Paints and Coatings Market Size, Share, Trends, & Industry Analysis Report

By Resin Type (Acrylic, Alkyd), By Technology, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM1303

- Base Year: 2024

- Historical Data: 2020-2023

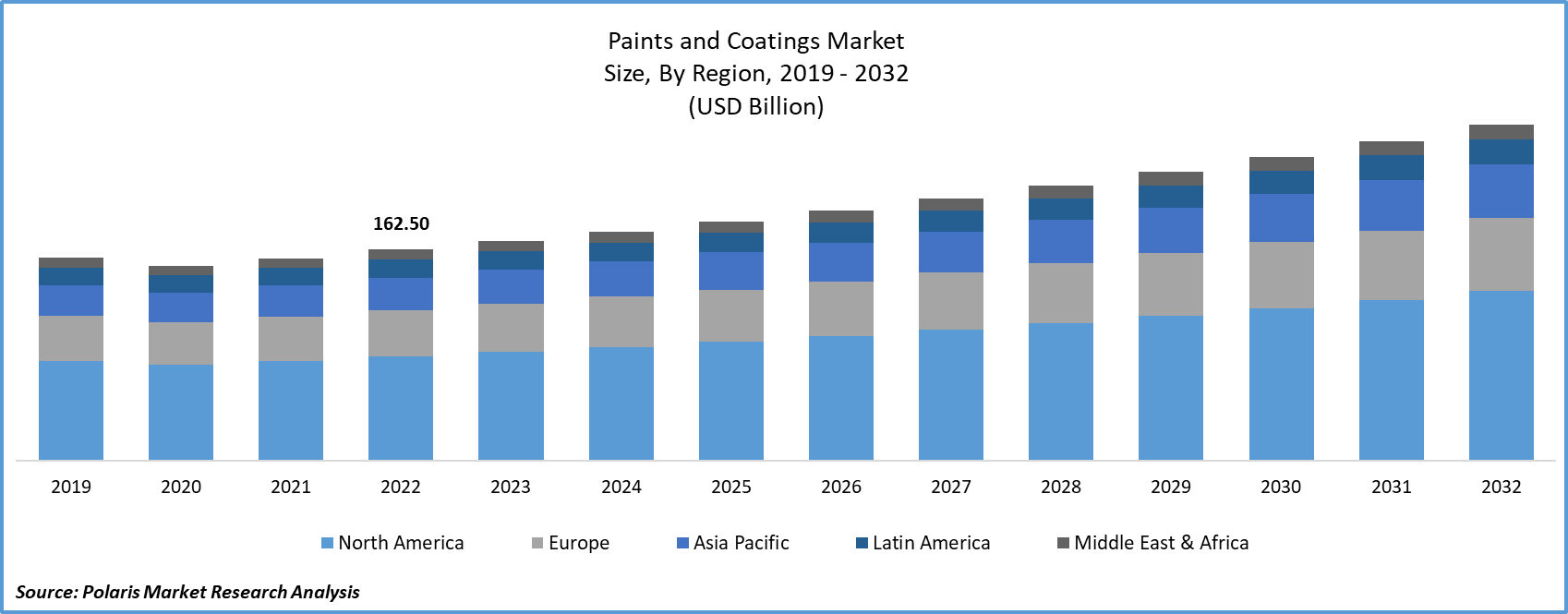

The global paints and coatings market was valued at USD 216.76 billion in 2024 and is expected to grow at a CAGR of 4.9% during the forecast period. The growth is driven by expansion of the construction industry and technological advancement.

Key Insights

- The epoxy segment is expected to witness significant growth during the forecast period due to its rising demand for floor coatings.

- The powder coating dominated with largest share in 2024 due to their environmentally friendly nature.

- Asia Pacific dominated with largest share in 2024 due to the increase in construction activity.

- Europe is projected to accounted for a significant share in the global market driven by increase in funding in construction sector.

Industry Dynamics

- The increase in urbanization is fueling the industry growth.

- The expansion of construction industry is driving the growth.

- The advancement in technology is boosting the industry growth.

- Volatile raw material prices, particularly for petrochemical-based resins and pigments, which increase production costs and impact profit margins is limiting the growth.

Market Statistics

- 2024 Market Size: USD 216.76 Billion

- 2034 Projected Market Size: USD 350.35 Billion

- CAGR (2025-2034): 4.9%

- Largest Market: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

Paints and coatings are used in various industries, including automotive, transportation, wood, and construction. In the construction sector, these materials play a crucial role in safeguarding structures from external damage. Moreover, they are employed for decorative purposes in both residential and non-residential buildings, as well as in infrastructure projects, marine environments, industrial plants, and various other applications.

Several factors are driving the growth of the paints and coatings market. The rise in population accompanied by rapid urbanization has surged the growth of the construction & architecture sector in both developing and developed countries such as the U.S., India, Japan, and China, where paints and coatings are utilized for flooring, roofing, and wall finishing applications. This is anticipated to boost the demand for paints and coatings in the increasing construction and architecture sector.

Advanced formulation technologies have enabled the fulfillment of diverse and emerging consumer needs. Innovations such as anti-corrosive protection, coatings with low volatile organic compound (VOC) content, and nano coatings have become prominent in the market. The incorporation of nanotechnology has been expanded the application of the paints and coatings, thereby driving the growth.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

What Factors are Driving the Paints and Coatings Market?

The growth in the construction industry drives the demand for paints and coatings. Construction coatings enclose protective coatings and sealants applied to distinct surfaces to improve their visual appeal, corrosion resistance, adhesion, and scratch resistance. Commonly employed construction coatings include acrylic, epoxy resin, and polyurethane coatings. Companies are developing smart coatings to meet the diverse need from the evolving end use verticals, which is expanding the industry. Smart coatings are used in various industries such as medical, military, textile, transportation, construction, electronics, and more, offering protection against corrosion and abrasion, among other threats. Specifically, anti-corrosion smart coatings play a crucial role in shielding metal surfaces by inhibiting the interaction with corrosive chemicals. These coatings act as a barrier, safeguarding substrates from corrosion even in conditions involving high temperatures and exceptionally corrosive environments. Primarily, smart coatings incorporate polymer-filled microcapsules, contributing to the development of self-healing coatings. The versatility of smart coatings is clear in their utilization across diverse sectors, ranging from cosmetics to construction, thereby driving the growth of the industry.

Report Segmentation

The market is primarily segmented based on resin type, technology, end-use, and region.

|

By Resin Type |

By Technology |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Which Segment by Resin Type is Expected to Witness Significant Growth?

The epoxy segment is anticipated to witness substantial growth during the forecast period due to their extensive use in floor coatings. Epoxy coatings are characterized by outstanding chemical resistance to sagging, strong adhesion, high bond strength, and low porosity. These coatings also indicate prolonged resistance to erosion and gloss retention, making them the favored choice for industrial-grade floor coatings. Increase in industrilization in developing counrtries such as India, Taiwan, and Brazil is further driving the demand for the epoxy based resins, thereby driving the segment growth.

Why Powder Coatings Dominated with Largest Share in 2024?

The powder coatings segment dominated with largest share in 2024. These coatings are applied as a dry powder finish through an electrostatic spray gun and then cured in an oven, delivering a robust and enduring coating. Their environmentally friendly nature stems from their solvent-free composition, reducing emissions of volatile organic compounds (VOCs), thereby facilitating both human health and environmental well-being. Furthermore, powder coatings exhibit outstanding performance attributes such as remarkable adhesion, durability, and resistance to chemicals, corrosion, and UV radiation. This fuels the adoption of powder coating in the wide range of applications with harsh environments, thereby driving the segment growth.

How Asia Pacific Captured Largest Market Share in 2024?

Asia Pacific dominated with largest market share in 2024 driven by the surge in construction activity. This rise in the construction activities is driven by the increasing disposable incomes in the developing countries such as India, Taiwan and Bangladesh. This has led to consumers pursuing top-notch paints and coatings for various purposes. Additionally, a surging awareness of aesthetics and an increasing interest in home improvement among consumers in the Asia Pacific region is increasing the demand for decorative paints and coatings, thereby driving the growth in the region.

What are the Reasons for Europe's Fastest Growth?

Europe accounted for the fastest growth in paints and coatings market driven by expanding construction activities in diverse nations like the U.K, Germany, Hungary, Poland, Sweden, Ireland, and Netherlands. This is anticipated to boost the need for paints and coatings in the forecast period. The extended funding from the European Union (EU) and favorable governmental policies is further fueling the growth of construction industry in the region. These policies encompass tax breaks, subsidies, and incentives implemented by the governments of several European countries, thereby driving the demand in the region.

Who are the Major Players Operating in the Paints and Coating Market?

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market

Some of the major players operating in the global market include:

- AkzoNobel N.V.

- Asian Paints Limited

- Axalta Coating System LLC

- BASF Coatings GmbH

- Beckers Group

- Berger Paints India Limited

- Diamond Vogel Paints

- Dunn-Edwards Corporation

- Hempel A/S

- Indigo Paints Pvt Ltd

- Jotun A/S

- Kansai Paints Co., Ltd.

- Kelly-Moore Paints

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries

- RPM International Inc

- Sacal International Group Ltd.

- S K Kaken Co., Ltd

- Shalimar Paints

- Sherwin-Williams Company

- Tiger Coatings GmbH & Co. Kg

- Tikkurila OYJ

- Valspar Corporation

- Vista Paints Corporation

Recent Developments

- October 2025, Carlyle acquired BASF’s coatings business in a deal valued at USD 7.7 billion, expanding its footprint in the chemical sector and strengthening its position in high-performance coatings markets.

- August 2025, AkzoNobel launched its Interpon D2525 Structura powder coating collection in the South Asian architectural market, offering enhanced durability, stylish textured finishes, and sustainable performance tailored to regional climate challenges and aesthetic demands.

- June 2022, Sherwin-Williams Company recently revealed its acquisition of Gross & Perthun GmbH, a German firm specializing in the development, manufacturing, and distribution of coatings, with a primary focus on the heavy equipment and transportation sectors. This strategic step not only introduces innovative waterborne and solvent liquid coatings technology to Sherwin-Williams but also establishes robust connections with both local and multinational clientele. The amalgamation of these enterprises presents numerous avenues for expansion across Europe and into global markets.

- May 2022, Sika AG, a Switzerland-based multinational corporation, has completed the acquisition of United Gilsonite Laboratories (UGL) in the United States. UGL, renowned for its production of consumer and do-it-yourself waterproofing solutions, is anticipated to enhance Sika's footprint in the U.S. market.

- April 2022, PPG has recently acquired the powder coatings manufacturing business of Arsonsisi, an industrial coatings company located in Milan, Italy.

Paints and Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size in 2024 |

USD 216.76 billion |

| Market size in 2025 | USD 227.19 billion |

|

Revenue forecast in 2034 |

USD 350.35 billion |

|

CAGR |

4.9% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Resin Type, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Want to check out the Paints And Coatings Market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

Browse Our Top Selling Reports

Cytosine Market Size, Share 2024 Research Report

Cocoa Derivatives Market Size, Share 2024 Research Report

Abaca Pulp Market Size, Share 2024 Research Report

Healthcare Finance Solutions Market Size, Share 2024 Research Report

FAQ's

The global paints and coatings market size is expected to reach USD 350.35 billion by 2034

Key players in the market are AkzoNobel N.V., Asian Paints Limited, Axalta Coating System LLC, BASF Coatings GmbH

Asia Pacific dominated the global paints and coatings market

The global paints and coatings market is expected to grow at a CAGR of 4.9% during the forecast period.

The paints and coatings market report covering key segments are resin type, technology, end-use, and region.