Automotive Transmission Market Size, Share, Trends, Industry Analysis Report

: By Transmission Type (Manual and Automatic), Fuel Type, Vehicle Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 119

- Format: PDF

- Report ID: PM1427

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Transmission Market Overview

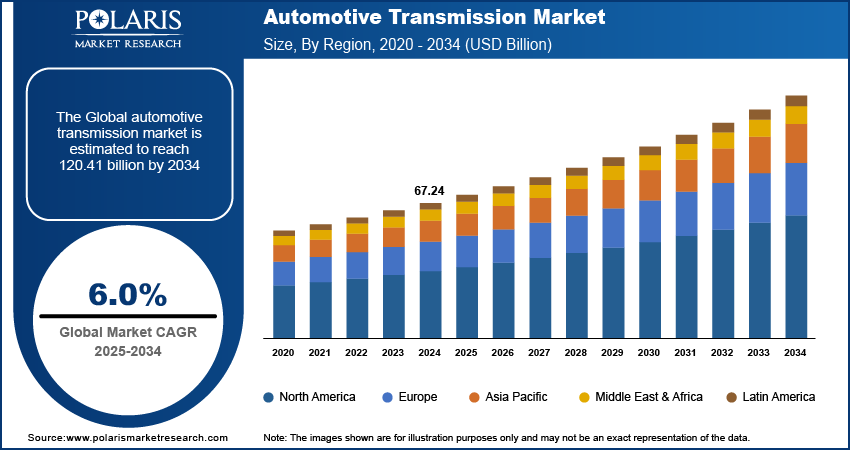

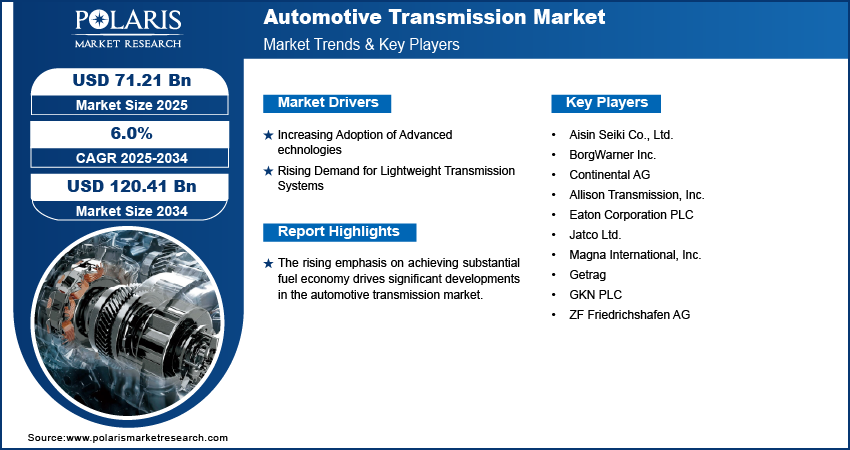

The global automotive transmission market size was valued at USD 67.24 billion in 2024. The market is projected to grow from USD 71.21 billion in 2025 to USD 120.41 billion by 2034, at a CAGR of 6.0% from 2025 to 2034.

The transmission system is a crucial component of automobiles that regulates the speed and torque of the drive wheels. Its functions include adjusting the gear ratio, enabling acceleration, reducing wear, and disconnecting the engine. Types of transmission systems are manual transmission and automatic transmission. A manual transmission needs human interference to shift gears, whereas an automatic transmission does not require manual efforts to change gears.

To Understand More About this Research: Request a Free Sample Report

The growing automotive industry and an increasing number of passenger and commercial vehicles are the key factors driving the automotive transmission market growth. In addition, the rising popularity of luxury vehicles and growing preference toward enhanced driving experience with high efficiency and improved fuel economy are having a favorable impact on the market expansion.

The rising emphasis on achieving substantial fuel economy drives significant developments in the automotive market. The growing adoption of hybrid vehicles, fueled by government initiatives and environmental concerns, presents substantial growth opportunities for market players. The automotive transmission market trends will be the development of personalized hybrid drive systems and the rise of car subscription services.

Automotive Transmission Market Dynamics

Increasing Adoption of Advanced Technologies

Passenger vehicles feature automatic transmission systems as they are easy to use and provide enhanced comfort. Also, the increasing traffic across the globe is prompting car owners to purchase vehicles with automated systems. As a result, major auto manufacturers are allocating substantial funding to research initiatives to develop automotive technologies that offer an enhanced driving experience. Therefore, the rapid use of advanced technologies, such as automatic transmission, in automobiles drives the automotive transmission market expansion.

Rising Demand for Lightweight Transmission Systems

Several governments worldwide have introduced regulations for carbon emissions, safety, and lightweight vehicles. These regulations have prompted original equipment manufacturers (OEMs) to use components that reduce the overall vehicle weight. OEMs are using lightweight materials such as magnesium, aluminum, and high-strength steel composites to reduce weight without compromising on durability or strength. In addition, advanced production processes such as 3D printing and additive manufacturing are enabling the development of complex vehicle parts such as transmission systems with lightweight designs. Thus, the growing demand for lightweight systems boosts the automotive transmission market development.

Automotive Transmission Market Segment Insights

Automotive Transmission Market Outlook by Transmission Type Insights

The automotive transmission market segmentation, based on transmission type, includes manual and automatic. The manual segment dominated the market with a larger revenue share of more than 51.5% in 2024. The growth is primarily attributed to the price differences that exist between manual and automatic transmission variations. Many consumers prefer manual transmission vehicles as they are more affordable than automatic variants. Also, manual transmission systems offer better mileage than automatic variants, as drivers can manually adjust gears to reduce fuel consumption.

Automotive Transmission Market Outlook by Fuel Type Insights

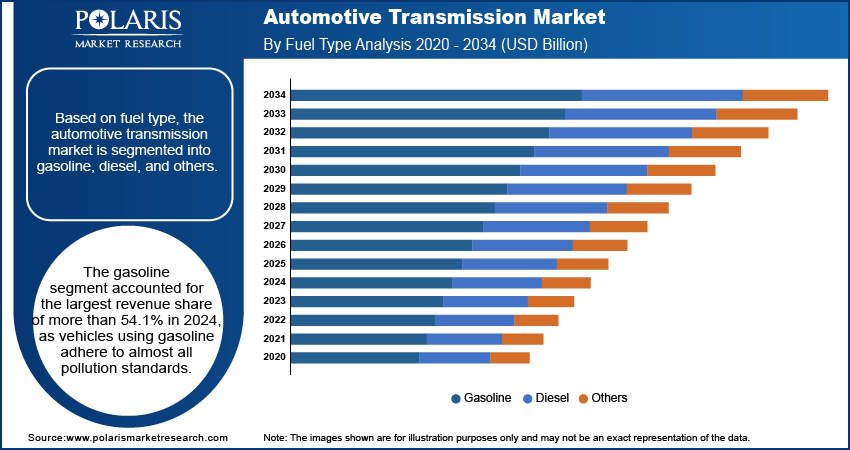

The automotive transmission market segmentation, based on fuel type, includes gasoline, diesel, and others. The gasoline segment accounted for the largest revenue share of more than 54.1% in 2024. Vehicles using gasoline adhere to almost all pollution standards. Also, they are efficient and emit less toxic gases into the environment as compared to their diesel counterparts. The growing demand for gasoline across major economies, such as India, China, and the US, further contributes to the automotive transmission market growth for the gasoline segment.

Automotive Transmission Market Outlook by Regional Analysis

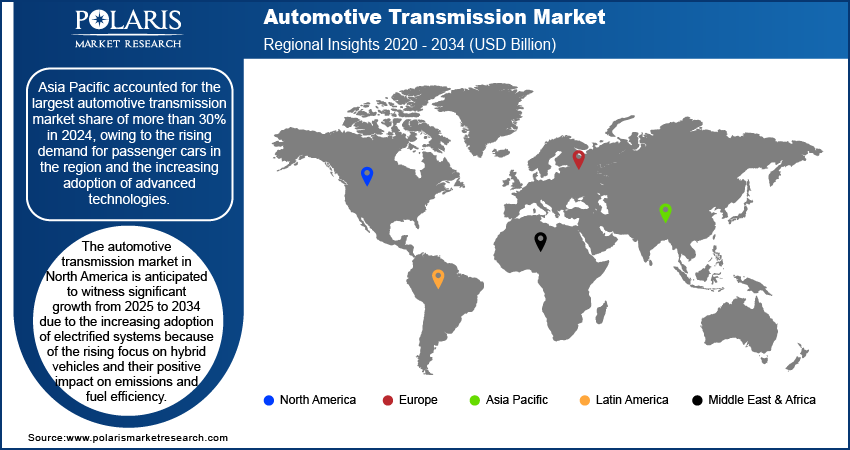

The research report offers automotive transmission market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest automotive transmission market share of more than 30% in 2024, owing to the rising demand for passenger cars in the region and the increasing adoption of advanced technologies to develop advanced transmission systems. The implementation of stringent regulations regarding automotive emission laws by governments across Asia Pacific further contributes to the regional market expansion.

The North America automotive transmission market is anticipated to witness significant growth from 2025 to 2034 due to the increasing adoption of electrified systems because of the rising focus on hybrid vehicles and their positive impact on emissions and fuel efficiency. Besides, the rising demand for aftermarket transmission systems is anticipated to positively impact the regional market growth.

Automotive Transmission Market – Key Players and Competitive Insights

The automotive transmission market has the presence of established players and new entrants. The leading market players focus on offering advanced products to improve their offerings. Also, they are undertaking various strategic initiatives such as collaborations, mergers and acquisitions, and partnerships to expand their market share. To expand and survive in a more competitive and rising market environment, the automotive transmission market must offer innovative solutions.

Manufacturing locally is one of the key business strategies used by manufacturers to benefit clients. In recent years, the automotive transmission market has witnessed several technological and innovation breakthroughs. A few key players operating in the market are Aisin Seiki Co., Ltd.; BorgWarner Inc.; Continental AG; Allison Transmission, Inc.; Eaton Corporation PLC; Jatco Ltd.; Magna International, Inc.; Getrag; GKN PLC; and ZF Friedrichshafen AG.

List of Key Companies in Automotive Transmission Market

- Aisin Seiki Co., Ltd.

- BorgWarner Inc.

- Continental AG

- Allison Transmission, Inc.

- Eaton Corporation PLC

- Jatco Ltd.

- Magna International, Inc.

- Getrag

- GKN PLC

- ZF Friedrichshafen AG

Automotive Transmission Industry Developments

December 2023: ZF Friedrichshafen AG announced expansion plans to increase the local production of axles and transmissions in India. The expansion includes setting up a new plant in Coimbatore to cater to the growing demand in domestic and international markets.

October 2022: Magna International, Inc. partnered with Stellantis to produce a 48-volt dual-clutch transmission system in Magna’s Slovakia facility. According to Magna, the partnership focuses on additional hybrid models in the future of Europe.

September 2023: AISIN corporations showcased a variety of electrification and technologies at the 2023 Detroit Auto Show. It showcased a 1-motor Hybrid Transmission, a 2-motor Hybrid system for improved performance, and advanced axles for increased energy efficiency at the event.

Automotive Transmission Market Segmentation

By Transmission Type Outlook

- Manual

- Automatic

By Fuel Type Outlook

- Gasoline

- Diesel

- Others

By Vehicle Type Outlook

- Passenger Cars

- LCVs

- HCVs

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Transmission Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 67.24 billion |

|

Market Size Value in 2025 |

USD 71.21 billion |

|

Revenue Forecast by 2034 |

USD 120.41 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The automotive transmission market size was valued at USD 67.24 billion in 2024 and is projected to grow to USD 120.41 billion by 2034.

The market is projected to register a CAGR of 6.0% from 2025 to 2034.

Asia Pacific accounted for the largest market share in 2024.

A few key players in the market are Aisin Seiki Co., Ltd.; BorgWarner Inc.; Continental AG; Allison Transmission, Inc.; Eaton Corporation PLC; Jatco Ltd.; Magna International, Inc.; Getrag; GKN PLC; and ZF Friedrichshafen AG.

The gasoline segment accounted for the largest market share in 2024.

The manual type segment dominated the market in 2024.