Beta Lactoglobulin Protein Market Share, Size, Trends, Industry Analysis Report

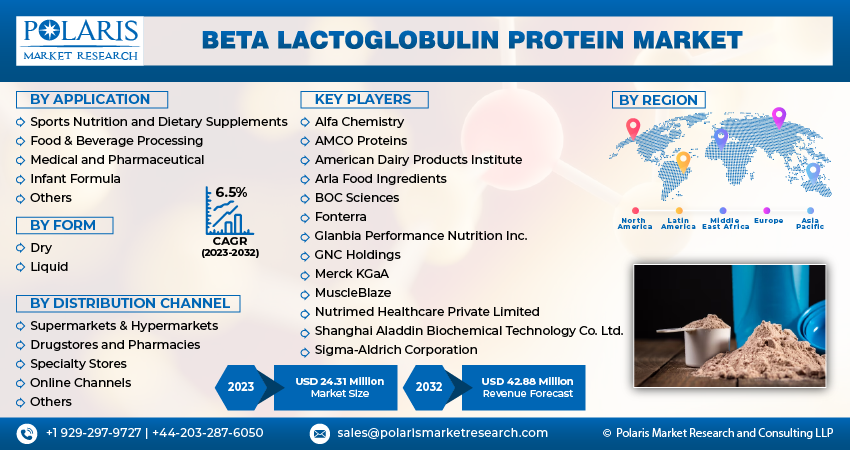

By Application (Sports Nutrition and Dietary, Food and Beverage Processing, Medical and Pharmaceutical, Infant Formula, and Others); By Form; By Distribution Channel; By Region; Segment Forecast, 2023 – 2032

- Published Date:Dec-2023

- Pages: 114

- Format: PDF

- Report ID: PM4087

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

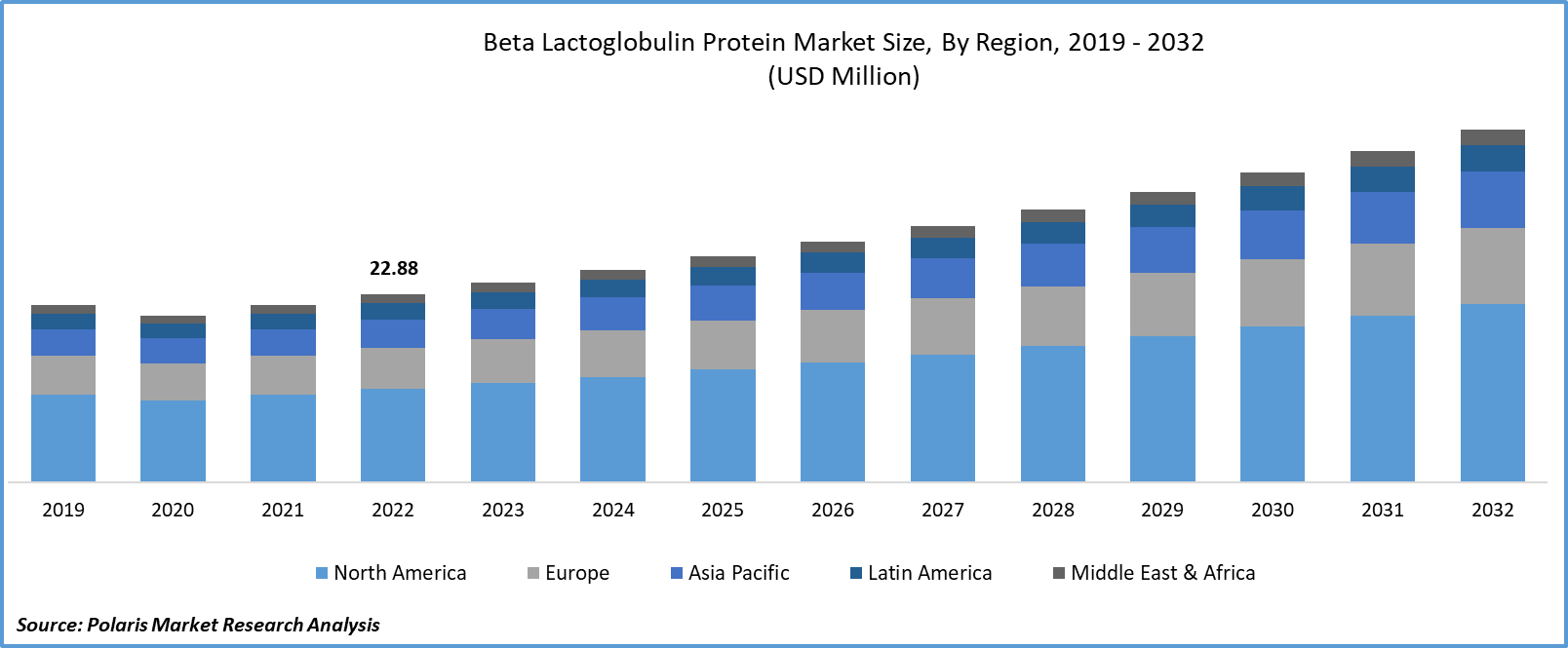

The global beta lactoglobulin protein market was valued at USD 22.88 million in 2022 and is expected to grow at a CAGR of 6.5% during the forecast period.

The rapid growth in product utilization in the manufacturing and production of nutritional supplements in the pharmaceutical sector and also in sports nutrition products due to its high-quality protein with various essential amino acids is significantly contributing to the growth of the market. In addition, the substantial increase in the consumption of dairy products, including milk, cheese, and yogurt, among others, as it is a major protein component of cow’s milk, which makes it a key ingredient in the dairy industry, is further likely to escalate product’s demand and market growth over the years.

To Understand More About this Research: Request a Free Sample Report

- For instance, according to our findings, the total consumption of cow milk in India stood at approx. 87 million metric tons, followed by the European Union, with 23.7 million metric tons in 2023. Also, milk production in India has substantially increased over the past few years, reaching more than 221 million metric tons in 2022.

Moreover, with the growing improvements in protein extraction and processing technologies that have led to increased yields and improved quality of beta-lactoglobulin and made it more accessible and cost-effective for various applications across industries, including food & beverage, pharmaceuticals and nutraceuticals, the market for beta-lactoglobulin protein in drastically increasing.

For Specific Research Requirements: Request for Customized Report

However, the surging number of individuals with milk allergies and experiencing adverse reactions when exposed to whey protein and the growing need to adhere to stringent labeling requirements to inform consumers regarding the availability of allergens are among the factors expected to hamper the global market growth.

Industry Dynamics

Growth Drivers

- Shifting preferences of consumers toward sustainable and natural ingredients boosting the market growth

With the continuous increase in consumers' focus on health and environmental sustainability, there is a surge in the number of individuals seeking sustainable and natural ingredients in their food choices, like beta-lactoglobulin, which is derived from milk sources and significantly aligns with consumer-changing dietary and eating preferences.

The increased consumer preferences for natural ingredients have drastically boosted the demand for beta-lactoglobulin, as several leading product manufacturers are focusing on incorporating such protein into their product formulations.

- For instance, in October 2021, Arla Foods Ingredients announced the commercial production of its pure BLG, a beta-lactoglobulin product. It will be produced at the company's food ingredients innovation centre and is purely created with a patented separation technology.

Report Segmentation

The market is primarily segmented based on application, form, distribution channel, and region.

|

By Application |

By Form |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

- Sports nutrition and dietary supplements segment accounted for the largest share in 2022

The sports nutrition and dietary supplements segment accounted for the largest beta lactoglobulin protein market share, mainly driven by increasing demand for dietary and sports nutrition supplements with higher amounts of natural and sustainable ingredients, including beta-lactoglobulin protein that supports muscle growth and encourages faster recovery and repair. In addition, there is an increasing proliferation among fitness enthusiasts, athletes, and bodybuilders towards adopting products that enhance their overall athletic performance and help in muscle building, resulting in greater demand for beta-lactoglobulin protein.

The food & beverage processing segment is anticipated to grow at the fastest growth rate during the forecast period, mainly attributable to the growing demand for food & beverage products as a result of exponential growth in the global population and the emergence of clean label trends encouraging people to opt for products made with natural ingredients.

- For instance, as per a recent report by the United Nations, the world’s population reached 8 billion in November 2022, with an increase of 1 billion people since 2010. Also, the worldwide population is anticipated to increase by approximately 2 billion in the next 30 years and could reach 9.7 billion in 2050.

By Form Analysis

- The dry segment held the maximum market share in 2022

The dry segment held the majority market share in terms of revenue in 2022, which is majorly driven by its numerous beneficial characteristics over other forms, such as rapid absorption, longer shelf life, specialized formulations, aiding in muscle prevention, and high protein content. Apart from this, dry protein powders are comparatively easy to store, transport, and use and can be mixed with milk and various other beverages for a rapid and convenient protein boost.

The liquid segment is anticipated to exhibit the highest growth over the next coming years on account of its growing popularity as a convenient choice for individuals with specific dietary or nutritional needs and its surging importance among individuals who are looking to monitor their protein intake closely.

By Distribution Channel Analysis

- Online channels segment is expected to witness highest growth over the forecast period

The online channels segment is expected to grow at a significant growth rate throughout the study period, which is largely attributable to the constant growth of e-commerce and online shopping trends, as it offers greater convenience to consumers and also allows manufacturers and sellers to broaden their market reach and tap into untapped and emerging markets. With the growing penetration of faster internet facilities and the rapid emergence of digitalization of payment methods all over the world that leading to more convenient and hassle-free online shopping experience, the segment market is likely to increase substantially.

- For instance, according to a report, the number of digital transactions in the year 2022 recorded a total of 89.5 million digital transactions, which makes approx. 46% of the global real-time payments.

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with a considerable share in 2022 and is also expected to continue its market dominance throughout the forecast period. The regional market growth is highly attributable to a continuous surge in the pharmaceutical industry due to rising R&D activities and drug manufacturing along with the greater demand for nutraceutical and dietary supplements incorporated with ingredients like beta-lactoglobulin protein.

Besides this, some countries of the APAC region, such as India, Thailand, and Indonesia, are among the leading exporters of dairy products, including beta-lactoglobulin, which significantly boosts the market across the region.

The North America region is anticipated to emerge as fastest growing region with a healthy CAGR over the forecasted period, owing to rising popularity and preferences for sustainable protein products and continuous R&D efforts, which have led to the development and creation of new product formulations and applications. Additionally, the drastic increase in the demand for specialized infant nutrition, which significantly utilizes beta-lactoglobulin as a prominent protein component is also driving its market growth.

Key Market Players & Competitive Insights

The beta-lactoglobulin protein market is highly fragmented in nature, with the presence of several regional and global market players. The top market players are significantly focusing on several business development strategies, including partnerships, collaborations, acquisitions, mergers, and new product launches, in order to expand their market presence and reach a wider customer base.

Some of the major players operating in the global market include:

- Alfa Chemistry

- AMCO Proteins

- American Dairy Products Institute

- Arla Food Ingredients

- BOC Sciences

- Fonterra

- Glanbia Performance Nutrition Inc.

- GNC Holdings

- Merck KGaA

- MuscleBlaze

- Nutrimed Healthcare Private Limited

- Shanghai Aladdin Biochemical Technology Co. Ltd.

- Sigma-Aldrich Corporation

Recent Developments

- In August 2022, Arla Foods Ingredients announced the launch of its two new solutions that are made using purified beta-lactoglobulin. The newly launched solutions are ready-to-drink beverages containing 7% protein and a shot format containing 21% protein. The second one is a high-protein shot and is specially formulated for the dietary management of people with CKD.

- In July 2022, Remilk, an emerging animal-free dairy startup, announced that they have teamed up with CBC Group, which aims to develop a new line of drinks, cheeses, and yogurts featuring animal-free proteins. The new range of products will feature whey protein, also known as beta-lactoglobulin, that is made through precision fermentation.

Beta Lactoglobulin Protein Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 24.31 million |

|

Revenue forecast in 2032 |

USD 42.88 million |

|

CAGR |

6.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |