Asia Pacific Fabry Disease Treatment Market Size, Share, & Industry Analysis Report By Route of Administration (Intravenous Route and Oral Route), By Therapy, By Distribution Channel, By Country – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5763

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

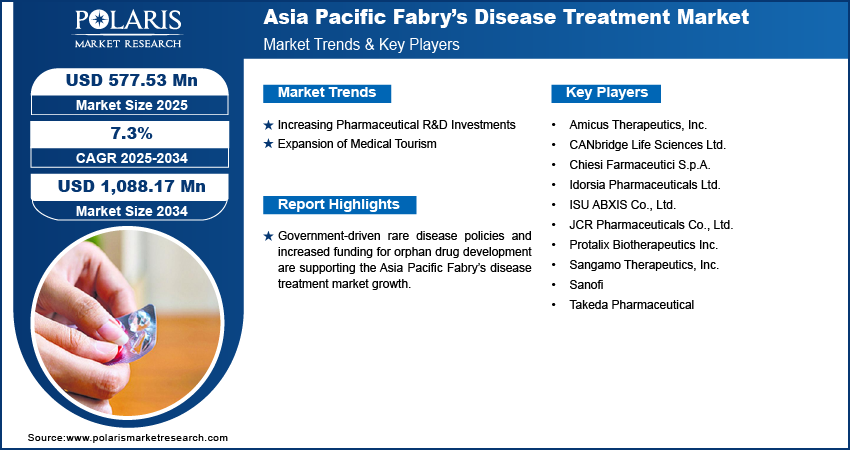

The Asia Pacific Fabry disease treatment market size was valued at USD 538.75 million in 2024 and is projected to register a CAGR of 7.3% during 2025–2034. Improved awareness and availability of diagnostic tools are enabling early identification of Fabry disease, leading to increased patient enrollment in treatment programs and greater adoption of advanced therapies across the region.

Fabry disease is a rare genetic disorder that affects the body's ability to break down specific fatty substances, leading to their expansion in various organs. The industry growth has grown in response to the need for managing and slowing the progression of this lifelong condition. It contains therapies that target the root cause of the disease as well as those that manage its symptoms, such as enzyme replacement therapy, Chaperone Therapy, and others. These treatments aim to improve the quality of life for patients and reduce complications that arise from damage to the heart, kidneys, and nervous system. Government-driven rare disease policies and increased funding for orphan drug development are supporting access to Fabry disease treatments, particularly through national reimbursement schemes and rare disease registries.

Expansion of specialized metabolic disorder centers and genetics clinics across urban hospitals is improving the diagnosis-to-treatment conversion rate, helping accelerate patient access to enzyme replacement and supportive therapies. Additionally, increased accessibility to genomic sequencing technologies is streamlining early and accurate diagnosis of Fabry disease, supporting timely therapeutic intervention and expanding the treatment-eligible patient population.

Market Dynamics

Increasing Pharmaceutical R&D Investments

Pharmaceutical R&D investments in Asia Pacific are playing a critical role in accelerating the development of advanced therapies for Fabry disease. Global and local biopharmaceutical companies are focusing on expanding their clinical trial networks and collaborating with regional research institutions to bring innovative treatments to market. For instance, Roche announced to allocate USD 283 million toward the establishment of a new manufacturing facility in China, aiming to enhance its production capabilities and operational efficiency within the region. A strong emphasis is being placed on gene therapies and next-generation enzyme replacement therapies that offer more targeted and durable outcomes. Supportive regulatory frameworks and government incentives are further encouraging companies to establish R&D facilities within the region. This trend is enhancing treatment availability and also positioning Asia Pacific as a key hub for rare disease innovation, which continues to strengthen the therapeutic landscape for Fabry disease.

Expansion of Medical Tourism

Expansion of medical tourism in Asia Pacific is positively impacting the Fabry disease treatment market in Asia Pacific. Countries such as India and Thailand are emerging as preferred destinations for patients seeking rare disease diagnostics and treatments due to their cost-effective healthcare services and availability of specialized care. Advanced medical infrastructure, skilled professionals, and faster access to diagnostics and therapeutics make these countries attractive for international patients. Multilingual support and the presence of JCI-accredited hospitals add to patient confidence. These factors collectively drive higher treatment volumes and stimulate demand for advanced therapies. The influx of medical tourists contributes to improved investment in healthcare technologies and fuels local industry growth. This regional advantage enables better disease management outcomes for Fabry patients while promoting overall market expansion.

Segment Insights

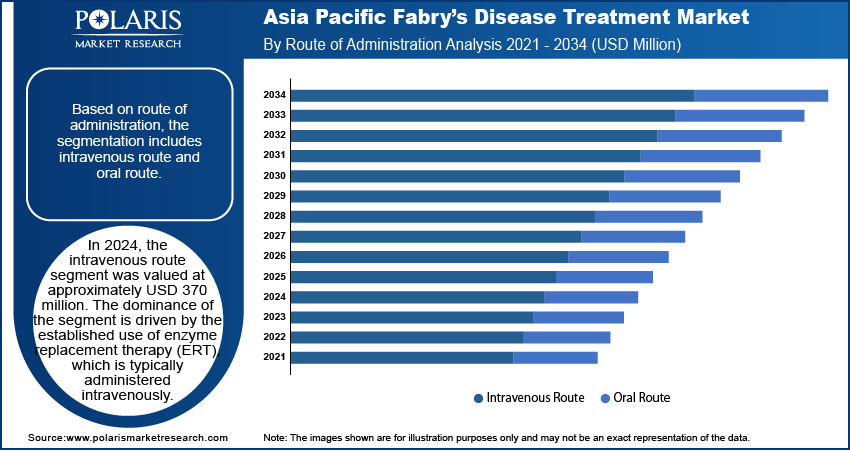

Market Assessment by Route of Administration

Based on route of administration, the segmentation includes intravenous route and oral route. In 2024, the intravenous route segment was valued at approximately USD 370 million. The dominance of the segment is attributed to the established use of enzyme replacement therapy (ERT), which is typically administered intravenously. Many patients, especially those in moderate to severe stages, rely on hospital-based infusion protocols to receive consistent and monitored therapy. The clinical efficacy and long-standing track record of intravenous treatments in stabilizing disease progression make it the preferred choice among specialists. The infrastructure across major economies in the region also supports infusion-based care, reinforcing the strong share of this segment despite emerging oral alternatives.

The oral route segment is projected to register a CAGR of 7.5% from 2025 to 2034 due to the increasing availability and acceptance of oral substrate reduction therapies. Patient preference is shifting toward convenient, home-based medication options that eliminate the need for hospital visits. Advancements in pharmacological formulations have led to the development of effective oral agents that reduce the accumulation of disease-causing substances in a targeted manner. The growing pipeline of oral therapies and positive regulatory momentum are encouraging broader adoption. Improved adherence rates and better quality of life further contribute to the segment rapid expansion, particularly among younger patients or those in earlier disease stages seeking less invasive treatment modalities.

Market Assessment by Therapy

Based on therapy, the segmentation includes enzyme replacement therapy (ERT), substrate reduction therapy (SRT), and others. In 2024, the enzyme replacement therapy (ERT) segment accounted for approximately 70% of the share. This dominance is largely attributed to the extensive clinical evidence supporting ERT in managing both classic and atypical Fabry manifestations. Healthcare providers continue to rely on ERT for its proven ability to slow disease progression and manage organ involvement, especially in the kidneys and heart. Its inclusion in national rare disease programs and availability through hospital-based administration ensures wide coverage. The strong reimbursement support in several Asia Pacific countries for ERT further sustains its high revenue share. Ongoing innovations aimed at enhancing the half-life and reducing immunogenicity of ERT formulations are expected to maintain their clinical relevance.

The substrate reduction therapy segment is expected to register a CAGR of 7.5% from 2025 to 2034, due to rising interest in noninvasive alternatives that address the disease mechanism at a metabolic level. Unlike ERT, SRT works by limiting the production of substrate that accumulates due to enzyme deficiency, offering a different treatment pathway. Patients seeking easier administration and those who experience adverse reactions to ERT are turning to SRT as a viable option. Biopharmaceutical companies are actively investing in developing next-generation SRT agents with enhanced specificity and fewer side effects. Regulatory support for oral therapies and increasing patient awareness are also contributing to this segment substantial expansion.

Market Evaluation by Distribution Channel

Based on distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online pharmacies. In 2024, the hospitals segment accounted for approximately 45% of the share due to the infusion-based nature of most enzyme replacement therapies, which require administration in a controlled medical environment. Hospitals serve as primary centers for diagnosis, monitoring, and treatment, offering specialized care for rare genetic diseases. The infrastructure to handle complex cold-chain logistics and provide trained personnel for intravenous therapy ensures the reliability of hospital pharmacies in managing such treatments. Strong relationships between healthcare providers and institutional pharmacies further reinforce this channel dominance in delivering Fabry disease therapies.

The retail pharmacies segment is expected to register a CAGR of 7.4% from 2025 to 2034, due to the growing demand for oral therapies that can be conveniently filled outside of hospital settings. As substrate reduction therapies and other oral agents gain popularity, retail channels are becoming more important in ensuring broader access and ease of purchase. Urbanization and better availability of high-value drugs at local pharmacies are also driving growth. Expansion of insurance coverage to include retail-distributed rare disease medications and pharmacist-led patient education initiatives further enhances the trust and utility of this distribution channel for Fabry disease treatments.

Country Analysis

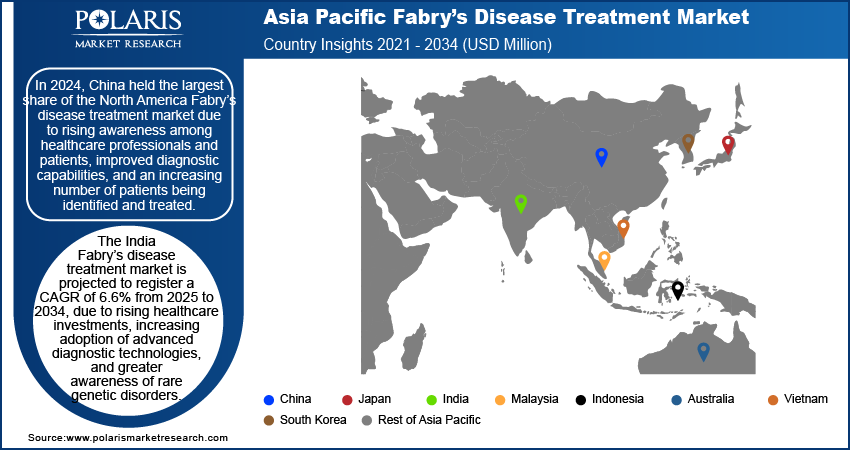

China Fabry Disease Treatment Market

The Fabry disease treatment market in China was valued at approximately USD 230 million in 2024. This market growth is driven by rising awareness among healthcare professionals and patients, improved diagnostic capabilities, and an increasing number of patients being identified and treated. Expanding government support for rare disease programs and strong interest from global biopharma companies are also fueling the growth. For instance, the "Healthy China 2030" initiative represents the Chinese government's responsibility to integrate health into all policies and connect health outcomes with economic development. It is a pivotal improvement aimed at transforming the healthcare system to enhance public health and economic progress. Availability of specialized treatment centers and gradual reimbursement policy reforms are enhancing patient access to enzyme replacement therapies and novel approaches such as gene therapy. The growing elderly population and prevalence of lifestyle-linked comorbidities further increase the number of diagnosed cases.

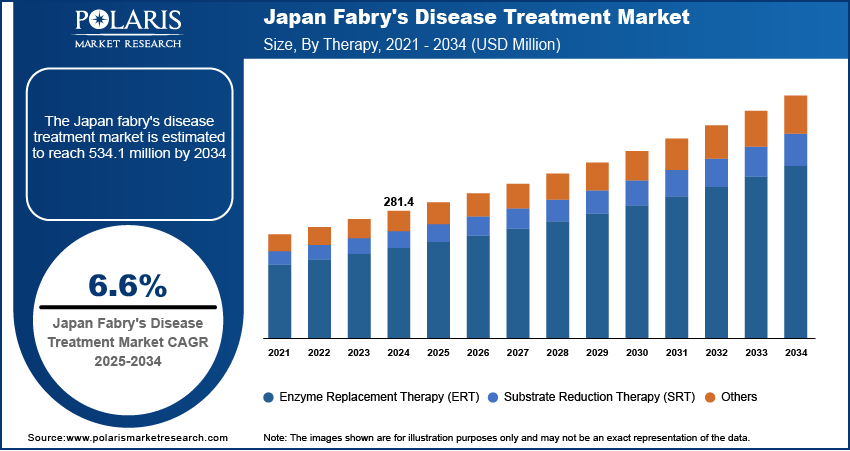

Japan Fabry Disease Treatment Market

The Fabry disease treatment market in Japan was valued at approximately USD 130 million in 2024 due to strong institutional frameworks supporting rare disease management and a well-developed healthcare infrastructure. A long-standing tradition of early diagnosis and treatment initiation improves clinical outcomes and drives consistent therapeutic demand. Continued clinical research into more effective and less invasive therapies, along with the integration of personalized medicine, ensures the market remains dynamic. Collaborative efforts between regulatory agencies and pharmaceutical companies streamline the introduction of new treatments, improving patient access and boosting market growth across the forecast period.

India Fabry Disease Treatment Market

The Fabry disease treatment market in India is projected to register a CAGR of 7.6% from 2025 to 2034 due to rising healthcare investments, increasing adoption of advanced diagnostic technologies, and greater awareness of rare genetic disorders. Enhanced public-private healthcare collaborations are improving accessibility to specialized therapies, particularly in urban centers. More frequent participation in global clinical trials and regulatory momentum to include rare diseases under national health schemes are further strengthening market prospects. An expanding medical tourism sector and the entry of international pharmaceutical players offering cost-effective treatments also support the growing therapeutic footprint for Fabry disease in the country. For instance, in 2024, India reported a notable rise in the influx of medical tourists, with approximately 7.3 million individuals seeking healthcare services, reflecting an increase from 6.1 million in 2023. This growth highlights India's emerging as a destination for medical tourism, driven by advancements in healthcare infrastructure and a diverse range of affordable treatment options.

Key Players & Competitive Analysis Report

The Asia Pacific Fabry disease treatment industry is witnessing robust development, driven by increasing diagnostic rates, supportive rare disease policies, and expanding clinical research infrastructure. Industry analysis indicates growing interest from global and regional biopharma firms pursuing industry expansion strategies and strategic alliances to enhance access and affordability of enzyme replacement and substrate reduction therapies. Mergers and acquisitions involving local healthcare distributors and specialty care providers are streamlining market entry and post-merger integration processes.

Companies are investing in localized production, while technology advancements in gene therapy and biomarker-driven diagnostics are accelerating the shift toward precision medicine. Launches of next-generation oral formulations and improved intravenous biologics are transforming therapeutic outcomes and patient compliance. Regulatory flexibility and favorable reimbursement frameworks across major economies are further fueling adoption. Joint ventures focused on awareness campaigns and early screening initiatives are helping address under diagnosis challenges. The market competitive dynamics remain active, highlighting a strong pipeline and strategic focus on long-term sustainable treatment delivery.

List of Key Companies with Approved Drugs

- Chiesi Farmaceutici S.p.A.

- JCR Pharmaceuticals Co., Ltd.

- Protalix BioTherapeutics Inc.

- Sanofi

- Takeda Pharmaceutical

List of Companies with Drugs Under Clinical Trial Phase

- Amicus Therapeutics, Inc.

- Idorsia Pharmaceuticals Ltd.

- Idorsia Pharmaceuticals Ltd.

- ISU ABXIS Co., Ltd.

- Sangamo Therapeutics, Inc.

Asia Pacific Fabry Disease Treatment Industry Developments

In March 2024, CENTOGENE extended its collaboration with Takeda to improve access to genetic testing for patients affected by lysosomal storage disorders (LSDs). This partnership aims to advance genetic diagnostics, ensuring timely and accurate testing for effective disease management.

In March 2022, JCR and Sumitomo Dainippon Pharma formed a partnership for marketing alliance for the Agalsidase Beta BS I.V. infusion to treat Fabry disease in Japan.

Asia Pacific Fabry Disease Treatment Market Segmentation

By Route of Administration Outlook (Revenue USD Million, 2020–2034)

- Intravenous Route

- Oral Route

By Therapy Outlook (Revenue USD Million, 2020–2034)

- Enzyme Replacement Therapy (ERT)

- Substrate Reduction Therapy (SRT)

- Others

By Distribution Channel Outlook (Revenue USD Million, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook (Revenue USD Million, 2020–2034)

- China

- Japan

- India

- South Korea

- Taiwan

- Indonesia

- Malaysia

- Pakistan

- Rest of Asia Pacific

Asia Pacific Fabry Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 538.75 million |

|

Market Size Value in 2025 |

USD 577.53 million |

|

Revenue Forecast by 2034 |

USD 1,088.17 million |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Asia Pacific market size was valued at USD 538.75 million in 2024 and is projected to grow to USD 1,088.17 million by 2034.

The Asia Pacific market is projected to register a CAGR of 7.3% during the forecast period.

In 2024, China held the largest share due to rising awareness among healthcare professionals and patients.

A few of the key players are Amicus Therapeutics, Inc.; CANbridge Life Sciences Ltd.; Chiesi Farmaceutici S.p.A.; Idorsia Pharmaceuticals Ltd.; ISU ABXIS Co., Ltd.; JCR Pharmaceuticals Co., Ltd.; Protalix Biotherapeutics Inc.; Sangamo Therapeutics, Inc.; Sanofi; and Takeda Pharmaceutical.

In 2024, the intravenous route segment accounted for the largest share due to its primary method for delivering enzyme replacement therapy (ERT) in Fabry’s disease treatment.

In 2024, the enzyme replacement therapy (ERT) segment dominated the market share. This dominance is largely attributed to the extensive clinical evidence supporting ERT in managing both classic and atypical Fabry’s manifestations.