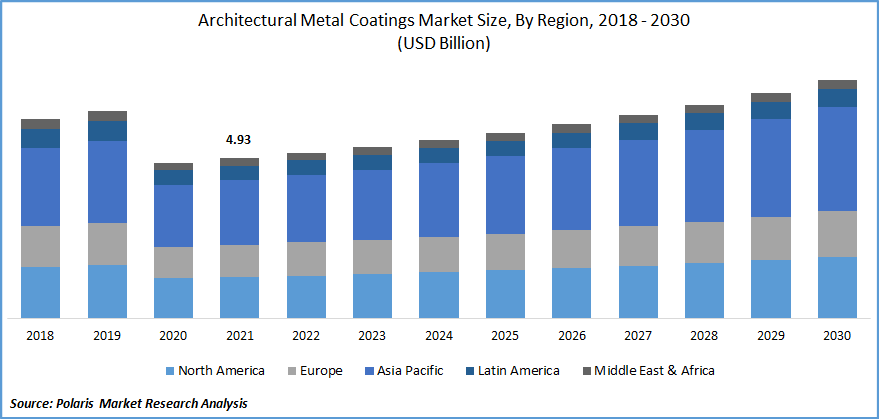

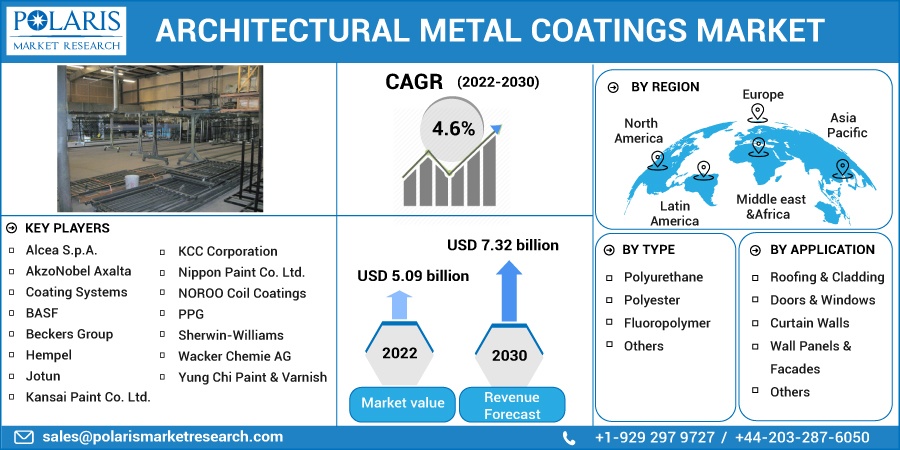

The global architectural metal coatings market was valued at USD 4.93 billion in 2021 and is expected to grow at a CAGR of 4.6% during the forecast period. The growing awareness of people regarding the safety & emission from architectural coatings and the increasing infrastructure of the construction sector drive the market.

Know more about this report: Request for sample pages

Architectural metal coatings are used in the building and construction sector in applications such as cladding, roofing, wall panels, and doors and windows. These solutions offer flexibility and durability. These solutions offer protection from corrosion, UV, and extreme weather conditions. They also offer high chemical and solvent resistance, and high performance, while being environmentally friendly and suitable for human health.

There has been a greater demand for sustainable architectural metal coatings with enhanced durability and varied color options. Architects are increasingly opting for innovative coil and extrusion finishes for durability, longevity, energy efficiency, and reduced maintenance. Rise in the adoption of green building codes and standards and introduction of other initiatives to reduce environmental degradation support the market growth. The rising adoption of energy-efficient buildings, greater need to decrease energy costs, and the use of less toxic materials contribute to the growth of the architectural metal coating market.

Coil-coated products are widely used in wall panels, fascia, and roofing. Extrusion solutions are factory-applied and involve cleaning and pretreating aluminum-preformed extrusions, followed by a spray process, and concluded with thermally curing. Extrusion products include storefronts, skylight, window, canopies, and curtain wall panel systems. Extrusion solutions are applied after the development of products, whereas coil coatings are applied before the products are formed.

The COVID-19 outbreak has restricted the growth of the architectural metal coating market. A decline in construction activities due to lockdown implementation and workforce impairment negatively affected the market growth. Delay in construction projects, limited availability of raw materials, and operational challenges were observed worldwide during the pandemic. Construction activities were halted to contain the spread of the virus and follow social distancing protocols.

Restrictions on the movement of goods affected the ability of the market players to acquire raw materials and distribute final products to the consumers. However, with the ease in lockdown implementation and growth in economy, the global architectural metal coating market is expected to experience growth owing to an increase in construction activities and the development of public infrastructure.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Growth in urbanization, especially in developing economies, coupled with rise in industrialization, supports the market’s growth. The rise in consumer disposable income increased spending power, and enhanced living standards have increased the trend toward design, aesthetics, and architecture, thereby increasing the application of architectural metal coatings in the residential sector.

Strengthening building and construction sector, rise in investment in development of public infrastructure, and increase in inclination toward development of smart buildings further boost the demand for architectural metal coatings.

Growth in awareness regarding sustainable buildings and ageing of existing buildings supports market growth. There has been an increase in construction of factories, offices, and manufacturing units, leading to increased demand for architectural metal coatings. Market players are introducing innovative products through technological innovation and research and development to cater to the growing consumer demand.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Polyester coatings accounted for a significant share in 2021

Based on type, the global market has been segmented into polyurethane, polyester, fluoropolymer, and others. Polyester segment dominated the global market in 2021. Polyester coatings provide advantages such as flexibility, durability, and chemical resistance.

These solutions are applied on mild steel, galvanized steel, and aluminum, among others to obtain textured, smooth, metallic, or pearlescent finishes upon curing. Polyester architectural metal coatings are widely used for external applications on façade, cladding, curtain walls, rain screens, signage, and handrails. Internal applications of these coatings include windows and doors, fittings, and trims.

Wall panels and facades accounted for a considerable share

Based on application, the global architectural metal coatings market has been segmented into roofing and cladding, doors and windows, curtain walls, wall panels and facades, and others. The wall panels and facades segment accounted for a considerable market share in 2021. Architectural metal coatings are increasingly used in wall panels and facades for improved durability, weather resistance, and aesthetics.

The application of these solutions offers greater structural strength and longevity of structures. Strengthening economies in developing countries, rising industrialization, and increasing investments in the construction sector boost the growth of this segment. A rise in investments by government and private organizations in public infrastructure development coupled with greater development of smart cities is expected to offer growth opportunities during the forecast period.

Asia-Pacific dominated the global architectural metal coatings market in 2021

Asia-Pacific accounted for a significant global market in 2021. Strengthening building and construction sector in developing countries of the region owing to the rise in urbanization and industrial growth boosts the demand for these solutions. Global market players operating in the architectural metal coating market are expanding their presence in this region to leverage the availability of raw materials and labor.

An increase in consumer spending in the residential sector has been observed in the region. The rise in inclination toward energy-efficient buildings, stringent regulations regarding safety in buildings, and increasing research and development activities further support the market growth.

The increase in demand for architectural metal coatings from residential and commercial buildings and the development of smart cities aimed at promoting the adoption of green and smart buildings contribute to the high demand for architectural metal coatings in the region.

Competitive Insight

The leading players in the architectural metal coatings market include Alcea S.p.A., AkzoNobel Axalta Coating Systems, BASF, Beckers Group, Hempel, Jotun, Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Co. Ltd., NOROO Coil Coatings, PPG, Sherwin-Williams, Wacker Chemie AG, and Yung Chi Paint & Varnish.

The major players operating in the global architectural metal coatings market are introducing new products to serve a wider customer base. They are also partnering with other companies to enter new geographic regions and strengthen their presence in existing markets. Several small and medium-sized businesses have entered the market and introduced innovative products to cater to the growing consumer demand.

Recent Developments

In February 2022, PPG acquired Arsonsisi’s powder coatings business. The acquisition is aimed at enhancing the company’s offerings in specialty powder coatings for the architectural and industrial markets. This acquisition would provide PPG access to Arsonsisi’s highly automated manufacturing plant in Italy.

In May 2021, PPG introduced a new coating for the architectural metal material market. The CORAFLON Platinum powder coatings offer superior coating efficiency and colour durability.

Architectural Metal Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 5.09 billion |

|

Revenue forecast in 2030 |

USD 7.32 billion |

|

CAGR |

4.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Alcea S.p.A., AkzoNobel Axalta Coating Systems, BASF, Beckers Group, Hempel, Jotun, Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Co. Ltd., NOROO Coil Coatings, PPG, Sherwin-Williams, Wacker Chemie AG, and Yung Chi Paint & Varnish. |