Biosensors Market Share, Size, Trends, Industry Analysis Report

By Application (Medical, Food Toxicity, Bioreactor, Agriculture, Environment, and Consumer Electronics); By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM1936

- Base Year: 2024

- Historical Data: 2020-2023

Report Outlook

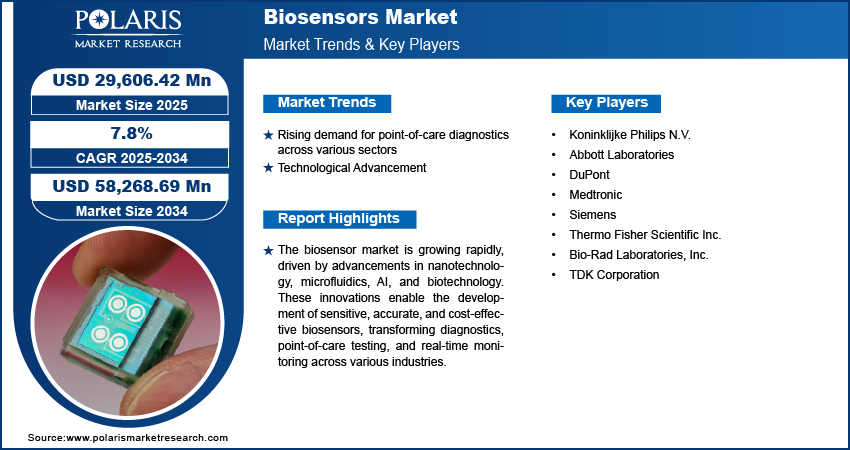

Biosensors Market size was valued at USD 27,904.26 million in 2024. The market is anticipated to grow from USD 29,606.42 million in 2025 to USD 58,268.69 million by 2034, exhibiting a CAGR of 7.8% during the forecast period.

Industry Trends

The rising prevalence of chronic diseases such as diabetes has contributed to the growing demand for biosensors. There is a heightened need for convenient and accurate monitoring of blood glucose levels with an increasing number of diabetic patients globally. Biosensors offer a practical solution by providing quick and reliable measurements, thereby improving disease management and patient outcomes.

To Understand More About this Research: Request a Free Sample Report

There is a growing emphasis on the regular use of biosensors for early disease detection among consumers. As chronic and lifestyle-related diseases continue to prevail, early detection becomes important for timely intervention and better treatment outcomes. Biosensors enable individuals to monitor their health status conveniently at home, promoting proactive healthcare management and reducing the burden on healthcare systems. Furthermore, the increasing application of biosensors is driven by the growing geriatric population globally and the affordability of conducting diagnostic tests.

For instance, in January 2023, NIST, Brown University, and CEA-Leti researchers developed a biosensor identifying biomarkers by measuring DNA strand binding interactions for accurate detection. Biosensors contribute to disease management, aligning with the specific needs of the elderly and improving their overall quality of life.

Moreover, advancements in biosensor technology, facilitated by interdisciplinary collaboration in nanotechnology, chemistry, and medicine, have significantly influenced the healthcare sector. These developments have led to the creation of compact, low-cost, and disposable biosensor devices with rapid response times. Such devices have revolutionized point-of-care diagnostics, enabling healthcare professionals to make faster and more informed decisions, ultimately improving patient care.

Key Takeaways

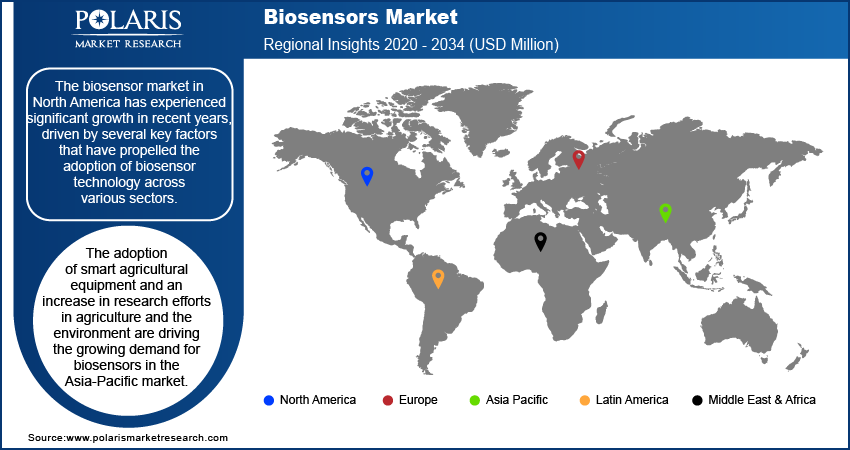

- North America dominated the market and contributed over 30% market share of the biosensors market size in 2024

- By application category, the medical segment dominated the global biosensors market size in 2024

- By end-use category, the home healthcare diagnostics segment is projected to grow with a significant CAGR over the biosensors market forecast period

What are the market drivers driving the demand for the Biosensors Market?

Rising demand for point-of-care diagnostics across various sectors

The biosensor market has witnessed remarkable growth in recent years, driven by a growing demand for point-of-care diagnostics across various sectors including healthcare, food industry, environmental monitoring, and agriculture. Biosensors are analytical devices that combine biological sensing elements with transducers to detect and quantify target analytes. One of the key driving factors behind the expansion of the biosensor market is the increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders, which necessitates efficient and rapid diagnostic solutions. Biosensors offer significant advantages over traditional diagnostic methods by providing real-time, accurate, and cost-effective detection of biomarkers, enabling early disease diagnosis and personalized treatment strategies.

In addition to healthcare, biosensors have found extensive applications in food quality monitoring and safety assessment. With increasing consumer awareness regarding foodborne illnesses and contamination issues, there is a growing demand for rapid and reliable detection methods to ensure food safety along the entire supply chain. Biosensors offer a rapid and on-site detection solution for various contaminants, including pathogens, pesticides, and allergens, thereby facilitating timely interventions to prevent foodborne outbreaks and reduce economic losses. Moreover, biosensors are being employed for environmental monitoring to assess water quality, detect pollutants, and monitor microbial contamination in soil, air, and water bodies, aiding in environmental sustainability efforts and regulatory compliance.

Which factor is restraining the demand for biosensor?

Stringent regulatory environment is likely to hinder the growth of the market

The biosensor market has witnessed significant growth in recent years, driven by advancements in technology and increasing applications across various industries such as healthcare, food and beverage, environmental monitoring, and agriculture. Biosensors play a crucial role in detecting and quantifying biological and biochemical substances by converting biological responses into measurable signals. These devices offer several advantages including high sensitivity, specificity, rapid detection, and portability, making them indispensable tools in both clinical diagnostics and point-of-care testing. However, despite the promising growth prospects, the biosensor market also faces certain restraining factors that may impede its expansion.

One of the primary challenges facing the biosensor market is the stringent regulatory environment governing the approval and commercialization of biosensor-based products. Regulatory agencies such as the Food and Drug Administration (FDA) in the United States impose rigorous requirements to ensure the safety, efficacy, and quality of medical devices, including biosensors. Obtaining regulatory clearance or approval can be a time-consuming and costly process, thereby delaying market entry and increasing overall development costs for manufacturers. Moreover, varying regulatory standards across different regions add complexity to the global commercialization efforts of biosensor companies, further hindering market growth.

Report Segmentation

The market is primarily segmented based on application, end-use and region.

|

By Application |

By End-Use |

By Region |

|

|

|

Category Wise Insights

By Application Insights

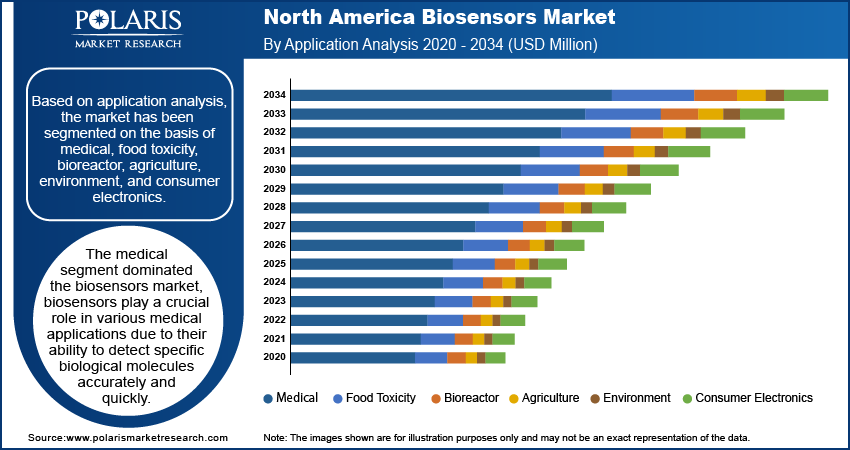

Based on application analysis, the market has been segmented on the basis of medical, food toxicity, bioreactor, agriculture, environment, and consumer electronics. The medical segment dominated the biosensors market, biosensors play a crucial role in various medical applications due to their ability to detect specific biological molecules accurately and quickly. In medical diagnostics, biosensors are utilized for cholesterol testing, blood glucose monitoring, pregnancy testing, and the identification of infectious disorders. These devices provide real-time data, enabling healthcare professionals to make timely and informed decisions regarding patient care.

In the medical field, biosensors are employed for drug discovery and development processes. They facilitate the screening of potential drug candidates by detecting interactions between target molecules and compounds, thus expediting the identification of effective treatments for various diseases, including diabetes and cancer. This application streamlines the drug discovery pipeline, leading to faster development of therapeutic interventions.

The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders drives the demand for biosensors in medical applications. Healthcare providers seek reliable and efficient diagnostic tools to monitor patients' health status continuously and manage these conditions effectively. Biosensors offer a cost-effective and convenient solution for regular monitoring and early detection of disease markers, contributing to improved patient outcomes and quality of life.

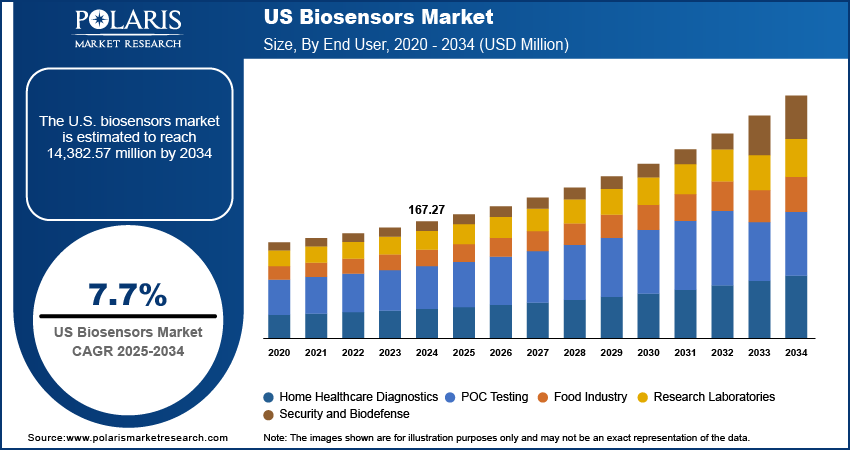

By End-Use Insights

Based on end-use analysis, the market has been segmented on the basis of home healthcare diagnostics, POC testing, food industry, research laboratories, and security and biodefense. The POC testing segment dominated the market and is anticipated to experience significant growth during the forecast period. The medical diagnostics market is experiencing a shift from traditional laboratory-based testing to point-of-care testing (POCT). POCT means diagnostics that are carried out at the bedside or close to the patient. These tests can be performed in physician's offices, hospital wards, retail clinics, or even at home. POCT has numerous applications in various medical specialties, including cardiology, diabetology, neurology, and infectious diseases.

Biosensors used in POCT are designed to provide rapid, accurate, and reliable measurements of various biomarkers such as glucose, cholesterol, hormones, and pathogens, among others. The use of POCT has grown significantly due to an increase in the prevalence of diseases. For instance, in February 2022, non-typhoidal Salmonella caused almost 93.8 million cases of gastroenteritis, making it a common cause of bacterial enteritis in humans.

Regional Insights

North America

The biosensor market in North America has experienced significant growth in recent years, driven by several key factors that have propelled the adoption of biosensor technology across various sectors. One of the primary driving factors is the increasing prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and cancer, in the region. Biosensors offer real-time monitoring and early detection capabilities, enabling timely intervention and improved management of these conditions. Moreover, the rising demand for point-of-care testing and personalized medicine has spurred the development and deployment of biosensors in healthcare settings, enhancing diagnostic accuracy and patient outcomes.

Furthermore, the North America biosensor market has benefited from robust investments in research and development, particularly in biotechnology and healthcare innovation. Academic institutions, research organizations, and private companies collaborate extensively to advance biosensor technologies, resulting in the introduction of novel sensing platforms and applications. These investments have fostered a culture of innovation and entrepreneurship, driving the growth of startups and small-to-medium enterprises (SMEs) specializing in biosensor development and commercialization.

Asia Pacific

Multiple factors are propelling the Asia Pacific region's considerable surge in the market demand for biosensors in the forecast period. The adoption of smart agricultural equipment and an increase in research efforts in agriculture and the environment are driving the growing demand for biosensors in the Asia-Pacific market. As farmers in the region become more aware of the benefits of utilizing advanced technologies such as soil moisture sensors, there is a corresponding increase in the adoption of smart agricultural equipment. This trend is supported by the availability of vast fertile land in countries such as China and India, where the use of soil moisture sensors is likely to be boosted. Furthermore, the growing concern about soil health in the region further propels the market's growth, as biosensors play a crucial role in monitoring and maintaining soil quality.

Competitive Landscape

The biosensors market is marked by intense competition, with players vying for market share through continual advancements in technology, strategic collaborations, and a commitment to innovation. Companies are actively investing in research and development to stay abreast of evolving industry needs and adhere to stringent quality standards. The competitive landscape of the biosensors market is complex and dynamic, with various players competing across different segments and geographies. To remain competitive, companies are focusing on product innovation, customer satisfaction, and strategic partnerships while keeping an eye on emerging trends and technologies.

Some of the major players operating in the global market include:

- Koninklijke Philips N.V.

- Abbott Laboratories

- DuPont

- Medtronic

- Siemens

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- TDK Corporation

Recent Developments

- In January 2023, Nova Biomedical introduced an innovative product named BioProfile FAST CDV. It is an efficient and fully automated analyzer that can determine the viable cell density and viability of a sample. This technology requires only 100µL of sample volume to generate results in under 70 seconds.

- In November 2023, Dupont Liveo collaborated with STMicroelectronics, a manufacturer of semiconductor technology to develop a new smart wearable device concept for remote bio signal-monitoring.

Report Coverage

The Biosensors Market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, application, end-use and futuristic growth opportunities.

Biosensors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 29,606.42 million |

|

Revenue Forecast in 2034 |

USD 58,268.69 million |

|

CAGR |

7.8% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

By Application, By End-user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global biosensors market size is expected to reach 58,268.69 Million by 2034.

Key players in the biosensors market are include Koninklijke Philips N.V., Abbott Laboratories, DuPont, Medtronic, Siemens,

North America contribute notably towards the global biosensors market.

The global biosensors market expected to grow at a CAGR of 7.8% during the forecast period.

The biosensors market report covering key segments are application, End-Use and region