Automotive Powertrain Systems Market Size, Share, Trends, Industry Analysis Report

: By Propulsion Type (Internal Combustion Engine and Electric Vehicle), Vehicles Type, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 126

- Format: PDF

- Report ID: PM1469

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

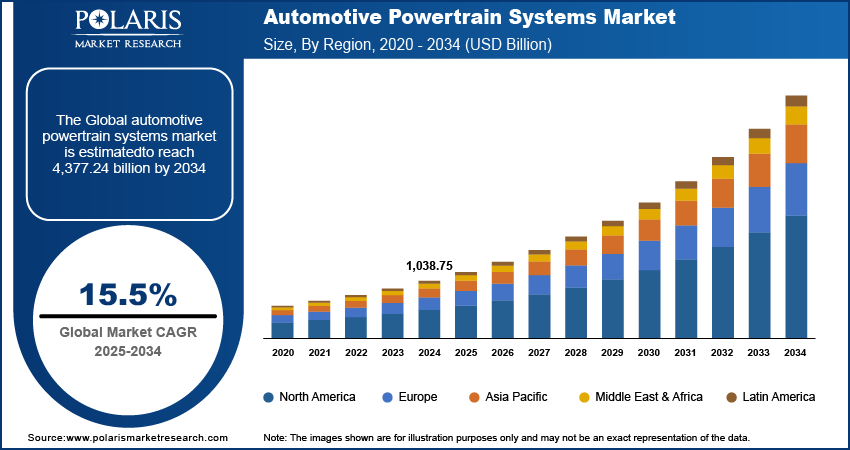

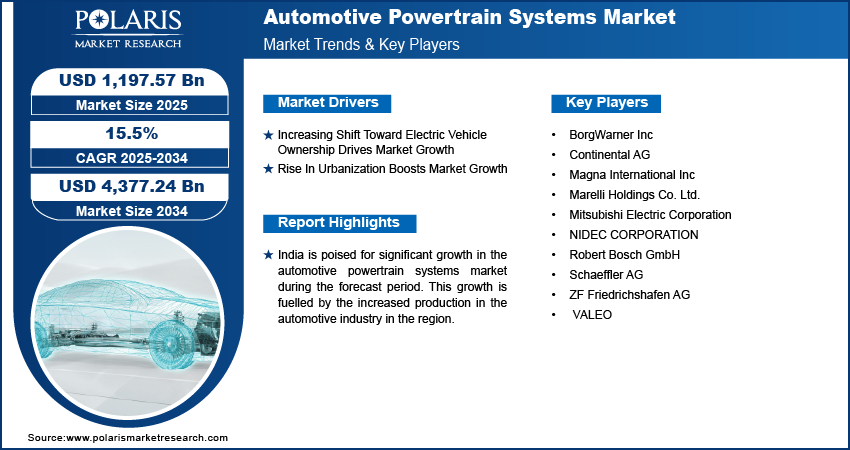

The automotive powertrain systems market size was valued at USD 1,038.75 billion in 2024. The market is projected to grow from USD 1,197.57 billion in 2025 to USD 4,377.24 billion by 2034, exhibiting a CAGR of 15.5% from 2025 to 2034.

The automotive powertrain system comprises the engine, transmission, driveshaft, differential, and axles, all of which work together to produce and transmit power to the wheels. In the case of electric and hybrid vehicles, power electronics and batteries are also integral components, responsible for managing and providing electrical energy. This system plays a critical role in converting engine power into vehicle motion.

Technological advancements are driving automotive powertrain systems market growth. Advanced engine management and transmission technologies are optimizing performance and fuel consumption. Turbocharging and direct fuel injection have further improved engine efficiency and power output, which increases their adoption. For instance, in March 2023, Nissan introduced a new strategy for developing electrified powertrains called "X-in-1." This approach involves sharing and modularizing core EV and e-POWER powertrain components, leading to a significant 30% reduction in cost and size. The X-in-1 strategy encompasses 3-in-1, 5-in-1, and potentially other variants, allowing EV and e-POWER core components to be manufactured on the same production line.

To Understand More About this Research: Request a Free Sample Report

The automotive powertrain systems market is driven by increasingly stringent emission safety regulations and standards. Governments globally are imposing increasingly rigorous standards to curtail greenhouse gas emissions and address air pollution. For instance, in December 2019, the European Commission announced the Green Deal, a comprehensive strategy aimed at achieving climate neutrality by 2050. As part of this initiative, the Commission has put forward a series of proposals designed to align the EU's climate, energy, transport, and taxation policies to reduce net greenhouse gas emissions by a minimum of 55% by 2030. Automakers are channeling significant investments into research and development to augment fuel efficiency and lower emissions through advanced technologies. Therefore, the increase in stringent emission standards and regulations by government and regulatory bodies is driving the market growth.

Market Trends and Drivers Analysis

Increasing Shift Toward Electric Vehicle Ownership

The rise in popularity of electric vehicles has resulted in an increased need for automotive powertrain systems. With consumers prioritizing environmental sustainability and seeking eco-friendly transport options, the demand for EVs has experienced a substantial upsurge, which is driving the market growth. For instance, in June 2021, according to the International Council on Clean Transportation (IEA), global electric vehicle (EV) sales surged to 6.9 million units, marking a 107% surge from the previous year. Notably, 98% of these sales comprised light-duty vehicles (LDVs), with the remaining 2% consisting of heavy-duty vehicles (HDVs). The expanding infrastructure for charging facilities is mitigating range anxiety and amplifying the feasibility of owning an electric vehicle. Thus, the increase in ownership of EVs is propelling the automotive powertrain systems market.

Rise In Urbanization

The increasing urbanization drives a significant shift in transportation requirements, leading to a rising demand for vehicles with advanced powertrains optimized for urban driving conditions. Many cities are implementing low-emission zones and providing incentives for electric and hybrid vehicles, further fueling their adoption. For instance, in October 2021, the Mayor of London extended the Ultra Low Emission Zone (ULEZ) to the perimeter of the North and South Circular roads. The expanded zone covers an area of 380 square kilometers, making it 18 times larger than its previous size. This expansion encompasses one-quarter of London and now includes nearly 4 million residents, making it the largest zone of its kind in Europe. This policy effectively encourages the transition to electric and hybrid vehicles. Therefore, the increasing urbanization is driving the automotive powertrain systems market.

Segment Analysis

Automotive Powertrain Systems Market Assessment by Propulsion Type Insights

The automotive powertrain systems market segmentation, based on propulsion type, includes internal combustion engine (ICE) and electric vehicle. The electric vehicle segment is estimated to grow at a significant CAGR during the forecast period due to the increasing consumer demand for sustainable transportation. Additionally, supportive government policies, including tax incentives and subsidies for EV purchases, are further encouraging consumers to opt for electric vehicles over traditional ICE models. For instance, in 2023, according to the International Energy Agency (IEA), there were 14 million new electric car registrations globally in 2023, with battery electric cars representing 70% of the electric car stock in that year. The expansion of charging infrastructure in urban areas is increasing the convenience of owning an electric vehicle. Therefore, the electric vehicle segment is driving the automotive powertrain systems market.

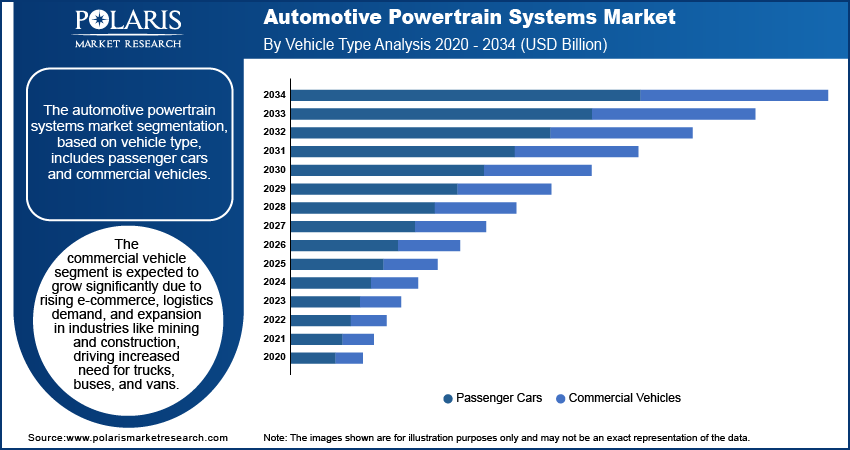

Automotive Powertrain Systems Market Evaluation by Vehicle Type Insights

The automotive powertrain systems market segmentation, based on vehicle type, includes passenger cars and commercial vehicles. The commercial vehicle segment is projected to register a significant CAGR in the global market due to the growing need for trucks, buses, and vans, which is mainly driven by the expansion of e-commerce, increased demands in logistics and transportation, and the growth of industries such as mining and construction. As e-commerce continues to expand, the requirement for efficient and dependable transportation solutions is escalating, leading to a larger fleet of commercial vehicles. The expansion of the commercial vehicle fleet is directly linked to a growing demand for reliable and efficient powertrain systems. For instance, in 2022, the European Automobile Manufacturers Association reported a global registration of approximately 15.9 million commercial vehicles, including vans, trucks, and buses. With the increase in demand, manufacturers are increasingly focusing on developing innovative and efficient powertrain solutions to enhance the performance and sustainability of commercial vehicles. Therefore, the commercial vehicles segment is driving the automotive powertrain systems market.

Automotive Powertrain Systems Market Breakdown by Regional Insights

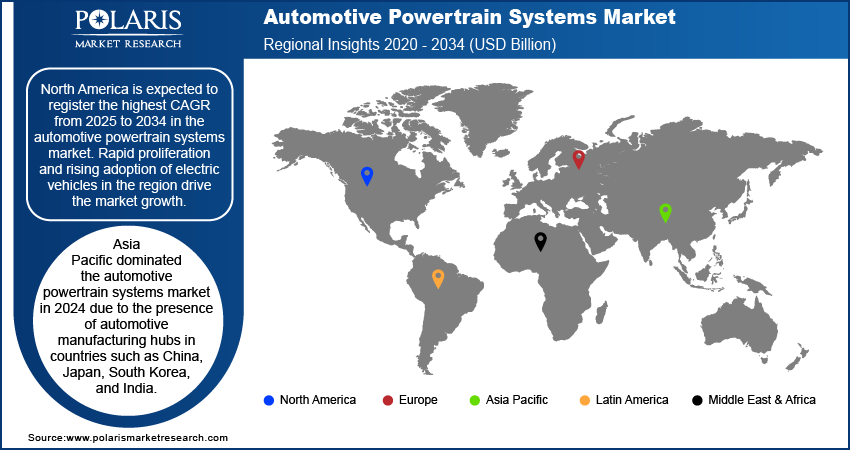

By region, the study provides the automotive powertrain systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest revenue share in the market in 2024 due to the expansion of automotive manufacturing hubs in countries like India, Japan, South Korea, and China, fueled by factors such as the expanding middle-class population, rapid urbanization, and increased vehicle ownership rates. For instance, according to the Oxford Institute for Energy Studies, in 2021, the Chinese automotive market saw the sale of 21 million new motor vehicles, with a notable increase in the market share for utility vehicles (UVs) and crossovers, which collectively accounted for 46% of total sales. The Chinese government's backing of the automotive industry, which encompasses providing subsidies for electric vehicles and allocating funds for infrastructure development, has significantly reinforced the industry's expansion. Therefore, the increase in the production of vehicles is fuelling the automotive powertrain systems market in Asia Pacific.

North America is projected to register a substantial CAGR from 2025 to 2034 due to the rapid proliferation and rising adoption of electric vehicles in the region, which are propelling the expansion of the automotive powertrain systems market. Furthermore, significant players are engaging in mergers and acquisitions to enhance their footprint in the global market within this region. For instance, in August 2023, First Brands Group, LLC., announced the completion of the acquisition of Horizon Global Corporation. The increase in mergers and acquisitions activities is propelling the automotive powertrain systems market in North America.

The automotive powertrain systems market in India is expected to experience significant growth due to increased production in the automotive industry. Vehicle manufacturers are increasing production to cater to consumer and commercial requirements, which will result in a parallel increase in the requirement for automotive powertrain systems. For instance, according to the Society of Indian Automobile Manufacturers (SIAM), in 2023, the overall production of vehicles reached the mark of 27.14 million in India, encompassing both passenger and commercial vehicles. Passenger vehicles accounted for 4.10 million of this totla. The significant production volume emphasizes India’s crucial position in the worldwide automotive industry and emphasizes the growing need for advanced powertrain systems. Therefore, the growing production of automotive vehicles in the region is anticipated to propel the automotive powertrain systems market growth.

Key Players & Competitive Analysis Report

The automotive powertrain systems market is a dynamic and rapidly evolving environment with several players striving to innovate and differentiate from each other. Major global companies are dominating the market by leveraging extensive research and development capabilities, advanced manufacturing technologies, and broad distribution networks to maintain a competitive edge. The players are engaged in strategic activities such as mergers and acquisitions, partnerships, and collaborations to enhance their portfolios and expand their market presence.

Additionally, startups are contributing to the market by introducing novel technologies in automotive powertrain systems. Major players in the automotive powertrain systems market include BorgWarner Inc., Continental AG, Magna International Inc., Marelli Holdings Co. Ltd., Mitsubishi Electric Corporation, NIDEC CORPORATION, Robert Bosch GmbH, Schaeffler AG, ZF Friedrichshafen AG, and VALEO.

Mitsubishi Electric Corporation, a Japanese company established in 1921, is a manufacturer of electrical and electronic equipment. The company specializes in advanced automotive systems, including powertrain control and driver-assistance technologies, aimed at improving vehicle safety and efficiency. In the field of industrial automation, Mitsubishi Electric provides solutions such as programmable logic controllers and robotics, which are instrumental in driving productivity across various sectors. The company has a presence in over 30 countries, with substantial operations in Japan, North America, Europe, and Asia. In May 2024, Mitsubishi Electric Corporation and Musashi Energy Solutions Co., Ltd., a subsidiary of Musashi Seimitsu Industry Co., Ltd., announced a partnership and co-development agreement for Innovative Energy Storage Devices to be incorporated into Innovative Energy Storage Modules and Battery Management Systems (BMSs) that monitor and control battery usage for railway operators and rolling stock manufacturers. This collaboration aims to deliver advanced energy storage solutions tailored to the specific needs of the railway industry.

Valeo, established in 1923, is an automotive supplier. Headquartered in Paris, the company boasts a robust global presence with over 150 plants and 60 research and development centers spanning across 30 countries. Valeo's diverse portfolio encompasses powertrain systems aimed at optimizing fuel efficiency and minimizing emissions, advanced comfort and driving assistance systems to enhance vehicle safety and convenience, as well as visibility systems including wipers and lighting technologies. Valeo is making substantial investments in electric powertrains, battery management, and charging solutions to drive sustainable mobility. In November 2023, Valeo announced that it would be supplying electric powertrains to Mahindra & Mahindra for its EV program. The powertrains will be used in a specific range of Mahindra & Mahindra's Born Electric passenger vehicle platform, along with onboard chargers for electric utility vehicles.

List of Key Companies

- BorgWarner Inc

- Continental AG

- Magna International Inc

- Marelli Holdings Co. Ltd.

- Mitsubishi Electric Corporation

- NIDEC CORPORATION

- Robert Bosch GmbH

- Schaeffler AG

- ZF Friedrichshafen AG

- VALEO

Market Developments

June 2024: Valeo and Dassault Systems forged a strategic partnership aimed at leveraging Dassault Systems’ Global Modular Platform and Smart, Safe & Connected industry solution experiences based on the 3DEXPERIENCE platform. The objective is to expedite the digital transformation of Valeo's research and development endeavors.

December 2023: Magna improved its automated driving capabilities by participating in NorthStar – Telia Sweden and Ericsson’s 5G innovation program for industrial enterprises. Under the terms of the agreement, Telia and Ericsson have established a dedicated, private 5G network at Magna’s test track in Sweden. This network serves as the testing ground for Advanced Driver Assistance System (ADAS) solutions, focusing on vehicle-to-vehicle (V2V) and vehicle-to-everything (V2X) connectivity.

Market Segmentation

By Propulsion Type Outlook (Revenue – USD Billion, 2020–2034)

- Internal Combustion Engine

- Gasoline

- Diesel

- Natural Gas Vehicle

- Electric Vehicle

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Cars

- Commercial Vehicles

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,038.75 billion |

|

Market Size Value in 2025 |

USD 1,197.57 billion |

|

Revenue Forecast in 2034 |

USD 4,377.24 billion |

|

CAGR |

15.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The automotive powertrain systems market size was valued at USD 1,038.75 billion in 2024 and is projected to grow to USD 4,377.24 billion by 2034.

The market is projected to grow at a CAGR of 15.5% from 2025 to 2034.

Asia Pacific had the largest share of the global market.

The key players in the market are BorgWarner Inc., Continental AG, Magna International Inc., Marelli Holdings Co. Ltd., Mitsubishi Electric Corporation, NIDEC CORPORATION, Robert Bosch GmbH, Schaeffler AG, ZF Friedrichshafen AG, and VALEO.

The electric vehicle segment is estimated to witness the fastest CAGR growth during the forecast period, driven by advancements in battery technology, growing environmental awareness, and supportive government policies promoting sustainable transportation.

The commercial vehicle segment is projected to account for a significant revenue share of the market due to the increasing demand for trucks, buses, and vans.