South Korea Microgrid Market Size, Share, Trends, Industry Analysis Report

By Power Source (Natural Gas, CHP, Solar PV, Diesel, Fuel Cell, Others), By Product, Application– Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6143

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

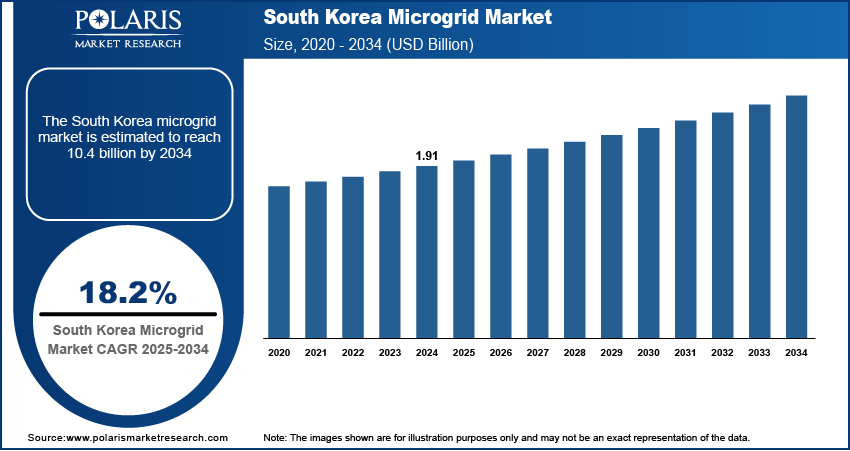

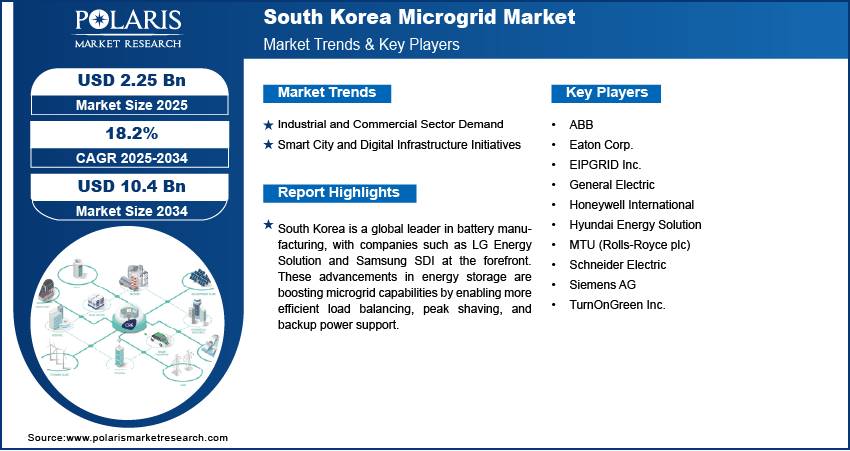

The South Korea microgrid market size was valued at USD 1.91 billion in 2024, growing at a CAGR of 18.2% from 2025 to 2034. The market growth is driven by the rising demand from industrial and commercial sector and increasing focus on smart city and digital infrastructure initiatives.

Key Insights

- In 2024, the CHP segment dominated with the largest share due to the country’s rising emphasis on energy efficiency and reducing carbon emissions.

- The remote segment is expected to experience the fastest growth during the forecast period as remote systems provide a self-sufficient and resilient solution as the country works to ensure reliable power for isolated or infrastructure-limited regions.

Industry Dynamics

- Increasing demand from the Industrial and commercial sector drives the adoption of microgrids.

- Rising focus on smart city and digital infrastructure initiatives is fueling the industry growth.

- The presence of major battery manufacturers is boosting microgrid capabilities by enabling more efficient load balancing, peak shaving, and backup power support.

- High initial investment costs and complex regulatory approvals restrain widespread adoption of microgrid systems.

Market Statistics

- 2024 Market Size: USD 1.91 billion

- 2034 Projected Market Size: USD 10.4 billion

- CAGR (2025–2034): 18.2%

To Understand More About this Research: Request a Free Sample Report

A microgrid is a localized energy system that can operate independently or in coordination with the main power grid. It typically includes distributed energy resources such as solar panels, batteries, generators, and control systems to produce, store, and manage electricity. Microgrids enhance energy reliability, reduce dependence on centralized grids, and support sustainability by integrating renewable energy sources.

South Korea is increasing its reliance on renewable energy sources such as solar and wind to reduce carbon emissions. Microgrids provide an efficient solution for integrating these intermittent energy sources, offering grid stability and reliability. The government’s Renewable Energy 3020 Implementation Plan, which aims to increase renewables’ share to 20% by 2030, supports the expansion of distributed energy systems, including microgrids. This transition is especially important in urban and industrial zones where local generation can reduce transmission losses and enhance energy efficiency. As a result, the rising focus on renewable energy integration propels microgrid adoption in South Korea.

South Korea is a global leader in battery manufacturing, with companies such as LG Energy Solution and Samsung SDI at the forefront. These advancements in energy storage are boosting microgrid capabilities by enabling more efficient load balancing, peak shaving, and backup power support. Lower battery costs and higher performance levels make microgrids more feasible for residential and industrial applications. South Korea’s technological edge and production capacity directly support the scalability and reliability of microgrid installations nationwide as energy storage is a critical component of any microgrid, thereby driving the growth.

Drivers and Opportunities

Industrial and Commercial Sector Demand: South Korea’s dense industrial base, including electronics, automotive, and manufacturing sectors, requires reliable and high-quality power. Microgrids help these industries manage energy costs, reduce carbon footprints, and avoid production downtime caused by power outages. Companies are increasingly investing in private microgrid systems to achieve energy efficiency and meet corporate sustainability goals. In industrial clusters and smart factories, microgrids are becoming an essential part of energy management strategies. This growing demand from the commercial and industrial sector is driving the growth.

Smart City and Digital Infrastructure Initiatives: South Korea is investing heavily in smart city projects as part of its broader digital transformation strategy. Microgrids play a vital role in these initiatives, enabling the management of localized energy production, smart metering, and demand-response systems. Cities such as Songdo and Sejong are notable examples where microgrids are being integrated into urban planning for enhanced energy efficiency and sustainability. Microgrids offer the flexibility and intelligence required to support these technologies with the rise of electric vehicles, 5G networks, and IoT-based infrastructure. This alignment with smart city goals is accelerating microgrid deployment across the country, thereby fueling the growth.

Segmental Insights

Power Source Analysis

The South Korea microgrid market segmentation, based on power source, includes natural gas, CHP, solar PV, diesel, fuel cell, and others. In 2024, the CHP segment dominated with the largest share due to the country’s emphasis on energy efficiency and reducing carbon emissions. CHP systems offer both electricity and thermal energy from a single fuel source, making them highly efficient and cost-effective. South Korea’s dense urban centers and industrial operations benefit greatly from the dual utility of CHP, particularly in regions with limited space for renewable energy infrastructure. Additionally, government initiatives to decarbonize energy while ensuring supply stability have further propelled the adoption of CHP-based microgrids in commercial and public facilities, thereby driving the segment growth.

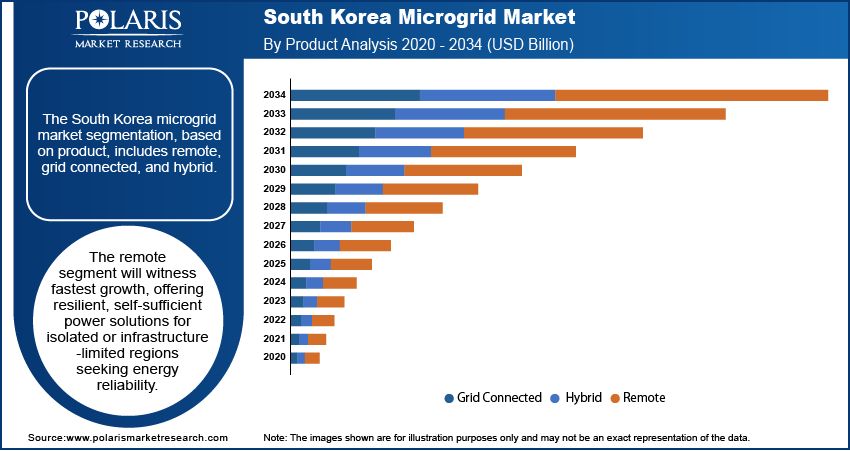

Product Analysis

The South Korea microgrid market segmentation, based on product includes remote, grid connected, and hybrid. The remote segment is expected to experience the fastest growth during the forecast period as remote systems provide a self-sufficient and resilient solution as the country works to ensure reliable power for isolated or infrastructure-limited regions. Islands and rural areas in South Korea, especially those with harsh weather or terrain challenges, benefit from microgrids that operate independently of the main grid. The government's focus on regional energy autonomy and disaster preparedness, along with the increasing cost-effectiveness of renewables and storage, is encouraging investments in remote microgrid projects across the country, thereby driving the segment growth.

Key Players and Competitive Analysis

The South Korea microgrid market is moderately consolidated, with both international and domestic players contributing to its growth and innovation. A few major technology providers such as ABB, Eaton Corp., General Electric, Honeywell International, Schneider Electric, and Siemens AG maintain a strong presence through their advanced energy solutions and smart grid technologies. These companies bring proven capabilities in grid integration, automation, and renewable energy management. Local firms such as Hyundai Energy Solution and EIPGRID Inc. are also key players, focusing on region-specific deployments and government-backed energy initiatives. MTU (Rolls-Royce plc) supports the market with efficient power systems, especially for industrial applications. TurnOnGreen Inc. adds further diversity through EV infrastructure integration into microgrid systems. These players compete on technological innovation, system reliability, scalability, and service customization. As South Korea accelerates its renewable energy transition and energy decentralization, competition is expected to intensify, especially in remote and island grid projects.

Key Players

- ABB

- Eaton Corp.

- EIPGRID Inc.

- General Electric

- Honeywell International

- Hyundai Energy Solution

- MTU (Rolls-Royce plc)

- Schneider Electric

- Siemens AG

- TurnOnGreen Inc.

South Korea Microgrid Industry Developments

In March 2024, EIPGRID acquired Mirae & Hwangyung (FE) and launched its community energy service on Jeju Island, marking its official entry into the VPP + EaaS ecosystem and expanding its portfolio into load aggregation and innovative distributed energy resource applications.

South Korea Microgrid Market Segmentation

By Power Source Outlook (Revenue, USD Billion, 2020–2034)

- Natural Gas

- CHP

- Solar PV

- Diesel

- Fuel Cell

- Others

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Remote

- Grid Connected

- Hybrid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Government

- Education

- Commercial

- Utility

- Defense

- Others

South Korea Microgrid Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.91 Billion |

|

Market Size in 2025 |

USD 2.25 Billion |

|

Revenue Forecast by 2034 |

USD 10.4 Billion |

|

CAGR |

18.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.91 billion in 2024 and is projected to grow to USD 10.4 billion by 2034.

The market is projected to register a CAGR of 18.2% during the forecast period.

A few of the key players in the market are ABB, Eaton Corp., EIPGRID Inc., General Electric, Honeywell International, Hyundai Energy Solution, MTU (Rolls-Royce plc), Schneider Electric, Siemens AG, and TurnOnGreen Inc.

The CHP segment dominated the market share in 2024.

The remote segment is expected to witness the fastest growth during the forecast period.