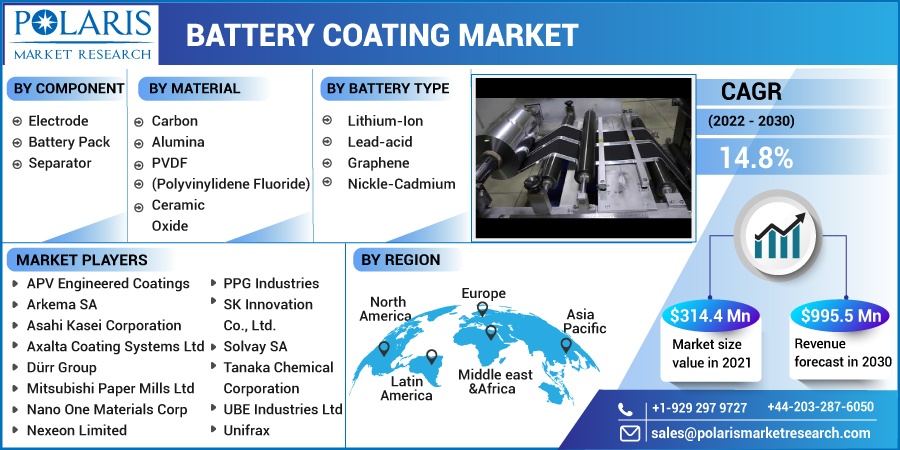

Battery Coating Market Share, Size, Trends, Industry Analysis Report, By Component; By Material; By Battery Type (Lithium-Ion, Lead-acid, Graphene, Nickle-Cadmium); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 114

- Format: PDF

- Report ID: PM2483

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

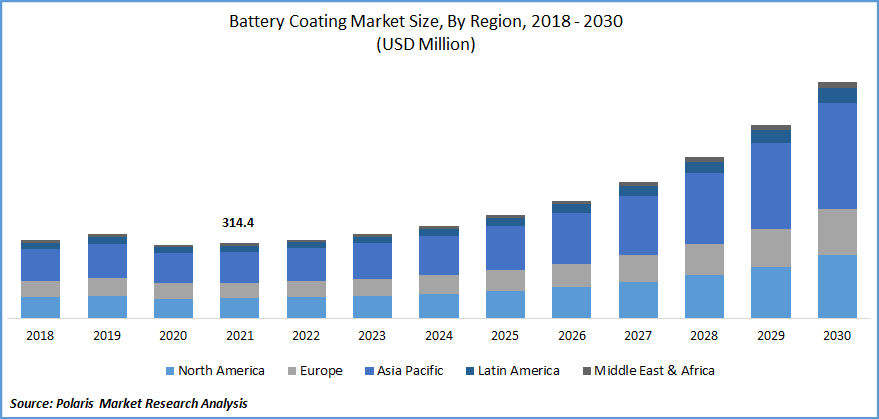

The global battery coating market was valued at USD 314.4 million in 2021 and is expected to grow at a CAGR of 14.8% during the forecast period. Battery coatings enhance energy storage capacity and overall battery performance while reducing production costs. They extend life, reduce degradation mechanisms, and improve safety and operational efficiency. The coatings help the battery to sustain and operate efficiently at higher voltages. In order to minimize the use of pollution-causing fossil fuels, the market demand is likely to increase in energy storage applications in the automobile and renewable energy sectors.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Battery coating technology is used in the manufacturing of lithium-ion secondary batteries. It is a thin film removal technology used in the electrochemical market to improve cars and vehicles' performance. The technologies used for coating include atomic layer depositions, plasma-enhanced chemical vapor deposition, and chemical vapor deposition. Specific materials are coated on the substrates such as the anode, cathode, and separator for isolating them, which unite to form the layered electrode. The battery coating is available in materials such as ceramic, alumina, oxides, and carbons.

Moreover, increasing the use of batteries in energy storage devices along with innovation and technological advances in battery materials will generate growth opportunities for the battery coating market. Battery coatings enhance stability and increase the energy density by approximately 15% to 25% while still operating at room temperature.

The global battery coating market was severely impacted due to the COVID-19 pandemic. Economic growth also declined, which in turn affected consumer spending. A decrease in market demand for electrical and electronics goods reduced the market demand for lithium-ion batteries, resulting in a fall in their price, which impacted market growth. The demand-supply gap also hampered the production rate of coating, which negatively impacted the market growth. However, this situation is expected to improve as the government has started relaxing norms worldwide for resuming business activities.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

There has been a shift toward adopting electric vehicles owing to stringent emission regulations and environmental concerns. Battery electric vehicles are solely powered through electricity while reducing greenhouse gas emissions, air pollution, and vehicular noise. The increasing requirement to reduce vehicle emissions and global carbon footprint drive the market demand for electric vehicles. Using electric vehicles offers low maintenance costs and reduced harmful vehicle emissions while providing comparable power. Electric vehicles are increasingly being used to restrict the emission of carbon, nitrogen, and other toxic compounds from gasoline and diesel vehicles.

The demand for battery coatings has been increasing across the globe owing to the high production of electric vehicles and the rise in demand for smart devices. The rise in urbanization has increased the consumption of electric vehicles in the automotive market. An increase in the need for high-performance batteries is also estimated to provide technological advancements in materials. All these factors have boosted the growth of the battery coating market.

Report Segmentation

The market is primarily segmented based on component, material type, battery type, and region.

|

By Component |

By Material |

By Battery Type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Electrode coating segment is expected to witness the fastest growth

Due to lithium-ion batteries' excellent performance and safety, there has been a surge in the need for electrodes. Particularly in EVs, smart gadgets, and energy storage systems, there is a surge in demand for more environmentally-friendly batteries. The electrode market section of the market will expand due to this demand. Technological advancements associated with new electrode materials and processes to improve the electrochemical performance of electrode materials will improve the electrochemical performance of batteries.

PVDF segment accounted for the largest market share

PVDF is a semi-crystalline polymer appropriate for separator coater components because of its low hardness, electrochemical stability, and strong affinity for electrolytes. The battery market is divided into segments based on the material: PVDF, ceramic, alumina, oxide, carbon, and others. PVDF is anticipated to be the most important substance in the market. Strong electron-withdrawing groups and a high dielectric constant in the PVDF polymer chains are advantageous for the complete dissolution of lithium salt and boost carrier concentration. The increase in demand for separator coatings from the lithium-ion end-use market is generating huge demand for the PVDF segment.

Graphene segment is expected to grow at a significant rate

The graphene segment is projected to register the highest CAGR during the forecast period. Graphene is light, durable, and suitable for high-capacity energy storage, as well as shorter charging times. Battery life is negatively linked to the portion of carbon layered on the material or added to the electrodes to achieve conductivity. However, graphene ensures conductivity without the need for carbon used in traditional batteries. This property of graphene boosts its demand, which drives the growth of the battery coating market.

Asia-Pacific is projected to be the largest region

Asia Pacific region has emerged as a hub for automobile production in recent years. Infrastructural developments and industrialization activities in the developing countries of this region have opened new avenues and opportunities. Huge demand for these coatings is being created in the area due to the manufacture of electric automobiles and other electronic products in countries like Japan, China, and South Korea.

China majorly drives the demand for coatings in the Asia Pacific. China is the hub for automotive manufacturing, which offers growth potential. As electric vehicle production has risen, battery coatings consumption in the country has also increased.

The presence of prominent lithium-ion manufacturing companies such as Samsung, LG, BYD, Panasonic, and Sony are also driving the demand for battery coatings in the Asia Pacific region.

Competitive Insight

Leading players in the battery coating market are APV Engineered Coatings, Arkema SA, Asahi Kasei Corporation, Axalta Coating Systems Ltd, Dürr Group, Mitsubishi Paper Mills Ltd, Nano One Materials Corp, Nexeon Limited, PPG Industries, SK Innovation Co., Ltd., Solvay SA, Tanaka Chemical Corporation, Targray Technology International Inc, UBE Industries Limited, and Unifrax. These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products to cater to the growing consumer demands.

Recent Developments

In May 2021, Nano One Materials Corp agreed with CBMM to jointly produce niobium-coated battery cathode materials with the latter company.

In order to address the growing demand for polyvinylidene fluoride (PVDF) in lithium batteries, Solvay SA announced the development of its SOLEF PVDF facility in China in November 2019. The development supports the company's G.R.O.W. strategy, which focuses on investing in high-growth, sustainable materials solutions.

Arkema SA established a new Kynar fluoropolymer (PVDF) production facility at its Calvert-City plant in Kentucky, USA. This shift brought about a 20% increase in its production capacity in the U.S.

Battery Coating Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 314.4 million |

|

Revenue forecast in 2030 |

USD 995.5 million |

|

CAGR |

14.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Material Type, By Battery Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

APV Engineered Coatings, Arkema SA, Asahi Kasei Corporation, Axalta Coating Systems Ltd, Dürr Group, Mitsubishi Paper Mills Ltd, Nano One Materials Corp, Nexeon Limited, PPG Industries, SK Innovation Co., Ltd., Solvay SA, Tanaka Chemical Corporation, Targray Technology International Inc, UBE Industries Limited, Unifrax |