Biocides Market Share, Size, Trends, Industry Analysis Report

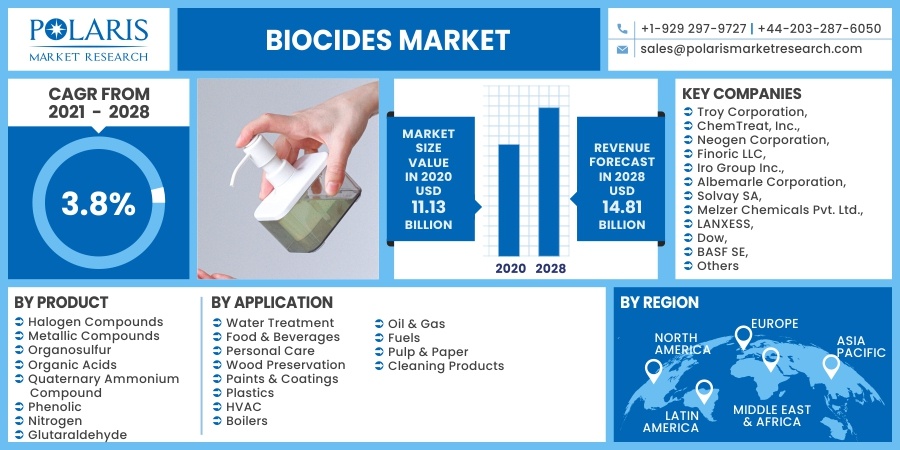

By Product (Halogen Compounds, Metallic Compounds, Organosulfur, Organic Acids, Quaternary Ammonium Compound, Phenolic, Nitrogen, Glutaraldehyde); By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 117

- Format: PDF

- Report ID: PM1959

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

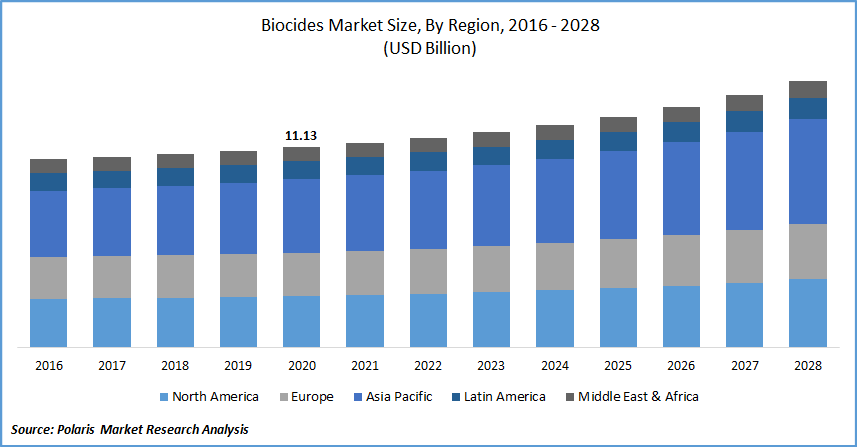

The global biocides market was valued at USD 11.13 billion in 2020 and is expected to grow at a CAGR of 3.8% during the forecast period. Constant investments in research and development, the production of synergic chemistries for product diversification, improved efficiency, innovation, and application extension contribute to the market's growth. Developed economies with stricter legislation and environmental regulations in the United States and the European Union are anticipated to offer lucrative opportunities for eco-friendly or bio-based goods.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The rising disposable income and the steady macroeconomic development of many countries are other growth drivers for the market. The biocide products are used as preservatives, sterilants, and disinfectants in consumer products to eliminate or inhibit microbial development. The expanding demand for consumer products is increasing their global sales. The increasing global population is driving up demand for various consumer goods, boosting the market growth for biocides.

Industry Dynamics

Growth Drivers

The increasing application of biocides in various fields is the major driving factor for the growth of the global market. Water treatment and painting are the major applications of biocides. Halogens such as chlorine and fluorine are used in water treatment to remove organic and synthetic impurities. These are primarily non-toxic. There are chances of microbial growth once the paint is dried on the walls of the building, and hence adding biocides in painting will prevent microbial growth and improve building quality.

Biocides are very useful in the oil and gas industry. Environmental Protection Agency (EPA) recommends its use in underground oil storage tanks. There are high chances harmful microbes such as bacteria, fungus, and yeast can grow inside the fuel. The addition of biocides at an appropriate concentration will inhibit microbial growth and improve the quality of the fuel.

Biocides have applications in many fields, but there are concerns about their use in food, cosmetics, and the agriculture industry. Hence, European Union, Biocide Product Regulation (528/2020) strictly regulates the biocides concentrations in these applications. Thus major players in the industry are constantly trying to develop new biocide products that will help overcome these limitations. This will provide an excellent opportunity for the market to further grow over the coming years.

Know more about this report: request for sample pages

Companies involved in biocides are developing and launching new products, acquisitions, and partnerships to strengthen their portfolio. For instance, Itibanyl Produtos Especiais Ltda. (IPEL) was acquired by LANXESS in February 2020. IPEL is a Brazilian company that manufactures biocides mainly for the painting and coating industry.

Lanxess will have access to the employees, production facility, and laboratory facilities of IPEL. The acquisition is expected to significantly strengthen the position of the company in the biocides market. In March 2019, LANXESS and SAFIC-ALCAN, a significant chemical distributor, collaborated to promote biocides solutions in the market.

Biocides Market Report Scope

The market is primarily segmented on the basis of product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The halogen compound segment dominated the market and generated the highest revenue in 2020. Iodophor is another form of iodine-based product that improves iodine's biocide safety and efficacy. High oxidizing and antimicrobial properties make chlorine one of the commonly used halogens in sewage treatment plants and municipal water plants, among several other applications.

In the food & beverage sector, chlorine formulations such as sodium hypochlorite and calcium hypochlorite are commonly used. The efficacy of halogens in inhibiting microbial development and their variety in potential applications is thought to be the key drivers for this section.

Following halogen compounds, metallic compounds and organosulfur emerged as important product segments. Heavy metals like silver and copper are widely used. Copper is thought to be more effective due to its increased toxicity to bacteria and other microbes. A copper sulfate-based formulation is commonly used in water treatment plants to prevent algal growth.

Since organosulfur substances are non-oxidizing and chlorine-free, they are suitable for non-corrosive uses. Other notable uses of the product include cars, heavy engineering industries, and air conditioning.

Insight by Application

The paints and coatings application segment dominates the market and is expected to maintain its position during the forecast period. Paints and coatings are highly vulnerable to airborne and waterborne microbial pollutants due to their proximity to mass processing and storage systems.

The use of biocides in paints and coatings has several advantages, including preventing microbial growth, preserving dry films, and in-can preservation. It also aids in preventing fungal growth after the film has developed and the paint has dried. As a result, using the commodity in paints and coatings to prevent degradation is becoming a need for manufacturers.

The cleaning products segment is anticipated to expand significantly in the coming years due to the bulk production of sanitizers, disinfectants, and sterilants to fight COVID infections and meet their rapidly increased market demand.

Geographic Overview

The Asia Pacific market is expected to be the most prominent region for the global market for biocides in 2020. The product is intended to be used primarily in water treatment, followed by cleaning products. The increased disinfectant production benefits increased consumption of cleaning products, particularly during the COVID-19 pandemic.

The countries like China and India are some of the most significant end-users of the oil & gas industry. The increasing need for fuel and the usage of biocides in water treatment will mainly drive the growth of the market for biocides in this region. There is also fast growth of the construction industry in the region in the past few decades.

The introduction of new regulations increased R&D activities among formulators, manufacturers, and end-users. The development of new products by manufacturers for emerging applications like cosmetics will positively influence the growth of the market for biocides in the North American region.

The region has a massive construction industry, and the U.S. is one of the significant markets for the oil & gas industry, and all these factors will boost the growth of the market for biocides in this region.

Competitive Insight

Major players in the market are investing in research and development. They are developing new biocides due to evolving regulation policy and increased adoption in areas such as the cosmetic industry. Companies are involved in recent acquisitions and partnerships to strengthen their foothold in the global market.

Some of the major players operating in the biocides market include Chemtreat, Inc., Neogen Corporation, Troy Corporation, Yuxiang Chemicals Co. Ltd., Iro Group Inc., Finoric LLC, Shine Chemical Co. Ltd., Albemarle Corporation, Jinghong Chemicals Co. Ltd., BASF SE, Solvay SA, Lubrizol, Lonza, and Lanxess AG.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 11.13 billion |

|

Revenue forecast in 2028 |

USD 14.81 billion |

|

CAGR |

3.8% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

|