Asia Pacific Energy Drinks Market Share, Size, Trends, Industry Analysis Report

By Product (Non-alcoholic, Alcoholic); By Type; By Distribution; By Country; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4468

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

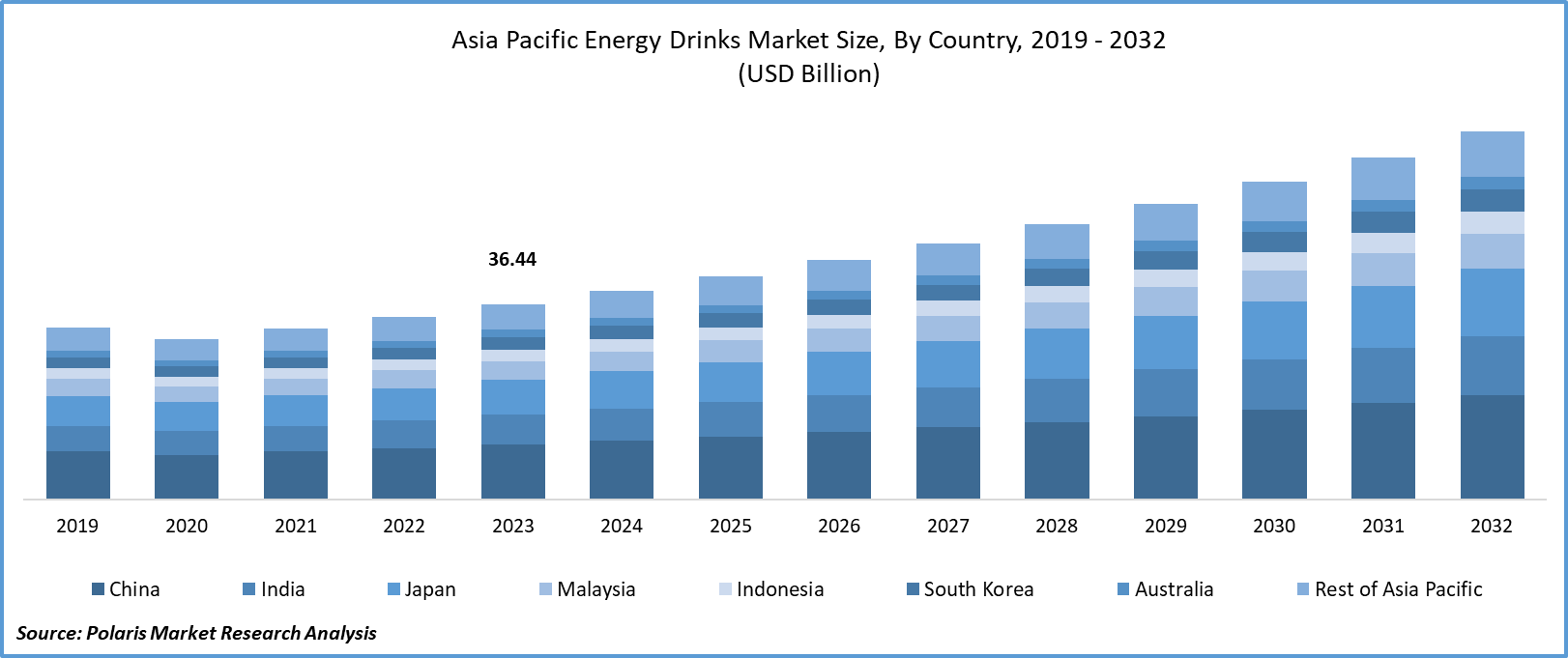

The asia pacific energy drinks market size was valued at USD 36.44 billion in 2023. The market is anticipated to grow from USD 38.98 billion in 2024 to USD 68.77 billion by 2032, exhibiting the CAGR of 7.4% during the forecast period.

Industry Trends

Asia Pacific region dominated the global energy drinks market in 2023, and this is because of a variety of factors, such as increasing awareness among consumers about the benefits of leading healthy lifestyles and the adoption of such practices. The demand for energy drinks has been on the rise due to various driving forces, such as increasing disposable income, a large young population, and numerous working professionals seeking quick energy boosts. Also, the introduction of new products with different flavors and functionalities has widened the consumer base for this market. The manufacturers have been constantly innovating and bringing new products to the market, which has attracted a wider range of consumers. However, despite the growth, some factors have been hindering the market's growth.

To Understand More About this Research: Request a Free Sample Report

One of the most significant restraining factors is the potential negative impact on health due to the high caffeine content in energy drinks. Consumers are becoming increasingly aware of the possible side effects associated with excessive consumption of caffeine and are shifting towards natural ingredients, low-caffeine, or caffeine-free alternatives.

Key Takeaways

- China dominated the market and contributed over 25% of the share in 2023

- By product category, the non-alcoholic segment accounted for the largest market share in 2023

- By type category, the natural segment is expected to grow with a significant CAGR over the forecast period

- By distribution channel category, the off-trade segment held the dominating revenue share in 2023

What are the market drivers driving the demand for Asia Pacific energy drinks market?

Expanding applications of energy drinks drive market growth in the Asia Pacific region.

The expanding applications of energy drinks have played a significant role in driving the growth of the energy drinks market in the Asia Pacific region. Energy drinks were initially popular among athletes and fitness enthusiasts, but their appeal has now expanded to a wider range of consumers, including students, professionals, and individuals leading busy lives.

- For instance, as per the study, employees in countries like Singapore, Japan, India, and the Philippines are spending more than 45 hours a week, and this overworking culture has left 73% of Singapore’s employees unhappy, whereas 62% reported exhaustion.

This has resulted in the increasing demand for beverages that can provide a quick energy boost and help people stay alert and focused throughout the day. Also, energy drinks are being used as a substitute for coffee or other sugary drinks, which has further contributed to their growing popularity. Similarly, the rise of e-commerce platforms and online retailing has made energy drinks more accessible to consumers in remote areas, thereby expanding their reach and customer base.

Which factor is restraining the demand for energy drinks?

The potential negative impact on health due to the high caffeine content in energy drinks hinders market growth.

The high caffeine content in energy drinks has been a major concern for consumers and health professionals alike, and this has acted as a restraining factor for the Asia Pacific energy drinks market. Excessive caffeine consumption leads to negative side effects such as jitteriness, anxiety, insomnia, rapid heartbeat, and digestive problems. In extreme cases, it may even result in more serious health issues like cardiovascular diseases, stroke, and seizures. This has led to a growing awareness among consumers about the potential health risks associated with energy drinks, which in turn has slowed down their adoption rate.

Moreover, several countries in the Asia Pacific region have implemented strict regulations regarding the amount of caffeine that can be added to energy drinks, further limiting their appeal. As a result, manufacturers are facing challenges in terms of balancing consumer demand for energy boosts with the need to ensure safety and regulatory compliance, thereby hindering the growth of the energy drinks market in the region.

Report Segmentation

The market is primarily segmented based on product, type, technology, distribution channel and country.

|

By Product |

By Type |

By Distribution Channel |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented on the basis of non-alcoholic and alcoholic. The non-alcoholic energy drinks segment accounted for the largest share of the Asia Pacific energy drinks market in 2023, owing to several factors, such as the growing demand for beverages that are low in sugar and calories but still provide a boost of energy. Non-alcoholic energy drinks cater to this demand by offering a range of flavors and functional ingredients like vitamins, minerals, and plant extracts that plead to health-conscious consumers.

Also, the younger population in countries like China, India, and Indonesia prefer non-alcoholic energy drinks as they are considered more socially acceptable and safer than alcoholic energy drinks. Students, working professionals, and athletes are the major contributors to the dominance of non-alcoholic energy drinks.

By Type Insights

Based on type analysis, the market has been segmented on the basis of conventional and natural. The natural type of energy drink is expected to grow with a significant CAGR over the forecast period in the Asia Pacific region due to the increasing health consciousness among consumers. Natural energy drinks, which are made with ingredients such as ginseng, guarana, green tea, and yerba mate, plead to this demographic as they are perceived as a healthier alternative to traditional energy drinks.

Similarly, the growing middle-class population in countries like China and India, who have more disposable income and are looking for ways to improve their productivity and overall well-being, are also driving the growth of this segment. Innovative product launches and strategic partnerships between companies are also contributing to the growth of the natural energy drinks market in the Asia Pacific region.

Country-wise Insights

China

China held the largest revenue share in 2023 for the Asia Pacific energy drinks market due to several factors, such as the population in the region, which presents a vast consumer base for energy drinks. In addition, the country has experienced rapid economic growth, leading to an increase in disposable income and a growing demand for convenience beverages. Also, the Chinese government's support for the sports industry and the rise of e-sports have contributed to the popularity of energy drinks among young consumers.

For instance, in 2020, Red Bull, one of the leading energy drink brands, partnered with Chinese e-sports teams and events, further increasing its brand visibility and appeal among Chinese consumers. These kinds of strategies used by the energy drinks manufacturers are driving the growth of China's market.

Competitive Landscape

In the Asia Pacific region, the market for energy drinks is largely dominated by key players who continue to explore new markets across multiple countries. These players have been implementing a range of strategies, including mergers and acquisitions, portfolio expansion, and the introduction of novel products to enhance their market share.

Some of the major players operating in the Asia Pacific market include:

- Amway

- AriZona Beverages USA

- Goldwin Healthcare

- GSK

- Living Essentials LLC

- Lucozade

- Monster Beverage Corporation

- PepsiCo. Inc.

- Power Horse

- Red Bull

- Taisho Pharmaceutical Co. Ltd.

- The Coca-Cola Company

- The Kraft Heinz Company

- Xyience Energy

- King Kongin

Recent Developments

- In January 2023, Monster Beverage Corporation, a leading manufacturer of premium energy drinks globally, had planned to launch its Predator energy drink line in China. This launch was a part of the company's strategy to focus on the affordable segment of the energy drink category in Asia.

- In December 2023, King Kongin launched the four irresistible zero-calorie flavors, including blue raspberry, candy, peach mango, and watermelon strawberry energy drinks.

Report Coverage

The Asia Pacific Energy Drinks market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, type, distribution channel, and their futuristic growth opportunities.

Energy Drinks Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 38.98 billion |

|

Revenue forecast in 2032 |

USD 68.77 billion |

|

CAGR |

7.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Type, By Distribution Channel, By Country |

|

Regional scope |

China, India, Malaysia, Japan, Indonesia, South Korea, Australia, Rest of Asia Pacific |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Asia Pacific Energy Drinks Market are Amway, AriZona Beverages USA, Goldwin Healthcare, GSK, Living Essentials LLC, Lucozade, Monster Beverage Corporation, PepsiCo. Inc

Asia Pacific Energy Drinks Market exhibiting the CAGR of 7.4% during the forecast period.

The Asia Pacific Energy Drinks Market report covering key segments are product, type, distribution channel and country.

key driving factors in Asia Pacific Energy Drinks Market are expanding applications of energy drinks

The Asia Pacific energy drinks market size is expected to reach USD 68.77 Billion by 2032