Automated Feeding Systems Market Size, Share, Trend & Industry Analysis Report

: By Component (Hardware, Software, and Services), By System, By Livestock, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5850

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

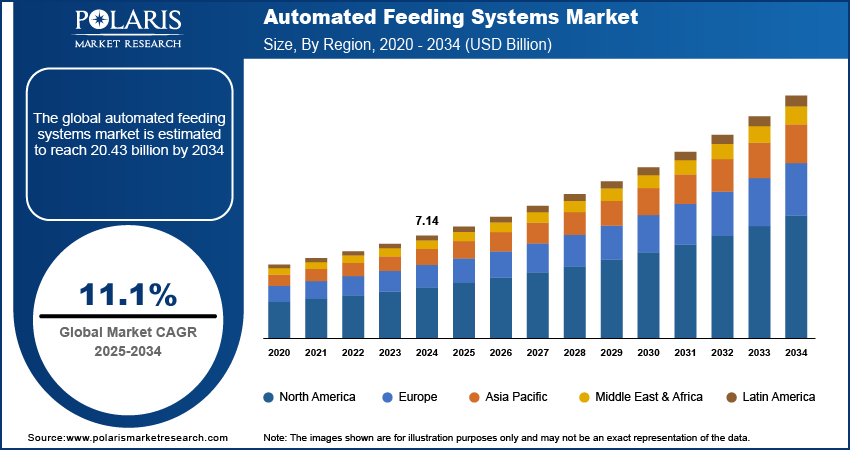

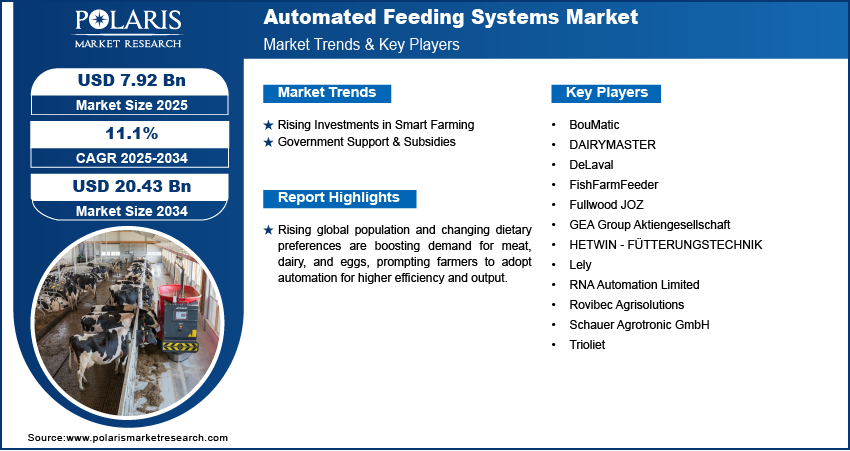

The global automated feeding systems market size was valued at USD 7.14 billion in 2024 and is projected to grow at a CAGR of 11.1% during 2025–2034. Rising global population and changing dietary preferences are boosting demand for meat, dairy, and eggs, prompting farmers to adopt automation for higher efficiency and output.

Market refers to the development, manufacturing, and distribution of technologically advanced systems that automate the process of feeding livestock, poultry, aquaculture, and pets. These systems enhance efficiency, accuracy, and consistency in delivering feed, improving productivity and reducing manual labor. Declining availability of farm labor due to urbanization and shifting workforce trends is driving the adoption of automated systems to maintain operational continuity and reduce dependency on manual labor.

To Understand More About this Research: Request a Free Sample Report

Automated systems ensure timely and accurate feeding, contributing to better animal health and welfare, which aligns with evolving consumer expectations and regulatory standards. Additionally, innovations such as IoT, artificial intelligence, and cloud monitoring systems are enhancing the functionality of feeding systems, making them more attractive to large- and small-scale farmers alike.

Market Dynamics

Rising Investments in Smart Farming

Rising investments in smart farming are playing a key role in advancing the automated feeding systems market. For instance, the US Department of Agriculture allocated USD 1.5 billion to finance 92 partnership initiatives aimed at enhancing conservation efforts and promoting climate-smart agricultural practices. This investment aligns with the strategic objectives of the Biden-Harris administration's Investing in America agenda, emphasizing the integration of sustainability and resilience within the agricultural sector. Venture capital firms and institutional investors are increasingly backing agri-tech startups focused on automation, precision livestock farming, and data-driven solutions. These investments are enabling rapid development of advanced feeding technologies that integrate sensors, artificial intelligence, and IoT platforms. Startups are using this funding to refine system performance, improve cost-efficiency, and expand their market reach. In turn, this capital influx is helping farmers adopt automated solutions that optimize feeding schedules, reduce labor costs, and enhance animal health. Strong investor interest also signals growing confidence in the long-term profitability and scalability of smart farming technologies, which is expected to further accelerate innovation and market growth.

Government Support & Subsidies

Government support and subsidies are another important driver behind the growth of automated feeding systems. Many agricultural ministries and rural development agencies are offering financial assistance programs that cover part of the cost for adopting advanced machinery, including automated feeders. These initiatives are aimed at improving farm productivity, animal welfare, and environmental sustainability. Farmers benefit from reduced upfront investment costs, making it easier to transition from manual processes to automated systems. In some regions, technical training and advisory services are also provided to promote technology adoption. This policy-backed push encourages modernization and also supports broader goals such as food security and efficient resource management. As government programs continue to prioritize agricultural automation, adoption of intelligent feeding technologies is expected to rise steadily in both large-scale and smallholder farms.

Segment Insights

Market Assessment by Component

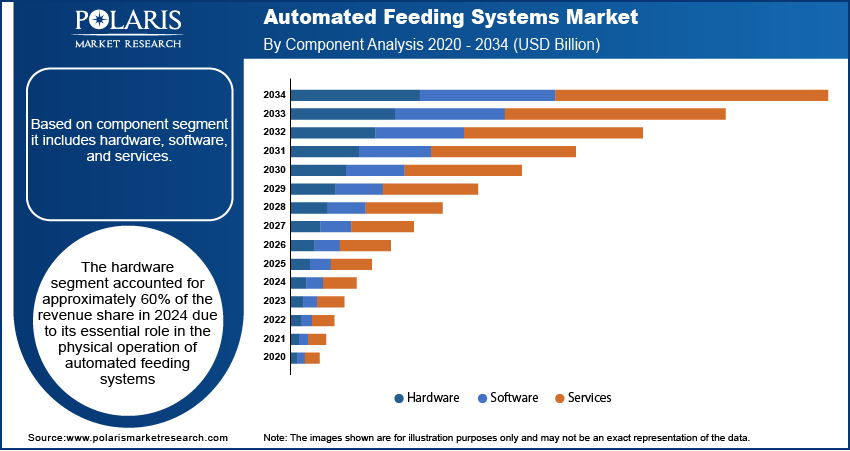

Based on component segment it includes hardware, software, and services. The hardware segment accounted for approximately 60% of the revenue share in 2024 due to its essential role in the physical operation of automated feeding systems. This includes feeding robots, silos, mixers, dispensers, and control panels, all of which are necessary for precise and consistent feed delivery. High initial investment in durable and efficient hardware components drives the segment’s dominance. Farmers prioritize reliable mechanical infrastructure that reduces manual labor and improves feeding accuracy. Continued innovations in sensor-equipped equipment and robotics are enhancing the effectiveness of hardware, reinforcing its demand across farms of all sizes. Equipment upgrades and replacements also contribute to recurring revenue.

The software segment is projected to grow at a CAGR of 12.1% from 2025 to 2034 due to rising demand for data-driven decision-making and real-time monitoring of livestock feeding behavior. Advanced software platforms enable farmers to analyze feed conversion rates, animal growth patterns, and feed inventory levels. Integration with IoT devices and cloud-based systems allows seamless automation and remote operation of feeding equipment. Demand for customizable interfaces, predictive analytics, and mobile applications is increasing, particularly in large-scale and precision farming setups. The shift toward smart farming is pushing investment in software solutions that maximize productivity while maintaining sustainability and animal welfare.

Market Assessment by System

Based on system segment it includes rail-guided, conveyor, and self-propelled. The conveyor segment accounted for approximately 45% of the revenue share in 2024, driven by its widespread use in intensive livestock operations where feed needs to be distributed quickly and uniformly across multiple feeding stations. Conveyor-based systems offer high throughput, operational reliability, and ease of integration with other feeding machinery. These systems are particularly effective in large barns and feedlots where consistency in delivery timing and quantity is critical. Farmers prefer conveyors for their minimal maintenance requirements and long service life, especially in ruminant and swine applications. Their compatibility with automated control systems further enhances feeding efficiency and labor savings.

The self-propelled segment is projected to register the fastest CAGR of 12.5% over the forecast period due to its ability to navigate independently and deliver feed with high precision. These systems are equipped with autonomous navigation, sensors, and smart control units that adapt to different barn layouts and animal densities. The flexibility to operate without fixed infrastructure, such as rails or tracks, makes them attractive for farms aiming to optimize mobility and space utilization. Growing interest in robotic feeding and labor-saving technologies is driving investment in self-propelled solutions, especially in regions facing workforce shortages. Their scalability and performance analytics capabilities also contribute to rising adoption.

Market Assessment by Livestock

Based on livestock segment it includes ruminants, poultry, swine, and others. The ruminants segment accounted for approximately 42% of the revenue share in 2024, driven by the high feed volumes and complex feeding schedules required for dairy and beef cattle. Automated systems help ensure consistent ration distribution, improving milk yield, weight gain, and overall herd health. Farmers managing large ruminant populations benefit from time savings and improved accuracy in feed mixing and delivery. Demand for systems that support total mixed ration (TMR) feeding is particularly strong. Precision feeding technologies are also becoming essential to meet sustainability goals by reducing feed waste and improving nutrient efficiency, making ruminants a key driver of market demand.

The poultry segment is projected to register the fastest CAGR of 11.9% over the forecast period due to increasing commercial poultry farming and the need for consistent, high-frequency feeding. Automated feeding systems in poultry operations improve flock uniformity, reduce feed spillage, and support round-the-clock management. These systems are designed for fast-paced environments and are integrated with climate and health monitoring tools. Adoption is growing in both broiler and layer farms, especially where biosecurity and production efficiency are top priorities. The rapid lifecycle of poultry and the demand for higher output per unit area are accelerating the shift toward automation across the poultry industry.

Regional Analysis

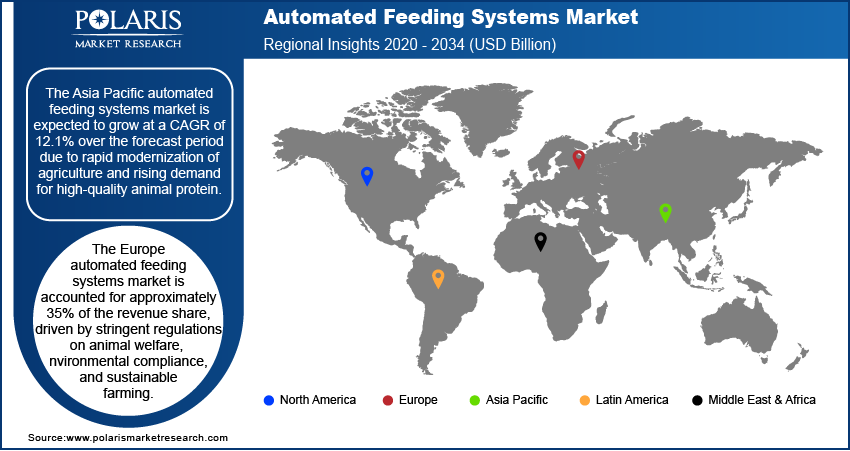

The North America automated feeding systems market is expected to grow at a CAGR of 11.5% over the forecast period due to increasing focus on labor efficiency and herd productivity. Large-scale livestock farms across the region are adopting automated solutions to address rising labor shortages and the need for precise feeding schedules. Strong demand for systems that integrate feed management with animal health monitoring is reshaping dairy and beef operations. Technological advancements and improved access to digital farm platforms are also encouraging investment in smart feeding infrastructure. Moreover, awareness campaigns are promoting sustainable livestock farming practices and optimized resource utilization.

US Automated Feeding Systems Market

The US automated feeding systems market is expected to grow significantly with a CAGR of 11% over the forecast period, supported by the expansion of intensive livestock operations and the adoption of precision farming tools. Farmers are increasingly relying on autonomous systems that reduce feed wastage and maintain consistent nutritional intake for animals. Financial incentives provided by local and federal agricultural programs are helping ease the cost of transitioning to automation. Demand for self-propelled feeders and intelligent software platforms is rising, particularly in the dairy and swine industries. Strong innovation ecosystems and domestic technology providers are also boosting product availability and customization options for US-based farms.

Asia Pacific Automated Feeding Systems Market

The Asia Pacific automated feeding systems market is expected to grow at a CAGR of 12.1% over the forecast period due to rapid modernization of agriculture and rising demand for high-quality animal protein. Countries in the region are shifting from traditional methods to automated processes to increase productivity, particularly in dairy and poultry sectors. Growing urban populations are driving pressure on livestock producers to deliver more consistent and hygienic food outputs. Government initiatives supporting smart farming practices are accelerating the deployment of intelligent feeding solutions. For instance, according to the World Economic Forum, The AI for Agriculture Innovation initiative held workshops in India to help farmers access AI tools for more efficient farming. In Khammam district, this initiative transformed chili farming through bot advisory services, AI-based quality testing, and a digital marketplace. Technological adoption is also being supported by the rise of agri-tech startups and expanding investment in digital infrastructure across rural regions.

China Automated Feeding Systems Market

China automated feeding systems market accounted for the largest revenue share in the Asia Pacific in 2024, fueled by large-scale commercial farms, rapid industrialization of agriculture, and strong domestic manufacturing capabilities. High demand for protein-rich diets is pushing livestock producers to enhance efficiency and production capacity through automated solutions. The integration of sensors, robotics, and AI into feeding systems is gaining traction in both the dairy and swine sectors. Supportive policies and agricultural subsidies are encouraging small and medium farms to adopt modern technologies. Local equipment providers are actively innovating to offer cost-effective and customized solutions, which further contributes to market expansion in the country.

Europe Automated Feeding Systems Market

The Europe automated feeding systems market is accounted for approximately 35% of the revenue share, driven by stringent regulations on animal welfare, environmental compliance, and sustainable farming. European livestock producers are prioritizing automation to ensure precise feed distribution, reduce emissions, and comply with regulatory standards. High adoption of smart dairy and meat production technologies is supported by government-backed sustainability initiatives and funding programs. For instance, in April 2025, the European Union has unveiled a significant USD 99.06 million investment aimed at advancing long-term initiatives focused on climate change mitigation and environmental sustainability. This funding is directed towards projects that will enhance ecological resilience, promote clean energy solutions, and support sustainable development practices across member states. Demand for software-integrated feeders that offer data analytics and real-time performance tracking is growing across several countries. Innovation in robotic feeding and modular systems tailored for diverse farm sizes is also strengthening the region’s leadership in the global automated feeding landscape.

Key Players & Competitive Analysis Report

The competitive landscape of the automated feeding systems market is shaped by a combination of aggressive market expansion strategies, product innovation, and increasing collaboration across key agricultural technology sectors. Industry analysis reveals that companies are focusing on strategic alliances and joint ventures to penetrate emerging markets and strengthen regional distribution capabilities. Mergers and acquisitions are being used to consolidate market presence and integrate complementary technologies, particularly in areas like sensor integration, IoT-enabled feeding platforms, and robotic automation. Post-merger integration efforts are centered around streamlining supply chains and enhancing system compatibility across livestock management operations. Technology advancements in precision feeding, mobile-guided units, and AI-based feed optimization are helping companies differentiate their offerings in a competitive landscape.

Rising demand for labor-efficient solutions and sustainable livestock farming practices is driving investments in smart software platforms and energy-efficient machinery. Customization and modularity in system design are gaining attention to meet varied farm sizes and species-specific feeding needs. The shift toward digital agriculture and automated livestock monitoring continues to influence product development strategies, while government incentives and global food security goals are encouraging rapid adoption. Companies are aligning R&D priorities with market needs, particularly in predictive feeding technologies, automation scalability, and remote operation capabilities.

List of Key Companies

- BouMatic

- DAIRYMASTER

- DeLaval

- FishFarmFeeder

- Fullwood JOZ

- GEA Group Aktiengesellschaft

- HETWIN - FÜTTERUNGSTECHNIK

- Lely

- RNA Automation Limited

- Rovibec Agrisolutions

- Schauer Agrotronic GmbH

- Trioliet

Automated Feeding Systems Industry Developments

In September 2024, Lely launched the Juno Max, an advanced autonomous feed pusher designed for large-scale farms. With advanced navigation and obstacle detection, the Juno Max efficiently distributes feed across multiple barns and feeding lanes, enhancing feed management and integrating smoothly into existing workflows.

In March 2023, DeLaval introduced the OptiWagon, an autonomous feed distribution robot designed to work with its Optimat automated feeding system. The robot, linked to the DeLaval DelPro farm management platform, offered efficient and adaptable feeding for different animal groups, delivering feed up to twelve times daily.

Automated Feeding Systems Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Hardware

- Software

- Services

By System Outlook (Revenue USD Billion, 2020–2034)

- Rail-Guided

- Conveyor

- Self-Propelled

By Livestock Outlook (Revenue USD Billion, 2020–2034)

- Ruminants

- Poultry

- Swine

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automated Feeding Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.14 billion |

|

Market Size Value in 2025 |

USD 7.92 billion |

|

Revenue Forecast by 2034 |

USD 20.43 billion |

|

CAGR |

11.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.14 billion in 2024 and is projected to grow to USD 20.43 billion by 2034.

The global market is projected to register a CAGR of 11.1% during the forecast period.

The Europe automated feeding systems market is accounted for approximately 35% of the revenue share, driven by stringent regulations on animal welfare, environmental compliance, and sustainable farming.

A few of the key players includes are BouMatic, DAIRYMASTER, DeLaval, FishFarmFeeder, Fullwood JOZ, GEA Group Aktiengesellschaft, HETWIN - FÜTTERUNGSTECHNIK, Lely, RNA Automation Limited, Rovibec Agrisolutions, Schauer Agrotronic GmbH, Trioliet.

The hardware segment accounted for approximately 60% of the revenue share in 2024 due to its essential role in the physical operation of automated feeding systems.

The conveyor segment accounted for approximately 45% of the revenue share in 2024, driven by its widespread use in intensive livestock operations where feed needs to be distributed quickly and uniformly across multiple feeding stations.