Biomethane Market Size, Share, Trends, Industry Analysis Report

: By Production Technology (Anaerobic Digestion and Gasification), Application, Feedstock, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3141

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

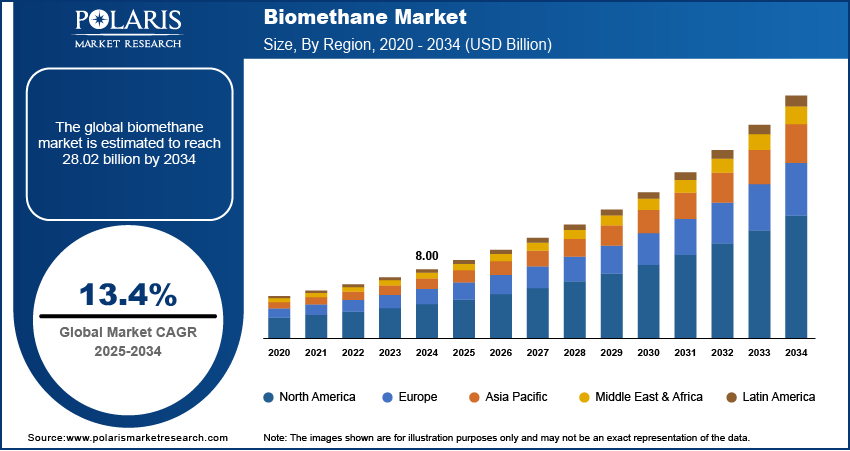

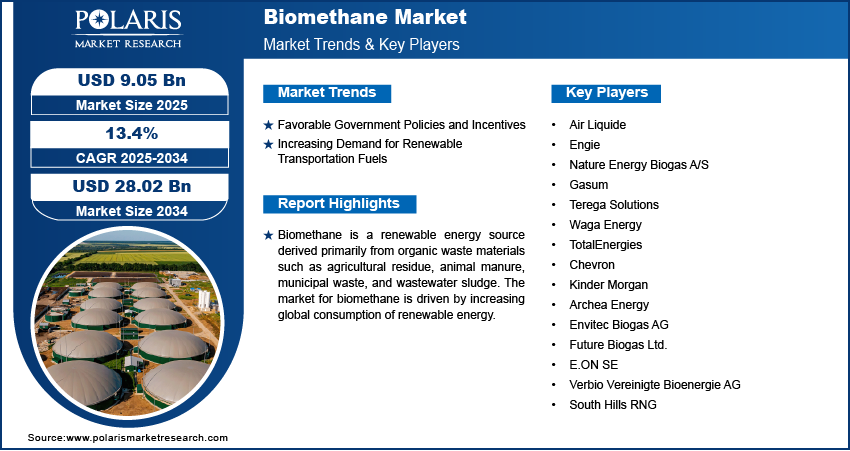

The global biomethane market size was valued at USD 8.00 billion in 2024, growing at a CAGR of 13.4% from 2025 to 2034. The rising global renewable energy consumption and the introduction of innovative technologies are the key factors fueling market growth.

Key Insights

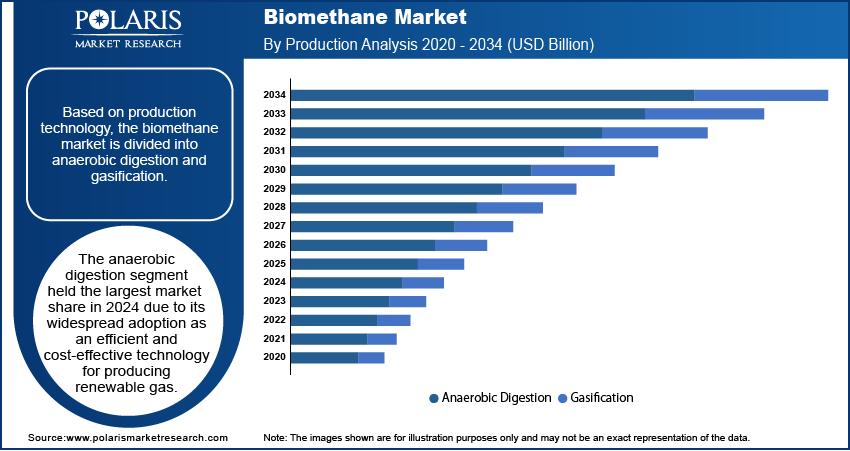

- The anaerobic digestion segment accounted for the largest market share in 2024. Anaerobic digestion has been widely adopted as an efficient and cost-effective technology for the production of renewable gas.

- The electricity generation segment led the market in 2024. The increased focus on the integration of renewable energy into power grids contributes to the segment’s leading market position.

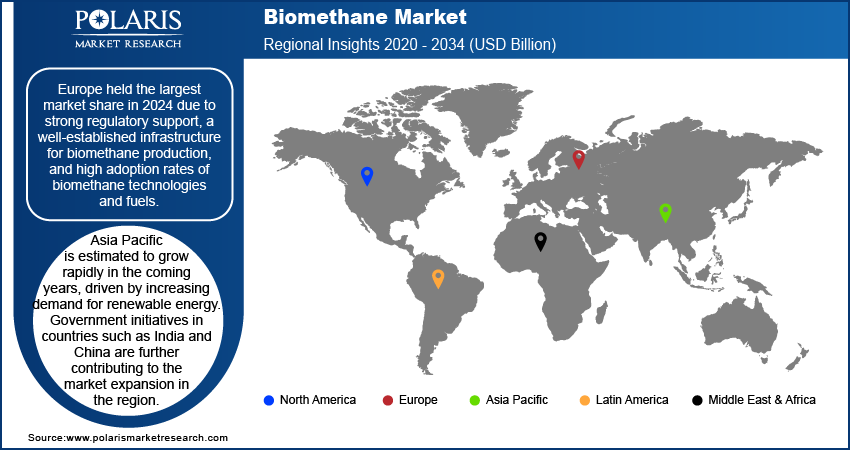

- Europe dominated the market in 2024, owing to the region’s strong regulatory support and high adoption rates of biomethane fuels and technologies.

- Asia Pacific is projected to witness rapid growth, driven by the increased demand for renewable energy in the region.

Industry Dynamics

- The introduction of financial incentives and favorable policies by governments globally to promote biomethane production and utilization drives market growth.

- The significant contribution of the transportation sector to global greenhouse gas emissions has created a need for sustainable fuel solutions, including biomethane.

- The development of large scale biomethane projects is expected to provide several market opportunities during the projection period.

- High setup costs associated with biomethane production plants can hinder market growth.

Market Statistics

2024 Market Size: USD 8.00 billion

2034 Projected Market Size: USD 28.02 billion

CAGR (2025-2034): 13.4%

Europe: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Biomethane is a renewable energy source derived primarily from organic waste materials such as agricultural residue, animal manure, municipal waste, and wastewater sludge. Biomethane is produced through anaerobic digestion or gasification processes and is chemically similar to natural gas, making it a sustainable alternative for energy production, heating, and transportation.

The biomethane market demand is driven by increasing global consumption of renewable energy. For instance, the International Energy Agency estimates that renewable energy consumption in the power, heat, and transport sectors will increase by nearly 60% from 2024 to 2030. The surge in renewable energy adoption drives investments in biomethane production facilities and infrastructure, particularly in industries such as transportation, electricity generation, and heating, which are turning to biomethane to reduce emissions and achieve sustainability goals.

The growing advancement in technology is also contributing to the biomethane market growth. Innovative technologies, such as biogas upgrading systems, make it easier to convert organic waste into biomethane. Advances in digital monitoring, automation, and data analytics allow for better control over biomethane production, enhancing output quality and reducing energy consumption. Businesses and governments are investing in large-scale biomethane projects with greater confidence as these technologies become more accessible. Additionally, technological advancements in transportation and storage infrastructure enable easier integration of biomethane into existing energy systems, further fueling market revenue.

Market Dynamics

Favorable Government Policies and Incentives

Governments across the globe are implementing policies and offering financial incentives to promote biomethane production and utilization. These policies include subsidies, feed-in tariffs, tax rebates, and grants, lowering the cost of biomethane production. In Europe, the Renewable Energy Directive II (RED II) mandates that at least 14% of the energy used in the transportation sector must come from renewable sources by 2030, boosting biomethane adoption. Similarly, the US Renewable Fuel Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS) are driving investments in biomethane production facilities. These regulatory frameworks ensure a profitable market for producers, enhancing the affordability and adoption of biomethane.

Increasing Demand for Renewable Transportation Fuels

The transportation sector contributes significantly to global greenhouse gas emissions, creating an urgent need for sustainable fuel solutions. Biomethane, with its near-zero carbon emissions, is emerging as a preferred renewable fuel for vehicles, particularly in heavy-duty trucking and public transportation. Countries such as Germany, Sweden, and the Netherlands are dominating the adoption of bio-CNG and bio-LNG as cleaner alternatives to diesel. Fleet operators are also showing growing interest due to biomethane’s ability to reduce operating costs while meeting emission compliance standards. Moreover, advancements in liquefaction technologies and the development of fueling infrastructure are making biomethane a viable option for long-haul transportation. Therefore, the transportation sector’s decarbonization efforts are driving the biomethane market development.

Segment Insights

Evaluation by Production Technology Insights

Based on production technology, the biomethane market is divided into anaerobic digestion and gasification. The anaerobic digestion segment held the largest biomethane market share in 2024 due to its widespread adoption as an efficient and cost-effective technology for producing renewable gas. This technology uses organic waste materials such as agricultural residues, food waste, and animal manure to generate energy-rich methane through microbial activity. Its scalability and compatibility with diverse feedstocks make it a preferred choice for biomethane producers in both developed and developing regions. Governments and regulatory bodies have further accelerated the adoption of this technology by offering subsidies and tax incentives to encourage waste-to-energy projects. Additionally, the growing focus on circular economy practices, which emphasize recycling organic waste into renewable energy, has driven the adoption of anaerobic digestion technology.

Assessment by Application Insights

In terms of application, the biomethane market is segregated into electricity generation, vehicle fuel, and heating. The electricity generation segment dominated the market share in 2024 due to the increasing global focus on renewable energy integration into power grids. Industries and utilities are prioritizing renewable gas as a sustainable alternative for generating electricity, particularly in regions with aggressive decarbonization goals, such as Europe and North America. Additionally, the energy crisis in several regions has led to a surge in demand for reliable and locally sourced energy solutions, further strengthening the electricity generation segment's dominance.

Regional Analysis

By region, the report provides the biomethane market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe held the largest biomethane market share in 2024 due to strong regulatory support, a well-established infrastructure for biomethane production, and high adoption rates of biomethane technologies and fuels. Germany dominated the region owing to its advanced biomethane infrastructure and strong government support. The country’s focus on transitioning to renewable energy, along with its comprehensive policies, such as the Renewable Energy Sources Act (EEG), have propelled biomethane production and utilization. Countries such as France and the UK have robust policies, such as feed-in tariffs and mandatory blending quotas, which are supporting the market growth in the region. Furthermore, the high number of biomethane plants in the region contributed to the regional market dominance. For instance, according to a report by the European Biogas Association, there were 1,322 biomethane-producing facilities in Europe by April 2023.

The Asia Pacific biomethane market is estimated to grow rapidly in the coming years, driven by increasing demand for renewable energy. Government initiatives in countries such as India and China are also contributing to the market expansion in the region. For instance, India launched the Sustainable Alternative Towards Affordable Transportation (SATAT) initiative, which aims to establish 5,000 biomethane plants by 2025 to support the transportation and energy sectors. Similarly, the carbon-neutrality goals set by the government of China are contributing to the regional market growth.

Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the biomethane market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The biomethane market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Air Liquide; Engie; Nature Energy Biogas A/S; Gasum; Terega Solutions; Waga Energy; TotalEnergies; Chevron; Kinder Morgan; Archea Energy; Envitec Biogas AG; Future Biogas Ltd.; E.ON SE; Verbio Vereinigte Bioenergie AG; and South Hills RNG.

Air Liquide S.A., a French multinational founded in 1902, is recognized as a global leader in the production and supply of industrial gases, technologies, and services across various sectors, including healthcare, chemicals, and energy. The company is headquartered in Paris and operates in over 70 countries. Its primary gases include oxygen, nitrogen, hydrogen, and argon, which are pivotal for numerous industrial processes. Air Liquide has increasingly focused on sustainable solutions in recent years, particularly in the field of biomethane and renewable energy.

Engie SA, a prominent French multinational utility company, was established in 2008 through the merger of Gaz de France and Suez. Headquartered in La Défense, Courbevoie, Engie operates in over 70 countries. The company is engaged in a diverse range of activities, including electricity generation and distribution, natural gas supply, biomethane, nuclear power plant control system, and renewable energy. Engie's strategic transformation has been marked by a significant shift towards low-carbon energy solutions, with an ambitious goal to achieve net-zero carbon emissions by 2045. This transition is supported by substantial investments in renewable energies such as solar, wind, hydroelectric, and biomass.

List of Key Companies

- Air Liquide

- Engie

- Nature Energy Biogas A/S

- Gasum

- Terega Solutions

- Waga Energy

- TotalEnergies

- Chevron

- Kinder Morgan

- Archea Energy

- Envitec Biogas AG

- Future Biogas Ltd.

- E.ON SE

- Verbio Vereinigte Bioenergie AG

- South Hills RNG

Biomethane Industry Developments

September 2024: Polska Grupa Biogazowa, a subsidiary of TotalEnergies, announced the opening of its Bagdad biogas plant. The company stated that the plant employs the latest technologies to annually produce 8.3 GWh of electricity and 8 GWh of heat.

June 2024: Naturgy, a multinational energy company, opened its third biomethane plant in Spain to increase its renewable gas production capacity to 29 GWh per year, an amount equivalent to the gas consumption of around 6,000 homes.

February 2022: Air Liquide, a France-based multinational company that provides industrial gases, technologies, and services for the healthcare and industrial sectors, announced to build its largest biomethane production unit in the US.

Biomethane Market Segmentation

By Production Technology Outlook (Revenue – USD Billion, 2020–2034)

- Anaerobic Digestion

- Gasification

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Electricity Generation

- Vehicle Fuel

- Heating

By Feedstock Outlook (Revenue – USD Billion, 2020–2034)

- Agricultural Waste

- Municipal Waste

- Animal Manure

- Wastewater Sludge

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.00 billion |

|

Revenue Forecast in 2025 |

USD 9.05 billion |

|

Revenue Forecast by 2034 |

USD 28.02 billion |

|

CAGR |

13.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global biomethane market size was valued at USD 8.00 billion in 2024 and is projected to grow to USD 28.02 billion by 2034.

• The global market is projected to grow at a CAGR of 13.4% during the forecast period.

• Europe had the largest share of the global market in 2024.

• Some of the key players in the market are Air Liquide; Engie; Nature Energy Biogas A/S; Gasum; Terega Solutions; Waga Energy; TotalEnergies; Chevron; Kinder Morgan; Archea Energy; Envitec Biogas AG; Future Biogas Ltd.; E.ON SE; Verbio Vereinigte Bioenergie AG; and South Hills RNG.

• The anaerobic digestion segment dominated the market in 2024.