Aseptic Connectors & Welders Market Size, Share, Trend & Industry Analysis Report

: By Product (Aseptic Connectors and Aseptic Welders), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5851

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

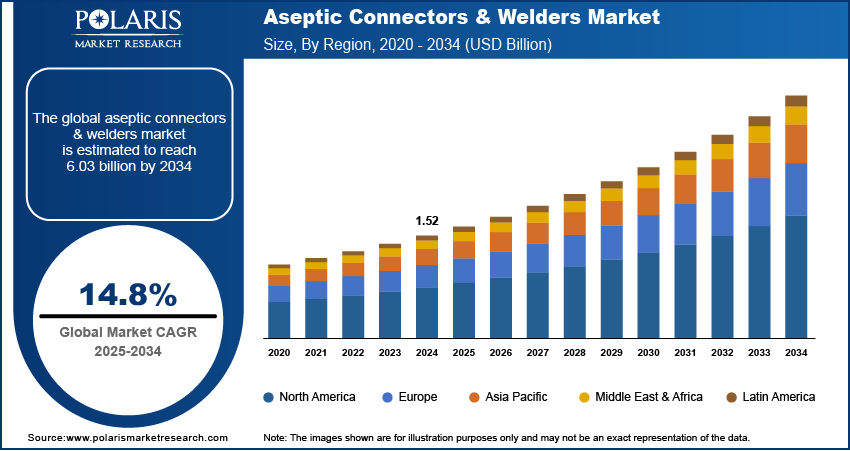

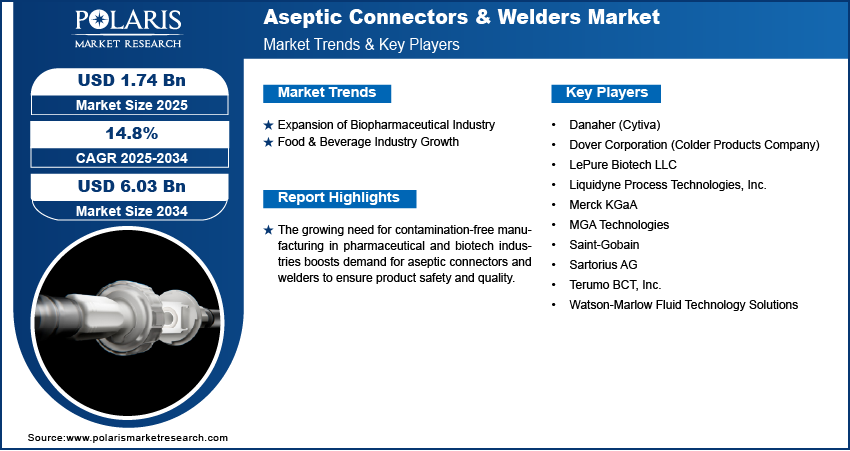

The global aseptic connectors & welders market size was valued at USD 1.52 billion in 2024 and is projected to grow at a CAGR of 14.8% during 2025–2034. The growing need for contamination-free manufacturing in pharmaceutical and biotech industries boosts demand for aseptic connectors and welders to ensure product safety and quality.

The market refers to the industry that produces and supplies specialized equipment used to create sterile, contamination-free connections and welds in fluid transfer lines. These tools are widely used in pharmaceuticals, biotechnology, food & beverage, and healthcare sectors to maintain product purity and safety during processing. Governments and regulatory bodies are enforcing stricter hygiene and sterility norms, prompting manufacturers to adopt aseptic technologies to meet compliance requirements.

To Understand More About this Research: Request a Free Sample Report

Companies aim to reduce downtime, minimize human error, and enhance process reliability, which makes automated and reliable aseptic connection methods more attractive. Additionally, many countries are upgrading their healthcare and pharmaceutical facilities, leading to higher adoption of advanced aseptic equipment for safe and efficient production.

Market Dynamics

Expansion of Biopharmaceutical Industry

Expansion of the biopharmaceutical industry is creating strong demand for aseptic connectors and welders, particularly in applications where sterility and contamination control are critical. For instance, in 2023, the Pharmaceutical Research and Manufacturers Association (PhRMA) reported that biopharmaceutical companies in the United States invested approximately USD 96 billion in research and development (R&D). This expenditure represented more than 20% of the industry’s total sales. The growing production of biologics, cell and gene therapies, and vaccines requires highly reliable sterile fluid transfer systems. Aseptic connection and welding technologies enable closed-system fluid handling, which is essential during upstream and downstream bioprocessing. Manufacturers are prioritizing equipment that ensures contamination-free fluid paths during media and buffer transfers, filtration, and filling operations. The need for flexible, single-use systems in biologics manufacturing is further supporting the adoption of these components. As biopharma facilities scale up globally to meet therapeutic demand, the integration of aseptic technologies into production systems continues to accelerate.

Food & Beverage Industry Growth

Food and beverage industry growth is also contributing to the increased use of aseptic connectors and welders. For instance, in 2024, the US Department of Agriculture announced USD 46 million investment to combat food and nutrition insecurity in underserved communities. This funding aims to improve access to fruits and vegetables, promoting healthier diets among eligible families and addressing food disparities, such investment by the government is enabling higher demand for aseptic connectors and welders to provide contamination-free food. Rising consumer preference for packaged, ready-to-consume, and long-shelf-life products has made hygienic processing a top priority. Maintaining sterility during fluid transfer, mixing, and filling operations is essential to preserve product safety and quality. Aseptic connectors and welders ensure contamination-free processing lines in dairy, beverages, sauces, and other liquid foods. The equipment enables efficient CIP/SIP processes, minimizes downtime, and reduces the risk of microbial intrusion. Food manufacturers are investing in modular and automated systems to improve hygiene and production efficiency, driving the demand for high-performance aseptic components. The need to comply with food safety regulations and reduce product recalls makes these technologies a crucial part of modern food processing environments.

Segment Insights

Market Assessment by Product

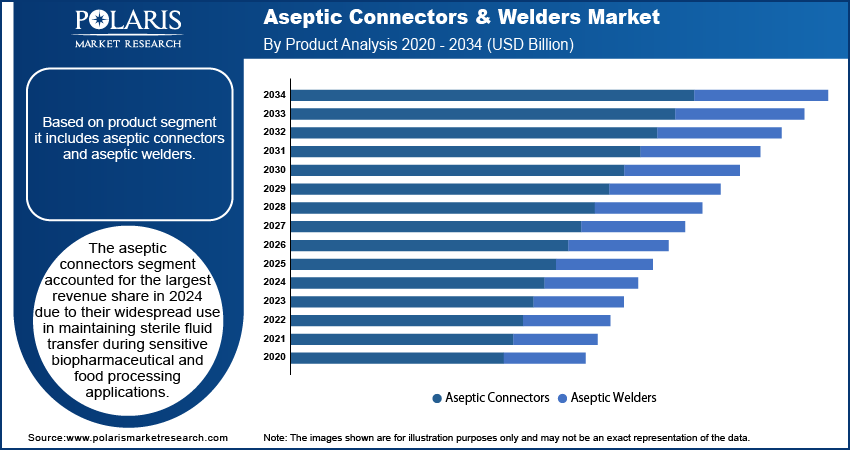

The aseptic connectors segment accounted for the largest revenue share in 2024 due to their widespread use in maintaining sterile fluid transfer during sensitive biopharmaceutical and food processing applications. These connectors allow secure, leak-proof connections between single-use systems and traditional stainless-steel setups without compromising product integrity. Their ability to support closed-system processing is critical in reducing contamination risks during production. Demand is driven by their compatibility with a variety of tubing sizes and system configurations, which makes them highly versatile across upstream and downstream workflows. Their ease of use and ability to maintain sterility even in non-classified environments continue to make them the preferred choice in many sterile processing setups.

The aseptic welders segment is projected to grow significantly over the forecast period due to rising demand for permanent, high-integrity connections in single-use and hybrid manufacturing systems. These welders are essential in applications requiring fluid path continuity without human intervention, ensuring sterile connections even under high-volume, high-pressure conditions. Adoption is increasing in high-throughput bioprocessing where speed, precision, and contamination prevention are vital. Their role is expanding in facilities that operate around-the-clock and need automation-ready solutions to minimize downtime. The growing trend toward continuous processing and modular facility design is also reinforcing the use of welders that ensure long-term sterility and operational efficiency.

Market Assessment by Application

The upstream bioprocessing segment accounted for approximately 45% of the revenue share in 2024, driven by the increasing volume of cell culture operations and media preparation that require sterile fluid handling. Maintaining sterility during these early stages is crucial to ensure consistent cell growth and product yield. Aseptic connectors and welders play a key role in transferring media, buffers, and seed cultures in closed systems, minimizing the risk of contamination. The scale-up of monoclonal antibody and recombinant protein production is further intensifying the need for reliable aseptic transfer solutions. Equipment compatibility with both single-use and stainless-steel systems adds to their appeal in upstream environments, especially in facilities adopting flexible manufacturing strategies.

The downstream bioprocessing segment is projected to register the fastest CAGR over the forecast period due to the critical role sterile fluid handling plays during purification, filtration, and final fill operations. At this stage, the risk of product loss from contamination is significantly high, and aseptic connections become vital for maintaining product quality and compliance. As biologics become more complex and batch sizes increase, demand for high-performance connectors and welders capable of ensuring secure and sterile connections has intensified. Modular and single-use downstream setups are being adopted more widely, driving the need for advanced aseptic technologies that support process scalability and validation requirements in commercial manufacturing.

Market Assessment by End Use

The OEMs segment accounted for approximately 40% of the revenue share in 2024, driven by the integration of aseptic connectors and welders into standardized equipment and systems provided to end users. Original equipment manufacturers are embedding these components into bioreactors, filling lines, and filtration systems to offer turnkey solutions to biopharmaceutical and food processing industries. Their focus on providing systems that meet global GMP and sterility standards ensures consistent demand for high-quality aseptic transfer components. Partnerships between OEMs and aseptic component suppliers also ensure seamless compatibility, which simplifies procurement for end users and speeds up system deployment. The OEM-driven design integration helps streamline production workflows, making them a preferred procurement channel.

The CROs & CMOs segment is projected to register the fastest CAGR over the forecast period due to the rising trend of outsourcing in the biopharmaceutical industry. Contract research and manufacturing organizations are scaling their capacity to meet growing client demand, often through flexible, single-use production systems that rely heavily on aseptic connectors and welders. These organizations prioritize sterility testing to meet diverse client specifications and regulatory expectations. Increasing demand for faster project turnaround times and smaller batch production has encouraged CMOs to adopt modular, pre-validated systems with reliable sterile connections. Their rapid response capabilities and commitment to contamination control make aseptic technologies a critical component of their operational model.

Regional Analysis

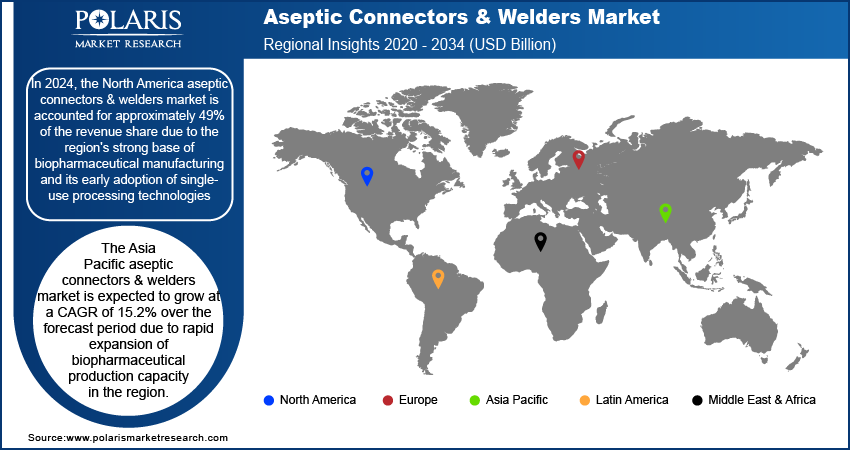

In 2024, the North America aseptic connectors & welders market is accounted for approximately 49% of the revenue share due to the region's strong base of biopharmaceutical manufacturing and its early adoption of single-use processing technologies. Large-scale production of biologics and vaccines is driving consistent demand for high-integrity sterile transfer systems. Regulatory focus on contamination control and compliance is pushing companies to integrate advanced aseptic components across upstream and downstream workflows. Growth is also supported by the presence of established suppliers offering modular, automation-compatible systems tailored for complex operations. Ongoing investment in R&D and facility expansion across biologics and cell therapy pipelines further supports market strength.

US Aseptic Connectors & Welders Market

The US aseptic connectors & welders market is expected to grow significantly over the forecast period, supported by rising investments in next-generation therapeutics such as gene therapy, mRNA platforms, and high-potency biologics. For instance, in August 2023, the US Department of Health and Human Services (HHS), through the Biomedical Advanced Research and Development Authority (BARDA), announced over USD 500 million in new funding to strengthen domestic bio manufacturing infrastructure for advanced therapeutics, including mRNA vaccines and therapeutics, gene therapies, and biologics. Expansion of contract manufacturing capabilities and a growing number of GMP-compliant facilities are boosting adoption of flexible and closed-system processing technologies. Demand for process reliability, reduced manual handling, and better scalability is pushing bio manufacturers to adopt robust sterile connection solutions. Increased outsourcing to CDMOs and government funding for biologics infrastructure is also driving the need for advanced aseptic handling tools that align with global regulatory standards and high-throughput production models.

Asia Pacific Aseptic Connectors & Welders Market

The Asia Pacific aseptic connectors & welders market is expected to grow at a CAGR of 15.2% over the forecast period due to rapid expansion of biopharmaceutical production capacity in the region. Countries are investing in local vaccine manufacturing, biosimilar development, and contract biologics services to strengthen healthcare self-sufficiency. Increasing awareness about contamination control and the shift toward single-use systems are accelerating demand for aseptic transfer solutions. Regulatory alignment with international quality standards is encouraging facility upgrades that include high-performance sterile components. The rising presence of global CDMOs and domestic innovation hubs is also creating a supportive environment for adopting automation-ready aseptic connectors and welders. For instance, In October 2023, the Government of India, through the Department of Biotechnology (DBT), launched the "National Biopharma Mission" with an additional investment of approximately USD 110 million USD to boost local biologics and vaccine manufacturing. The initiative focuses on strengthening GMP facilities, promoting biosimilar development, and supporting contract development and manufacturing organizations (CDMOs).

China Aseptic Connectors & Welders Market

China aseptic connectors & welders market accounted for the largest revenue share in the Asia Pacific in 2024, fueled by large-scale expansion in biologics manufacturing and government-backed initiatives promoting pharmaceutical self-reliance. Rapid development of biosimilar and vaccine pipelines has led to greater adoption of modular, GMP-compliant production systems. Manufacturers are increasingly adopting single-use components to reduce cleaning time, minimize cross-contamination, and meet fast production timelines. Local companies are also entering partnerships to bring in high-quality aseptic technologies. Demand for scalable and flexible fluid handling systems is being reinforced by the growth of CDMOs and a strong push toward international market certification for export-ready therapies.

Europe Aseptic Connectors & Welders Market

The Europe aseptic connectors & welders market is growing steadily, due to the region's continued investment in advanced therapeutics and emphasis on quality assurance. Regulatory bodies enforce strict sterility standards, prompting the widespread use of closed-system processing equipment. Demand is supported by the expansion of biologics manufacturing facilities and increased R&D in personalized medicines. Biopharma companies are integrating aseptic components to enhance batch integrity and streamline scale-up processes. The region's strong focus on sustainability and waste reduction is also encouraging the shift from traditional stainless-steel setups to single-use systems. Ongoing digital transformation across pharmaceutical production lines is further supporting adoption of automation-friendly sterile connectors and welders.

Key Players & Competitive Analysis Report

The competitive landscape of the aseptic connectors and welders market is shaped by strategic initiatives focused on expanding product portfolios, enhancing technological capabilities, and strengthening global distribution networks. Industry analysis indicates a rising number of joint ventures and strategic alliances aimed at accelerating product innovation and enabling rapid market penetration in emerging regions. Market participants are actively pursuing mergers and acquisitions to consolidate their position, diversify offerings across single-use technologies, and tap into complementary capabilities such as sterile transfer systems and bioprocessing integration. Post-merger integration efforts are focused on streamlining manufacturing, aligning quality standards, and leveraging synergies in supply chain operations. Technology advancements in laser welding, smart sensors, and fully automated sterile connectors are becoming key differentiators in both upstream and downstream bioprocessing applications. Companies are investing in compact, modular designs that support high throughput, reduce contamination risk, and enable seamless scale-up in flexible manufacturing environments. Increasing demand from CROs, CMOs, and OEMs is influencing competitive strategies that emphasize cost-effectiveness, compliance with GMP standards, and system compatibility. Players are also focusing on sustainability, offering recyclable materials and reduced-waste solutions to align with global environmental goals. The market remains dynamic, driven by innovation, regulatory evolution, and rising demand for precision-engineered sterile transfer systems.

List of Key Companies

- Danaher (Cytiva)

- Dover Corporation (Colder Products Company)

- LePure Biotech LLC

- Liquidyne Process Technologies, Inc.

- Merck KGaA

- MGA Technologies

- Saint-Gobain

- Sartorius AG

- Terumo BCT, Inc.

- Watson-Marlow Fluid Technology Solutions

Aseptic Connectors & Welders Industry Developments

In January 2025, CPC introduced the MicroCNX Nano Series aseptic connectors in the US during the Advanced Therapies Week event in Dallas. These connectors were designed for cell and gene therapy applications, offering a sterile fluid path for small tubing sizes without requiring welding or biosafety cabinets.

Aseptic Connectors & Welders Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Aseptic Connectors

- Connection type

- Tubing Size

- Aseptic Welders

By Application Outlook (Revenue USD Billion, 2020–2034)

- Upstream Bioprocessing

- Downstream Bioprocessing

- Harvest & Fill-finish Operations

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Biopharmaceutical & Pharmaceutical Companies

- OEMs

- CROs & CMOs

- Academic & Research Institutes

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aseptic Connectors & Welders Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.52 billion |

|

Market Size Value in 2025 |

USD 1.74 billion |

|

Revenue Forecast by 2034 |

USD 6.03 billion |

|

CAGR |

14.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 1.52 billion in 2024 and is projected to grow to USD 6.03 billion by 2034.

• The global market is projected to register a CAGR of 14.8% during the forecast period.

• In 2024, the North America aseptic connectors & welders market is accounted for approximately 49% of the revenue share due to the region's strong base of biopharmaceutical manufacturing and its early adoption of single-use processing technologies.

• A few of the key players includes are Danaher (Cytiva); Dover Corporation (Colder Products Company); LePure Biotech LLC; Liquidyne Process Technologies, Inc.; Merck KGaA; MGA Technologies; Saint-Gobain; Sartorius AG; Terumo BCT, Inc.; Watson-Marlow Fluid Technology Solutions.

• The aseptic connectors segment accounted for the largest revenue share in 2024 due to their widespread use in maintaining sterile fluid transfer during sensitive biopharmaceutical and food processing applications.

• The upstream bioprocessing segment accounted for approximately 45% of the revenue share in 2024, driven by the increasing volume of cell culture operations and media preparation that require sterile fluid handling.