Bank Kiosk Market Share, Size, Trends, Industry Analysis Report

By Offering (Hardware, Software, Services), By Distribution (Rural, Semi-urban, Urban, Metropolitan), By Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 116

- Format: PDF

- Report ID: PM2419

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

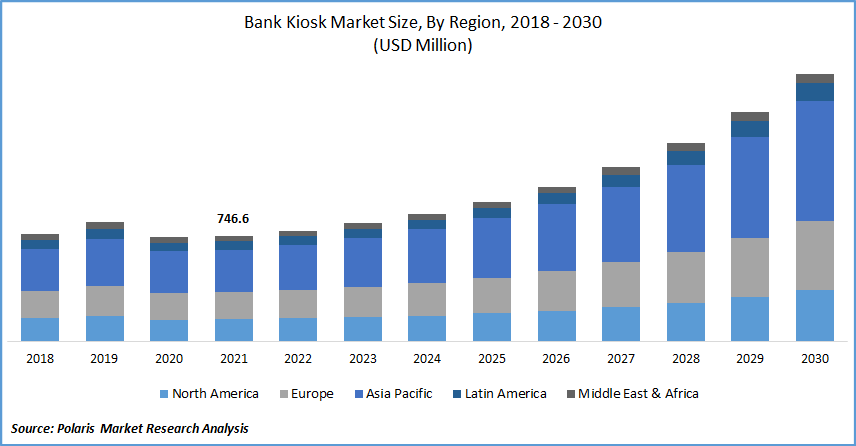

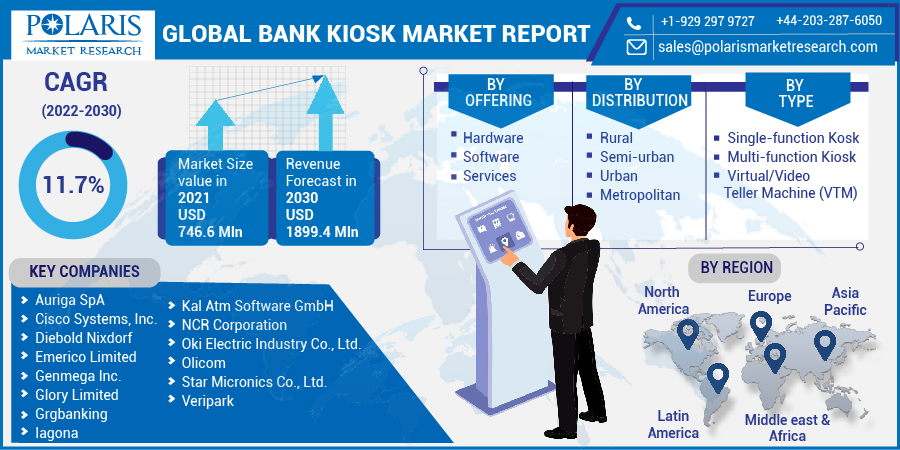

The global bank kiosk market was valued at USD 746.6 million in 2021 and is expected to grow at a CAGR of 11.7% during the forecast period. The growing need for self-service in financial and banking services applications, improvements in customer service provided by banking kiosks, and a decrease in the total operational costs are the key factors that are attributed to the global industry growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

A bank kiosk is a computer gadget that is initiated to aid users in carrying out particular activities and services on their own such as transactions, account checking, paying bills, and many others. Also, the rising investments in technological developments, coupled with the growth of the emerging nations, are also bolstering the market demand in the forthcoming period.

The global bank kiosk market is expected to witness growth due to the entry of new competitors into the market and the introduction of innovative products. The widespread of the COVID-19 has led the global industry to battle an economic crisis. This pandemic has exhibited a huge impact on the various sectors of the global economy.

Consequently, the bank kiosk market has also witnessed a substantial downfall in market growth owing to the lockdowns and limited availability of labor and raw materials. Moreover, during this period, various leading vendors of the bank kiosk have also been adversely impacted due to the financial crises. However, the gradual opening of lockdown is offering several growth prospects to the industry growth. Therefore, the availability of raw materials and the removal of stringent lockdown policies are creating productive demand for bank kiosks in the global market.

Industry Dynamics

Growth Drivers

The growing trend of retail banking is a chief factor that is likely to foster bank kiosk market demand around the world. This includes services such as debit/credit cards, certificates of deposits (CDs), mortgages, and saving and checking accounts. Additionally, it also aims toward the one-stop-shop for many financial services as possible on behalf of individual retail clients.

Besides, it is the most feasible aspect for the general public, and these services are generally presented at the ubiquitous ATMs and physical brick-and-mortar branches. Moreover, the various customer is inclining toward self-service solutions as it lessens their time and effort.

Accordingly, these retail platforms assist users in evading further human-associated errors and helps in completing their tasks more competently in less time. For instance, as per the Retail Banking Research, nearly 4 million ATMs will be set up globally in 2021, and the Asia Pacific will strengthen its share by 46% and record over half of the global number of ATMs. Thereby, the rising number of ATMs and the growing need for retail financial services act as a catalyzing factor for the global bank kiosk industry growth.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented on the basis of offering, distribution, type, and region.

|

By Offering |

By Distribution |

By Type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Type

The single-function kiosk segment is recorded to hold the largest revenue share. The surging need for automated systems and increasing adoption of single-function kiosks are the primary factors for the segment growth. The bill payment and other transaction activities are rapidly carried out with the help of ATM machines in a quick and safe manner, impelling the segment demand.

Accordingly, the bill payment software in the single-function kiosk facilitates users to transfer the fund from anywhere in an easy and convenient way. Moreover, numerous financial institutions and financial merchants worldwide are highly tending toward bill payment systems owing to their cost-efficiency in comparison to further cash handling charges. Thereby, these factors are augmenting the segment growth across the globe.

The multi-Function Kiosk segment is projected to witness the highest growth rate in the forecasting years. The segment facilitates the efficient integration of diverse functionalities in a single platform aiding numerous enterprises in decreasing their capital expenditure on investing in discrete machines. Accordingly, low capital expenditure in various installation, maintenance, application development, and equipment purchase also propels the segment demand among end-users, which may boost the segment demand in the near future.

Geographic Overview

North America accounted for the largest revenue share in the global market. The increasing expenditure on technological developments, and rising investment in R&D activities, coupled with the presence of major economies like the U.S. and Canada, are bolstering the regional industry growth. In addition, the development of the Fintech industry and the rising availability of innovative solutions are also fuelling regional growth.

The development of the Fintech sector in the region is gaining huge traction from the various national and international innovators taking the regional finance sector to the next level. Hence, North America is a main region in the global bank kiosk market owing to it being the early adopter and implementor of innovative solutions.

Moreover, the Asia Pacific market is anticipated to exhibit the highest CAGR over the forecasting years. The increasing digitalization and growing public and private sector investments are the major factors that are contributing to the regional industry growth. In addition, the rising number of initiatives undertaken by regional governments, as well as the collaboration of RBI and the government of India with the objective of encouraging self-banking and supporting the entry of leading players in the industry, are further would creating growth prospects in the regional market growth.

For instance, the Government of India has initiated a digital India program with the objective of transforming India into a digitally empowered society and knowledge economy. Also, the program aims to offer the facility of seamless digital payment to all residents of India in an easy, convenient, affordable, and secure way. Thereby, this initiative promotes growth in digital payment, which, in turn, augments the global market demand over the forecasting years.

Competitive Insight

Some of the major players operating in the global market include Auriga SpA, Cisco Systems, Inc., Diebold Nixdorf, Emerico Limited, Genmega Inc., Glory Limited, Grgbanking, Hitachi-Omron Terminal Solutions, Corp., Iagona, Kal Atm Software GmbH, NCR Corporation, Oki Electric Industry Co., Ltd., Olicom, Star Micronics Co., Ltd., and Veripark.

Bank Kiosk Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 746.6 Million |

|

Revenue forecast in 2030 |

USD 1,899.4 Million |

|

CAGR |

11.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2022 to 2030 |

|

Segments covered |

By Offering, By Distribution, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Auriga SpA, Cisco Systems, Inc., Diebold Nixdorf, Emerico Limited, Genmega Inc., Glory Limited, Grgbanking, Hitachi-Omron Terminal Solutions, Corp., Iagona, Kal Atm Software GmbH, NCR Corporation, Oki Electric Industry Co., Ltd., Olicom, Star Micronics Co., Ltd., and Veripark |