Bitumen Market Share, Size, Trends, Industry Analysis Report

By Product Type (Paving Grade, Hard Grade, Oxidized Grade, Bitumen Emulsions, Polymer Modified Bitumen, and Others); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM1264

- Base Year: 2024

- Historical Data: 2020-2023

What is bitumen market size?

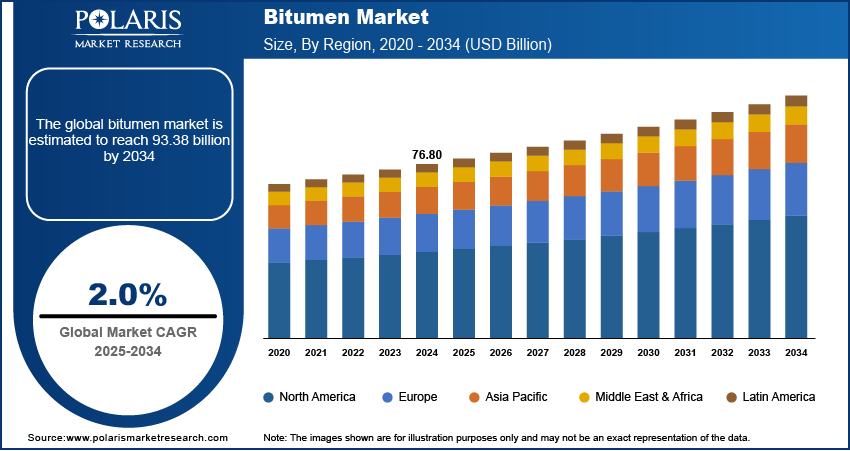

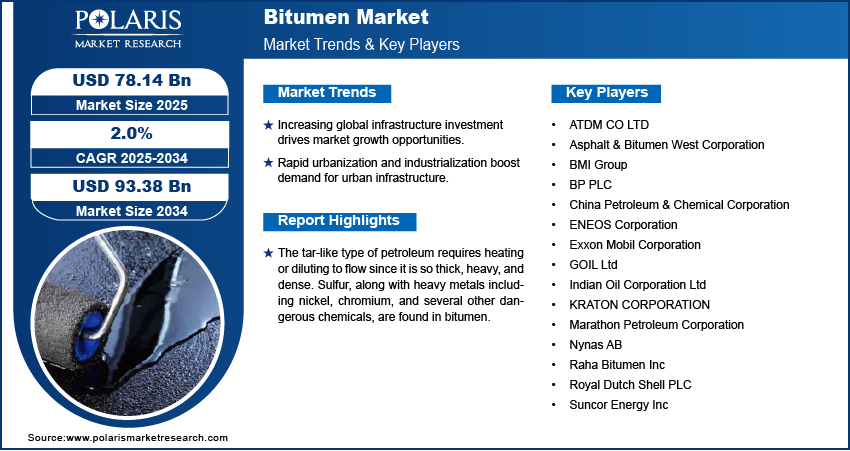

The global bitumen market was valued at USD 76.80 billion in 2024 and is expected to grow at a CAGR of 2.0% during the forecast period. It is frequently employed as an ingredient in many different chemical applications, including solvents and black paints. It functions as a chemical additive that increases the effectiveness of paints and coatings and the viscosity of waterproofing substances.

Key Insights

- By type, the paving grade subsegment held the largest share in 2024 because of its extensive and crucial role in road construction activities globally.

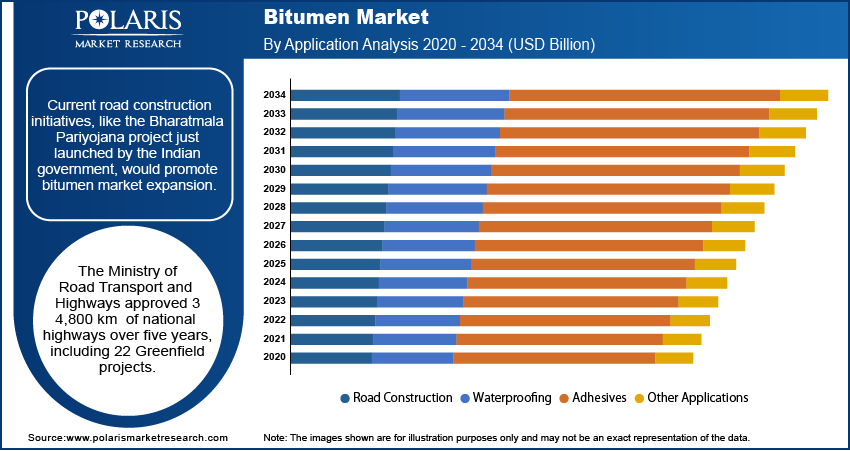

- By application, the road construction subsegment held the largest share in 2024, driven by massive and continuous government spending on infrastructure and highway development.

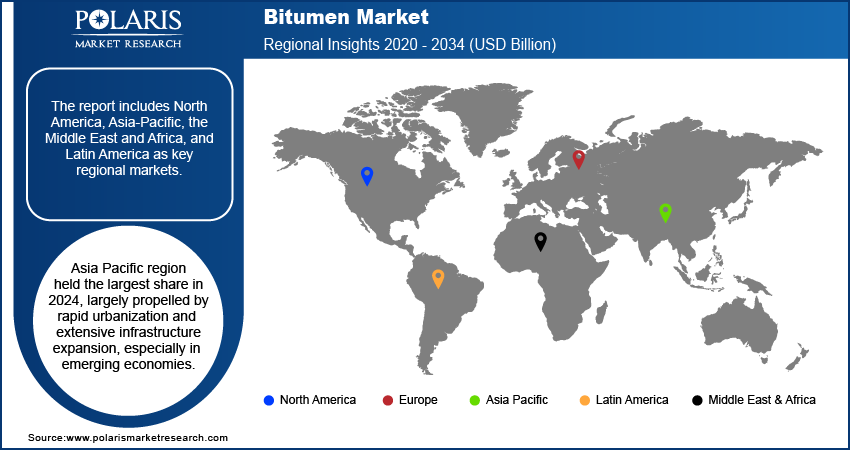

- By region, the Asia Pacific region held the largest share in 2024, largely propelled by rapid urbanization and extensive infrastructure expansion, especially in emerging economies.

Industry Dynamics

- Growing investment in large-scale infrastructure projects worldwide is a primary growth factor, especially in emerging economies.

- Rapid urbanization and industrialization are key demand trends, as they lead to a greater need for robust urban infrastructure.

- The increasing need for road repair and maintenance across various regions ensures consistent market demand.

Market Statistics

- 2024 Market Size: USD 76.80 billion

- 2034 Projected Market Size: USD 93.38 billion

- CAGR (2025-2034): 2.0%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Other factors influencing the use of bitumen across numerous industries include using chemically modified asphalt in road building and waterproofing as well as a sweets chemical component in emulsification. Carbon disulfide is accessible in bitumen, which is made up of highly condensed polycyclic aromatic hydrocarbon. It is a mixture of thick, dark, and extremely sticky organic liquids.

The tar-like type of petroleum requires heating or diluting to flow since it is so thick, heavy, and dense. Sulfur, along with heavy metals including nickel, chromium, and several other dangerous chemicals, are found in bitumen. Typically, it is widely used for sealing, waterproofing, and road paving.

The safety objectives of the government and road authority are being met by advanced bitumen solutions. For improved skid resistance and the creation of colorful and textured asphalt, these solutions are blended with asphalt. The market demand for cutting-edge bitumen solutions is being fueled by bus lanes, bus stops, and bicycle pathways.

Contractors were unable to organize the labor force during the early stages of the epidemic, while suppliers were unable to locate basic materials. The building industry has been in a state of turmoil for the past few months, but recovery is anticipated. Positive market recovery indicators, such as declining unemployment, are emerging in the post-COVID environment. Despite the resumption of projects, the rising costs of goods and raw materials point to a robust economic recovery.

Industry Dynamics

What factors are driving the bitumen market growth?

Rapid Growth in Road and Transportation Infrastructure Development

One of the major growth factors is the increasing government investment in infrastructure development and maintenance. Bitumen is a core material in asphalt production, which is heavily used in building and fixing roads, highways, and bridges. Governments across the world are spending huge amounts to upgrade and expand their transportation networks, especially in response to aging infrastructure and the need to support growing economic activities.

Bitumen is primarily used as a binder in asphalt for road construction, making the overall infrastructure segment the biggest driver. A large portion of the worldwide bitumen demand comes from building new roads, highways, and repairing the existing ones. For instance, the Ministry of Road Transport and Highways in India constructed over 12,000 kilometers of highways in the fiscal year 2023−2024, showing the massive scale of road development projects that drive bitumen demand.

Rising Demand for Specialized and Modified Bitumen

Another significant driver is the growing demand for high-performance and durable paving materials, which has led to the increased adoption of products like Polymer-Modified Bitumen (PMB). Conventional bitumen can face challenges in extreme weather conditions, such as becoming brittle in the cold or too soft in high heat. However, when polymers are added, the modified bitumen gains superior characteristics, including enhanced elasticity, better resistance to rutting and cracking, and a longer overall service life. This makes PMB an ideal choice for high-stress applications like heavily trafficked highways, airport runways, and bridge decks, especially in regions with widely varying climates. The push for more resilient and long-lasting infrastructure is fueling the need for these advanced bitumen variants.

Modified bitumen, which is blended with polymers or other materials, offers greater durability, better resistance to rutting and cracking, and a longer life span for the road. Additionally, there is a push for more sustainable materials, which increases the use of modified products like bitumen emulsions and bio-bitumen.

Report Segmentation

The market is primarily segmented based on product type, application, and region.

|

By Product Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Road Construction is expected to witness the fastest growth

Due to its excellent qualities and benefits over other materials used to make pavement, bitumen is a material that is frequently utilized in paving and road construction. They can be utilized as the primary component of roads and pavements because of their special and inherent qualities.

Current road construction initiatives, like the Bharatmala Pariyojana project just launched by the Indian government, would promote bitumen market expansion. The Ministry of Road Transport and Highways has authorized the construction of 34800 km of national highways as part of this project during the next five years. This program calls for the construction of 22 Greenfield developments.

Also, the central road fund had a total allocation of US$38.86 million as of the Union Budget 2022–23, which included a 19% increase. The government started a conversion project for 15 key roads in the smart city of Agartala in October 2021. The government unveiled regulations to increase traffic safety in October 2021, including a requirement for commercial truck drivers to keep to set driving hours and a need for the installation of sleep detection sensors in commercial vehicles.

The Ministry of Road Transport and Roadways built national highways that extended 3,824 km in September 2021 as opposed to 3,335 km in August 2021. The Indian government has planned to build highways reaching 313 km for Rs. US$ 1.48 billion to revamp the road infrastructure in Punjab, Haryana, and Rajasthan. Thus, the government's continued focus on the development of roads is boosting bitumen market growth.

Waterproofing applications accounted for a significant market share in 2024

It is frequently employed as a waterproofing material on the roofs of residential and commercial structures because of its extremely sticky and vicious character. To prevent water leaks and seepage through the roof, bituminous waterproofing is applied.

Additionally, it acts as an additional barrier in the event of blow-offs or water infiltration through flashings, roofing, or ceilings. Roofing felt or tar paper, which is a sheet or membrane formed of bitumen and then used to divide roof decks from roof coverings to provide secondary weather protection, are other names for bitumen, which is used mostly in waterproofing constructions and roofs.

In waterproofing applications, asphalt waterproofing sheets are employed. Bituminous membranes and films are extensively used to waterproof underground constructions, bridges, basements, and other infrastructure.

The paving segment is expected to hold the largest market share

A paving grade bitumen with a penetration grade of 60/70 is made from carefully monitored refining procedures using precisely chosen crude oils. To create asphalt concrete, fine and coarse aggregates, such as gravel or crushed stone, must be combined with asphalt, which serves as the binding agent.

Due to the significant market demand from the road construction sector, the paving grade segment is expected to hold the largest market share. The oxidized and cutback segment is anticipated to exhibit considerable growth. Due to its remarkable qualities and advantages over cutback and oxidized asphalt, polymer-modified asphalt is predicted to expand significantly.

The demand in Asia-Pacific is expected to witness significant market growth

The regional growth is accelerated by the rising government initiatives, rising investment in road development, and increasing construction sector. Due to the numerous initiatives and programs put in place by governments to develop public infrastructure, the Asia Pacific region dominated the market and is predicted to maintain its dominance going forward.

For instance, the Indian government announced road projects in September 2021 to build Jammu & Kashmir's road infrastructure, costing USD 13.8 billion. The main factors fueling market growth are the expanding socio-economic conditions and the burgeoning building industry.

Further, the government approved the spending of US$ 13 million in August 2021 to repair Konkan and Western Maharashtra roads damaged by heavy rains. There are two parts to this: an interim restoration budget of US$ 7.0 million and a permanent restoration budget of US$ 6 million.

For the development of 42 highways and bridges in Uttarakhand, the central government authorized US$ 81 million from the Central Road and Infrastructure Fund (CRIF) in August 2021. Economic Importance and Inter State Connectivity Scheme (EIC&ISC) funding totaling US$ 22 million was given by the Ministry of Road Transport & Highways in July 2021 for FY22. Thus, these factors are assisting the development of the region.

Europe's budget cuts and high demand for an emulsion are predicted to increase market demand. The market is projected to increase as a result of rising building activities and the use of asphalt films and sheets in waterproofing solutions. The development of roads and highways in the area is rapidly growing, with factors including rising urbanization and a rise in the number of car owners playing significant roles. As a result, bitumen is in great market demand in the area.

North America region holds a significant share in the bitumen market, driven primarily by large-scale public and private infrastructure development projects across the US and Canada. Strong government spending on road and highway maintenance, rehabilitation, and expansion is the key factor fueling the demand for paving-grade bitumen. For example, substantial federal infrastructure investments in the US are consistently boosting construction activities. Moreover, the increasing adoption of high-performance materials like polymer-modified bitumen is a major trend, as these products offer enhanced durability and resistance to harsh weather conditions, making them ideal for long-lasting road and roofing applications. The focus on sustainable infrastructure and the rise in residential construction for roofing and waterproofing also contribute to the steady growth of the region's market.

Competitive Insight

Which are the key players in bitumen market?

Some of the major players operating in the global market include Asphalt & Bitumen West Corporation, ATDM CO. LTD, BMI Group, China Petroleum & Chemical Corporation, ENEOS Incorporation, Exxon Mobil Inc., GOIL Ltd., Indian Oil Corporation Ltd., KRATON CORPORATION, Marathon Petroleum Inc., Nynas AB, Raha Bitumen Inc., Royal Dutch Shell, and Suncor Energy Incorporation.

Recent Developments

In April 2024, Indian Oil Corporation and Panasonic Energy Co. Ltd. signed a binding agreement outlining a strategy for producing cylindrical lithium-ion cells to meet the growing battery demand for two- and three-wheelers in India.

In March 2021, Puma Bitumen has announced the launch of its newest bitumen terminal in India. Up to 40KT of asphalt will be produced annually by the new facility to help the nation's infrastructure expansion.

Bitumen Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 76.80 billion |

| Market size value in 2025 | USD 78.14 billion |

|

Revenue forecast in 2034 |

USD 93.38 billion |

|

CAGR |

2.0% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Asphalt & Bitumen West Corporation, ATDM CO. LTD, BP PLC, BMI Group, China Petroleum & Chemical Corporation, ENEOS Corporation, Exxon Mobil Corporation, GOIL Ltd., Indian Oil Corporation Ltd, KRATON CORPORATION, Marathon Petroleum Corporation, Nynas AB, Raha Bitumen Inc., Royal Dutch Shell PLC, and Suncor Energy Inc. |