Germany Aluminum Nitride Ceramic Heaters Market Size, Share, Trends, Industry Analysis Report

By Production Technology (Thin-Film, Thick-Film), By Power Output, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6170

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

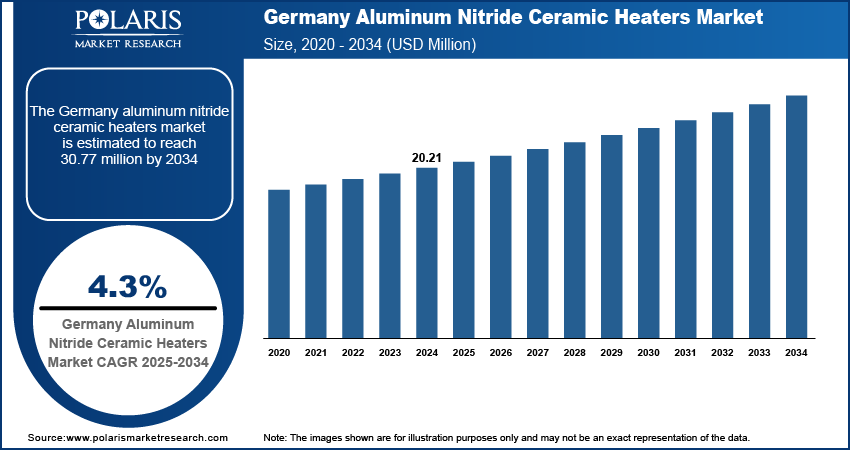

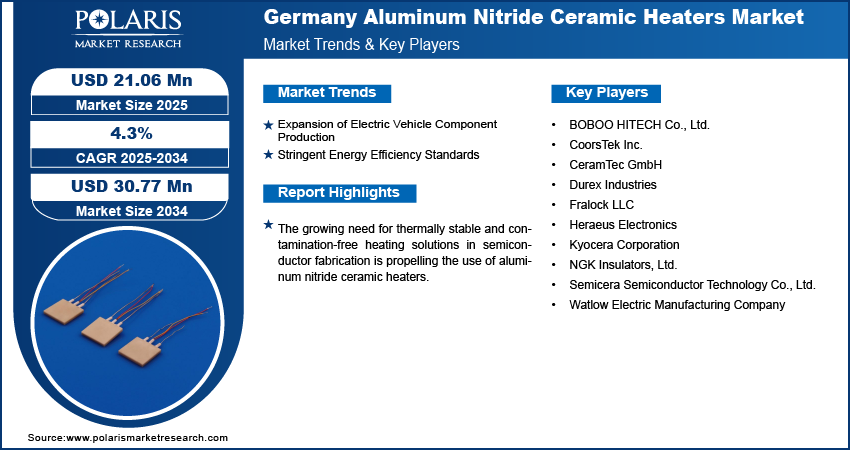

The Germany aluminum nitride ceramic heaters market size was valued at USD 20.21 million in 2024, growing at a CAGR of 4.3% from 2025 to 2034. Growing need for thermally stable and contamination-free heating solutions in semiconductor fabrication is propelling the use of aluminum nitride ceramic heaters. Their superior thermal conductivity and chemical resistance make them ideal for maintaining precise thermal control in wafer processing, deposition, and etching equipment, driving sustained adoption across fabs and OEMs.

Key Insights

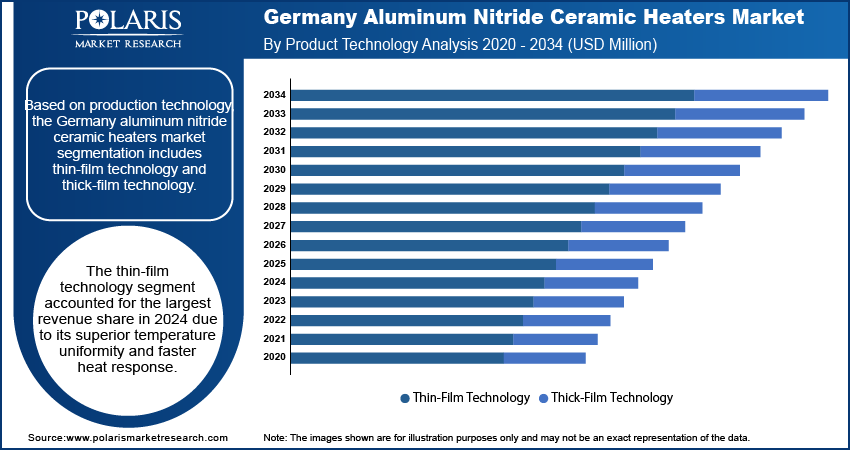

- The thin-film technology segment captured the largest revenue share in 2024, driven by its excellent temperature uniformity and rapid heat response in precision applications.

- The medical devices segment is projected to register the highest CAGR from 2025 to 2034, fueled by rising demand for compact and high-performance thermal solutions in diagnostic and therapeutic equipment.

Industry Dynamics

- Growing demand for high-precision thermal management in semiconductor and industrial automation drives the adoption of aluminum nitride ceramic heaters in Germany.

- Rising electric vehicle (EV) production and power electronics manufacturing boost demand for reliable, high-performance ceramic heating solutions across German industry.

- Integration with Industry 4.0 systems enables smart, real-time controlled heating for advanced manufacturing and process optimization in high-tech sectors.

- Stringent environmental and material compliance regulations increase development costs and slow down product approvals for new ceramic heater technologies.

Market Statistics

- 2024 Market Size: USD 20.21 million

- 2034 Projected Market Size: USD 30.77 million

- CAGR (2025–2034): 4.3%

To Understand More About this Research: Request a Free Sample Report

The Germany aluminum nitride ceramic heaters market refers to the industry focused on the production and distribution of high-performance heaters made from aluminum nitride (AlN) ceramic. These heaters are valued for their excellent thermal conductivity, electrical insulation, chemical resistance, and fast response times. They are widely used in semiconductor manufacturing, electronics, automotive, and industrial processing applications where uniform and precise heating is essential. Germany’s strong med-tech ecosystem is driving the demand for heaters that offer compactness, rapid thermal cycling, and biocompatibility. Aluminum nitride heaters are being integrated into diagnostic cartridges, surgical tools, and microfluidic devices where sterilization and thermal precision are essential, further reinforcing their importance in healthcare applications.

Industries involved in high-precision assembly and inspection processes require heaters that offer localized heating without compromising component quality. Aluminum nitride heaters meet these specifications, enabling defect-free thermal bonding, material processing, and calibration operations, especially in optics, MEMS, and laser-based systems, accelerating their deployment in advanced production setups. Moreover, the shift toward digitally connected factories has intensified the need for intelligent thermal control systems. Aluminum nitride ceramic heaters, capable of integration with temperature sensors and feedback mechanisms, are well-suited for smart automation platforms, enabling real-time control and predictive maintenance in smart assembly lines.

Drivers & Opportunities

Expansion of Electric Vehicle Component Production: The rising focus on electric vehicle manufacturing is pushing the demand for advanced thermal management technologies. In 2023, the European Environment Agency reported that approximately 20% of newly registered passenger vehicles in Germany were battery electric vehicles (BEVs). Aluminum nitride ceramic heaters are becoming essential in battery systems, electronic control units, and sensor housings due to their fast and even heating performance. These heaters can endure rapid temperature shifts without cracking or degrading, making them reliable for use in harsh automotive environments. Their compact design also allows for easy integration into limited spaces within battery packs and drivetrains. As Germany continues to strengthen its position in electric mobility, manufacturers are actively incorporating these heaters into production lines to ensure efficiency and performance.

Stringent Energy Efficiency Standards: Germany’s commitment to energy conservation and carbon reduction is prompting industries to adopt more energy-efficient heating solutions. Aluminum nitride ceramic heaters are gaining traction because they provide fast and uniform heat with minimal energy waste. Their low thermal mass helps achieve desired temperatures quickly, reducing overall power consumption during operations. These heaters also support precise temperature control, which helps lower heating errors and material wastage in production. As EU policies push for greater energy optimization across industrial processes, companies are transitioning from traditional heating elements to advanced ceramic technologies. This shift is encouraging long-term growth in applications that demand energy-conscious solutions.

Segmental Insights

Production Technology Analysis

Based on production technology, the Germany aluminum nitride ceramic heaters market segmentation includes thin-film technology, and thick-film technology. The thin-film technology segment accounted for the largest revenue share in 2024 due to its superior temperature uniformity and faster heat response. This technology allows precise deposition of heating elements directly onto the ceramic substrate, ensuring close thermal contact and high efficiency. Industries such as semiconductors and aerospace benefit from its micro-scale accuracy and ability to maintain temperature stability during delicate operations. Manufacturers prefer thin-film heaters for their compact design, ease of integration, and enhanced thermal performance in space-constrained applications. Consistent investments in high-precision manufacturing processes are supporting the adoption of thin-film-based ceramic heaters across critical equipment lines.

Application Analysis

In terms of application, the Germany aluminum nitride ceramic heaters market segmentation includes semiconductor equipment, medical devices, aerospace components, automotive components, and others. The medical devices segment is projected to register the highest CAGR from 2025 to 2034 due to the growing demand for compact, high-performance thermal solutions in diagnostic and therapeutic equipment. Aluminum nitride ceramic heaters offer sterile, rapid, and stable heating in devices such as analyzers, infusion pumps, and surgical tools. Their biocompatibility and electrical insulation make them ideal for direct integration into sensitive medical environments where temperature control is vital. Rising demand for portable and minimally invasive devices is prompting manufacturers to shift toward lightweight, energy-efficient heating components. Continuous innovation in healthcare technologies is opening new application areas for these ceramic heaters, accelerating growth in this segment.

Key Players and Competitive Analysis

The competitive landscape of the Germany aluminum nitride ceramic heaters market is shaped by a strong focus on technology advancements and market expansion strategies aimed at meeting the precision heating demands of advanced manufacturing sectors. Industry analysis reveals that companies are heavily investing in research and development (R&D) to improve heater efficiency, thermal uniformity, and integration flexibility across applications such as semiconductors, aerospace, and medical devices.

Strategic alliances and joint ventures are becoming central to accessing niche expertise and extending product portfolios. Mergers and acquisitions are used to consolidate supply chains and gain market share, followed by deliberate post-merger integration processes to streamline operations and unify technological capabilities. Market players are also forming cross-border collaborations to support regional demand shifts and broaden distribution networks. Emphasis on cleanroom manufacturing, automation compatibility, and miniaturization is driving competition, while continuous upgrades in thin-film deposition and ceramic processing techniques are reinforcing product differentiation across the competitive landscape.

Key Players

- BOBOO HITECH Co., Ltd.

- CoorsTek Inc.

- CeramTec GmbH

- Durex Industries

- Fralock LLC

- Heraeus Electronics

- Kyocera Corporation

- NGK Insulators, Ltd.

- Semicera Semiconductor Technology Co., Ltd.

- Watlow Electric Manufacturing Company

Germany Aluminum Nitride Ceramic Heaters Market Segmentation

By Production Technology Outlook (Revenue, USD Million, 2020–2034)

- Thin-Film Technology

- Thick-Film Technology

By Power Output Outlook (Revenue, USD Million, 2020–2034)

- Standard-Power Heaters

- High-Power Heaters

- Low-Power Heaters

By Application Outlook (Revenue, USD Million, 2020–2034)

- Semiconductor Equipment

- Medical Devices

- Aerospace Components

- Automotive Components

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Industrial Manufacturing

- Healthcare

- Others

Germany Aluminum Nitride Ceramic Heaters Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 20.21 million |

|

Market Size in 2025 |

USD 21.06 million |

|

Revenue Forecast by 2034 |

USD 30.77 million |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Germany market size was valued at USD 20.21 million in 2024 and is projected to grow to USD 30.77 million by 2034.

The Germany market is projected to register a CAGR of 4.3% during the forecast period.

A few of the key players in the market are BOBOO HITECH Co., Ltd.; CoorsTek Inc.; CeramTec GmbH; Durex Industries; Fralock LLC; Heraeus Electronics; Kyocera Corporation; NGK Insulators, Ltd.; Semicera Semiconductor Technology Co., Ltd.; and Watlow Electric Manufacturing Company.

The thin-film technology segment accounted for the largest revenue share in 2024 due to its superior temperature uniformity and faster heat response.

The medical devices segment is projected to register the highest CAGR from 2025 to 2034 due to the growing demand for compact, high-performance thermal solutions in diagnostic and therapeutic equipment.