South Korea Aluminum Nitride Ceramic Heaters Market Size, Share, Trends, Industry Analysis Report

By Production Technology (Thin-Film, Thick-Film), By Power Output, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6169

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

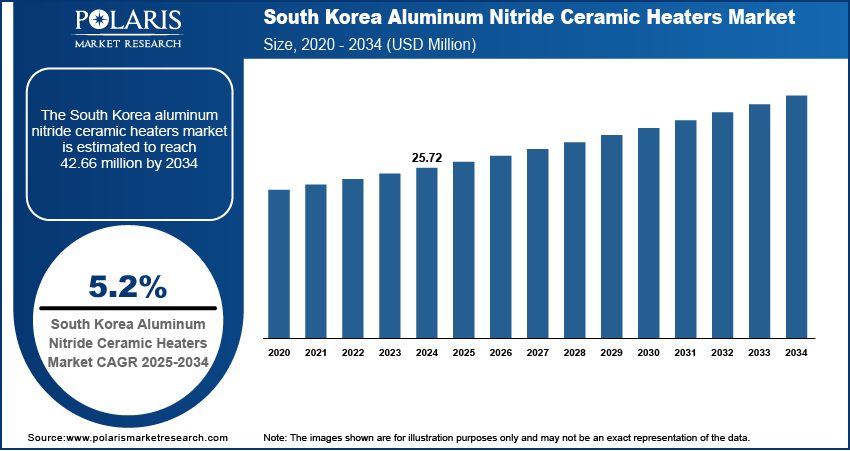

The South Korea aluminum nitride ceramic heaters market size was valued at USD 25.72 million in 2024, growing at a CAGR of 5.2% from 2025 to 2034. Growing investments in next-generation semiconductor fabs by major chipmakers are driving demand for aluminum nitride ceramic heaters across the country.

Key Insights

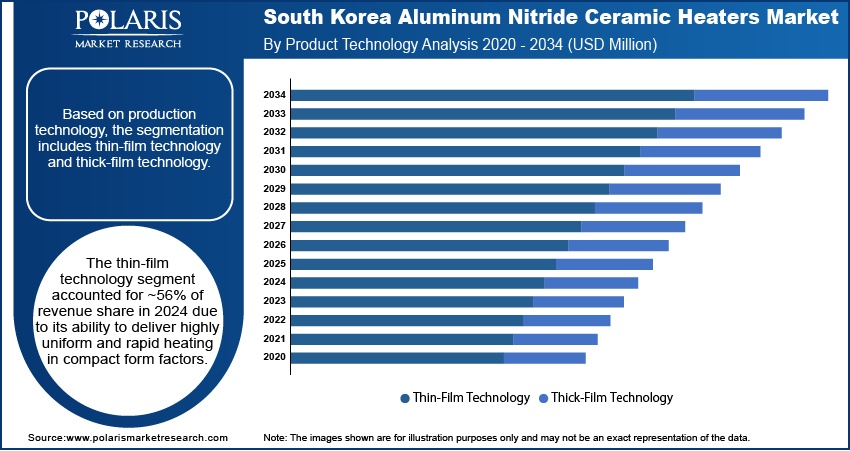

- The thin-film technology segment held ~56% of the revenue share in 2024, owing to its exceptional thermal precision and compact design, essential for space-constrained and high-performance applications.

- The medical devices segment is projected to register a CAGR of 5.4% from 2025 to 2034, supported by South Korea’s advancements in healthcare technology and growing exports of medical equipment.

Industry Dynamics

- Strong presence of global semiconductor and display manufacturers in South Korea drives demand for high-precision, thermally efficient ceramic heating components.

- Government support for advanced materials development and smart manufacturing accelerates R&D and local production of aluminum nitride-based components.

- Growing use in EV battery production lines and next-gen displays creates new demand for reliable, high-temperature stable heating solutions.

- Intense competition and tight supply chains make it difficult for new entrants to gain market share in the established ecosystem.

Market Statistics

- 2024 Market Size: USD 25.72 million

- 2034 Projected Market Size: USD 42.66 million

- CAGR (2025–2034): 5.2%

To Understand More About this Research: Request a Free Sample Report

The aluminum nitride ceramic heaters market refers to the industry focused on the production and distribution of high-performance heaters made from aluminum nitride (AlN) ceramic. These heaters are valued for their excellent thermal conductivity, electrical insulation, chemical resistance, and fast response times. They are widely used in semiconductor manufacturing, electronics, automotive, and industrial processing applications where uniform and precise heating is essential. A well-developed domestic medical device sector is increasingly utilizing aluminum nitride heaters in applications such as surgical tools, diagnostic systems, and sterilization equipment. Their compact footprint and biocompatibility make them suitable for precise thermal management in sensitive and high-reliability medical environments.

Growth in the aerospace industry, especially in avionics and defense electronics, is contributing to rising demand for high-reliability thermal components. Aluminum nitride ceramic heaters are preferred in critical aerospace applications where thermal shock resistance, rapid heat-up times, and consistent temperature distribution are necessary. Moreover, Growth in optoelectronic device manufacturing, such as lasers and photonic sensors, is creating demand for heaters capable of maintaining stable temperatures in confined spaces. Aluminum nitride ceramics offer excellent heat dissipation and minimal outgassing, supporting consistent optical alignment and performance in high-end optical assemblies.

Drivers & Opportunities

Government Support for Smart Manufacturing: The South Korean government is actively promoting smart manufacturing through various national strategies aimed at enhancing productivity, automation, and digital transformation in key industries. This push toward Industry 4.0 has created significant demand for advanced components that support precision and efficiency in automated systems. Aluminum nitride ceramic heaters are being widely adopted in this environment due to their ability to provide uniform, localized heating with high thermal stability. These heaters are now integral to robotic arms, high-speed assembly lines, and temperature-sensitive production equipment. Their reliability and performance in high-temperature settings support consistent output and enable the manufacturing of smaller, more complex components with tight tolerances.

Strong EV Battery Production Ecosystem: South Korea has emerged as a major hub for electric vehicle battery manufacturing, supported by leading battery producers and strong supply chain infrastructure. In 2024, according to the Ministry of Trade, Industry and Energy (MOTIE), South Korea’s battery production capacity reached 620 GWh, with plans to increase to 900 GWh by 2026 to meet rising global EV demand. As the industry scales production to meet global EV demand, the need for precise thermal control during battery assembly has grown. Aluminum nitride ceramic heaters are becoming essential in this context as they provide fast, stable heating with high thermal conductivity and minimal contamination risk. These features make them suitable for applications such as cell welding, electrolyte filling, and bonding in cleanroom environments. Their durability and chemical resistance enhance equipment lifespan while maintaining the strict quality standards required in battery module production.

Segmental Insights

Production Technology Analysis

Based on production technology, the South Korea aluminum nitride ceramic heaters market segmentation includes thin-film technology and thick-film technology. The thin-film technology segment accounted for ~56% of revenue share in 2024 due to its superior thermal precision and compact structure, which are critical in applications where space and heat control are tightly managed. In South Korea’s advanced electronics and semiconductor sectors, thin-film aluminum nitride ceramic heaters are widely used in wafer processing, inspection equipment, and microfabrication tools. These heaters offer fast response times and stable heating profiles, supporting the production of highly sensitive components. Their ability to deliver consistent performance under demanding operational conditions makes them a preferred choice in high-value manufacturing environments where reliability and accuracy are key.

Application Analysis

In terms of application, the South Korea aluminum nitride ceramic heaters market is segmented into semiconductor equipment, medical devices, aerospace components, automotive components, and others. The medical devices segment is projected to register a CAGR of 5.4% from 2025 to 2034, driven by South Korea’s rising healthcare innovation and export-oriented medical equipment production. Aluminum nitride ceramic heaters are increasingly used in diagnostic instruments, fluid warming systems, and surgical equipment that require biocompatible, fast-response, and sterilizable heating solutions. These heaters ensure thermal safety and precise temperature control, which are critical in sensitive clinical applications. Their chemical inertness and ability to function in compact designs align with the miniaturization trend in medical technology. The push toward higher-performance diagnostic and therapeutic tools is fostering steady adoption in this segment.

Key Players & Competitive Analysis

The competitive landscape of the South Korea aluminum nitride ceramic heaters market is shaped by strong emphasis on technology advancements, efficient thermal management, and integration into high-precision applications such as semiconductors and EV batteries. Industry analysis indicates that manufacturers are pursuing market expansion strategies by diversifying product portfolios tailored to emerging Industry 4.0 needs and high-performance electronics. Joint ventures between local fabricators and international material science companies are gaining traction to enhance domestic supply capabilities and address advanced engineering requirements. Strategic alliances are being used to strengthen R&D capabilities, enabling innovation in thin-film and high-power heater formats. Mergers and acquisitions are contributing to consolidation and production scale-up, allowing firms to optimize cost structures and accelerate technology transfer. Post-merger integration strategies focus on combining specialized expertise in ceramics, microelectronics, and automation to deliver superior heating solutions. Competitive positioning is increasingly linked to precision, reliability, and ability to serve fast-evolving cleanroom and manufacturing environments.

Key Players

- BOBOO HITECH Co., Ltd.

- CoorsTek Inc.

- CS Ceramic Co., Ltd.

- Durex Industries

- Fralock LLC

- Kyocera Corporation

- MICO Co., Ltd (MiCo Ceramics Co., Ltd.)

- NGK Insulators, Ltd.

- Semicera Semiconductor Technology Co., Ltd.

South Korea Aluminum Nitride Ceramic Heaters Industry Developments

October 2023: Kyocera International, Inc. expanded its semiconductor and microelectronic device assembly capabilities at its San Diego facility. This investment addresses the increasing demand for advanced domestic assembly solutions in the South Korea semiconductor industry.

South Korea Aluminum Nitride Ceramic Heaters Market Segmentation

By Production Technology Outlook (Revenue, USD Million, 2020–2034)

- Thin-Film

- Thick-Film

By Power Output Outlook (Revenue, USD Million, 2020–2034)

- Standard-Power Heaters

- High-Power Heaters

- Low-Power Heaters

By Application Outlook (Revenue, USD Million, 2020–2034)

- Semiconductor Equipment

- Medical Devices

- Aerospace Components

- Automotive Components

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Industrial Manufacturing

- Healthcare

- Others

South Korea Aluminum Nitride Ceramic Heaters Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 25.72 million |

|

Market Size in 2025 |

USD 27.03 million |

|

Revenue Forecast by 2034 |

USD 42.66 million |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The South Korea market size was valued at USD 25.72 million in 2024 and is projected to grow to USD 42.66 million by 2034.

The South Korea market is projected to register a CAGR of 5.2% during the forecast period.

A few of the key players in the market are BOBOO HITECH Co., Ltd.; CoorsTek Inc.; CS Ceramic Co., Ltd.; Durex Industries; Fralock LLC; Kyocera Corporation; MICO Co., Ltd (MiCo Ceramics Co., Ltd.); NGK Insulators, Ltd.; and Semicera Semiconductor Technology Co., Ltd.

The thin-film technology segment accounted for ~56% of revenue share in 2024 due to its ability to deliver highly uniform and rapid heating in compact form factors.

The medical devices segment is projected to register a CAGR of 5.4% from 2025 to 2034, driven by South Korea’s rising healthcare innovation and export-oriented medical equipment production.