U.S. Aluminum Nitride Ceramic Heaters Market Size, Share, Trends, Industry Analysis Report

By Production Technology (Thin-Film, Thick-Film), By Power Output, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6171

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

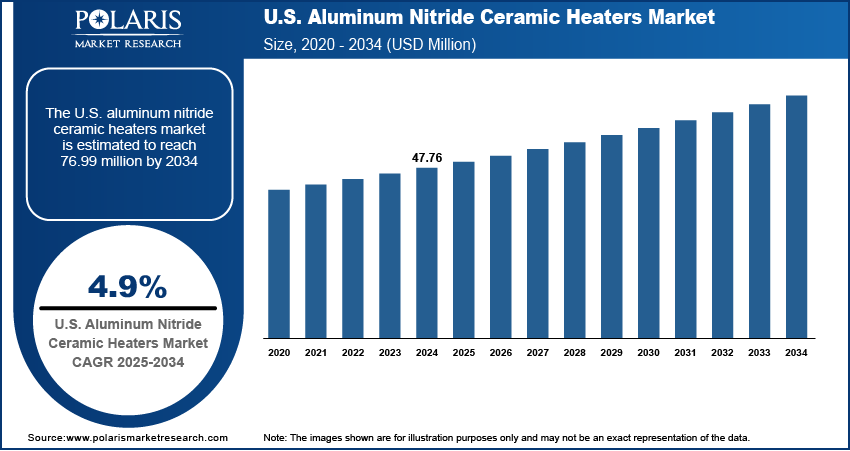

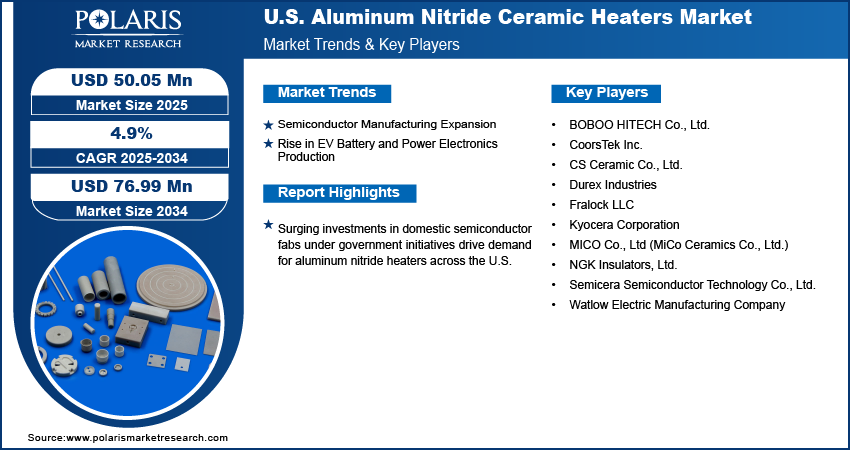

The U.S. aluminum nitride ceramic heaters market size was valued at USD 47.76 million in 2024, growing at a CAGR of 4.9% from 2025 to 2034. Surging investments in domestic semiconductor fabs under government initiatives is driving demand for aluminum nitride heaters. These components provide uniform heating critical to wafer processing, photoresist curing, and etching applications in next-gen chip production lines.

Key Insights

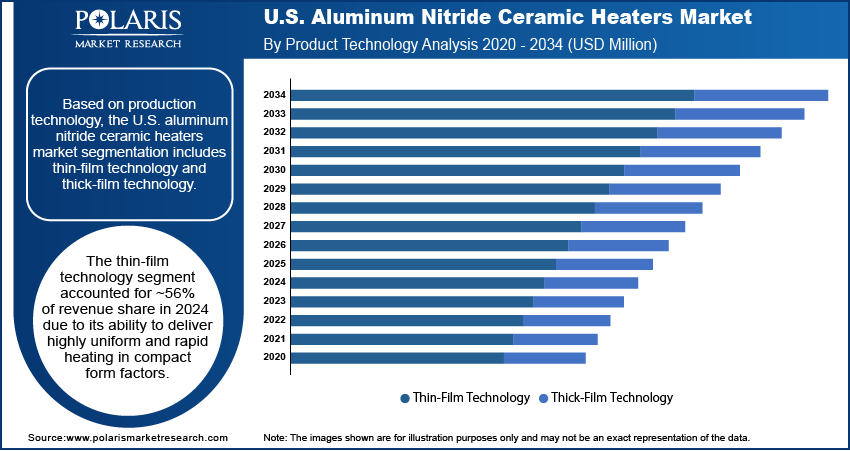

- The thin-film technology segment captured around 56% of the market in 2024, driven by its capability to provide rapid, uniform heating in miniaturized and high-efficiency heater designs.

- The standard-power heaters segment accounted for about 45% of the revenue share in 2024, due to their broad applicability in mid-range thermal management across industrial and commercial systems.

- The semiconductor equipment segment held ~35% of the market share in 2024, fueled by ongoing investments in domestic chip fabrication and advanced packaging facilities

Industry Dynamics

- Growing demand for high-performance thermal management in semiconductor and defense applications is driving the adoption of aluminum nitride ceramic heaters.

- Expansion of domestic semiconductor manufacturing under the CHIPS Act is boosting demand for precision heating solutions in advanced fabrication processes.

- Integration with AI-driven process control systems enables real-time temperature regulation in next-generation semiconductor and medical equipment.

- High material and production costs limit widespread adoption, especially among small-scale manufacturers and cost-sensitive industries.

Market Statistics

- 2024 Market Size: USD 47.76 million

- 2034 Projected Market Size: USD 76.99 Million

- CAGR (2025–2034): 4.9%

To Understand More About this Research: Request a Free Sample Report

The aluminum nitride ceramic heaters market refers to the industry focused on the production and distribution of high-performance heaters made from aluminum nitride (AlN) ceramic. These heaters are valued for their excellent thermal conductivity, electrical insulation, chemical resistance, and fast response times. They are widely used in semiconductor manufacturing, electronics, automotive, and industrial processing applications where uniform and precise heating is essential. The U.S. market is experiencing increased adoption due to demand for high-reliability components in advanced technologies and critical manufacturing environments.

Growth in minimally invasive surgical tools and diagnostic equipment is fueling use of compact, high-efficiency ceramic heaters. Aluminum nitride’s biocompatibility and cleanroom compatibility support stringent thermal requirements in medical device manufacturing and sterilization systems. Moreover, rising automation in industrial processes across the U.S. requires precision heating in robotics, sensors, and actuators. Aluminum nitride ceramic heaters deliver reliability under thermal stress and compact design suited for embedded heating applications in smart manufacturing systems.

Drivers & Opportunities

Semiconductor Manufacturing Expansion: Domestic semiconductor manufacturing in the U.S. is experiencing significant momentum, largely driven by government-backed initiatives and rising demand for advanced microelectronics. According to the Semiconductor Industry Association, in 2024, over 90 new semiconductor manufacturing initiatives were announced across the U.S. These projects represent nearly USD 450 billion in planned investments distributed across 28 states, highlighting a significant expansion in the domestic semiconductor supply chain. This expansion is directly impacting the need for high-performance thermal management solutions, including aluminum nitride ceramic heaters. These heaters deliver consistent and uniform heat distribution, which is essential for maintaining strict process control during wafer etching, deposition, and photoresist curing. Their excellent thermal conductivity and low thermal expansion make them suitable for cleanroom environments where even minor deviations can lead to defects. This precision and reliability have positioned aluminum nitride heaters as a preferred choice across new and upgraded semiconductor fabs.

Rise in EV Battery and Power Electronics Production: The acceleration of electric vehicle manufacturing across the U.S. is leading to increased demand for reliable, high-precision heating components used in battery module assembly and power electronics fabrication. Aluminum nitride ceramic heaters are emerging as essential components due to their ability to handle rapid temperature cycling while maintaining chemical stability. These heaters help maintain uniform heating profiles during bonding, lamination, and testing processes. Their electrical insulation, combined with high thermal conductivity, supports compact integration into automated EV production systems. As manufacturers seek to improve battery safety and energy efficiency, demand for these advanced heaters continues to rise across both new and retrofitted production lines.

Segmental Insights

Production Technology Analysis

Based on production technology, the segmentation includes thin-film technology and thick-film technology. The thin-film technology segment accounted for ~56% of revenue share in 2024 due to its ability to deliver highly uniform and rapid heating in compact form factors. This technique enables the deposition of fine resistor patterns on aluminum nitride substrates, allowing precise temperature control and fast thermal response. Its compatibility with semiconductor-grade cleanroom requirements and micro-scale fabrication makes it a preferred solution for wafer processing, photolithography, and inspection tools. Thin-film heaters also offer better energy efficiency and integration into miniaturized devices, supporting next-generation semiconductor production. These advantages continue to strengthen their adoption in high-precision, temperature-sensitive environments across critical U.S. industries.

The thick-film technology segment is expected to register a CAGR of 5.1% from 2025 to 2034 due to its suitability for robust, high-durability applications. This method involves screen-printing heating elements onto the aluminum nitride surface, offering strong adhesion and resistance to thermal and mechanical stress. It supports cost-effective production and simplified customization, which appeals to manufacturers requiring scalable, long-life solutions. Thick-film heaters are gaining traction in industrial settings where thermal consistency is essential under harsh operating conditions. The ability to support medium-to-high power output, combined with easier assembly, is encouraging broader adoption across automated equipment, power electronics, and heating systems where cost-performance balance is a priority.

Power Output Analysis

In terms of power output, the segmentation includes standard-power heaters, high-power heaters, and low-power heaters. The standard-power heaters segment accounted for ~45% of the revenue share in 2024 due to their versatility across mid-range thermal applications. These heaters deliver sufficient output for controlled heating in semiconductor test benches, analytical instrumentation, and precision assembly systems. They provide a reliable balance between energy consumption and performance without over engineering, making them ideal for large-scale use. Manufacturers prefer standard-power units for applications requiring consistent thermal regulation without high current loads. Their adaptability across various substrates and assembly environments has expanded their role in supporting mid-power heating processes across cleanrooms, diagnostic tools, and laboratory environments.

The high-power heaters segment is projected to register a CAGR of 5.2% from 2025 to 2034 due to their increasing relevance in high-demand applications. These heaters are engineered to maintain uniform heat distribution at elevated power levels, crucial in thermal shock testing, advanced materials research, and high-speed semiconductor fabrication. Their thermal stability and superior electrical insulation enable performance at extreme temperatures, reducing energy losses while ensuring product safety. High-power models are also integrated into aerospace and automotive manufacturing systems, where intense thermal cycles are frequent. Their growth is supported by rising investments in sectors demanding high throughput and precision under thermal stress.

Application Analysis

In terms of application, the segmentation includes semiconductor equipment, medical devices, aerospace components, automotive components, and others. The semiconductor equipment segment accounted for ~35% of the revenue share in 2024, driven by the ongoing expansion of domestic chip manufacturing capacity. Aluminum nitride ceramic heaters play a crucial role in wafer processing, deposition, and etching systems where precise and contamination-free thermal environments are mandatory. Their high thermal conductivity and resistance to chemical degradation allow integration into vacuum chambers and reaction vessels. Equipment manufacturers rely on these heaters to ensure yield consistency and process repeatability, especially as devices shrink to nanoscale dimensions. These performance traits, combined with the clean thermal profile of aluminum nitride, reinforce its critical role in advanced semiconductor toolsets.

The medical devices segment is projected to register a CAGR of 5.4% from 2025 to 2034, due to the rising adoption of aluminum nitride heaters in diagnostic, surgical, and therapeutic applications. These heaters offer fast response times and safe operation at tightly regulated temperatures, which are vital in blood analyzers, fluid warming devices, and DNA amplification systems. Their biocompatibility, non-reactivity, and ability to maintain accurate thermal profiles make them ideal for medical equipment where patient safety and precise thermal management are critical. Increasing demand for point-of-care testing devices and portable healthcare systems is further encouraging the integration of compact, efficient ceramic-based heaters.

End Use Analysis

In terms of end use, the segmentation includes industrial manufacturing, healthcare, and others. The industrial manufacturing segment accounted for ~60% of the revenue share in 2024 due to the widespread use of aluminum nitride ceramic heaters across diverse production processes. These heaters support tasks such as bonding, sealing, printing, and drying, where accurate and reliable heat is essential. Their resistance to thermal shock and harsh chemicals enables uninterrupted performance in continuous production lines. Manufacturers favor them for their longevity, quick heating, and ability to maintain tight thermal tolerances, especially in environments requiring stable temperature control. The segment’s dominance is reinforced by ongoing automation and process optimization trends driving precision thermal integration across manufacturing equipment.

The healthcare segment is projected to register a CAGR of 4.2% from 2025 to 2034 due to increasing reliance on high-performance thermal control in medical and diagnostic equipment. Aluminum nitride heaters are well-suited to sterile and sensitive environments, offering consistent and clean heat delivery for instruments used in labs, clinics, and hospitals. Applications range from PCR analyzers to infusion systems where reliability and rapid temperature cycling are essential. Miniaturization of medical devices and demand for compact components that operate safely under electrical load are encouraging healthcare OEMs to integrate ceramic-based heaters. Rising healthcare R&D and technological innovation continue to enhance growth potential within this segment.

Key Players & Competitive Analysis

The competitive landscape of the U.S. aluminum nitride ceramic heaters market is shaped by a combination of strategic alliances, targeted market expansion strategies, and ongoing technology advancements. Industry analysis indicates growing emphasis on thermal efficiency, miniaturization, and compatibility with advanced electronic systems, prompting firms to innovate product designs and production methods. Market participants are pursuing mergers and acquisitions to enhance their product portfolios and manufacturing capabilities, particularly to meet the rising demand from the semiconductor and medical sectors. Joint ventures and collaborative R&D efforts are fostering the development of next-generation heater solutions with faster thermal response and improved durability. Post-merger integration remains critical in consolidating distribution channels and optimizing cost structures across production units. Companies are also investing in automation and precision engineering to scale production of thin-film and thick-film technologies. These efforts are directed at strengthening U.S.-based manufacturing in alignment with reshoring trends and supply chain security priorities across electronics, healthcare, and industrial applications.

Key Players

- BOBOO HITECH Co., Ltd.

- CoorsTek Inc.

- CS Ceramic Co., Ltd.

- Durex Industries

- Fralock LLC

- Kyocera Corporation

- MICO Co., Ltd (MiCo Ceramics Co., Ltd.)

- NGK Insulators, Ltd.

- Semicera Semiconductor Technology Co., Ltd.

- Watlow Electric Manufacturing Company

U.S. Aluminum Nitride Ceramic Heaters Industry Developments

November 2025: Watlow and AEQT partnered to enhance energy efficiency and innovation in the chemical industry, with a focus on sustainable industrial processes.

October 2023: Kyocera International, Inc. expanded its semiconductor and microelectronic device assembly capabilities at its San Diego facility. This investment addresses the increasing demand for advanced domestic assembly solutions in the U.S. semiconductor industry.

U.S. Aluminum Nitride Ceramic Heaters Market Segmentation

By Production Technology Outlook (Revenue, USD Million, 2020–2034)

- Thin-Film Technology

- Thick-Film Technology

By Power Output Outlook (Revenue, USD Million, 2020–2034)

- Standard-Power Heaters

- High-Power Heaters

- Low-Power Heaters

By Application Outlook (Revenue, USD Million, 2020–2034)

- Semiconductor Equipment

- Medical Devices

- Aerospace Components

- Automotive Components

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Industrial Manufacturing

- Healthcare

- Others

U.S. Aluminum Nitride Ceramic Heaters Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 47.76 million |

|

Market Size in 2025 |

USD 50.05 million |

|

Revenue Forecast by 2034 |

USD 76.99 million |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 47.76 million in 2024 and is projected to grow to USD 76.99 million by 2034.

The U.S. market is projected to register a CAGR of 4.9% during the forecast period.

A few of the key players in the market are BOBOO HITECH Co., Ltd.; CoorsTek Inc.; CS Ceramic Co., Ltd.; Durex Industries; Fralock LLC; Kyocera Corporation; MICO Co., Ltd (MiCo Ceramics Co., Ltd.); NGK Insulators, Ltd.; Semicera Semiconductor Technology Co., Ltd.; and Watlow Electric Manufacturing Company.

The thin-film technology segment accounted for ~56% of revenue share in 2024 due to its ability to deliver highly uniform and rapid heating in compact form factors.

The standard-power heaters segment accounted for ~45% of the revenue share in 2024 due to their versatility across mid-range thermal applications.