Asia Pacific Cell Culture Market Size, Share, Trends, Industry Analysis Report

By Product, By Consumables, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM3540

- Base Year: 2024

- Historical Data: 2020-2023

What is the Asia Pacific Cell Culture Market Size?

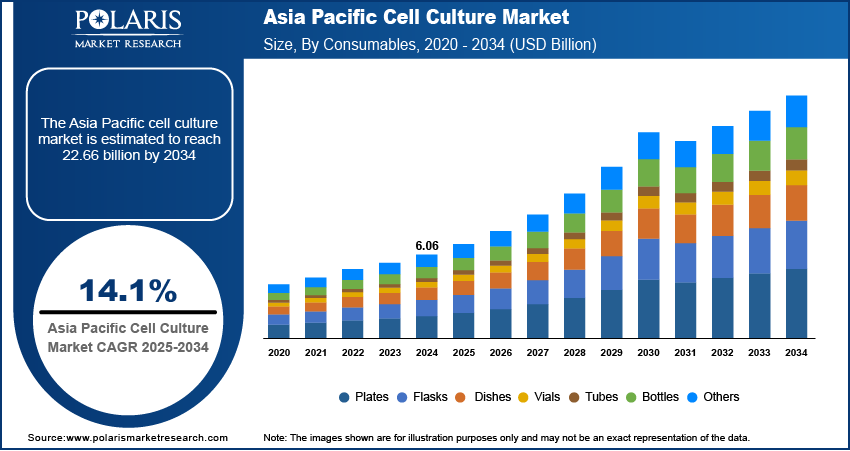

The Asia Pacific cell culture market size was valued at USD 6.06 billion in 2024, growing at a CAGR of 14.1% from 2025 to 2034. Rising prevalence of chronic and infectious diseases along with increasing government funding and supportive policies are boosting the market growth.

Key Insights

- Culture systems dominated in 2024, due to its essential role in supporting reproducible and controlled cell growth for research, biopharmaceutical production, and tissue engineering applications.

- Vaccine production is projected to grow at a rapid pace during the forecast period, supported by the expansion of pharmaceutical manufacturing infrastructure, increasing R&D investment, and adoption of cell culture technologies for novel therapies.

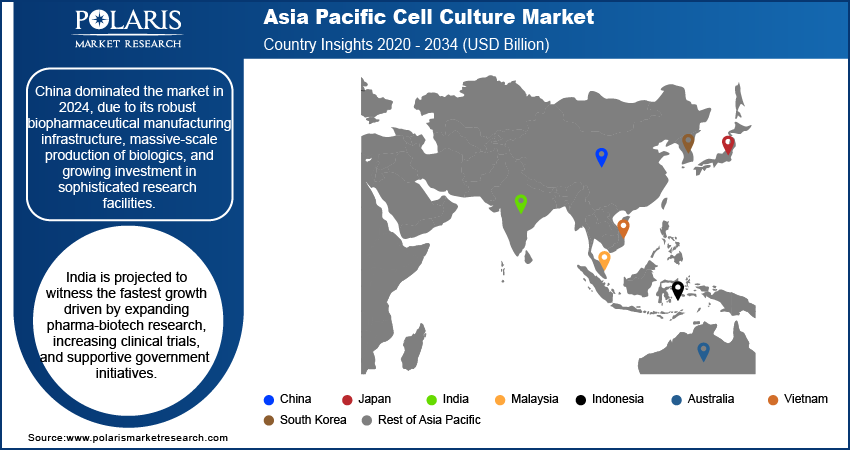

- China led the market in 2024 due to its well-established biopharmaceutical manufacturing base, large-scale production of biologics, and heightened investment in state-of-the-art research facilities.

- India to growth at a fast pace over the forecast period due to the rapid growth of pharmaceutical and biotech research, increasing clinical trial activities, and encouraging government policies.

Industry Dynamics

- Growing number of chronic and infectious diseases across the region is driving the demand for advanced cell culture technologies to support vaccine development and therapeutic research.

- Increasing government investment and supportive policies for strengthening biopharmaceutical research and manufacturing are fueling market growth.

- High cost of advanced cell culture equipment, reagents, and media is restraining adoption among small- and mid-scale research facilities.

- 3D and organ-on-chip culture system development for sophisticated drug screening and tissue modeling is opening up tremendous growth prospects in the region.

Market Statistics

- 2024 Market Size: USD 6.06 Billion

- 2034 Projected Market Size: USD 22.66 Billion

- CAGR (2025–2034): 14.1%

What is cell culture market comprising of?

The Asia Pacific cell culture market includes specialized equipment, reagents, and media used for the cultivation, maintenance, and analysis of cells in research and biopharmaceutical purposes. The solutions are extensively utilized in drug development, regenerative medicine, and vaccine discovery in order to provide reproducibility, reliability, and scalability. Automation advancements, maximized media formulations, and high-throughput systems are increasing efficiency, diminishing the threat of contamination, and meeting the increasing demand for biopharmaceutical R&D in the region.

The rise of contract research organizations (CROs) services and expansion of academic research facilities are driving adoption of cell culture technologies. These entities are dependent on high-quality cell culture solutions for preclinical testing, translational research, and biopharmaceutical development, hence providing steady demand throughout the region.

The Asia Pacific cell culture market is growing strongly, fueled by growing pharmaceutical and biotechnology research efforts in markets such as China, India, and Japan. In 2023, Chinese biotech companies collectively raised a total of USD 20.61 billion in funding among 69 companies, with an average of about USD 299 million per company, as reported by Crunchbase. Growth in drug discovery, regenerative medicine, and biologics is generating demand for sophisticated cell culture solutions that enable innovation and efficiency.

Drivers & Opportunities

Which factors drives the Cell Culture Market Growth?

Rising Prevalence of Chronic and Infectious Diseases: The growing incidence of chronic diseases, cancer, and infectious diseases is fueling the need for cell-based research and treatment. As estimated by the Health and Global Policy Institute, non-communicable diseases (NCDs) constitute approximately 82% of overall fatalities in Japan, which highlights the rising health burden. Cell culture technology is vital in determining disease processes, drug screening, and treatment development, thus fueling the market growth in the region.

Increasing Government Funding and Favorable Policies: Governments across the region are boosting life science research by supporting programs, offering tax incentives, and favorable policies for biotech innovation. For instance, India launched the Promotion of Research and Innovation in Pharma MedTech (PRIP) scheme to facilitate R&D and innovation. The scheme has a USD 600 million budgetary allocation, including USD 84 million for establishing Centers of Excellence in seven NIPERs and USD 504 million for enhancing the national R&D ecosystem. Such programs are boosting investments in state-of-the-art laboratory infrastructure and cell culture platforms, propelling market growth.

Segmental Insights

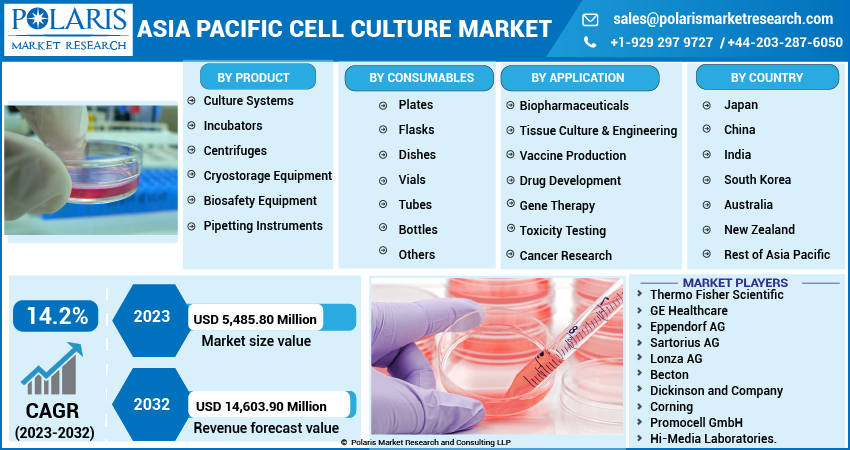

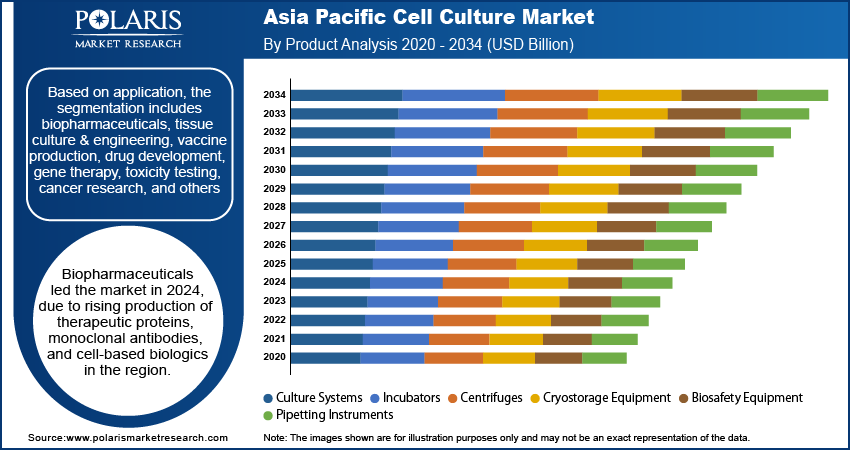

By Product

On the basis of product, the Asia Pacific cell culture market is divided into culture systems, incubators, centrifuges, cryostorage equipment, biosafety equipment, and pipetting instruments. Culture systems dominated the market in 2024 due to its critical role in enabling reproducible and controlled growth of cells for research, biopharmaceutical manufacturing, and tissue engineering applications.

Incubators are expected to grow at a rapid pace during the forecast period driven by its pivotal role in sustaining the ideal temperature, humidity, and CO₂ conditions for diverse cell types.

By Consumables

Based on consumables, the market is classified into plates, flasks, dishes, vials, tubes, bottles, and others. Plates held the leading market share in 2024 owing to their extensive applications in high-throughput screening, drug testing, and cell-based assays.

Vials, tubes, and bottles are also expected to rise steadily as laboratories increase their storage, transportation, and experimentation capabilities to accommodate growing volumes of cell culture and sophisticated assays.

By Application

On the basis of application, the market is divided into biopharmaceuticals, tissue culture & engineering, vaccine production, drug development, gene therapy, toxicity testing, cancer research, and others. Biopharmaceuticals accounted for the leading share in 2024 owing to increasing production of therapeutic proteins, monoclonal antibodies, and cell-based biologics in the region.

Vaccine production is estimated to rise at a high growth rate during the forecast period. This is driven by increasing pharmaceutical manufacturing facilities, growing R&D expenditures, and installation of cell culture technologies for new therapies.

Country Analysis

China AI In Drug Repurposing Market Overview

China led the Asia Pacific Cell Culture Market in 2024 due to its robust biopharmaceutical manufacturing infrastructure, massive-scale production of biologics, and growing investment in sophisticated research facilities. As per Center for Strategic & International Studies, the worth of China-licensed drugs exported to Western markets increased to USD 48 billion in 2024, which is a 15-fold jump from 2020. Increasing collaboration between local and international biopharma companies further enhances the nation's dominance in the region.

India AI In Drug Repurposing Market Insights

India is projected to be the fastest-growing market during the forecast period, supported by rapid expansion of pharmaceutical and biotechnology research, growing clinical trial activities, and favorable government initiatives aimed at boosting life sciences R&D. The Federation of Indian Chambers of Commerce and Industry (FICCI) estimates that the Indian pharmaceutical industry to reach a total market size of USD 120 billion by 2030. Growing focus on regenerative medicine and cell-based therapies is driving demand for advanced cell culture systems and consumables across the country.

Key Players & Competitive Analysis

The Asia Pacific cell culture market is experiencing intense competition, led by the swift development in biotechnology, pharmaceutical R&D, and life sciences. Firms are focusing on the innovations in cell culture media, reagents, and bioprocessing systems to facilitate applications in drug discovery, vaccine development, and regenerative medicine. Enhancing biopharmaceutical manufacturing capacity, raising R&D expenditures, and rising number of partnerships with research organizations are driving the growth and technological advancements of the regional market.

Major players in the Asia Pacific cell culture market are Agilent Technologies, Inc., Beckton, Dickinson and Company, Bio-Rad Laboratories, Inc., Corning Incorporated, Danaher Corporation, Eppendorf SE, FUJIFILM Irvine Scientific, Inc., Greiner Bio-One International GmbH, HiMedia Laboratories Pvt. Ltd., Lonza Group Ltd., Merck KGaA, Miltenyi Biotec B.V. & Co. KG, PromoCell GmbH, Sartorius AG, and Thermo Fisher Scientific Inc.

Key Players

- Agilent Technologies, Inc.

- Beckton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Danaher Corporation

- Eppendorf SE

- FUJIFILM Irvine Scientific, Inc.

- Greiner Bio-One International GmbH

- HiMedia Laboratories Pvt. Ltd.

- Lonza Group Ltd.

- Merck KGaA

- Miltenyi Biotec B.V. & Co. KG

- PromoCell GmbH

- Sartorius AG

- Thermo Fisher Scientific Inc.

Asia Pacific Cell Culture Industry Developments

In August 2025: WuXi Biologics launched WuXia293Stable, a proprietary HEK 293 stable cell line development platform designed to express difficult-to-produce biologics with robust stability and high titers. The platform reportedly achieves fed-batch yields up to 5.0 g/L while improving purity and maintaining consistent performance through long-term cell passages

In September 2024: Ajinomoto CELLiST Korea unveiled several new cell culture media products at BIO KOREA 2024, including BASAL CHO MX and F7, as well as upcoming HEK293-vaccine media and HEK293-gene-therapy media. These are designed for high bioprocess performance, improved CHO and HEK293 cell line yields, and better consistency.

Asia Pacific Cell Culture Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Culture Systems

- Incubators

- Centrifuges

- Cryostorage Equipment

- Biosafety Equipment

- Pipetting Instruments

By Consumables Outlook (Revenue, USD Billion, 2020–2034)

- Plates

- Flasks

- Dishes

- Vials

- Tubes

- Bottles

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Biopharmaceuticals

- Tissue Culture & Engineering

- Vaccine Production

- Drug Development

- Gene Therapy

- Toxicity Testing

- Cancer Research

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

Asia Pacific Cell Culture Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.06 Billion |

|

Market Size in 2025 |

USD 6.90 Billion |

|

Revenue Forecast by 2034 |

USD 22.66 Billion |

|

CAGR |

14.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 6.06 billion in 2024 and is projected to grow to USD 22.66 billion by 2034.

The market is projected to register a CAGR of 14.1% during the forecast period.

A few of the key players in the market are Agilent Technologies, Inc., Beckton, Dickinson and Company, Bio-Rad Laboratories, Inc., Corning Incorporated, Danaher Corporation, Eppendorf SE, FUJIFILM Irvine Scientific, Inc., Greiner Bio-One International GmbH, HiMedia Laboratories Pvt. Ltd., Lonza Group Ltd., Merck KGaA, Miltenyi Biotec B.V. & Co. KG, PromoCell GmbH, Sartorius AG, and Thermo Fisher Scientific Inc.

The culture systems segment dominated the market revenue share in 2024.

The vials, tubes, and bottles segment is projected to witness the fastest growth during the forecast period.