Bakuchiol Market Size, Share, Trends, & Industry Analysis Report

By Form (Oil-Based, Cream-Based, Serum-Based, Plant-Based), By Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6064

- Base Year: 2024

- Historical Data: 2020-2023

Overview

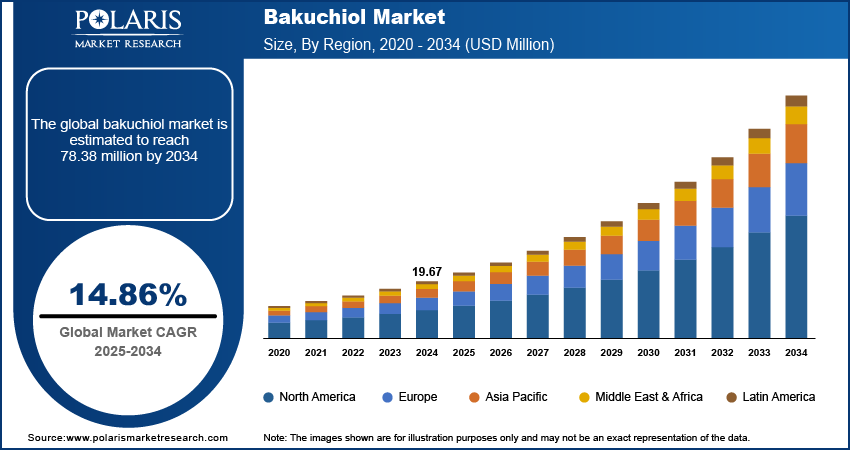

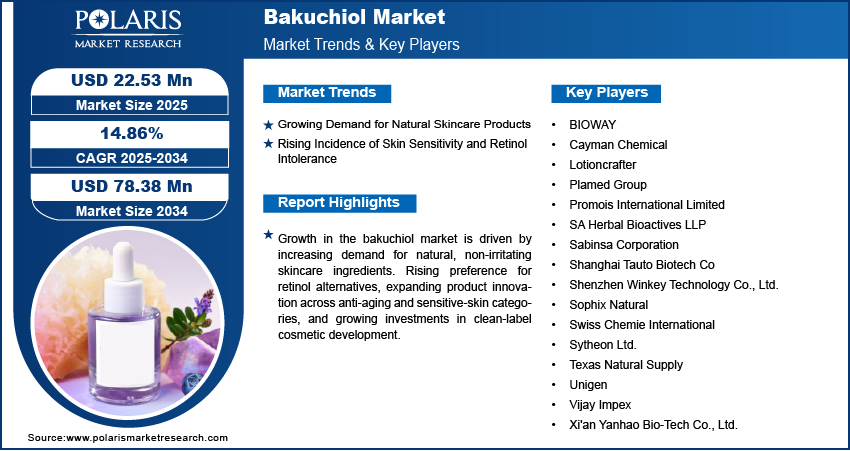

The global bakuchiol market size was valued at USD 19.67 million in 2024, growing at a CAGR of 14.86% from 2025–2034. Rising demand for plant-based skincare combined with growing cases of skin sensitivity and intolerance to retinol, is accelerating the adoption of bakuchiol as a gentle and natural alternative in cosmetic formulations.

Key Insights

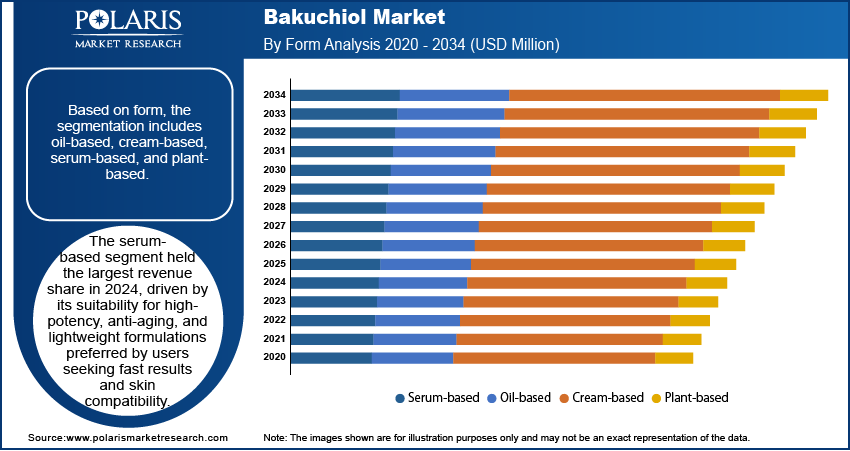

- The serum-based segment accounted for largest market share in 2024.

- The haircare products segment is projected to grow at the fastest rate over the forecast period, driven by rising demand for scalp-friendly formulations, clean-label ingredients, and botanical actives in premium haircare.

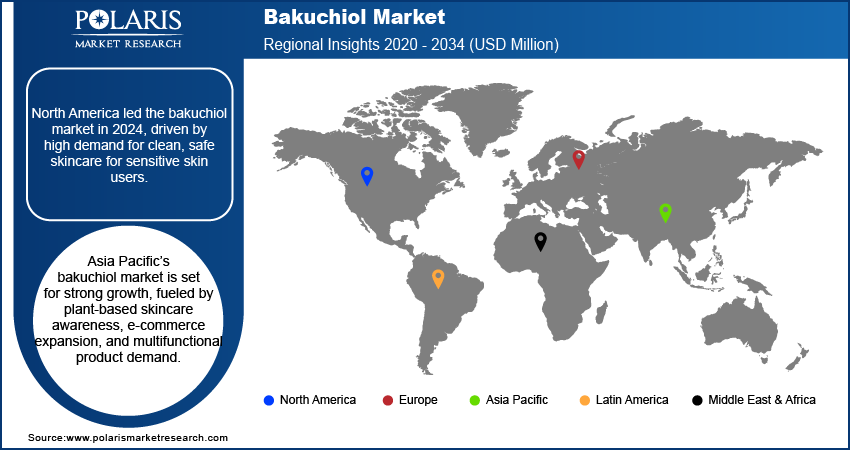

- The North America bakuchiol market accounted for largest global market share in 2024.

- The US bakuchiol market held largest regional North America market share in 2024, driven by strong domestic demand for natural skincare products, increasing brand investments, and the expansion of ingredient-conscious consumer segments.

- The market in Asia Pacific is projected to grow at a CAGR from 2025–2034, owing to rapid expansion of the personal care sector, growing interest in vegan cosmetics, and increased access to clean beauty products through online platforms.

- China market is expanding steadily, driven by rising demand for plant-based skincare, local manufacturing scale-up, and strong consumer inclination toward multifunctional and gentle cosmetic ingredients.

Industry Dynamics

- Growing demand for natural and plant-based skincare solutions is driving the use of bakuchiol in cosmetic formulations to provide clean beauty for ingredient-conscious consumers.

- Increasing cases of skin sensitivity and retinol intolerance are pushing skincare brands to adopt bakuchiol as a non-irritating alternative with comparable anti-aging and skin-renewal benefits.

- Rising demand for skin-friendly actives in men’s grooming and unisex cosmetic ranges offers a new application channel for bakuchiol, thus creating opportunity for the market in the coming years.

- Limited raw material availability and supply chain constraints is posing a challenge to wider adoption among mid-scale personal care brands.

Market Statistics

- 2024 Market Size: 19.67 million

- 2034 Projected Market Size: 78.38 million

- CAGR (2025-2034): 14.86%

- North America: Largest market in 2024

Bakuchiol, also known as Babchi or Bakuchi, is a natural compound extracted from the Psoralea corylifolia plant. It is widely used in skincare products as a plant-based alternative to retinol that offers anti-aging, anti-inflammatory and antioxidant benefits. Bakuchiol is growing popular in clean beauty and dermatological products due to its ability to reduce fine lines, improve skin tone and support collagen production without causing irritation. Major personal care brands are utilizing bakuchiol into serums, creams and facial oils to meet the rising demand for vegan and sensitive-skin-friendly ingredients.

The growing preference for natural and sustainably sourced ingredients is driving the adoption of bakuchiol across the cosmetic industry. In May 2025, Sabinsa introduced Babchiol, a new active ingredient derived from Psoralea corylifolia as a natural alternative to retinol for skincare formulations. This ingredient is designed to deliver anti-aging and antioxidant benefits without the irritation often associated with traditional retinoids. In addition, key players in the industry are focusing on bakuchiol-based formulations to meet evolving regulatory norms and consumer expectations for transparency and ingredient safety. The compound’s stability, skin compatibility and eco-friendly sourcing make it suitable for brands pursuing ethical and high-performance product portfolios.

The demand for high-efficacy cosmetic actives with minimal side effects is boosting the adoption of bakuchiol in advanced skincare formulations. Cosmetic manufacturers are focusing on bioactive ingredients that deliver visible results without compromising skin tolerance. Bakuchiol meets this need by offering anti-aging and skin-brightening effects without the irritation associated with traditional actives. Its compatibility with a wide range of emulsion systems and formulation bases is helping brands accelerate product development timelines. The growing demand for multifunctional ingredients that address multiple skin concerns in a single application is driving the adoption of bakuchiol, as it offers versatility across serums, night creams and leave-on treatments.

Drivers & Opportunities/Trends

Growing Demand for Natural and Plant-Based Skincare Solutions: The shift toward clean-label beauty is increasing the demand for naturally sourced actives in cosmeceutical formulations. As an example, in March 2024, Grant Industries introduced new bakuchiol-based innovations aimed at enhancing performance in anti-aging and sensitive-skin formulations. The launches reflect the growing industry focus on natural retinol alternatives with improved stability and skin compatibility. Growing consumer’s awareness towards natural skincare products that exclude synthetic ingredients and chemical preservatives is fueling the demand for the bakuchiol-based products. Rising awareness of ingredient safety and environmental impact is further boosting the adoption of bakuchiol in natural skincare lines. In addition, growing regulatory pressure to disclose ingredient origins is accelerating the use of plant-based compounds among skincare brands to meet transparency and sustainability standards. This preference for non-toxic and biodegradable inputs is increasing demand for nature-derived cosmetic actives.

Increased Incidence of Skin Sensitivity and Retinol Intolerance: Growing cases of skin irritation linked to retinol usage are driving the use of bakuchiol cosmetic products as a non-irritating alternatives. These products are growing popularity due to its plant-based compound that offers comparable anti-aging performance without triggering sensitivity. Therefore, skincare manufacturers are developing gentler formulations to meet demand from users with reactive or compromised skin. This rising trend toward dermatologically safe and hypoallergenic products is boosting the demand for the Bakuchi industry. Additionally, the increasing preference for vegan and cruelty-free actives is fueling the adoption of bakuchiol in sensitive-skin product lines due to its compatibility with mild formulations used in daily-use and prescription skincare.

Segmental Insights

Form Analysis

Based on form, the segmentation includes oil-based, cream-based, serum-based, and plant-based. The serum-based segment dominated the market in 2024, driven by the growing demand for concentrated actives in skincare routines. Bakuchiol offer features such as compatibility with waterless and oil-soluble systems that fuels its usage in serums to deliver targeted anti-aging and brightening effects. Skincare manufacturers are rapidly utilizing the use of bakuchiol in serums to address fine lines, uneven skin tone and skin sensitivity without harsh side effects. The lightweight texture and high absorption rate of serums makes its suitable option for consumers seeking visible results. The dominance of this segment is further driven by premium skincare trends and rising consumer spending on specialized facial care products.

The plant-based segment is expected to grow at the fastest rate during the forecast period. The growth is driven by increasing demand for vegan and ethically sourced skincare ingredients, due to rising consumer preference for formulations free from synthetic solvents, petrochemicals and animal-derived compounds. The botanical origin of bakuchiol, derived from Psoralea corylifolia comply with clean-label expectations in personal care products. In addition, the rising regulatory scrutiny on synthetic additives is further accelerating the shift toward fully plant-derived actives. Furthermore, the rise of conscious consumerism and green beauty trends is expanding the adoption of plant-based bakuchiol across mass-market and premium skincare categories.

Type Analysis

By type, the segmentation includes natural, semi-synthetic, and completely synthetic. The natural segment dominated the market in 2024, driven by increasing demand for clean-label cosmetic ingredients. Manufacturers are favoring naturally derived actives to meet sustainability objectives and evolving consumer expectations around ingredient transparency. It is widely used in premium anti-aging and sensitive-skin product lines due to its skin-compatible properties and non-irritating profile. In addition, the growing regulatory support for botanical extracts in personal care along with rising preference for minimal processing and traceable sourcing, continues to drive the dominance of this segment across global skincare formulations.

The non-packaging segment is projected to grow at the fastest pace through 2034, driven by advancements in extraction technologies and controlled processing methods that ensure consistent quality, longer shelf life and improved scalability. Cosmetic manufacturers are increasingly adopting semi-synthetic bakuchiol to achieve a balance between high purity, cost-efficiency, and formulation flexibility. This approach is growing popular among mid-range skincare brands seeking reliable performance while compliance with consumer preferences for sustainable and plant-based ingredients. Regulatory acceptance of semi-synthetic actives that comply with safety and efficacy standards further boost market adoption. Additionally, the ability to tailor concentration and purity levels without compromising the botanical origin is fueling demand in this segment.

Application Analysis

Based on application, the segmentation includes skincare products and haircare products. The skincare products segment accounted for the highest market share in 2024. This growth is driven by rising consumer preference for plant-based anti-aging and skin-brightening formulations. For instance, in September 2023, Eminence Organic Skin Care launched a new Bakuchiol + Niacinamide Collection as a gentle alternative to retinol, designed for all skin types, including sensitive skin. The products harness bakuchiol’s plant-based anti-aging benefits to visibly improve skin texture, reduce the appearance of fine lines, and enhance overall skin tone without irritation. Bakuchiol is rapidly used in creams, serums and moisturizers due to its proven ability to reduce fine lines, improve skin tone and stimulate collagen production. Growing demand for gentle and non-irritating ingredients is accelerating its adoption in sensitive-skin products. Additionally, brands are positioning bakuchiol as a natural alternative to retinol, supporting product differentiation in clean beauty portfolios. Its compatibility with facial care formats is increasing its dominance in global personal care applications.

The haircare products segment is projected to grow at the fastest pace during the forecast period. driven by the rising demand for scalp-friendly and plant-derived actives in premium formulations. Bakuchiol’s anti-inflammatory and antioxidant properties are growing its use in scalp serums, hair oils and treatment masks designed to reduce irritation and improve overall scalp health. Growing consumer preference for holistic and chemical-free haircare solutions is accelerating its adoption in clean-label product lines. Additionally, formulators are utilizing bakuchiol to strengthen brand positioning across ingredient-conscious consumer segments. The segment is also expected to growth at the highest CAGR, due to the expansion of functional and premium haircare products across online and specialty retail platforms.

Regional Analysis

North America bakuchiol market accounted for largest share of global market in 2024. This is driven by growing consumer preference for retinol alternatives that are suitable for sensitive-skin formulations in premium skincare products. In addition, growing regulatory focus on ingredient safety and labeling transparency is accelerating the use of plant-based actives across major cosmetic brands. Furthermore, the rising demand for dermatologically tested and clinically proven natural ingredients is fueling the growth of bakuchiol-based formulations across high-end and clinical skincare lines.

The US Bakuchiol Market Insight

The US held largest regional share in North America bakuchiol landscape in 2024, due to increasing consumer shift toward clean beauty in facial serums and anti-aging treatments. Also, the rising cases of retinol-related skin sensitivity are pushing cosmetic brands to formulate gentler alternatives with plant-based actives. In April 2024, Sabinsa introduced Bakuchiol to expand its active ingredient portfolio in plant-based skincare. This launch fuels bakuchiol’s growing relevance in the cosmetics industry as brands increasingly prioritize natural and effective alternatives for sensitive-skin formulations. Moreover, growing regulatory focus on ingredient disclosure and safety testing is propelling the widespread adoption of bakuchiol in clinical and premium skincare lines.

Asia Pacific Bakuchiol Market

The market in Asia Pacific is projected to grow at a significant CAGR during the forecast period. This growth is witnessed due to rising demand for gentle, multifunctional skincare products in anti-aging and tone-correcting formulations. Moreover, the prominent countries such as India, China, South Korea, and Japan are growing awareness of herbal and ayurveda-based skincare trends that is driving the shift toward plant-derived bakuchiol products in this region. Additionally, rapidly expanding e-commerce access to niche, clean-label brands is further fueling bakuchiol market presence across emerging Asian economies.

China Bakuchiol Market Overview

The market in China is expanding due to growing demand for functional natural ingredients in anti-aging and brightening products across domestic skincare brands. Moreover, rapidly expanding middle-class spending on high-efficacy, low-irritation formulations is driving its adoption in premium and mass-market offerings. According to the National Bureau of Statistics of China, the country's per capita disposable income reached USD 5759 in 2024. This marks a nominal rise of 5.3% from the previous year, with a real growth of 5.1% after adjusting for inflation. Furthermore, the rise of domestic clean beauty brands focused on botanical actives is further accelerating market growth.

Europe Bakuchiol Market

The bakuchiol landscape in North America is projected to hold a substantial share in 2034. This is owing to the strong consumer focus on vegan-certified and cruelty-free skincare in natural cosmetic formulations. Also, the rising regulatory compliance with sustainability and green beauty standards is pushing manufacturers to replace synthetic retinoids with safer botanical alternatives. In April 2024, the EU Commission amended its Cosmetics Regulation to limit the use of retinol in skincare products. This regulatory shift is expected to boost the adoption of bakuchiol as a safer, plant-based alternative. The preference for biodegradable and non-irritating ingredients across EU countries is driving the expansion of bakuchiol in face care and sensitive-skin product ranges.

Key Players & Competitive Analysis Report

The bakuchiol industry is moderately fragmented, with key players focusing on ingredient purity, sustainable sourcing and formulation compatibility. Manufacturers are investing in clinical validation, botanical extraction efficiency and regulatory-compliant production to meet rising demand for clean-label skincare actives. Rising collaborations with cosmetic brands and contract formulators are driving product innovation across anti-aging and sensitive-skin segments. Major players are expanding distribution through e-commerce and premium retail channels to enhance global reach. Growing focus on vegan certification, safety testing and consumer education is helping strengthen brand positioning and build long-term customer loyalty in the natural cosmetics market.

Major companies operating in the bakuchiol industry include Sabinsa Corporation, Shenzhen Winkey Technology Co., Ltd., Cayman Chemical, Unigen, Shanghai Tauto Biotech Co, Vijay impex, SA Herbal Bioactives LLP, Lotioncrafter, BIOWAY, Plamed Group, Swiss Chemie International, Promois International Limited, Texas Natural supply, Sophix Natural, Xi'an Yanhao Bio-Tech Co., Ltd., and Sytheon Ltd.

Key Players

- BIOWAY

- Cayman Chemical

- Lotioncrafter

- Plamed Group

- Promois International Limited

- SA Herbal Bioactives LLP

- Sabinsa Corporation

- Shanghai Tauto Biotech Co

- Shenzhen Winkey Technology Co., Ltd.

- Sophix Natural

- Swiss Chemie International

- Sytheon Ltd.

- Texas Natural Supply

- Unigen

- Vijay Impex

- Xi'an Yanhao Bio-Tech Co., Ltd.

Industry Developments

- November 2024: Hallstar acquired Sytheon to strengthen its active ingredient portfolio with scientifically backed skincare actives. The acquisition expands Hallstar’s offerings to include bakuchiol, a plant-based retinol alternative known for its anti-aging and skin-soothing properties.

- August 2024: USANA introduced a new skincare line that incorporates bakuchiol as a gentle, plant-based alternative to retinol. This launch aims to use scientifically backed ingredients to support healthy and radiant skin without compromising skin sensitivity.

- August 2024: Norwex introduced a bakuchiol serum as part of its all-natural skincare line expansion. With this launch company aims to focus on clean beauty by utilizing Nordic-inspired, plant-based ingredients such as bakuchiol as a gentle alternative to retinol.

Bakuchiol Market Segmentation

By Form Outlook (Revenue, USD Million, 2020–2034)

- Oil-based

- Cream-based

- Serum-based

- Plant-based

By Type Outlook (Revenue, USD Million, 2020–2034)

- Natural

- Semi-Synthetic

- Completely Synthetic

By Application Channel Outlook (Revenue, USD Million, 2020–2034)

- Skincare Products

- Anti-aging Creams

- Serums

- Moisturizers

- Acne Treatments

- Haircare Products

- Scalp Serums

- Anti-hair falls Products

- Pharmaceuticals

- Dermatological Ointments

- Prescription Topicals

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bakuchiol Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 19.67 Million |

|

Market Size in 2025 |

USD 22.53 Million |

|

Revenue Forecast by 2034 |

USD 78.38 Million |

|

CAGR |

14.86% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 19.67 million in 2024 and is projected to grow to USD 78.38 million by 2034.

The global market is projected to register a CAGR of 14.86% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Sabinsa Corporation, Shenzhen Winkey Technology Co., Ltd., Cayman Chemical, Unigen, Shanghai Tauto Biotech Co, Vijay impex, SA Herbal Bioactives LLP, Lotioncrafter, BIOWAY, Plamed Group, Swiss Chemie International, Promois International Limited, Texas Natural supply, Sophix Natural, Xi'an Yanhao Bio-Tech Co., Ltd., and Sytheon Ltd.

The serum-based segment dominated the market in 2024. This dominance is attributed to its extensive use in high-efficacy skincare applications due to its fast absorption, lightweight texture, and compatibility.

The haircare products segment is expected to witness the fastest growth during the forecast period, driven by rising demand for scalp-friendly actives, clean-label hair treatments, and the increasing inclusion of plant-derived ingredients in premium haircare formulations.