Behavioral Biometrics Market Share, Size, Trends, Industry Analysis Report

By Solution (Software, Services); By Application; By Enterprise Size; By Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3696

- Base Year: 2023

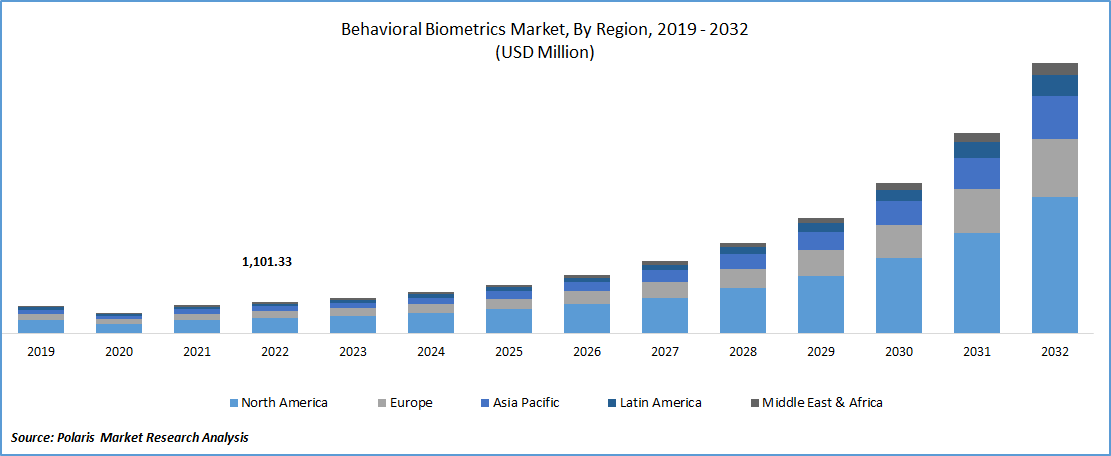

- Historical Data: 2019-2022

Report Outlook

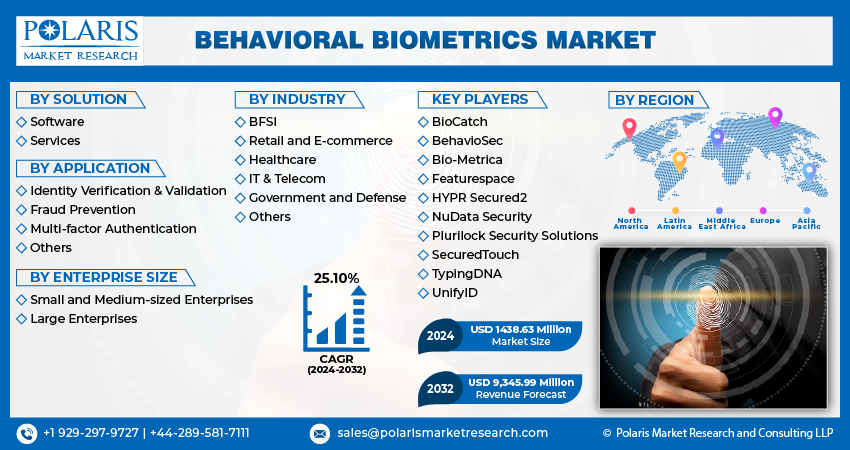

The global behavioral biometrics market was valued at USD 1245.39 million in 2023 and is expected to grow at a CAGR of 25.10% during the forecast period.

- The adoption of behavioral biometrics is being driven by financial fraud executives seeking effective measures to counter the rising threat of scam attacks. LexisNexis Risk Solutions recently published a white paper, in collaboration with Aite-Novarica, which delves into the challenges faced in addressing sophisticated fraud threats, particularly considering increased digital adoption and consumers' high expectations for secure online transactions. The white paper, titled "Multifaceted Fraud Attacks: Behavioral Biometrics as a Defensive Tool," highlights the growing usage of P2P payment portals since the onset of pandemic. However, this survey also revealed, that a percentage of respondents in the United States (10%), the United Kingdom (9%), and Singapore (7%) have reduced their usage of P2P services. Notably, a significant portion of consumers in these regions altered their behavior due to concerns related to fraud.

To Understand More About this Research: Request a Free Sample Report

These findings underscore the pressing need for robust fraud prevention measures, leading financial institutions, & fraud executives to turn to behavioral biometrics as a defensive tool. By analyzing and monitoring user behavior patterns, behavioral biometrics offers an innovative approach to identifying and mitigating fraud risks. Financial fraud executives recognize the value of leveraging behavioral biometrics technology to provide enhanced security measures and instill confidence among consumers in conducting secure online transactions.

Industry Dynamics

Growth Drivers

Rising cases of Phishing are responsible for the growth of the market

The rise of phishing attacks targeting financial institutions has become a catalyst for driving the growth of the behavioral biometrics market. BioCatch, a global leader in fraud detection and a pioneer of behavioral biometrics, has recognized this trend and unveiled a new solution called Phishing Site Detection with Phishing Victim Reports. As phishing levels reach unprecedented highs, with the financial services industry being a primary target, the need for robust fraud prevention measures has become increasingly evident. In the first quarter of 2022, the financial sector experienced the highest frequency of phishing attacks, comprising 23.6% of all reported incidents. The impact of these attacks on consumers is substantial, with losses of USD 43 billion in 2021 due to fraud schemes involving robocalls and phishing. With an average victim losing USD 1,100, the urgency to combat these threats has intensified.

BioCatch's Phishing Site Detection with Phishing Victim Reports solution is specifically designed to address the growing menace of phishing attacks directed at financial institutions. By leveraging behavioral biometrics, this solution enhances the ability to detect and prevent phishing attempts in real-time. Financial organizations are increasingly recognizing the value of incorporating behavioral biometric intelligence into their fraud prevention strategies. The adoption of such technology not only strengthens security measures but also instills confidence in customers, driving the growth of the global market.

Report Segmentation

The market is primarily segmented based on solution, application, enterprise size, industry and region.

|

By Solution |

By Application |

By Enterprise Size |

By Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Solution Analysis

Software segment is projected to experience faster growth in the study period

Software segment is expected to have faster growth for the market. Software solutions in the behavioral biometrics market incorporate sophisticated algorithms and analytics capabilities. These software solutions can efficiently capture, process, and analyze large volumes of behavioral data, enabling accurate identification and authentication of individuals. The development and improvement of advanced software algorithms have significantly enhanced the accuracy, reliability, and performance of behavioral biometrics systems, driving their adoption and growth. It is designed to integrate seamlessly with existing systems and applications, making it easier for organizations to adopt and leverage behavioral biometrics technology.

By Application Analysis

Fraud Prevention segment accounted for the largest market share in 2022

Fraud Prevention segment holds the largest market share for the market in the study period. Fraud has become a pervasive and costly issue for businesses across various industries. The increasing sophistication of fraudulent activities, such as account takeovers, identity theft, and financial fraud, has created a strong demand for robust fraud prevention solutions. Behavioral biometrics offer a proactive and dynamic approach to detecting and preventing fraud, making them highly sought after by organizations looking to safeguard their operations and protect their customers.

By Enterprise size Analysis

Large Enterprises segment is expected to hold the larger revenue share in 2022

Large Enterprises segment is projected to witness a larger revenue share in the coming years. These enterprises typically handle a substantial volume of sensitive data and conduct a high number of transactions. With their extensive operations and widespread presence, they face greater risk exposure to security threats and fraud attempts. Large enterprises recognize the need for robust security measures to protect their valuable assets and mitigate the potential financial losses associated with fraud. As a result, they are increasingly adopting behavioral biometrics as an effective solution to enhance their security posture and combat fraudulent activities.

By Industry Analysis

Banking, Financial Services and Insurance segment is growth of the market in 2022

BFSI segment is expected to have higher growth for the market in coming years. This industry is highly susceptible to fraud, identity theft, and other security threats. The vulnerabilities of traditional authentication methods, such as passwords and PINs, have become increasingly evident. Behavioral biometrics offer an additional layer of security by analyzing unique patterns in user behavior, making it more difficult for fraudsters to impersonate legitimate users. The need to combat fraud and enhance security in the BFSI sector is driving the adoption of behavioral biometrics solutions.

Regional Insights

APAC expected to have highest growth rate in the forecast period

APAC is projected to witness a higher growth rate for the market. The release of the 2023 Asia-Pacific (APAC) Digital Banking Fraud Trends Report by BioCatch exposes the alarming rise of scams and their significant impact on the financial cybercrime landscape in the region. This emerging trend is a driving force behind the growth of the behavioral biometrics market in Asia Pacific. The report reveals that scams account for a staggering 54% of all reported fraud cases in the region. This highlights the urgent need for robust fraud prevention measures to combat increasingly sophisticated tactics employed by cybercriminals.

Furthermore, there is growing concern about the rise in the call-center gangs, as the organized crime rings recognize the higher ROI offered by the scams. A notable shift in the digital crime landscape is the 200 percent increase in the voice scams from 2022-23. This seismic increase in fraudulent activities necessitates proactive measures to protect consumers and financial institutions alike. Authorized push payment (APP) fraud attacks have reached new records in the region, constituting 54 percent of all the fraud cases.

Europe is expected to witness a larger revenue share for the market. The significant role of scams in the European banking fraud landscape, as revealed by the EMEA Digital Banking Fraud Trends report released by BioCatch, is a key factor driving the growth of the behavioral biometrics market in Europe. Scams accounted for over 50% of reported fraud cases in digital retail banking in 2022, signaling the need for robust fraud prevention measures.

As awareness of scams and their impact increases, there is a growing demand for advanced technologies like behavioral biometrics that can effectively combat fraudulent activities. With global losses to fraud surpassing USD 41 billion in 2022, financial institutions face mounting pressure to implement strong fraud prevention measures. Behavioral biometrics, offering real-time fraud detection and prevention capabilities, becomes an essential component of the solution, fostering its adoption and propelling market growth.

Key Market Players & Competitive Insights

The behavioral Biometrics market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- BioCatch

- BehavioSec

- Bio-Metrica

- Featurespace

- HYPR Secured2

- NuData Security

- Plurilock Security Solutions

- SecuredTouch

- TypingDNA

- UnifyID

Recent Developments

- In June 2023, BioCatch, a renowned company specializing in fraud detection, has recently expanded its global presence in the field of behavioral biometric intelligence solutions. This expansion is made possible through a collaboration with Microsoft, and the company's offerings are now available through Microsoft's Cloud for Financial Services (FSI Cloud).

- In May 2022, LexisNexis Risk Solutions acquired BehavioSec, a move aimed at enhancing its capabilities in anti-fraud detection and identity authentication through the implementation of passive behavioral biometrics technology.

Behavioral Biometrics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1438.63 million |

|

Revenue forecast in 2032 |

USD 9,345.99 million |

|

CAGR |

25.10% from 2023 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Solution, By Application, By Enterprise Size, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

BioCatch, BehavioSec, Plurilock Security Solutions, NuData Security, Bio-Metrica, SecuredTouch, Featurespace, TypingDNA, UnifyID, HYPR & Secured2. |

FAQ's

The global behavioral biometrics market size is expected to reach USD 9,345.99 million by 2032

Key market players in the market BioCatch,BehavioSec,Bio-Metrica,Featurespace,HYPR Secured2.

Europe region contribute notably towards the global behavioral biometrics market.

The global behavioral biometrics market is expected to grow at a CAGR of 25.10% during the forecast period.

The behavioral biometrics market report covering key segments are solution, application, enterprise size, industry and region.