Bio Plasticizers Market Share, Size, Trends, Industry Analysis Report

By Product (Epoxidized Soybean Oil, Citrates, Castor oil, Succinic Acid, Glycol Esters, Others); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 119

- Format: PDF

- Report ID: PM1492

- Base Year: 2024

- Historical Data: 2020-2023

The global bio-plasticizers market was valued at USD 3.8 billion in 2024 and is forecasted to grow at a CAGR of 9.70% from 2025 to 2034. Growth is driven by demand for non-toxic and eco-friendly alternatives in the plastics industry.

Industry Trends

Bio plasticizers are a type of plasticizers derived from renewable biological sources, such as vegetable oils, starch, and other plant-based materials. These additives are used to enhance the flexibility, durability, and workability of polymeric materials, such as plastics and elastomers, by reducing their glass transition temperature and increasing their plasticity.

The bio plasticizers market is experiencing significant growth, driven by increasing environmental awareness and the demand for sustainable and eco-friendly products. As industries and consumers become more conscious of the environmental impact of traditional plasticizers, there is a notable shift towards bio-based alternatives. This trend is particularly strong in sectors such as packaging, medical devices, consumer goods, and automotive applications, where the use of bio plasticizers can significantly reduce the carbon footprint and enhance the biodegradability of products.

To Understand More About this Research: Request a Free Sample Report

Governments and regulatory bodies worldwide are also supporting this shift through stringent regulations and incentives that encourage the use of renewable and less harmful materials in manufacturing processes. The rising market trends involve ongoing research and development efforts to improve the performance of bio plasticizers, positioning them as potential rivals or even surpassing traditional plasticizers. Innovations in biotechnology and material science are leading to the development of bio plasticizers with enhanced thermal stability, low volatility, and better compatibility with a variety of polymers. Additionally, the rising popularity of bio-based packaging solutions, driven by consumer preference for sustainable products, is boosting the demand for bio plasticizers.

However, the bio plasticizers market is hampered by the higher cost of bio plasticizers compared to their petroleum-based counterparts, which is a deterrent to widespread adoption, particularly in price-sensitive markets. The production process of bio plasticizers is often more complex and resource-intensive, contributing to these higher costs.

Key Takeaways

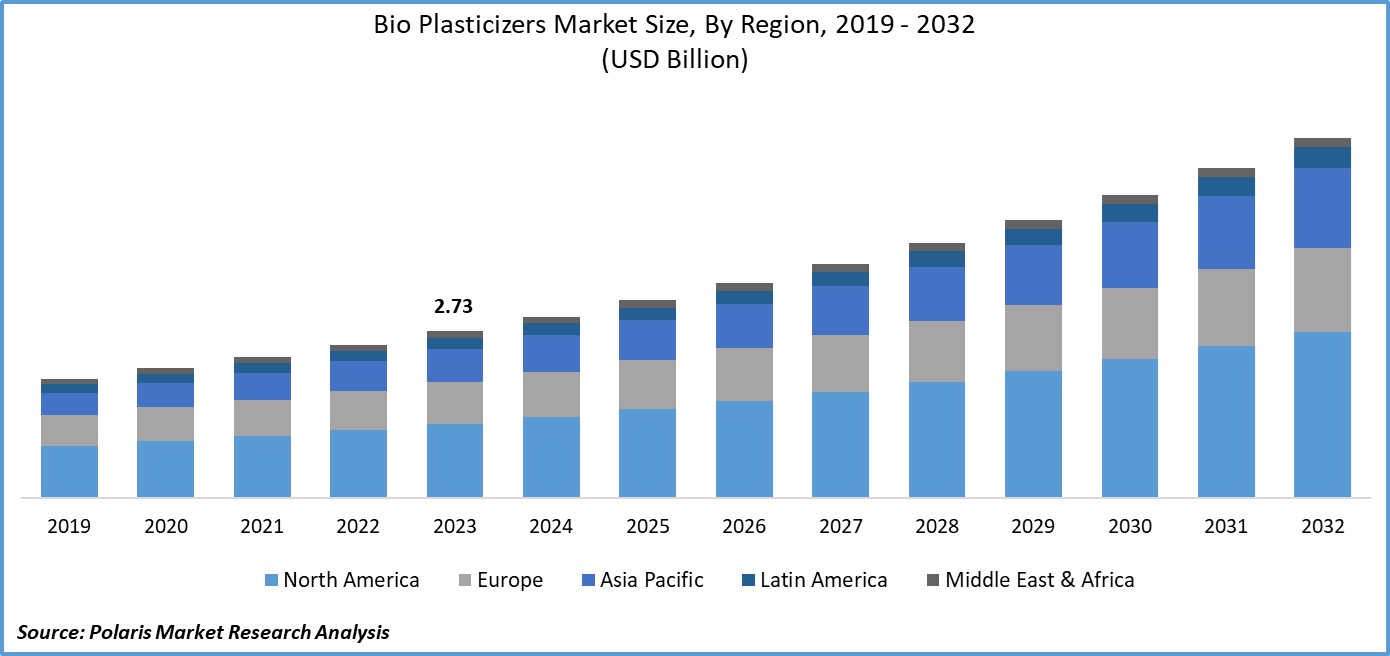

- North America dominated the market and contributed over 40% market share of the bio plasticizers market size in 2023.

- By product category, the epoxidized soybean oil (ESBO) segment dominated the global bio plasticizers market size in 2024.

- By application category, the packaging segment held the dominant revenue share in 2024.

What Are the Market Drivers Driving the Market Demand?

Technological Advancements in Bio Plasticizers are Driving Market Growth

The market for bio plasticizers is experiencing significant growth due to rising demand for eco-friendly products. In addition, growing advancements in the production of bio plasticizers are enhancing the performance, efficiency, and application range of bio plasticizers. Research and development efforts are focused on creating bio plasticizers with superior thermal stability, low volatility, and improved compatibility with various polymers, making them competitive alternatives to traditional petroleum-based plasticizers.

Innovations in biotechnology and material science are enabling the production of bio plasticizers from diverse and abundant bio-based feedstocks, reducing production costs and ensuring a more sustainable supply chain. Advancements in processing techniques are also improving the scalability and economic feasibility of bio plasticizers, making them more accessible to a wider range of industries. These technological improvements are crucial in overcoming previous limitations associated with bio plasticizers, accelerating their adoption, and expanding their bio plasticizers market presence.

Which Factor Is Restraining the Demand for Bio Plasticizers?

Higher Cost and Production Complexity Hampers the Market Growth

Higher costs and production complexity are significant restraining factors for the market, limiting their widespread adoption despite growing environmental and regulatory pressures. Bio plasticizers generally require more expensive raw materials and sophisticated processing technologies compared to conventional petroleum-based plasticizers, leading to higher production costs. This cost disparity makes bio plasticizers less competitive, particularly in price-sensitive markets and industries. Also, the production of bio plasticizers often involves complex biochemical processes and specialized equipment, which can be resource-intensive and challenging to scale. These complexities result in lower production yields and higher operational costs, further constraining bio plasticizers market growth.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product category analysis, the market has been segmented on the basis of epoxidized soybean oil, citrates, castor oil, succinic acid, glycol esters, and others. The epoxidized soybean oil (ESBO) segment dominated the global bio plasticizers market size in 2023 due to its favorable properties and wide-ranging applications. ESBO is highly valued for its excellent plasticizing efficiency, thermal stability, and resistance to migration and extraction, making it an ideal additive for various polymer products, especially in the PVC industry.

Also, being derived from soybean oil, ESBO is readily available, cost-effective, and renewable, aligning well with the growing demand for sustainable and eco-friendly materials. Its non-toxic nature and compliance with stringent regulatory standards for health and safety further bolster its appeal, particularly in food packaging, medical devices, and children's products. These attributes, combined with ongoing advancements in production technologies that enhance its quality and performance, have cemented ESBO's leading position in the bio plasticizers market.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of packaging materials, building and construction, consumer goods, automotive, medical devices, and others. The packaging materials segment held the dominant revenue share in the bio plasticizers market in 2023 due to the increasing demand for sustainable and environmentally friendly packaging solutions. As consumers and businesses are becoming more environmentally conscious, there is a significant shift towards using biodegradable and non-toxic materials in packaging. Also, major brands and retailers are prioritizing sustainable packaging to enhance their corporate social responsibility profiles and meet consumer expectations. The growing e-commerce industry, with its need for diverse packaging solutions, further drives the demand for bio plasticizers. These factors, combined with technological advancements that improve the performance and cost-efficiency of bio plasticizers, have led to their increased adoption in the packaging sector, thereby contributing to its dominant revenue share in 2023.

Regional Insights

North America

In 2023, North America led the global bio plasticizers market due to a combination of strong regulatory support, advanced technological infrastructure, and growing consumer demand for sustainable products. The region has implemented stringent environmental regulations that encourage the reduction of toxic chemicals in manufacturing processes, driving the adoption of eco-friendly alternatives like bio plasticizers. Also, North America's robust research and development capabilities have fostered significant advancements in bio plasticizer technologies, enhancing their performance and cost-effectiveness. The presence of major industry players and the increasing investments in green chemistry initiatives further bolster market growth.

Asia Pacific

The Asia Pacific region is expected to grow substantially in the bio plasticizers market due to rapid industrialization, increasing environmental awareness, and supportive government policies. The region's burgeoning manufacturing sector, particularly in countries like China and India, is driving demand for sustainable and high-performance materials in various applications, including packaging, automotive, and consumer goods. Additionally, rising consumer awareness regarding the environmental impact of traditional plastics is fueling the demand for biodegradable and non-toxic alternatives in the region.

Competitive Landscape

The competitive landscape for the bio plasticizers market is characterized by the presence of several key players striving to gain a competitive edge through innovation, strategic partnerships, and expansion of production capacities. Major companies dominate the market with their extensive product portfolios, advanced research and development capabilities, and strong distribution networks. These industry leaders are investing heavily in the development of new and improved bio plasticizer formulations to meet the growing demand for sustainable materials. Also, regional players and startups are emerging with innovative solutions and localized production to cater to specific market needs.

Some of the major players operating in the global market include:

• ACS Technical Products

• Avient Corporation

• BASF SE

• Cargill, Incorporated

• DIC CORPORATION

• Dow

• Emery Oleochemicals

• Evonik Industries

• GOLDSTAB ORGANICS PVT LTD

• JIAAO ENPROTECH

• Jungbunzlauer Suisse AG

• LANXESS

• Matrìca S.p.A.

• Roquette Frères

• Solvay

• Valtris Specialty Chemicals

Recent Developments

- In March 2024, Baerlocher USA launched a distribution partnership with Innoleics to supply bio-based PVC plasticizers in the U.S. The collaboration expands Baerlocher's portfolio, offering sustainable, high-performance alternatives to traditional plasticizers, enhancing PVC applications while supporting sustainability goals.

- In March 2024, Baerlocher USA partnered with Innoleics, a U.S. company specializing in bio-based plasticizers. This partnership entails Baerlocher USA acting as the distributor of Innoleics' bio-based plasticizers developed for flexible polyvinyl chloride (PVC) applications in the U.S. market.

- In October 2021, Cargill expanded its bio-industrial solutions portfolio by introducing BioveroÔ, a bio-based plasticizer. This product is utilized in the manufacturing of various products, including flooring, clothing, wires, cables, and plastic films and sheets, and it has been made available to industrial customers in North America with the intention to extend its global reach further.

- In April 2021, BASF introduced a new line of plasticizers called Hexamoll DINCH BMB, Palatinol N BMB, Palatinol 10-P BMB, and Plastomoll DOA BMB, which are based on renewable raw materials. These plasticizers are biomass-balanced (BMB), signifying their use of sustainable feedstock.

- In July 2021, Valtris Specialty Chemicals introduced Santicizer Platinum G-2000, a biobased General Purpose Plasticizer, as the latest member of its Santicizer plasticizer portfolio. This innovative biobased plasticizer offers the PVC industry a renewable non-phthalate alternative, allowing manufacturers to distinguish their products with environmentally friendly plasticizer options.

Report Coverage

The bio plasticizers market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, and their futuristic growth opportunities.

Bio Plasticizers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 4.17 billion |

|

Revenue forecast in 2034 |

USD 9.6 billion |

|

CAGR |

9.70% from 2024 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global bio plasticizers market size was valued at USD 3.8 Billion in 2024 and is projected to grow to USD 9.6 Billion by 2034.

The global market is projected to grow at a CAGR of 9.70% during the forecast period, 2025-2034.

North America had the largest share in the global market

The key players in the market are ACS Technical Products, Avient Corporation, BASF SE, Cargill, Incorporated, DIC CORPORATION, Dow, Emery Oleochemicals, Evonik Industries, GOLDSTAB ORGANICS PVT LTD, JIAAO ENPROTECH, Jungbunzlauer Suisse AG, LANXESS, Matrìca S.p.A., Roquette Frères, Solvay, and Valtris Specialty Chemicals.

The epoxidized soybean oil category held the highest share in the market in 2024

The packaging materials segment held the highest revenue share in the market in 2024.