Automated Suturing Devices Market Share, Size, Trends, Industry Analysis Report

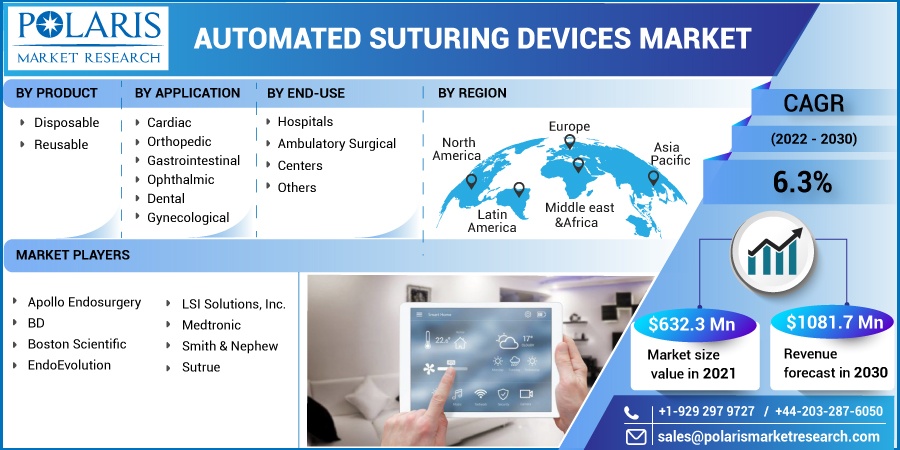

By Product (Disposable, Reusable); By End-Use (Hospitals, Ambulatory Surgical Centers, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 111

- Format: PDF

- Report ID: PM2252

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

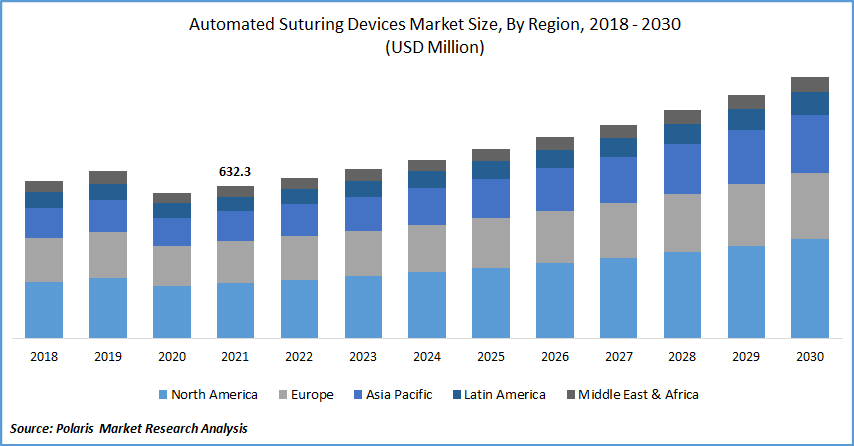

The global automated suturing devices market was valued at USD 632.3 million in 2021 and is expected to grow at a CAGR of 6.3% during the forecast period. One of the high-impact contributing variables driving an increase in demand for automated suturing devices is the growth in automobile accidents. According to the World Health Organization, around 1.3 million people whose lives are ended prematurely every year.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

As a result, a rise in the incidence of wound injury is leading to an increase in the number of wound operations, which is predicted to have a favorable long-term influence on the automated suturing devices market. Burn injuries, sports injuries, trauma, and fall injuries are among the other types of accidents. According to the American Burn Association, burn injuries accounted for roughly 44% of all hospital admissions. The majority of severe injuries necessitate surgical intervention, which contributes significantly to the market growth of automated suturing devices.

Besides, rising accidents are predicted to boost the number of surgical treatments and, as a result, the market's growth during the forecast period. According to the “WHO Global Report on Road Safety 2018”, India accounted for about 11% of all accident-related deaths in the world. With such a large number, the automated suturing devices industry is bound to grow.

According to the 2019 Road Accident Report, around 449,002 accidents occurred in the country in the calendar year 2019, resulting in 151,113 deaths and 451,361 injuries. The number of accidents declined by 3.86 percent in 2019 compared to the previous year, while accident-related mortality decreased by 0.20 percent and the number of people injured decreased by 3.86 percent. Thus, the rise in accidents and injuries has led to an increased demand for the automated suturing devices industry.

However, there is a danger of postsurgical problems in senior persons, which may impede growth to a lesser amount. During the projection period, low product availability, high device costs, and a scarcity of skilled specialists are projected to hinder the market expansion of automated suturing devices.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The automated suturing devices market has witnessed extensive developments in the last few decades, supported by factors such as the rising prevalence of chronic disease and rising demand for minimally invasive treatment. According to the Centers for Disease Control and Prevention (CDC), chronic disease affects 6 out of 10 people in the U.S. Also, around 4 out of 10 people have two or more chronic diseases in the US. The primary causes of death and disability and the $3.8 trillion in annual healthcare costs in the U.S.

Due to the obvious Tips program, 16.4 million cigarettes attempted to stop between 2012 and 2018, with 1 million succeeding. From 43.3 percent in 2005–2006 to 48.5 percent in 2015–2016, the proportion of adults who do have their high condition under control has increased. The National Diabetes Prevention Program change of lifestyle program has enlisted the help of almost 400,000 people. The rise in prevalence of the chronic disease across the globe and the reason for chronic diseases such as a change in lifestyle are the factors that are boosting the market growth of automated suturing devices during the forecast period.

Further, minimally invasive procedures such as endoscopic surgery, laparoscopic surgery, arthroscopy, bronchoscopy, and hysteroscopy have become more common as a result of the growth in chronic illnesses. As the geriatric population expands and the number of surgical procedures performed increases, the automated suturing devices industry is likely to expand. As the prevalence of obesity climbs, more people are opting for bariatric surgery. In bariatric and gastrointestinal procedures, automated suturing devices are used.

As a result, rising obesity rates are predicted to fuel market demand increase over the forecast period. The growing elderly population, together with the rising prevalence of CVD, will drive demand for less invasive treatments, propelling the automated suturing devices market forward. According to AgeingAsia.org, the number of people aged 60 and more in Vietnam was 11,988,000 in 2019 and is anticipated to climb to 29,841,000 by 2050.

In addition, the overall percentage of people aged 60 and up was 12.3% in 2019 and is predicted to climb to 27.2 percent by 2050. Similarly, Myanmar's geriatric population (those aged 60 and above) was 5,443,000 in 2019 and is anticipated to reach 62,253,000 by 2050. As a result of the expanding geriatric population in the United States, there is a higher demand for CVD therapy, boosting the market growth of automated suturing devices. Thus, the rise in minimally invasive treatment for various chronic diseases is the factor that is boosting the market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on product, application, end-use, and region.

|

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by End-Use

Based on the end-use segment, the hospital segment is expected to be the most significant revenue contributor in the global automated suturing devices industry in 2021 and is expected to retain its dominance in the foreseen period. The hospital segment's demand is being boosted by increasing the number of patients admitted to hospitals. In addition, hospitals' ease of access and availability over other settings and good reimbursement rules are projected to drive the market expansion of automated suturing devices. Handheld automated suturing devices are useful for closing wounds in limited locations, reducing hospital stay, and improving total recovery time.

Geographic Overview

In terms of geography, North America had the largest revenue share in 2021. Due to the growing geriatric population and the increasing number of surgical procedures. According to the US Government, the “Geriatric Surgery Verification (GSV) Program” of the American College of Surgeons (ACS) introduced 32 new medical standards aimed at systematically improving patient outcomes for the aging adult population.

Every day in the United States, 10,000 people reach the age of 65. According to the US Census Bureau, the number of older individuals would increase by 55 percent between 2010 and 2050, eventually accounting for 21 percent of the population. In the United States, older persons account for more than 40% of all inpatient operations and 33% of all outpatient procedures performed each year. This figure will climb as the population ages and the demand for surgical services rises at the same time. Besides, demand is likely to be fueled by a strong desire for robot-assisted minimally invasive operations and technological developments in automated suturing devices.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. The increasing burden of chronic diseases and rising consumer awareness are projected to propel the market in the area forward. According to the World Health Organization (WHO), the primary causes of death and disability are chronic diseases (such as cardiovascular disease, mental health disorders, diabetes, and cancer) and injuries in India.

With a population of nearly 1.3 billion people, India's illness burden is on the rise. Two different groups cause the majority of chronic diseases in India. The first is cardiovascular disease, which is largely found in the wealthier sections of society and is linked to overnutrition. The other is a diarrheal illness and lower respiratory tract infections, both of which point to undernourishment and poverty among the poor. Also, local businesses are launching strategic initiatives to develop and market new patient treatment options. As a result, the market growth of automated suturing devices is likely to accelerate.

Competitive Insight

Major players operating in the global automated suturing devices market include Apollo Endosurgery, BD, Boston Scientific, EndoEvolution, LSI Solutions, Inc., Medtronic, Smith & Nephew, and Sutrue.

Automated Suturing Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 632.3 million |

|

Revenue forecast in 2030 |

USD 1,081.7 million |

|

CAGR |

6.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Apollo Endosurgery, BD, Boston Scientific, EndoEvolution, LSI Solutions, Inc., Medtronic, Smith & Nephew, and Sutrue. |